Introduction

Gains Network is a decentralized perpetual exchange on Polygon, with plans to expand and provide a suite of DeFi products. Their first product - gTrade, allows massive on-chain leverage, up to 50x for US stocks, 150x for cryptocurrencies, and 1000x for forex markets.

Various trading pairs have been listed on gTrade including 10 forex pairs (USD, EUR, JPY), 25 stocks (APPL, GME, TSLA) and over 48 cryptocurrencies (APE, BTC, ETH) that all share the same liquidity in GNS/DAI.

Key Features

1. gTrade

- Unique Trading Engine

- Accurate Pricing

- Guaranteed Stop-Loss Price

- Competitive Fees

2. DAI Vault

3. GNS Token

4. GNS NFTs

Unique Trading Engine

All pairs on gTrade are backed by DAI vaults and leverage is synthetic which means capital can be shared between multiple pairs. Trades are opened with DAI collaterals, which get deposited into the DAI vault, regardless of the trading pair. Any leverage is then synthetically backed by the DAI vault, GNS/DAI liquidity, and the GNS token. When a trade is closed, DAI is removed from the vault to pay the traders.

Accurate Pricing

Decentralized leveraged trading platforms often use Chainlink Price Feeds as reference spot prices in order to compute the funding rate based on the difference between spot prices and futures contract prices.

Since price feeds on Polygon are not updated every time in real-time, Gains Network has created a custom on-demand, real-time Chainlink DON that allows users to trigger new oracle price updates while executing trading orders.

Source: Gains Network

Their unique oracle architecture uses a custom Decentralized Oracle Network (DON) to supply on-demand prices to an aggregator contract while the official Chainlink Price Feeds serve as anchors. A circuit breaker on gTrade is triggered when prices differ by more than 1.5% from the Chainlink Price Feeds, rejecting the node and waiting for the next answer. This mitigates the possibility of scam wicks and stop-losses will be triggered regardless of network congestion. As orders on gTrade are executed using real spot prices of listed assets, they do not charge a funding fee.

Source: Gains Network

Guaranteed Stop-Loss Price

This feature is unique to gTrade and cannot be found on any other decentralized perpetual platforms like GMX or even centralized platforms. Having a guaranteed stop-loss price is absolutely beneficial for traders on a large leveraged position.

Assuming a trader sets his stop-loss at -10% of X price. If the price of an asset absolutely dumps and the Chainlink nodes return the current price of -50%, gTrade essentially says "the price is at -50% but since there was a stop-loss set @ -10%, let's be friends and look back at the price when it was -10%". The platform would then trigger their stop-loss at -10%.

You can see how this benefits traders as they will be able to dodge a bullet if the asset price dumps and the stop-loss price is honoured.

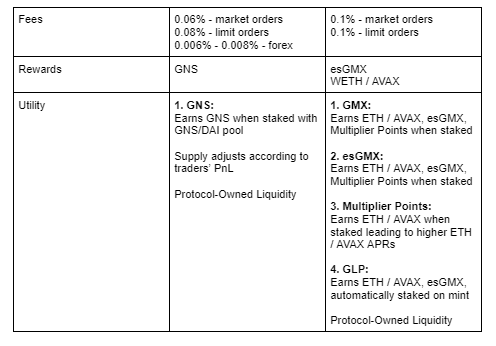

Competitive Fees

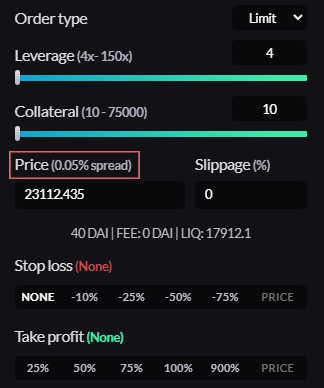

gTrade currently charges 0.06% for market orders, 0.08% on limit orders for all cryptocurrencies, and 0.006% - 0.008% for forex. The fee is applied upon opening and closing a trade.

There is a small spread on the price of each pair when opening trades to prevent high-frequency bots to exploit very small price movements. The exact percentage varies from 0.05% to 0.14% and can be seen in the trading panel. Check out their full fee breakdown here.

Additionally, gTrade offers low price impact subjected to the position size of your trade, and the liquidity of the pair on spot exchanges.

Lastly, funding fees and rollover fees are charged based on your position size and your collateral respectively. This was implemented to manage the risk of the DAI vault, depending on the net exposure of a pair, and depending on its volatility. For the latest rates, visit the gTrade platform and select your desired pair.

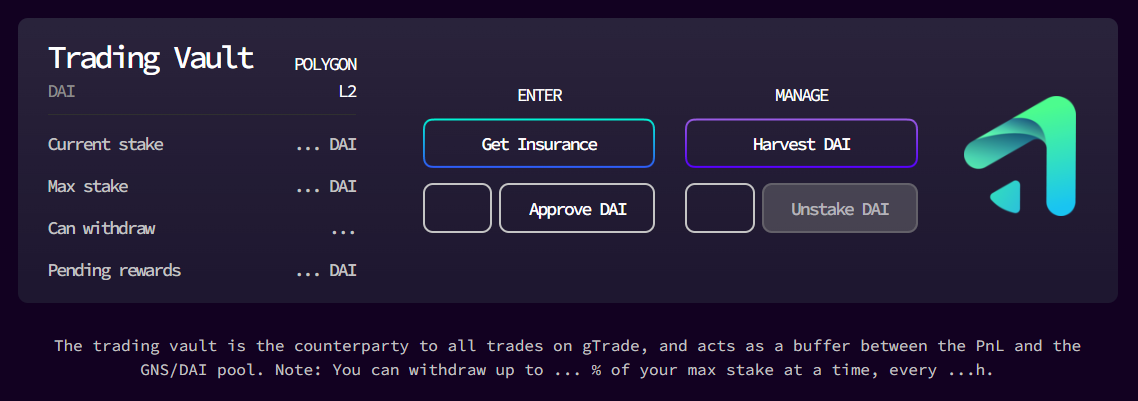

DAI Vault

The DAI vault is where the DAI from open trades goes and is used to pay out traders when the trades are closed. Anybody can stake DAI in the vault and earn DAI rewards from fees based on the gTrade volume.

The staked DAI can only be withdrawn at a max rate of 25% of your maximum historical holdings every 24 hours. This means if you have 10,000 DAI in the vault, you can withdraw 2,500 DAI every 24 hours and will have withdrawn the entirety after 4 days.

The vault will always be over-collateralized and it achieves this by burning and minting GNS. If the vault is more than 10% over-collateralized because users have opened trades, the vault will use the extra DAI to market buy GNS and burn it.

On the other hand, if the vault is less than 100% full because traders have been winning, the vault will mint GNS and market sell it in very small amounts over time to refill the vault with DAI.

Collateral size is relative to the amount of DAI staked in the vault. This is updated based on its TVL. Currently, there is about 10 million DAI in the vault, and the max collateral allowed on a single trade is 75,000 DAI.

Finally, the vault reduces unnecessary volatility for GNS since both buys and sells are performed via the vault and spread over time.

GNS Token

GNS is essential to gTrade and its synthetic structure. Currently, GNS is a single utility token that is meant to capture the PnL of traders and drive that value back to token holders. GNS tokens are minted when traders profit from their trades and burnt when they make a loss.

The maximum supply of GNS is capped at 100 million GNS. This is used as a failsafe mechanism that in theory, should never be reached.

Currently, GNS holders are unfortunately exposed to the risk of traders’ performance. This allows them to earn the upside of losing trades while the token supply contracts but also risk losing big from profitable trades while the token supply expands from minting and dumping.

The chart above tracks the supply of GNS which has until recently been deflationary due to traders losing to the market on top of massive liquidations from February to May.

GNS can also be paired with DAI on Quickswap and then staked on the GNS/DAI pool to earn incentives. Majority of the trading fees will be sent to the GNS staking pool once the protocol has enough protocol-owned liquidity (POL).

GNS NFT

Within the GNS ecosystem, there are 1,500 NFTs, each of which is then categorized into a different tier based on their rewards.

There are five different tiers:

- Bronze: 500 NFTs

- Silver: 400 NFTs

- Gold: 300 NFTs

- Platinum: 200 NFTs

- Diamond: 100 NFTs

Each of these tiers comes with its own selection of benefits, incentivizing users to supply total liquidity in order to mint these NFTs. Diamond NFTs come with the largest amount of benefits and thus require the most amount of NFT credits.

Users can expect the following benefits from the NFTs, with varying returns based on the tier:

- Spread Reduction – Spread is reduced by between 15% (bronze) and 35% (diamond) when holding an NFT in their trading wallet.

- LP Reward Boost – If a user takes an NFT on the v5 pool, they will receive boosted rewards varying between 2% (bronze) to 13% (diamond).

- NFT Bot – The NFT bot will create rewards, execute liquidations, and allow for the surpassing of limit orders.

The connection of ecosystem benefits and NFT possession creates a unique feature of the platform, one that inherently increases the digital value of the NFTs, while incentivizing their trading.

Users can buy their NFTs on OpenSea at the current floor price of 1 ETH. The team has plans to rename them to "GNS", and also include the art in their metadata.

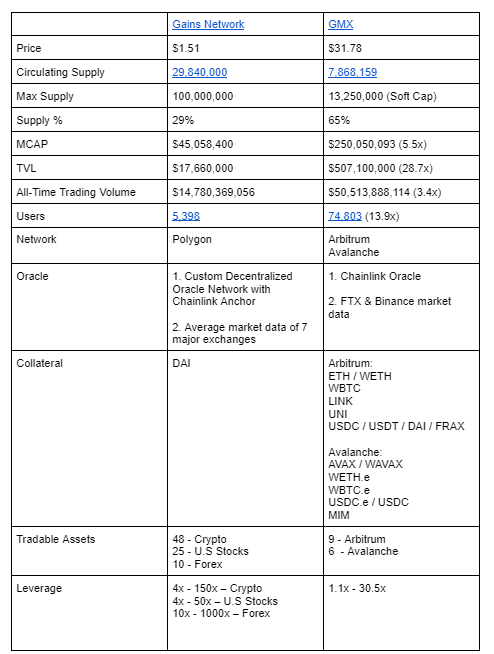

Comparison

If we take a look at Gains Network versus GMX, we can see that there's a lot of potential for GNS to grow as the protocol is still in its early stages of development.

gTrade offers a wider range of assets compared to GMX, with 15 vs 48 assets on cryptocurrency pairs alone. The platform also benefits traders with lower trading fees for opening and closing their positions. This can be seen from the comparison above. Despite having 13.9x less users and a 28.7x lower TVL, Gains Network has managed to net an all-time trading volume of $14 million which is only 3.4x less than GMX.

The single asset collateral (DAI) on gTrade is also a very attractive feature as users do not have to manage multiple positions using multiple assets as collateral, resulting in potential liquidations if poorly managed.

The team has plans to utilize GNS as their governance token in the future which could potentially drive the price of GNS up.

Conclusion

Gains Network uses a range of DeFi products to deliver a new form of trading. Through their integration of GNS into gTrade, they provide the option to leverage in ways that would not be possible with traditional brokerage platforms.

The biggest advantage to gTrade is the ability to open a 100x leveraged position while having a guaranteed stop-loss price feature as a protective mechanism during a downturn. By using a Chainlink node and taking the median price from seven major data sources, Gains Network also prevents manipulated scam wicks or false prices from impeding its daily trading.

If you’re looking for a new leverage platform that could potentially become the next big perpetual platform, Gains Network is a great choice for you.