Fetch.AI is a UK-based blockchain company that focuses on machine learning and artificial intelligence. Developers utilize the platform to build and test intelligence apps which can then be used to complete a diversified list of tasks. All solutions within the Fetch.AI platform are paid for in $FET.

Context

The machine-to-machine (M2M) economy, although still at its infancy stage, is an evolving ecosystem that is powered through the convergence of three developing technologies: Internet of Things (IoT), Artificial Intelligence and Machine Learning & Blockchain.

According to research, it is estimated that M2M communication, together with Machine Economy’s underpinning technologies, is expected to rise over the next five to ten years at a compounded annual growth rate of between 10% to 50%.

The M2M economy promises significant benefits for people, businesses, and the broader economy by combining the actions of multiple agents. This includes:

- Reducing costs and increasing revenue.

- Improving operational efficiency.

- Creating new value.

- Mitigating risks associated with owning assets.

- Strengthening workforce and output.

- Increasing transparency through data.

Businesses across the world are starting to be prepared to adopt this whole idea of a M2M economy that will usher in a new era of radical automation that consists of billions of smart, connected machines interacting and transacting with each other on behalf of human beings. This could potentially unlock trillions of dollars in business value by achieving outcomes that would not be possible with centralized architectures as the environments are too complex, spatially distributed or involve multiple stakeholders.

Introduction

Fetch.AI plays a significant role as the building technology of the M2M economy. An example is the administration of novel blockchain and a generic framework in the creation of off-chain protocols. By utilizing techniques from multi-agent systems, this agent framework can be applied on oracles, interchain transfers, state channels and many other applications. It is also securely integrated with the Fetch ledger.

Fetch.AI is also exploring new domains in finance, supply chain, mobility, smart cities and IoT applications. The blockchain supports a myriad of services, which includes staking, governance and identity that support deployment of agent applications.

As Fetch.AI is situated on the Cosmos-SDK, token interoperability is enabled with many other chains via the inter-blockchain communication (IBC) protocol. Thus, this would allow agent-based services to be deployed on other networks such as Ethereum, Cosmos and Binance Smart Chain.

With the technology to potentially revolutionize a multitude of industries, Fetch.AI is also looking to come up with a series of applications that will enhance and optimize solutions to everyday problems via intelligent data sharing, machine learning and Artificial Intelligence. Ultimately, the platform aims to grant anyone the access to the power of AI with their interoperable decentralized network and open‑source software tools.

Product Analysis

Fetch.AI depends on near-autonomous system combining with multiple components of a complex system, easy integration & use of Machine Learning (ML) / Artificial Intelligence (AI) outcomes into decision making (without needing a thorough understanding of how ML or AI operates), and collective intelligence made of machine and human intelligence to produce a non-siloed AI model, enabling improvements in the processes of decision making.

Tech Overview

Fetch.AI’s technology is built on the following four distinct elements:

- The Agent Framework: Supplies modular and reusable components for developing multi-agent systems.

- The Open Economic Framework: Offers search and discovery functions to allow agents to identify one another together with peer-to-peer networking tools for routing messages between them.

- The Agent Metropolis: A collection of smart contracts that run on a WebAssembly (WASM) VM. This helps to maintain an immutable record of agreements between agents and provide a range of services to support agent applications.

- The Fetch.AI Blockchain: Integrates novel multi-party cryptography and game theory to enable secure, censorship-resistant consensus and other features such as rapid chain-syncing to protect agent applications.

The technical focus of the platform includes: machine learning, agents and cryptography. Focusing mainly on these 3, Fetch.AI’s ultimate goal is to "automate a limitless number of markets that require tremendous manual intervention". The team expects autonomous economic transactions to deliver near-frictionless marketplaces, working at a very fast speed.

Network Participants

- Validators: Essentially the node operators, they take part in the following:

The ones who typically acts as validators are:

- Community members who are enthusiastic about the Fetch.AI protocol.

- Those wishing to take part directly in governance or network operations.

- Professional staking operations.

- Blockchain founders and developers.

2. Delegators: Smaller holders of $FET can choose to delegate their stake to validators in exchange for a share of the rewards, to be decided by the validator.

3. Autonomous Agents: An Autonomous Economic Agent (AEA) acts as the representative of an individual, organisation or object and looks after its interests. They act independently of constant input from their owner and autonomously execute actions to achieve their prescribed goals. Their main purpose of these agents is to create economic value for you, their owner, in clearly defined domains. Agents have a wide range of application areas and some of their use cases will be highlighted in the following section.

4. Developers: The ones who are responsible for the building of agents. They can join other agents in the permanent testnet known as “AgentLand” to explore new applications and opportunities in hospitality, delivery, transportation, supply chains and more.

Use Cases

By improving efficiency through the enhancement and optimization of existing systems, Fetch.AI has introduced solutions to everyday problems.

A notable use case would be the recent launch of AI ‘agent’ to counter DeFi impermanent losses. Instead of constantly having to monitor price actions and needing to manually withdraw liquidity, Fetch.AI DeFi Agents simplify and streamline that whole process for LPs. To begin, users can create up to five agents with stop-loss triggers for all liquidity pools on Uniswap and PancakeSwap. These agents can then be tracked and updated via a dedicated dashboard. Users can freely customize the DeFi agents according to their requirements.

An illustration of how DeFi agents work:

Some other use cases of Fetch.AI include:

- Delivery Agents: Realized with the v.1.0 release of the Fetch.AI Mobility Framework, making transportation systems more resilient and more efficient.

- Autonomous AI Travel Agents: Reduces the role of centralized aggregators and services, therefore encouraging direct provider-to-consumer interaction and thus allowing significant cost savings for both hotels and consumers.

- Commodity exchange & decentralized finance: By overcoming existing barriers to entry through technology, market players can gain access to exciting new risk management tools, while maintaining market efficiency and security. Fetch.AI will also unlock new funding models for the supply chain participants and allow spread hedging between raw materials and finished products, helping market players to better hedge the portion of the supply chain which is more relevant to them.

- Collective Learning: A tool that allows distributed parties to work together to train machine learning models without sharing the underlying data or trusting any of the individual participants. An example is the case of the healthcare industry. With wider implementation of Fetch.AI’s collective learning network, information from hospitals across the globe can be rapidly and effectively combined to improve prognostic predictions and ensure patients are given the right care.

- Smart Homes: Fetch.AI’s autonomous agents can use a new deep reinforcement learning technique to lower daily domestic energy costs by nearly 20%.

More can be found on https://Fetch.AI/use-cases/.

Mainnet v2.0 Release

On 31st March 2021, Fetch.AI launched their Mainnet v2.0, enabling $FET to be used to get work done on the network. Using $FET as the fuel, autonomous agents, the smart ledger, synergetic and AI-powered smart contracts are now a reality. This is incredibly exciting as developers and commercial businesses are now able to work on Fetch.AI’s unique platform to build applications.

More details can be found here: https://medium.com/fetch-ai/lifting-the-hood-on-mainnet-the-good-bits-eb2ffd25a24a

Tokenomics

Key Metrics

$FET and Use Cases:

The Fetch.AI ($FET) token serves as the value exchange on the Fetch.AI network. It is utilized as the payment method for all transaction fees, also a refundable method of registering on the ledger, and can be staked to secure the overall network.

$FET has the following use cases:

- Building and connecting agents to the network: Somewhat like staking, $FET can be utilized to assign agents the right to operate in the network. $FET is deposited to ensure that it is economically infeasible for bad actors to deploy malicious agents (due to the escalating cost).

- Training and deploying agents onto the network: By paying a small amount of $FET, developers will be able to access Machine Learning based utilities in the training of an autonomous agent and deployment of collective intelligence into the network.

- Accessing ledger-based AI/ML algorithms: Fetch.AI has a wide range of ‘primary’ AI & ML functionality embedded in the ‘Smart Ledger’ itself. This includes trust scores for agents to be aware of broader contextual prediction models and which agents they should do business with. Agents require $FET to access this core functionality.

- Performing oracles and trust services: To facilitate network validation and reputation, users can stake $FET to be enabled as validation nodes.

- Be part of the digital economy: Once an agent has been built, $FET can serve as a medium of exchange on OEF (Open Economic Framework) to exchange value between agents. $FET is used as a means for agents to pay for access, where they will then be allowed to acquire data or services from other agents.

Token Supply:

Fetch.AI has a current circulating supply of 865,279,978 FET. The live statistics of the $FET token can be found here: https://token-information.Fetch.AI/.

Genesis Supply:

The initial token supply consists of 11% of the total $FET supply, which is equivalent to approximately 126,829,733 tokens. The initial token supply will be released as per following:

The Token Generation Event (TGE) was held in February 2019. Various tranches of token lockups and vesting schedules are detailed as follows:

- Public Sale: no lockup after TGE.

- Private & Seed Sale: 3-month lockup after TGE, vesting monthly over 3 months thereafter.

- Founders & Team: 3-month lockup after TGE, vesting quarterly over 3 years thereafter.

- Advisors: no lockup after TGE. Vesting quarterly over 3 years.

- Future Release: targeted monthly release 12 months after TGE.

- Mining Release: targeted monthly release 6 months after TGE.

- Foundation: no lockup after TGE, vesting monthly over 4 years.

Total Supply

The total number of tokens generated is intended to be 1,152,997,575. No more tokens will be added, but native Fetch.AI tokens can be subdivided indefinitely.

Token Inflation

The team has decided for $FET to carry an inflation rate of 3%, as it gives the network a three-year time-frame to become established. This means that the token is more or less “hard” money with an issuance rate that is comparable to the 1.8% yearly increase in the supply of Gold that we have seen over the last century.

Although the total supply remains at 1,152,997,575 $FET, some have noticed that the total supply on the mainnet was lower during its launch at 1,055,156,116 $FET. The team’s plan is that for the first three years of Fetch.AI’s operation, these missing tokens will be minted as block rewards to cover up for this difference. This will use up the 15% of token supply allocated for this purpose (termed “mining”) in the launch tokenomics document.

Governance

Although the network’s governance is currently still centralized, the team conducts multiple discussions with the different stakeholders and anticipates progressively decentralizing the Fetch.AI network over time.

Value Capture

At Fetch.AI’s Token Generation Event, ERC-20 Fetch.AI tokens will be issued. These are required to access the public test network and no one can participate or develop on the Fetch.AI test network if they do not hold the ERC-20 $FET. Essentially, it acts as the key enabler to allow access to the test network’s existing utility value as well as the component that facilitates the ability to develop and acquire future utility value.

Since the native $FET token is the only accepted form of payment for the network’s services, this thus allows the token to capture more network value. Furthermore, Fetch.AI uses a combination of proof-of-stake with proof-of-work to deliver consensus.

Under proof-of-work, miners are rewarded with $FET for performing useful on-ledger computing and consensus calculations that helps to optimise network performance and generate trust and prediction information for network users. 15% of the issued tokens are provided as mining rewards and these tokens are present over the initial years of Fetch.AI as an additional incentive while this value grows.

Under proof-of-stake, token holders are incentivized to stake to validate transactions. It is introduced to optimize the ledger's performance and enable smart (and difficult) decisions and predictions to be made inside the ledger and its smart contracts.

Motivation

To motivate participants, system incentives are distributed to processing nodes for block production and data mining operations on the smart ledger. According to several assumptions made by the team, the following profit rates could be expected by a validator with an 8% commission rate, and average running costs of $3000 per year:

Holders are also rewarded for staking their $FET:

- Staked $FET entitles them to rewards from participating in incentivised test-nets.

- They can run validators to receive further rewards.

- They can receive a fixed return for staking $FET in the staking smart contracts.

- They will also be able to participate in the planned future projects.

Developers are also rewarded for their participation in Fetch.AI’s incentivized testnets that are up and running, with over a million $FET worth of rewards to be earned over the testnet phases.

Planned Roadmap

As of now, they have fulfilled the following milestones on time:

✅ Fetch Mainnet V2 Launch

✅ Upgrade of launchpad network to Stargate version of Cosmos-SDK

✅ Stake swap for Mainnet 2.0

✅ Stargate upgrade on mainnet. Token bridge cap increases to 250 million FET tokens.

✅ Launch of Mobix token.

Exciting upcoming milestones include:

🔜 Connection of Fetch.ai mainnet to Cosmos-hub with IBC

🔜 NFT staking support on mainnet

🔜 AW-6 DeFI trading agent competition on test/mainnet

🔜 Tokenized collective leaming system on mainnet

🔜 Agent-based oracle network

More can be found on https://fetch.ai/roadmap/.

Fundamental Analysis

Macro Analysis

The increasing usage of connected devices and IoT penetration are governing the growing demand for M2M services globally. The rapidly advancing trends in Asia Pacific has boosted the industry, leading to a positive outlook of M2M services in the world’s most potential market. It is estimated that the M2M connections market will grow from USD 19.31 billion in 2016 to USD 27.62 billion in 2023, at a CAGR of 4.6% from 2017 to 2023.

With the integration of blockchain & IoT leading us to the future of M2M communication, this could potentially be a game changer in future ecosystems. Through the use of smart contracts, a new machine economy can be created and blockchains can also enable smart devices to become independent agents.

Competitor Analysis

The key competitors of Fetch.AI includes SingularityNET and Vectorspace AI.

SingularityNET lets anyone create, share, and monetize AI services at scale by gathering leading minds in machine learning and blockchain to democratize access to AI technology. Ultimately, the team aims to establish a network of complex AI Agent interactions primarily using resources from the OpenCog Foundation. By tokenizing the network, it has allowed users to develop more robust AI solutions, AI services and products to be bought and sold, created revenue and established price points that have never existed before.

Vectorspace AI’s platform leverages on advanced approaches in Natural Language Processing (NLP) and Machine Learning (ML) to create dynamic smart "token baskets" based on trends rising in context-controlled sentiment, search, social media, and news. They are particularly focused on how they can get machines to trade information with one another or exchange and transact data in a way that minimizes a selected loss function.

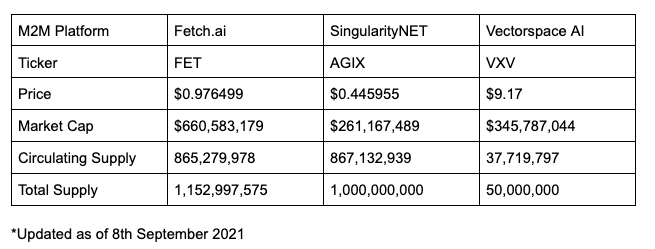

Comparing Market Stats

Opportunity

The global COVID pandemic outbreak has overall positively affected the global M2M market, which is set to rise following the COVID-19 pandemic. This is mainly due to the fact that more and more sectors and businesses were forced to transit into remote work settings due to the widespread of the pandemic. As such, M2M systems have helped many businesses and manufacturing plants to monitor, record, operate, and diagnose many of their tools without having the need to send an employee down to the site to do so.

As we progress from here, the incoming Machine to Machine (M2M) era will radically transform the way companies and assets are managed through the introduction of Autonomous Economic Agent, Machine Learning and new business models. This serves as a huge opportunity for Fetch.AI to appeal their product to the world.

Target Audience

Fetch.AI’s network extends to a multitude of industries that are seeking solutions to everyday problems through intelligent data sharing, machine learning and Artificial Intelligence.

Network’s Activity

As of 7th September 2021, Fetch.AI have a total of 41,660 contributions to their development activity:

The number of transactions is as follow:

From the chart above, the number of transactions on the network seems relatively stagnant around the range of 1-4 transactions per day.

Social Media & Community

Telegram - 12,694 members

Twitter - 76,000 followers

YouTube - 5,400 subscribers

Community growth has always been an important aspect in Fetch.AI’s development plan. The team has organized numerous community-orientated meetups and hackathons across the globe.

With regards to social media growth, Fetch.AI has observed a healthy growth as a result of announcements, public relations, and speaking at conferences. Furthermore, Fetch.AI has also embarked on paid media campaigns in the run up to key events such as token sale, testnet or mainnet launch.

The team will also continue to leverage wider communities - for instance, sponsored video coverage and interviews with well-known influencers from the cryptocurrency, blockchain, AI and general technical fields.

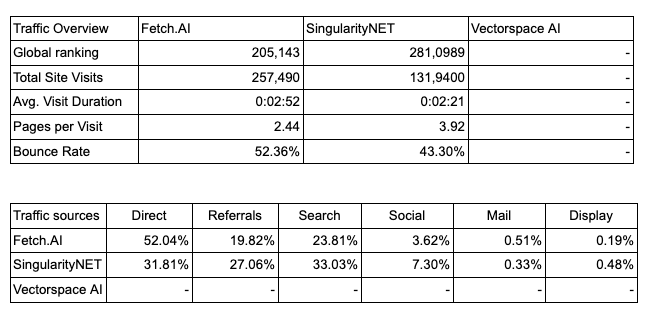

Traffic

Team

An innovation entrepreneur, founding investor in DeepMind with a record in revolutionizing trading in the steel sector.

Formerly an early developer at DeepMind, he has thirty years of experience in software, ten years as CTO and now focused on crypto-economics.

Professor at Sheffield and established scientist in advanced machine learning AI who bridges real world and academia. He is inspired by the opportunities brought by AI to modern society.

A researcher in machine learning, complex systems and blockchain technology with a PhD in machine learning from UCL. He is excited by the challenge of deploying decentralized multi-agent systems in smart cities, supply chain and healthcare.

More about the rest of the team and developers on https://fetch.ai/about/.

Partners

Technical Analysis

$FET has been around since 2019 and performed poorly during the initial year as it was still largely in development.

The 0.5 fib retracement around $0.18 acted as a strong support level, bouncing off to a new all time high at $1.15.

Using similar fib retracements, as well as strong moving averages such as the 20 weekly moving average which often acts as a bull market support band, and the 100 and 200 day sma, $0.48 is likely a strong area of support.

Using fib retracements and mayer multiplier bands, the likely top is between $1.9 to $3.9, which is between the 0.786 to 1.0 fib extensions. This would put its market cap around 1 - 2b.

In terms of momentum indicators, the stoch RSI is back into bullish territory which is typically followed by further upwards momentum when in a bull market.

This presents a risk-reward of around 4.5 in the bull case scenario which is acceptable.

Risks

A potential weakness of Fetch.AI would be the fact that there is still a relatively low adoption of the protocol. Since the project only launched their mainnet in 2020, they still have a long way to go to prove to the market that their product is sustainable in the long term. In the event if commercialization efforts start to move slower than expected, it could slow down the overall development of the project.

However, it is obvious that the team has put in a lot of effort to drive up the demand and utility of the token. They have played out impressively during the recent Bitcoin-led market meltdown by notching a 60% gain. Owing to their rising number of real-world use cases and protocol upgrades, $FET was able to spike 60% amidst the red market for many other crypto projects. Prior to this price increase, there has already been many bullish outlook from the market and this incident further proves the value of $FET and how stable it is.

Conclusion

With continued growth in the demand for M2M services, Fetch.ai is in an optimal position to benefit from this growing trend by building a machine learning network through the deployment of AI agents.

In a recent interview with Fetch.ai’s CEO, he mentioned that 2022 will be the year for Fetch.ai. They will be aggressively scaling the number of applications offered on their platform, and bringing to life the commercial partnerships that they have been forging. When asked about when the first application can be expected to land in consumers’ hands, the CEO revealed that it would be as early as before Christmas this year.

There is still a lot more to expect from the network, with impressive long term vision set by the team. Due to its strong fundamentals and being in an industry with strong growth in the future, the network is still potentially undervalued.