The start of 2023 has been blessed by a strong crypto rally:

$SOL: 114% 📈

$OP: 51% 📈

$LDO: 114% 📈

$FIS: 74% 📈

$ATOM: 34% 📈

The FOMO is starting to be felt by those who are sitting on the sidelines, but it is not wise to act recklessly and chase hyped trends blindly. We saw in 2022 that did not end up well for most investors.

It is better to take a step back and look for the next trend, or tokens that are part of existing trends but are overlooked and have not rallied.

Here are 7 trends with high-potential coins that may rally hard in 2023.

Space rocket launching from gifs

1. Liquid Staking Derivatives

Liquid staking is the hype now as the Shanghai hard fork in March will enable withdrawals of staked ETH.

However, like many hyped rally, it is likely a 'buy the rumour and sell the news', these tokens will likely top out before the event.

For fundamental analysis on LSDs read some of our past research articles:

Popular LSD protocols and their market cap you want to keep an eye out for:

- Lido $LDO: $1.5b

- Frax $FXS: $424m

- Stafi $FIS: $23m

- pSTAKE $PSTAKE: $20m

- Stader $SD: $9m

- Stride $STRD: $2.6m (Cosmos' Lido?)

2. Revival of DEXs:

Many users are now worried about the lack of transparency and control of CEXes and are afraid of losing their funds after the FTX incident.

DEXs are non-custodial and are a key part of DeFi where trades happen, and they have now gotten a renewed interest. Although liquidity is less on DEXs, we’ve seen interesting mechanics like GLP from GMX and the DAI vault from Gains Network acting as the counterparty liquidity.

Perp v2 and Rage Trade leveraging on top of Uniswap v3's concentrated liquidity mechanics also improve liquidity. Carbon ($SWTH) also launched amplified pools which maximizes the capital efficiency of liquidity, achieving tighter spreads.

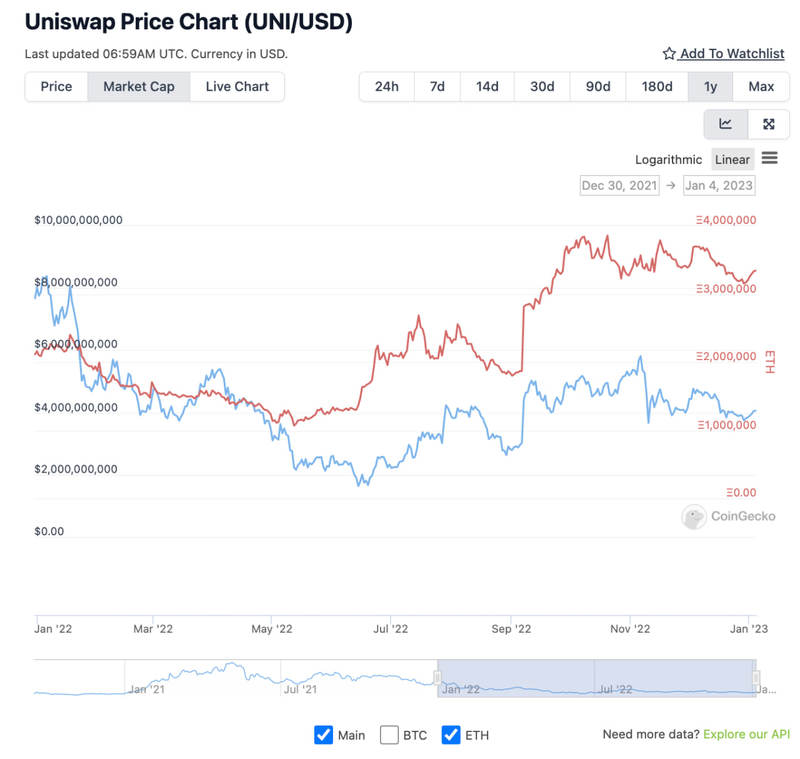

$RAGE $PERP $GMX $GNS Interestingly, Uniswap is still the leading DEX by TVL, and its market cap has held up better than ETH in 2022.

After Uniswap v3 license runs out in April 2023, Uniswap v4 could come out with even more cool features, which could be a turning point for the DEX space.

DEX protocols to keep an eye on:

- GMX: $387m (going to BNB chain)

- GNS: $65m (landed on Arbitrum)

- Joe: $58m (landed on Arbitrum)

- Perp $PERP: $39m (leading DEX on Optimism)

- Camelot $GRAIL: $16m (Popular dex on Arbitrum)

- Vela $DXP: $7.5m (Synthetic assets 100x leverage)

3. Decentralized Derivatives and Options

With the revival of DEXs comes increased interest in on-chain derivatives.

Derivatives are the largest markets in the world in terms of notional value and volume, and CEXs' derivative volume is currently sitting at over $1 trillion. Derivatives are perpetual and options, which give users a lot of leverage, up to 50x on some of the most popular perpetual DEXs.

In 2021, we saw the popularity of Single Staking Options Vaults (SSOV), a structured options yield product by protocols like Ribbon.

In 2023, it is possible that options achieve greater adoption with the rise of a new narrative called "OpFi: DeFi infrastructure powered by options."

Popular options protocols and their market cap you want to keep an eye out for:

- Ribbon $RBN: $113m

- Dopex $DPX: $62m

- Lyra $LYRA: $22m (coming to Arbitrum)

- Premia $PREMIA: $8m

- Buffer $BFR: $1.7m

4. On-chain Real-world Assets (RWA)

Bringing RWA on-chain helps unlock significant liquidity and utility that would be difficult to do in the real world.

We see a great example of this with @OndoFinance bringing treasury and corporate bonds to DeFi at 8% stablecoin yields. Imagine if a decentralized money market protocol like AAVE, starts accepting these tokenized bonds as collateral, billions of liquidity can potentially be unlocked.

Another RWA example is MakerDAO who has over $500 million in US Treasury bonds, accounting for 57% of their revenue.

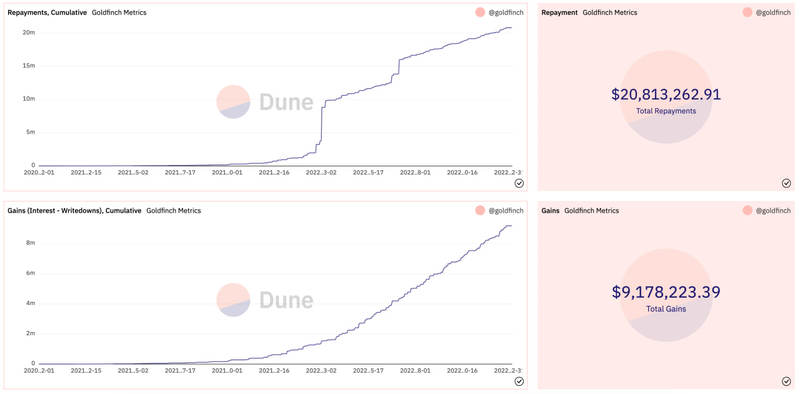

Goldfinch, a decentralized undercollateralized loan platform that helps users to loan out USDC to real businesses, has continued to grow through the bear market as well.

RWA lending protocols is still a nascent industry with lots of small caps.

Here are some protocols and their market cap to keep an eye on:

- MakerDAO $MKR: $576m

- Goldfinch $GFI: $17.2m

- Bluejay Finance: $158k (microcap that is exploring RWA in corporate bonds) 👀

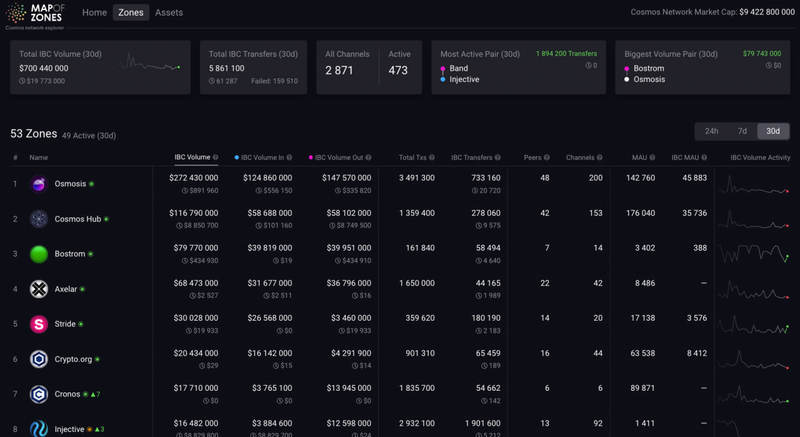

5. Continued Growth of Cosmos

Cosmos app-chains have proved to be a successful scaling solution, attracting dApps over. They have kept a healthy number of active users despite the current bear market.

DEXs like Osmosis still have more than 100k active users monthly.

With liquid staking unlocking billions of liquidity in Cosmos, the prime benefactors are DEXs and money markets that support LSDs and deep liquidity.

ATOM 2.0 and Interchain Accounts will also make it easier for Cosmos chains to work with each other and make Cosmos a more vibrant ecosystem.

Read our article summarizing the ATOM 2.0 whitepaper here.

New to Cosmos? Here are some high-potential Cosmos chains to consider:

- Osmosis $OSMO: $408m (AMM Liquidity hub of Cosmos)

- Terra $LUNA: $305m (Contrarian)

- Kujira $KUJI: $57m (CLOB DEX)

- Demex $SWTH: $11m (Perp CLOB DEX + Money market)

- Stride $STRD: $2.6m (Cosmos' Lido?)

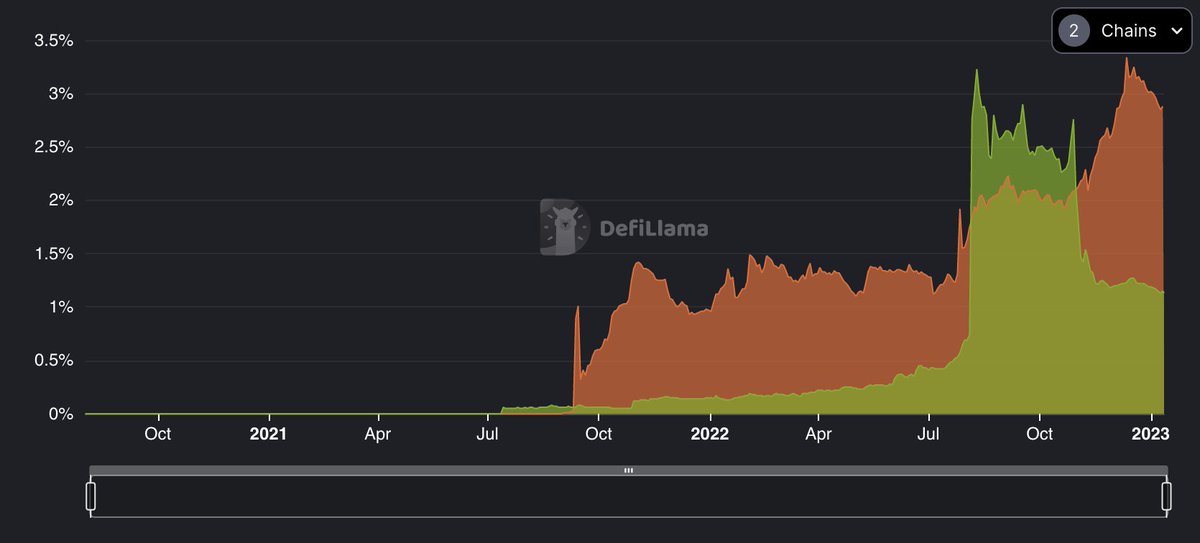

6. L2s are Dominating

We can’t talk about app chains without talking about L2 rollups. The launch of Optimism's OP token sparked an increase in TVL and DeFi activities across L2 ecosystems.

Arbitrum is currently leading and growing in TVL due to the potential $ARBI airdrop.

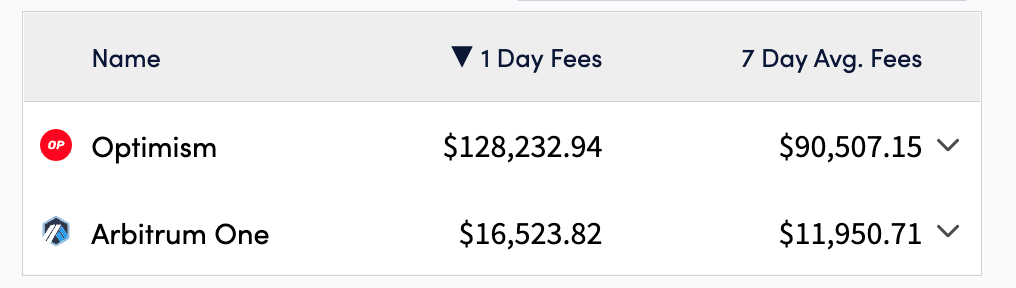

Although Optimism's TVL has dropped, the fees generated continue to increase and have been consistently higher than Arbitrum.

Their upcoming Bedrock upgrade will also improve their speed, fees, and be ZK-proofs ready (huge).

Looking for L2 plays? Here are some high-potential low-cap dapps to consider:

- Dopex $DPX: $60m (Top DeFi Options)

- JonesDAO $JONES: $7.4m (Options Vault and upcoming Delta-neutral vaults)

- GMD $GMD: $3.8m (Delta-neutral GLP vaults)

- Buffer $BFR: $1.6m (Short-term options)

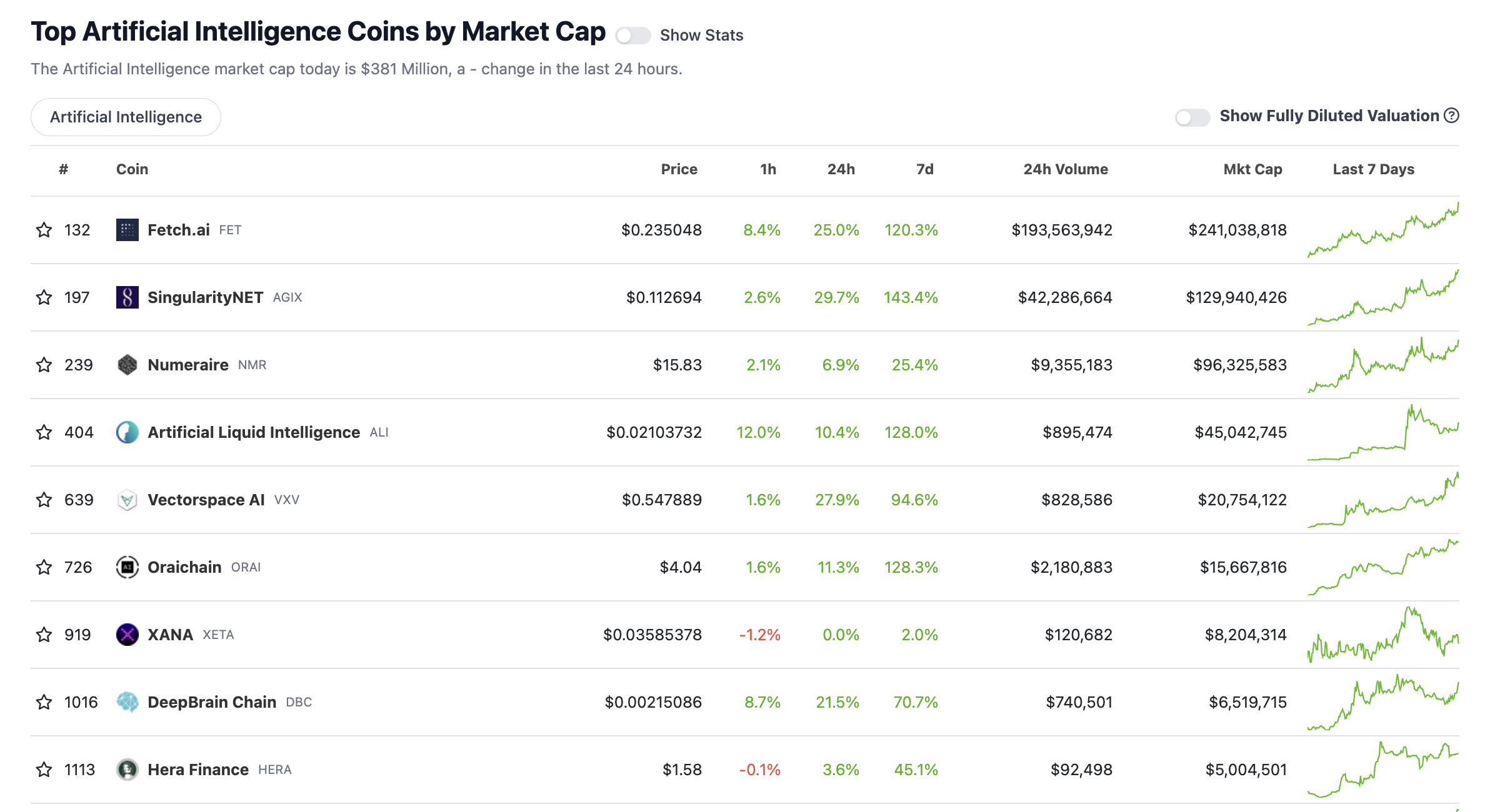

7. AI is here

With the success and popularity of ChatGPT, AI is hitting the mainstream, and crypto is one way for the mainstream masses to speculate on AI tokens as well.

Microsoft plans to invest $10 billion in ChatGPT creator, which can spark a bull run similar to Meta.

Wondering which AI token to buy?

Fetch.ai is an AI-backed blockchain for a decentralized machine to machine economy, built on the Cosmos SDK as well.

Read our past research to know more: https://blog.switcheo.com/switcheo-research-fetch-ai/

Conclusion

This bear market has removed the fluff and hype from the boom of DeFi.

It is the best time for long-term investors to research and gain insights on trends as this space will develop for many years to come!

Share this article if this helped you, we would appreciate it!