In this strategy, you will be able to earn a pseudo delta neutral yield of over 20% APY through a synergy between Demex and liquid staked OSMO (lsOSMO).

In short, the essence of this strategy is to obtain lsOSMO which is currently yielding over 20% APY, and hedging the exposure of OSMO by shorting it on Demex's OSMO perps. This strategy involves Keplr wallet extension.

As Stride is the first to launch lsOSMO, we will be synergizing with their lsOSMO, which is called stOSMO, but this can be done with any type of liquid staked OSMO in the future.

Let's explore how this is done, but first, if you are not familiar with Demex, here's an introduction to Demex's perps:

If you are not familiar with Stride, we recommend checking out our previous article explaining the mechanics of Stride here:

Strategy Execution:

1. Getting stOSMO

The first step is to get stOSMO which will yield staking rewards of about 20% APY currently, and we will hedge the price exposure to be delta neutral later on. The annualized amount you earn will be 20% of how much stOSMO you obtain. Note that stOSMO takes about 21 days to unbond into OSMO on Stride.

There are various ways to obtain stOSMO, let's go through them:

- Buy OSMO on Demex or Osmosis and stake on Stride (withdraw to Stride)

- Buy stOSMO on Demex or Osmosis directly (might have higher slippage)

- Borrow OSMO on Demex's Money Market (Nitron) and stake on Stride (requires collateral)

2. Getting USDC Margin for OSMO Perp Trading

Now that you have some stOSMO, the next step is to obtain some Ethereum USDC on Demex to use as margin for perp trading to short OSMO.

Thanks to leverage, you do not need to obtain the exact dollar value of your exposure as you can choose to multiply your margin power with leverage. I.e. I deposit $1000 of rATOM, borrow $333 of USDC, and short ATOM with 3x leverage to give me a $1000 short exposure to hedge my $1000 of rATOM.

There are various ways to obtain USDC, let's go through them:

- If you already have axlUSDC on Osmosis, you can view this guide on how to send USDC from Osmosis to Carbon, and sell axLUSDC to USDC here.

- If you have USDC on Ethereum, you can click here to deposit.

- Recommended: Collateralize stOSMO on Nitron to mint USC and sell to USDC, or immediately borrow USDC. Remember to watch your health factor.

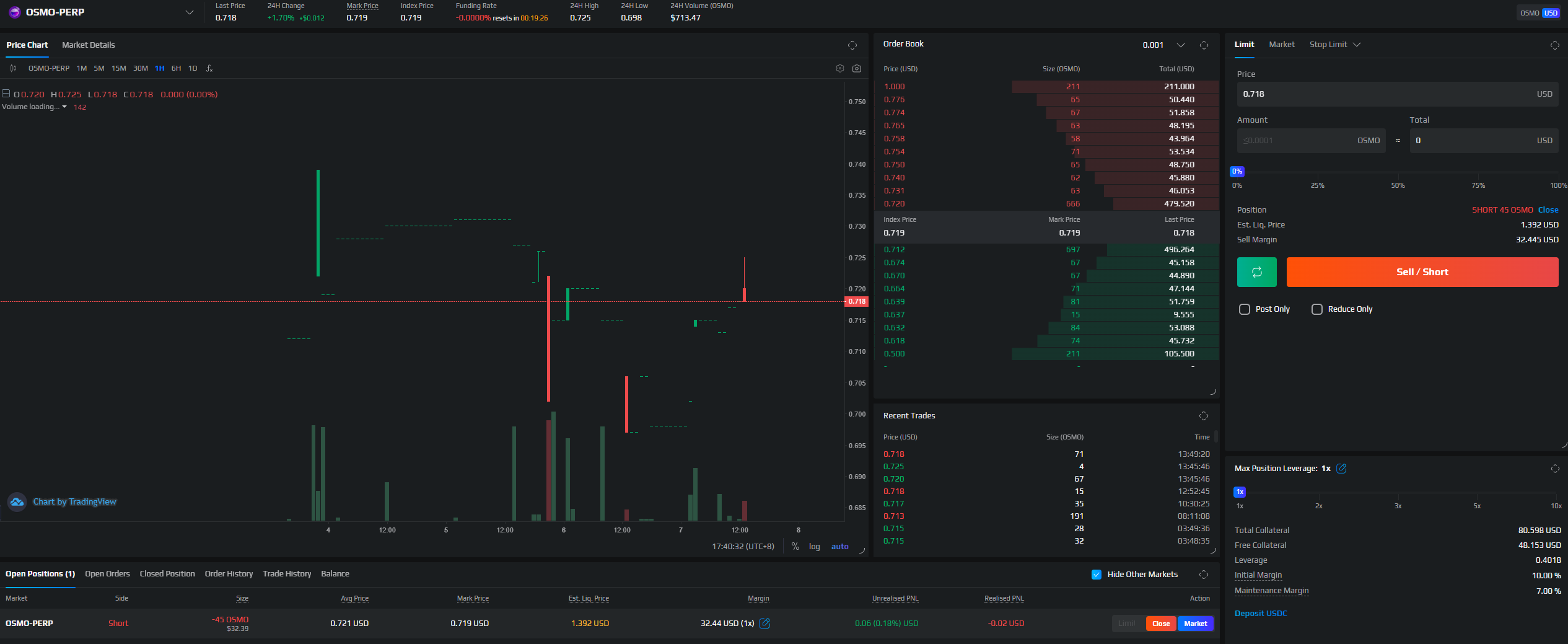

3. Hedging OSMO price exposure on Demex

Now that you have some USDC, the next step is to short OSMO.

Go to Demex's OSMO perp page by clicking here, and you can make a limit / market order to short the amount of OSMO exposure that you have, in order to be delta neutral.

Tip: Ensure the total amount of OSMO you short is the same exposure that you have in stOSMO. I.e. if stOSMO is 1.1x of OSMO, you will need to take that into account to be properly delta neutral, as one stOSMO is not equal to one OSMO, because stOSMO auto compounds and accrues value in the token overtime.

If done properly, overtime your stOSMO position will accrue in value against OSMO, and your short position will hedge your OSMO exposure, allowing you to earn about 20% APY from OSMO's current staking rewards (this changes overtime), and minusing away the funding rate on Demex, and interest rate that you may be paying if you minted USC or borrowed USDC.

Risks

This strategy is involves certain risks, let's explore some of them.

- If you are using stOSMO to mint USC or borrow USDC to short OSMO, you will need to check your health factor (if stOSMO drops too much) and liquidation price (if OSMO pumps too much) and top up accordingly

- If stOSMO gets exploited, it can be permanently depegged, ruining this strategy, however Stride has 3 audits and is a minimalistic protocol that specializes only in liquid staking so it looks safe for now

- There may not be enough liquidity to enter or exit your short position at one shot if your size is big, so it might take time and during this period, the price of OSMO might move, leaving you with some market exposure

- Generic smart contract risks

Conclusion

Although crypto is in a bear market now, innovation continues to happen in DeFi and there are still certain opportunities and strategies that you can take to earn yield during this period.

However, it is important to understand the mechanics of how things work and where the yield is coming from. In this case, the yield you are earning comes from OSMO staking rewards, and if you do not wish to have exposure to OSMO price, you are hedging it away via perps.

Carbon will continue to build itself to be an all-in-one DeFi hub where traders and investors can partake in various strategies to hedge and invest in the market. We hope you enjoyed this strategy and stay tuned for more feature update and guides!