The Switcheo token $SWTH is the native governance token of the Carbon network which is a custom-built L2 sidechain using the Cosmos SDK to create a cheap, fast, and secure network for users to trade on.

It is used in every transaction as gas fees as well, but with our latest update on flexible network fees, you can now use other tokens as gas and they will be converted to $SWTH as gas on the backend.

In today's article, let's explore the top 6 use cases of the $SWTH token.

Using $SWTH as collateral

With our upcoming CDP feature, $SWTH can be used as collateral to open Collaterized Debt Positions (CDP) such as the Carbon Stablecoin, or to borrow other assets across all chains that we are integrated with. The design will be similar to the Maker Protocol.

This would allow $SWTH holders to leverage their $SWTH holdings to mint/borrow assets and then use those assets to trade, creating long and short positions depending on the assets borrowed.

Earning #realyield by Staking

In PoS, validators and delegators accrue base rewards for making blocks. These are fixed base rewards that decrease at a weekly rate, and is also known as the $SWTH inflationary supply.

However, as $SWTH started in 2018, about 80% of all $SWTH is already in circulation, reducing the inflationary pressure for $SWTH holders.

With most of the downward selling pressure gone, more and more of the staking rewards you get will be from the fees generated by activities on the Carbon network, aka #realyield.

Some of these fees include:

- Network fees for any transaction

- Taker fees in the underlying currency exchange, giving you a diversified basket of crypto assets as fees

- CDP-related fees such as minting fee, stability fee, liquidation fee, interest rate fee, etc

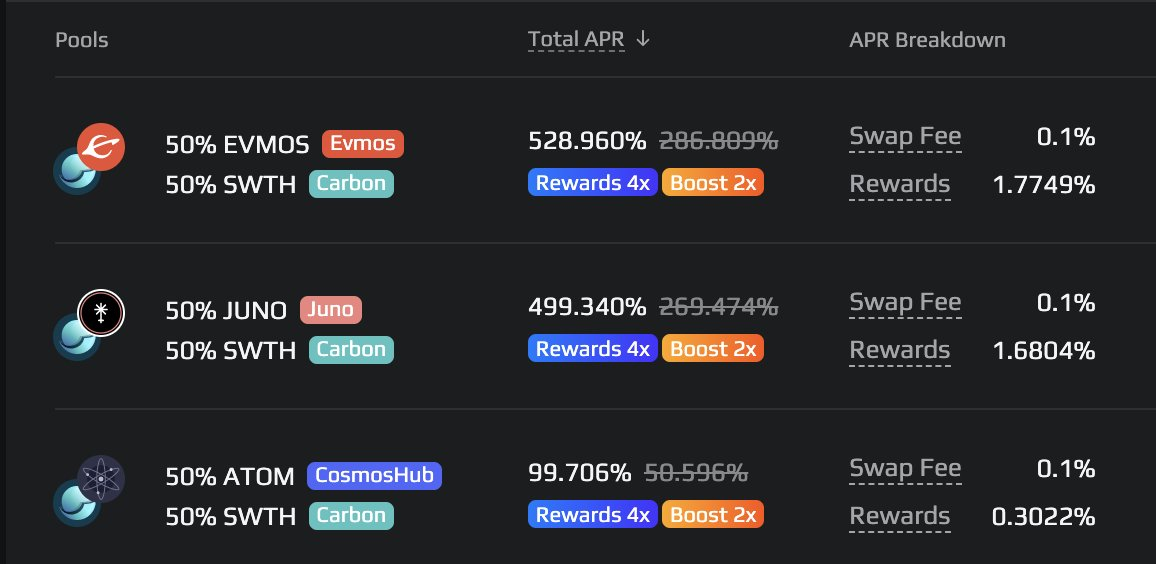

Earning high liquidity provision APR rewards

Already holding $SWTH? Put it to work by providing liquidity on our $SWTH pools and get over 100% APR.

We are one of the few CLOB dexes where you can provide liquidity and it gets used to market make the orderbook. Now you can get paid to become a market maker on our platform with just a few clicks!

Using $SWTH as a bridge

With more and more chains appearing everyday, Carbon is slowly but surely integrating with more of these chains.

This means we can also act as a bridge for these chains. For instance, if you want to get some $JUNO onto Juno network, but you only have $ETH on the Ethereum network, you can send in $ETH and swap it to $SWTH and then swap $SWTH to $JUNO, and withdraw to the Juno network.

Demex is a bridge where you have full control over your funds yourself.

Governance token of Carbon Network

Last but not least $SWTH is the governance token for making and voting on proposals. For instance, 10,000 $SWTH is needed to create a proposal.

Therefore, $SWTH stakers are able to vote, submit and implement proposals to change the parameters and features of the Carbon network.

This ensures that Carbon operates as a full Decentralized Autonomous Organization (DAO) and is thus not vulnerable to the risks associated with Centralized Exchanges.

Governance on Carbon is entirely on-chain, meaning that proposals can be enacted immediately, without the approval of any admin/multi-signature committee.

Using $SWTH for Trading Fee Discounts (Soon)

Similar to $BNB, holding $SWTH in your wallet provides reduced trading fees for your taker orders. Users can receive tiered discounts for the Taker fee as seen in the table below.

The taker fees are not paid in $SWTH token, the fee taken will be deducted from the underlying currency traded.

Note: This feature is not out yet and will come soon.

Summary

- Used as collateral in Nitron money market

- #realyield by staking as every on-chain fee goes to $SWTH stakers

- Provide liquidity and earn rewards

- Using $SWTH as a bridge between ecosystems

- Governance

- Trading fee discounts