Undercollateralized crypto loans started in 2020 but are gaining popularity in recent times due to higher capital efficiency, improved risk scoring metrics, and better default insurance for undercollateralized loans.

With the global lending market valued around $8 trillion based on interest fee generated, this is a huge market that is coming onto DeFi. Could Carbon protocol offer undercollateralized loans as well and tap on this huge market?

In this article, we will talk about undercollateralized loans and compare 5 undercollateralized lending protocols, Maple Finance, TrueFi, Clearpool, Goldfinch, and Ribbon Lend, as well as talk about the role that undercollateralized crypto lending plays in the market.

What are undercollateralized loans?

Undercollateralized loans allow borrowers to access crypto assets by providing collateral smaller than the loan's value.

But in crypto, the identity of most market participants is hidden so an undercollateralized or unsecured loan to an unknown individual would likely lead to the individual taking the money and running away.

That's why overcollateralized loans became popular such as AAVE or the Money Market that we at Carbon are building. It was a completely permissionless way to leverage or borrow money by providing collateral more than loan value, while still keeping the existing collateral that can continue to grow in value.

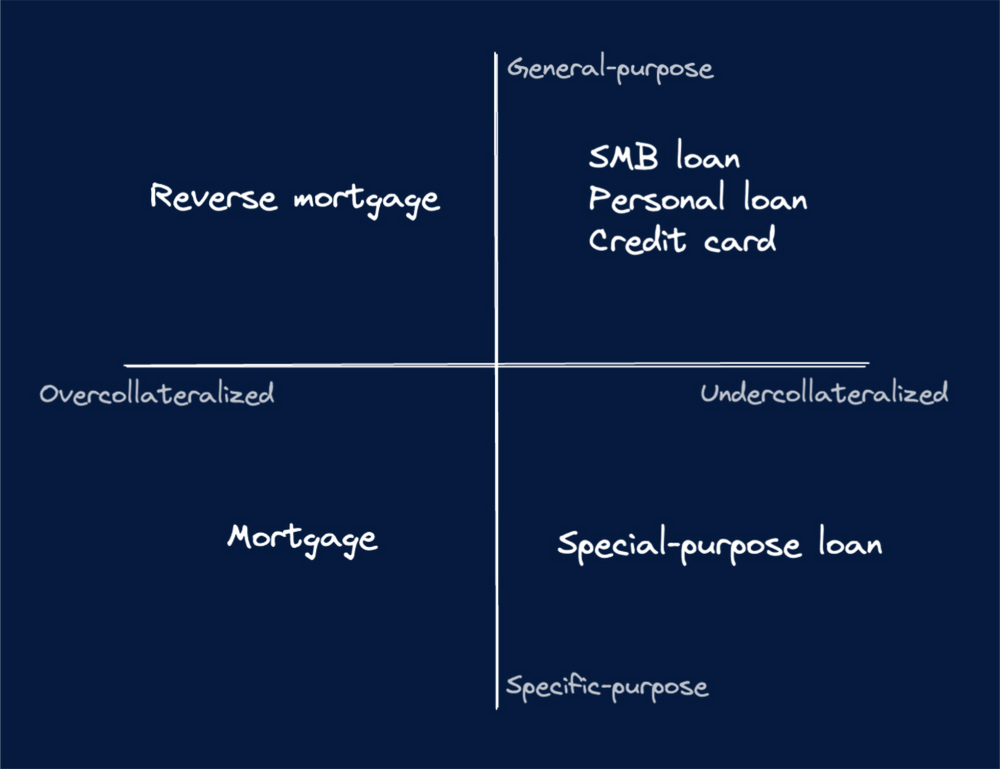

Here is a great chart from Jumpcrypto on the difference between overcollateralized and undercollateralized loans.

Carbon's money market would fall under overcollateralized general-purpose loans while most undercollateralized loans would be somewhere between general-purpose and specific-purpose.

Why do we need undercollateralized loans?

In the real world, a business could borrow money from a bank by using its credit score and the health of the business as justification that it can repay back the loan. This is known as an unsecured loan and is one of the most popular types of loans due to the ease of access to cheap capital for many businesses.

With crypto in a volatile bear market right now, overcollateralized loans are proving to be risky for many market participants due to liquidation risks. And the additional capital required that gets locked up to overcollateralize the loan makes it less capital efficient compared to undercollateralized loans.

Additionally, overcollateralized loans do not fulfill most purposes of taking a loan in the real world which is to borrow cheap capital without having the capital to begin with.

If DeFi's goal is to create an alternative system to the traditional financial system, unsecured loans are one of the biggest pillars it needs to recreate as well as it is a key driver to liquidity creation which drives investments and growth.

Additionally, one way to grow DeFi without consistently relying on external credit coming into DeFi is to create our own credit within DeFi. If a protocol that can change the face of DeFi by creating great productive output and earning great revenue streams as a result but required great upfront liquidity, it would not be able to achieve it due to a chicken and egg problem.

Hence undercollateralized loans, which are the most popular type of loans in the real world are starting to gain in popularity in crypto as well and help act as an engine of growth in Crypto.

How are undercollateralized loans performing?

Overcollateralized loans in DeFi are still the dominant type of lending, with AAVE alone lending out close to $3B in assets. But interest rates across lending protocols have dropped given the market slowdown.

AAVE's and Compound's USDC market on Ethereum gives lenders less than 2% variable APY, compare that to the fed funds rate of 3-3.25%, it's no wonder that DeFi overcollateralized lending is barren at the moment.

However, undercollateralized loans have grown significantly, and as of this writing has slightly more than $0.5B of active loans (about 16% of AAVE's active loans) across various protocols with Maple Finance leading the pack.

We expect to see continued strong growth in the undercollateralized loan space as unsecured lending is one of the best ways to borrow money in DeFi, however, there are still risks with unsecured lending as well as a lack of clarity around legal recourse for lenders in the event of a default.

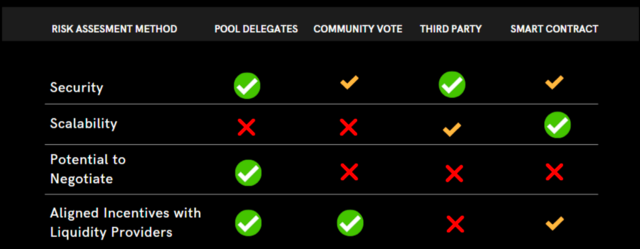

Most undercollateralized loan protocol also assess risk using pool delegates which are not a scalable method, so the growth of this sector is also dependent on the quantity and quality of pool delegate coming into the space.

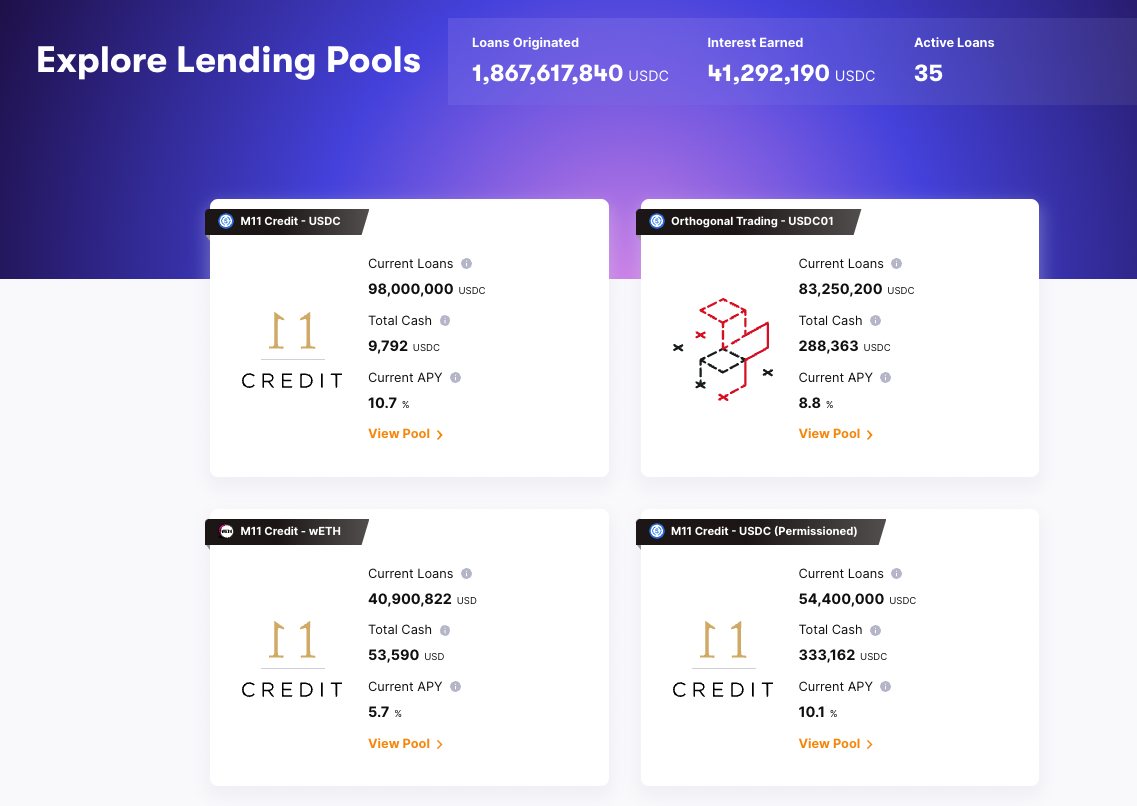

Maple Finance is the standout protocol this year, issuing more loans than any other than its competitors, partially due to its expansion to Solana which generated over $100M in loans. In total, Maple has originated over $1.8B in loans on Ethereum alone this year, compared to TrueFi’s ~$1.7B and Clearpool’s ~$340M.

Ultimately, undercollateralized loans are also affected by the state of the market and it has been a tough year for crypto with TVL dropping drastically together with token prices, but for users looking for higher yields in DeFi and are comfortable with the risks, unsecured lending platforms still offer some of the highest yield.

Maple Finance

Maple Finance is a capital market platform and they are one of the leaders in the unsecured loans space, they have the largest deposits and loan origination, with almost $2B of loans to date and over $40M in interest earned from those loans.

There are five key parties involved: Lenders, Borrowers, Pool Delegates, Cover Providers, and Stakers.

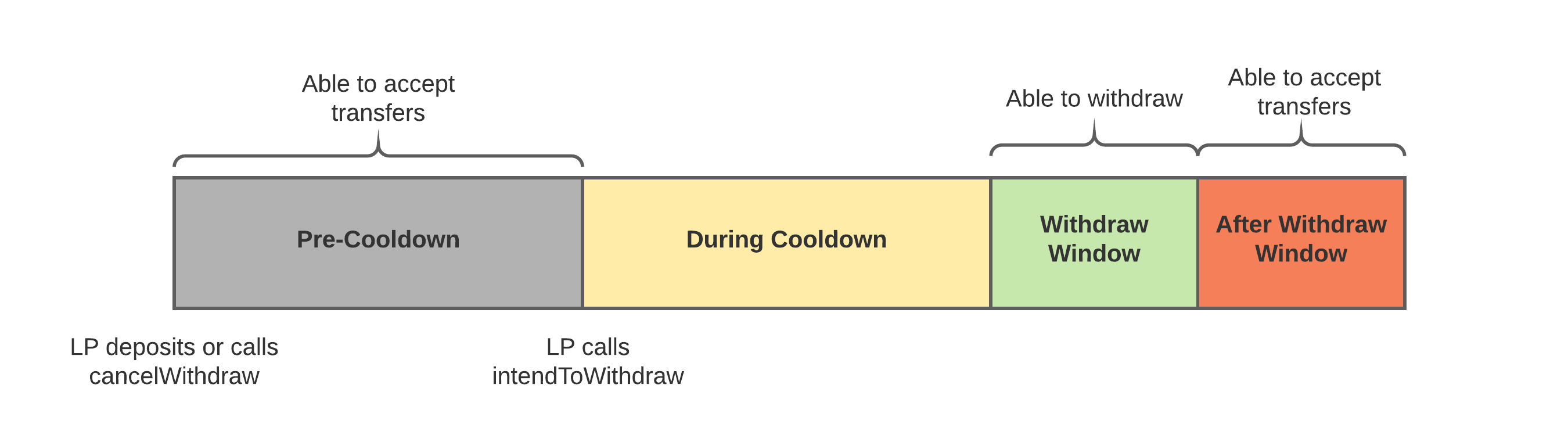

Lenders in the DeFi ecosystem supply capital into individual pools that are then lent out to institutional borrowers. Their deposits are locked for a 90-day period, with an additional 10 day cooldown period before they can finally withdraw within a 48 hour window. There is no minimum deposit requirement.

Borrowers will take a loan from lenders on-chain but are required to go through an approval process beforehand. The most common borrowers are market makers but they include hedge funds, prop traders, exchanges, centralized lenders, crypto miners, and scale-ups. Borrowers pay an establishment and ongoing fee which will be discussed later in the article and can take undercollateralized or even uncollateralized loans and have a 5 day grace period to make their repayments.

Pool delegates are individuals responsible for managing the pools, from underwriting and doing the due diligence on institutional borrowers and negotiating terms with them before providing borrowers access to funds for drawdown at a fixed term, rate, and collateralization level. As a deterrent or alignment of incentives, they must stake a minimum of $100,000 worth of MPL-USDC Balancer pool token when establishing a pool to incentivize proper administration of the lending pool.

Cover Providers can provide a sort of buffer protection to lending pools by posting MPL-USDC balancer tokens and earn additional rewards, but they will be liquidated first in the event of a default, protecting the lenders above that provide the lending capital.

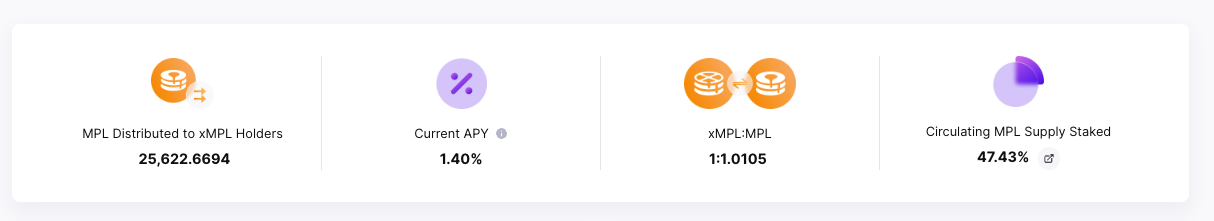

Stakers can stake MPL and receive xMPL which accrues distributed protocol revenues and can still participate in protocol governance.

Business Model

Maple Finance has two main revenue streams:

- Establishment Fees: Its main cash flow where when a borrower sources and takes out loans on Maple Finance it pays a 1% establishment fee where 2/3 goes to Maple Finance's treasury, and 1/3 goes to the pool delegate.

- Interest Fees: Interest is charged on the loan and a portion of the interest is provided to the pool delegate for underwriting. The break down of fees are as follows: 10% to pool delegates, 10% to cover reserve, 80% to lenders.

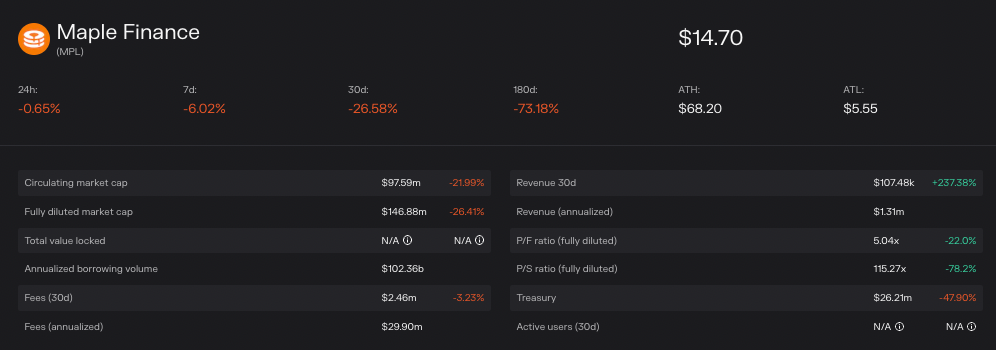

Maple has issued over $1.8 billion in loans and has a current active loans of about $276m, generating about $18 million in establishment fees and $42 million in interest earn till date, with about $4 million going to MPL stakers .

However, they also suffered a $10M default in one of their lending pools as a result of the 3AC contagion.

In their roadmap, they mentioned that they are expanding to new markets such as Crypto mining, FinTech, and SaaS businesses which should see new non-crypto related and hopefully sustainable revenue streams. They are also focusing on enabling fiat deposits into Maple pools allowing institutions that don’t interact with crypto to participate on Maple’s platform as Lenders or Borrowers.

They are also building Maple 2.0 which will introduce more features such as redesigning pool cover to single-sided asset, liquid staked lending assets, auto compounding interest, and more, which should increase the demand.

Tokenomics

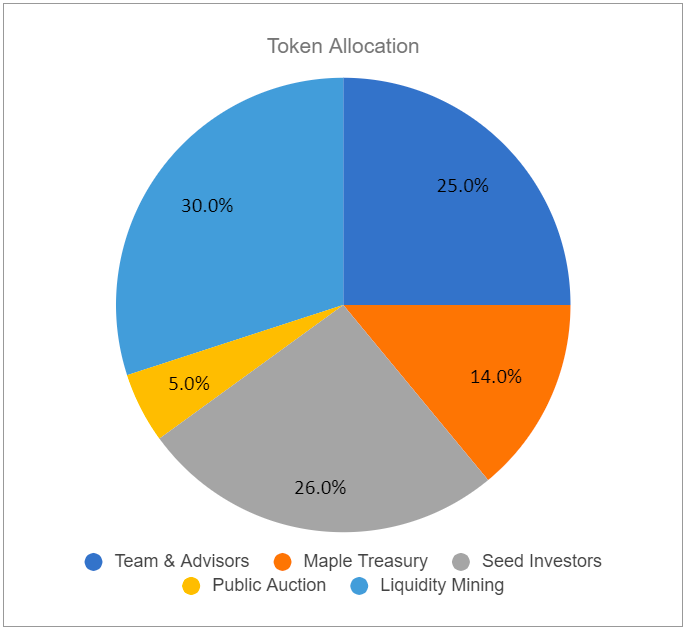

MPL is the governance token and has a fixed total supply of 10 million MPL tokens. Maple’s Token Generation Event (TGE) occured on April 28, 2021, with supply distributed and allocated to the groups shown below.

Overall portion allocated to only the public is low with just 5% done through the public auction which was conducted via a Balancer Liquidity Bootstrapping Pool (LBP) that raised $10.3mm across around 1000 participants.

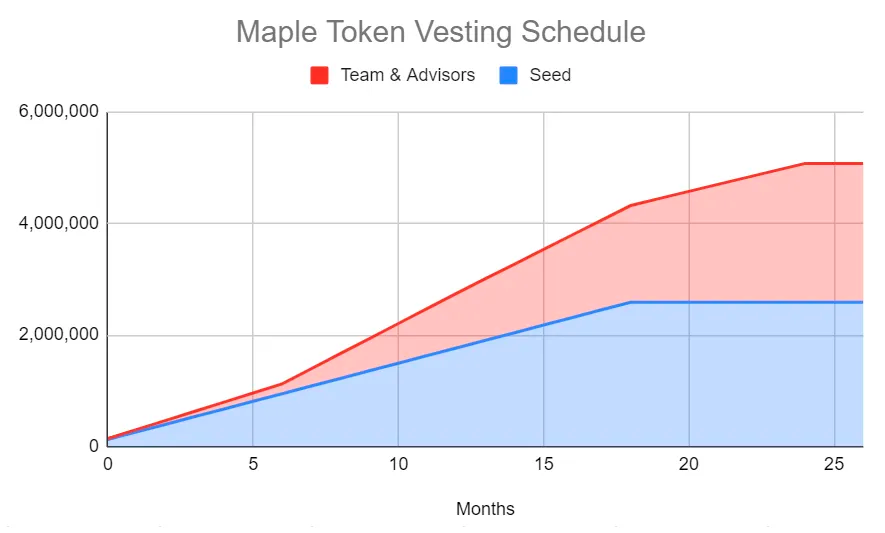

Majority of the tokens seem to be held by insiders and investors which a portion were unlocked upon the Token Generation Event (TGE) and will vest linearly across a 1.5 - 2 year period, as shown by the vesting schedule below.

Approximately 6.5 million MPL tokens are in circulation as of this writing with about 47% staked at a relatively low staking rewards APY of 1.4% which pales in comparison to many other forms of staking rewards on DeFi such as GMX which usually sits at above 10% for staking rewards.

In terms of market cap, it is sitting around $100m, with an FDV of about $150m, a treasury of $26m, and a fully diluted PE and PS ratio of 5x and 115x respectively.

Default Insurance

They have the largest insurance cover thanks to their cover provider system that utilizes MPL-USDC Balancer tokens to backstop default losses as first-loss capital, which Pool Delegates also have to contribute.

This aligns the delegate’s interests with lenders, since pool delegates are the ones that approve the loans that lender capital goes to. Maple’s principal loan coverage currently stands at around ~6-7%, or $5M-$7M in absolute terms for each of its public USDC pools as of this writing.

Maple Conclusion

Maple was one of the earliest to begin their undercollateralized institutional borrowing product and is one of the leading player in this space.

Although lending and borrowing demand has remained active, it is hard to project a continuous growth amidst a bear market, and MPL's value has not benefited much from the protocol revenues.

Market participants are likely to benefit more from being a lender than simply staking MPL tokens, or for really bullish users, be a cover provider to earn the most while still being exposed to MPL.

TrueFi

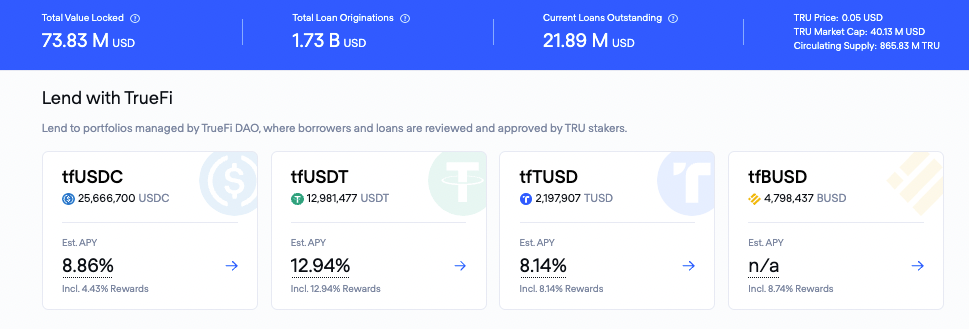

TrueFi is the next leading undercollateralized lending protocol after Maple. They are both top protocols in terms of funds deposited and loans issued.

One major difference is that TrueFi’s lending pools are segregated by stablecoins while Maple’s lending pools are segregated by pool delegates.

On TrueFi, lenders and borrowers can deposit and earn from the same stablecoin pool, allowing for risk diversification across all loans of a particular stablecoin. For instance, when a user loans USDC, the loan is distributed across all borrowers looking to borrow USDC.

Maple’s design allows risk to be isolated within each individual lending pool, where there can be a USDC pool that only lends out to extremely high-quality borrowers for lower yields and another pool that lends USDC to more risky borrowers but has higher yields.

However unlike Maple, due to Truefi's consolidated lending borrowing pools, instead of solely relying on pool delegates, TrueFi adopts a community voting layer atop the credit risk team. In order to be funded, the loan must be approved by individuals who stake the native token $TRU and requires an 80%+ approval rate in order to open the lending pool for deposits.

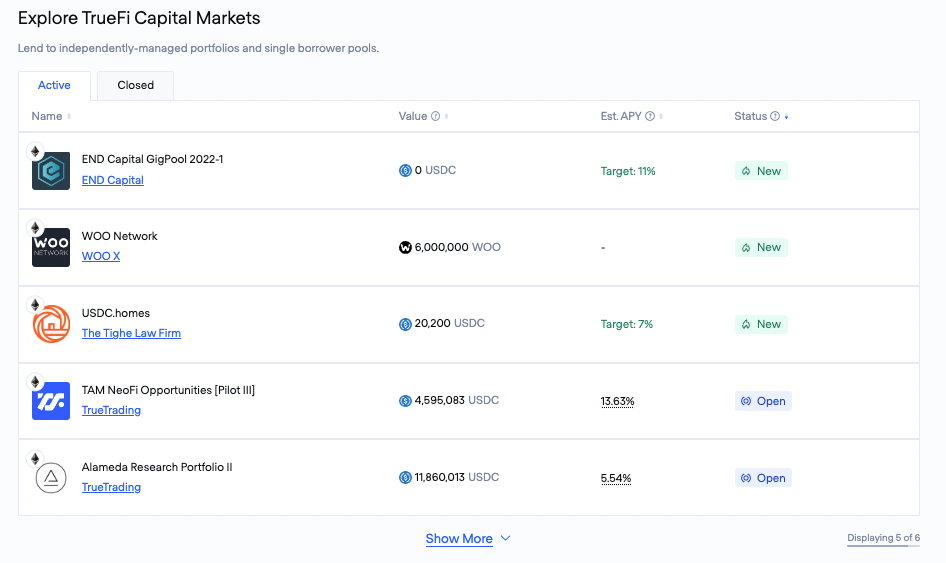

Similar to Maple, TrueFi has also launched isolated pools where users can choose to lend assets directly to, but requires KYC on their TrustToken platform to be whitelisted, and are not permissionless unlike the others.

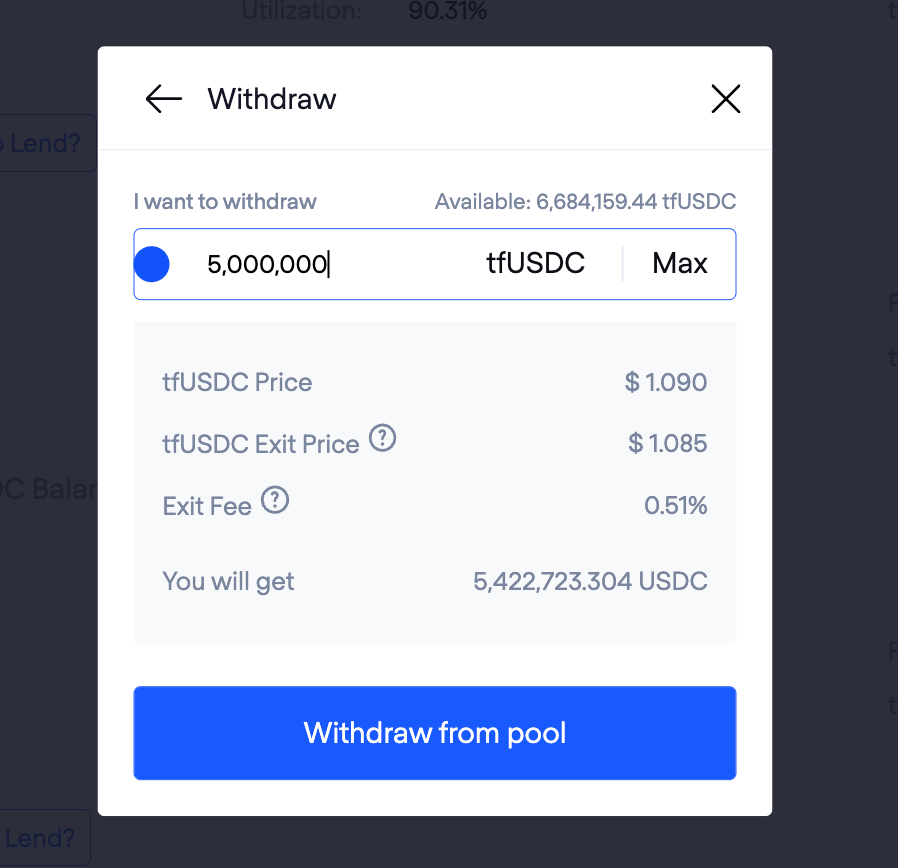

Another major difference is that TrueFi allows for lenders to withdraw their loans at anytime by paying an exit fee, compared to Maple's 90 days locked with no fees.

They call this 'Liquid Exit' and the fee is inversely proportional to the amount of available idle liquidity in the pool. For example, when there is a large amount of liquid assets in the pool, the fee is low. When there is a small amount of liquid asset in the pool, the fee is high. This fee is earned by the pool for the existing lending pool token holders.

This liquid exit feature would definitely be more popular in Crypto due to how fast things can change in just a few days, not to mention 90 days, which could be one of the reasons why TrueFi has earned a total interest fee of about $40 million, comparable to Maple's $41 million. This figure can be viewed on TrueFi's analytics page that also showcases details of each loan.

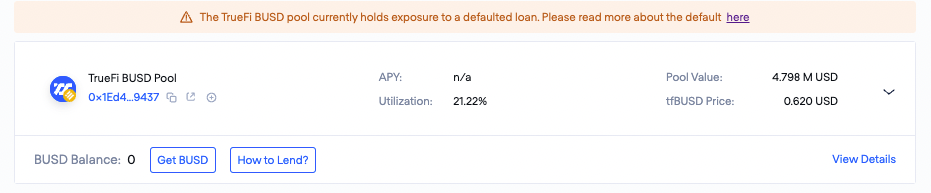

Despite the strict KYC and underwriting process for institutional borrowsers with at least $10 million in net unencumbered assets, there has been one case of default so far of about 2% of their total value outstanding. It is isolated to the BUSD pool, tainting one of their four stablecoin pools, and has affected all BUSD lenders with the value dropping 38% to $0.62 per dollar lent.

Tokenomics

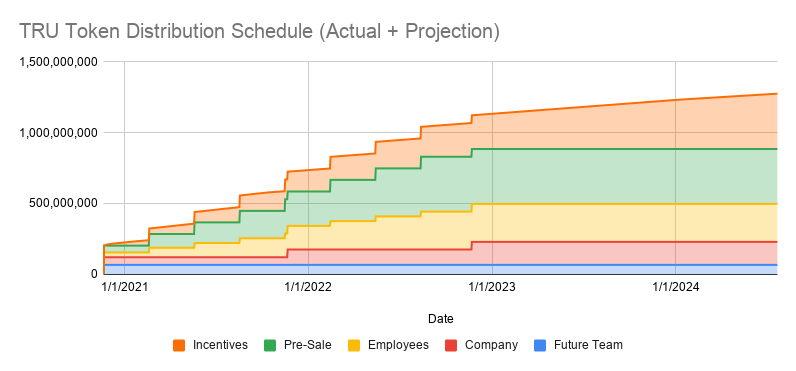

In terms of TrueFi tokenomics, the emission schedule and allocations are:

- Incentives (yield farming) = 565,500,000 (39%)

- Pre-Sale = 387,917,402 (26.75%)

- Team = 268,250,000 (18.5%)

- Company/Foundation = 163,082,598 (11.25%)

- Future Team = 65,250,000 (4.5%)

Majority of the allocation is to insiders, and the public is able to get $TRU it via yield farming incentives.

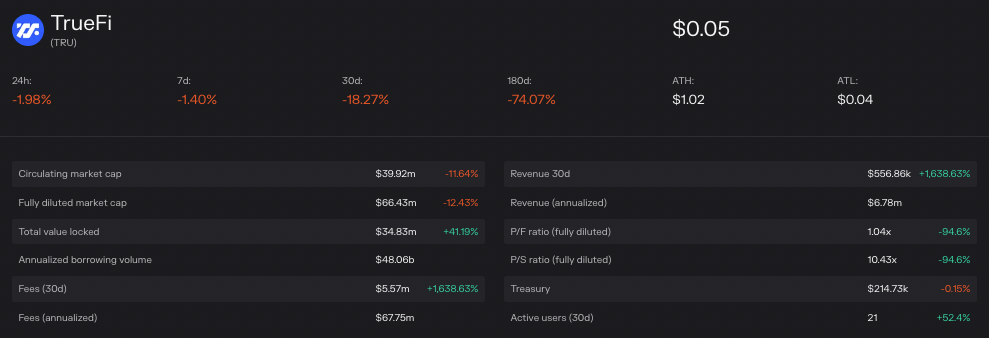

Their current market cap is at $40m and an FDV of $66m, with a surprisingly small treasury of $214k and a PE and PS ratio of 1x and 10x, one of the lowest in this sector.

They are building new products such as DAO Pools, Single Borrower Pools, Automated Lines of Credit (ALOCs), and Portfolios, and some has already launched. For more information, you can read their blog post.

Default Insurance

TrueFi sells up to 10% of all staked TRU to cover defaults and if insufficient, it uses the SAFU fund that has been funded by Trust Token (the company behind TrueFi).

This method subjects the value of the insurance fund to price movements of TRU which has dropped drastically and in a default, the value of TRU is likely to crash lower due to FUD, and makes the insurance value likely overstated and insufficient if a default really were to occur.

However, TrueFi have legal agreements with their institutional borrowers and can enforce the loans and recoup any defaults if necessary, although it may be a long legal process.

TrueFi Conclusion

TrueFi was the first to do an undercollateralized loan in DeFi and is one of the leading player in this space.

Although lending and borrowing demand has remained active, it is hard to project a continuous growth amidst a bear market, and $TRU value has not benefited much from the protocol revenues, suffering over a 90% drawdown YTD.

Market participants are likely to benefit more from being a lender than simply staking TRU tokens.

Goldfinch

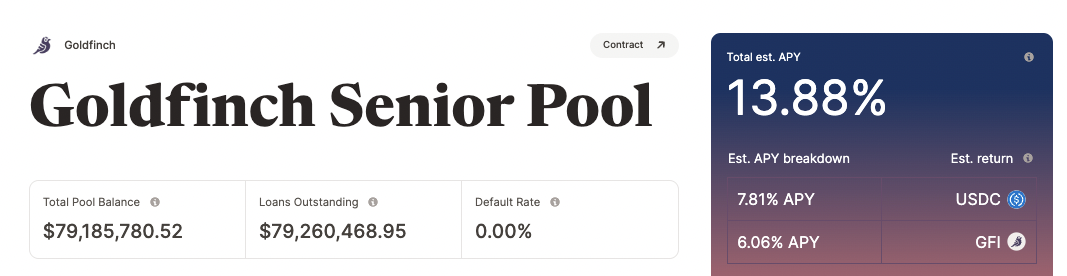

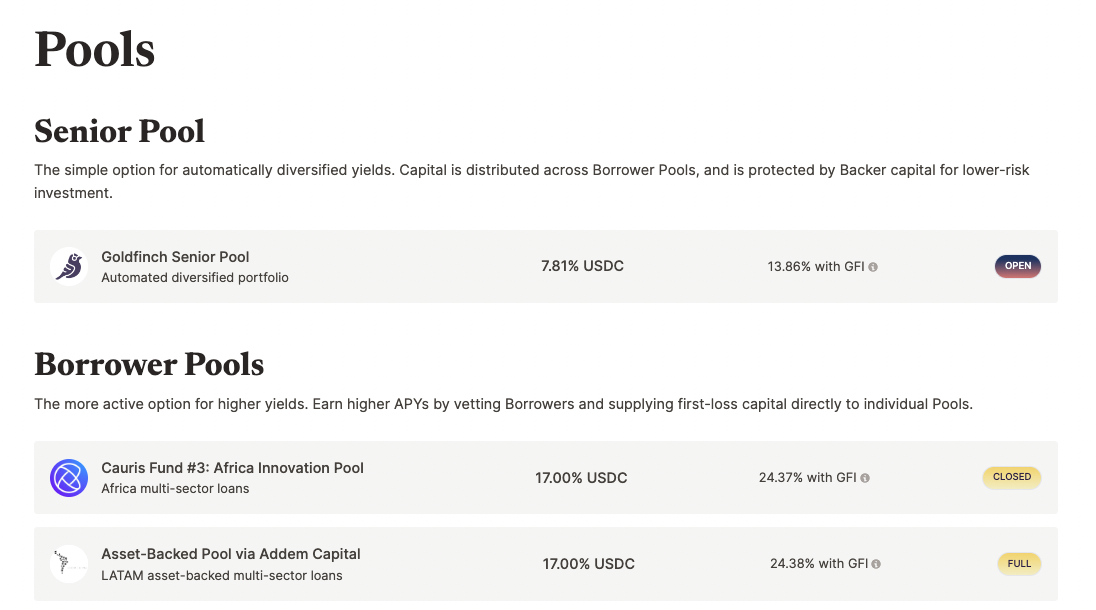

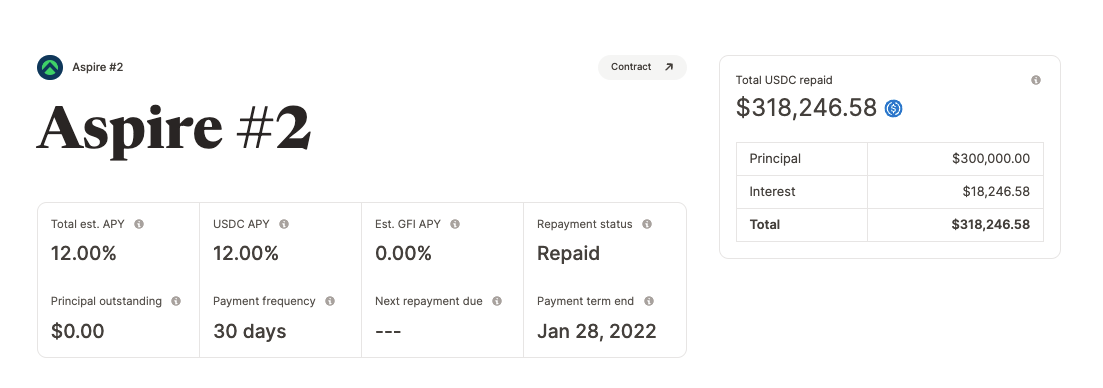

Goldfinch is a decentralized lending protocol that allows for crypto borrowing without crypto collateral but off-chain collateral. It aims to bring the world’s credit activity on-chain while expanding access to capital and fostering financial inclusion, starting in emerging markets.

What makes Goldfinch different from other undercollateralized lending protocol is that they focus on lending to real companies to generate yield to DeFi Lenders, and loans are fully collateralized with off-chain assets such as using future payments from a lending company’s customers as collateral.

This helps to create an immutable, on-chain credit history, a core foundation of any scalable lending model to help facilitate credit for many growing markets globally, to drive economic growth.

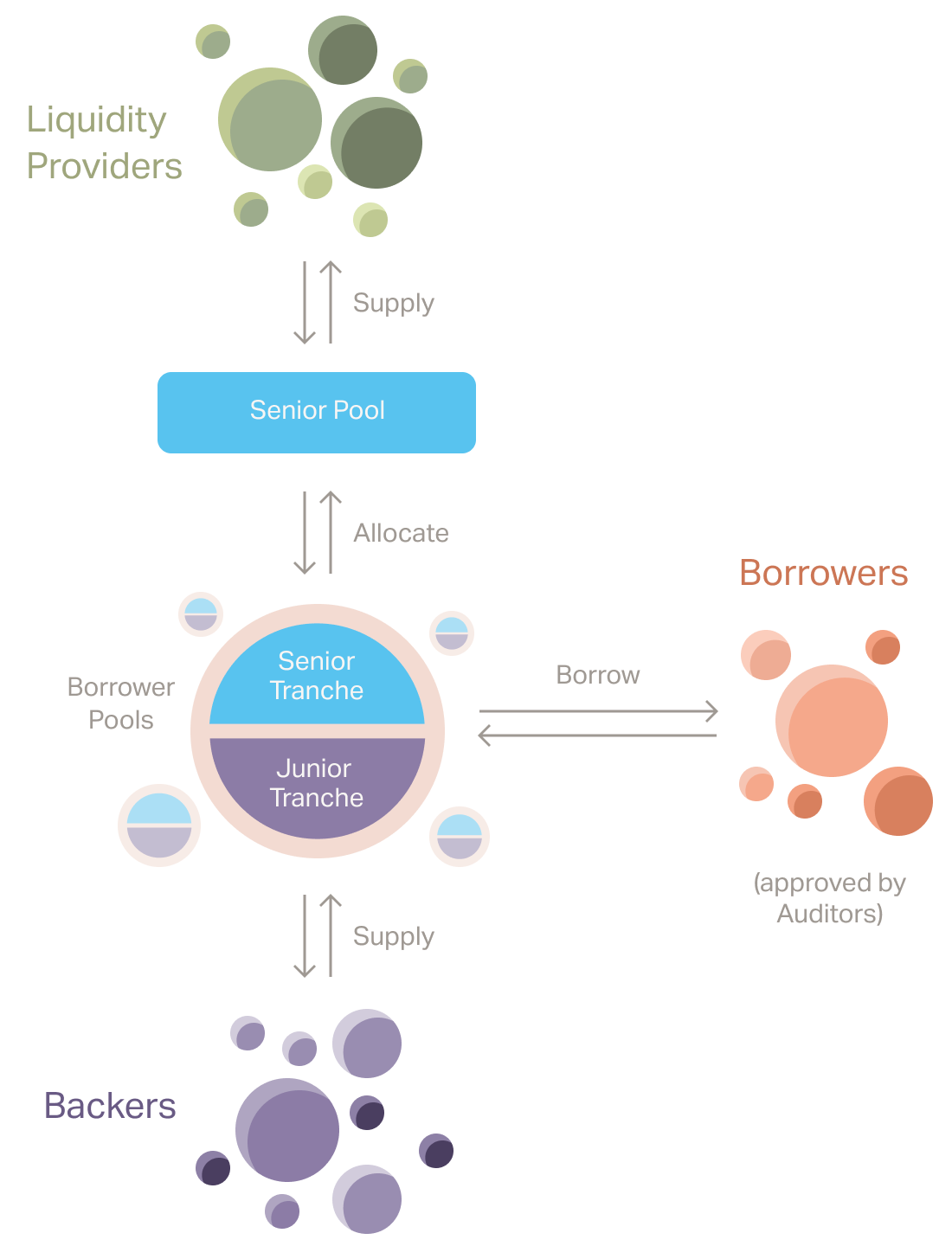

There are five roles: Investors, Backers, Liquider Providers, Borrowers, and Auditors.

Investors, similar to lenders, provide USDC to Borrowers, and can be in the form of Backers who provide first-loss capital for higher yields, or Liquidity Providers who provider second-loss capital to the Senior Pool which automatically allocate funds across all Borrower Pools according to the assessment of Backers.

The Senior Pool is the simple, lower risk, lower yield option and have a 0.5% withdrawal fee. Capital is automatically diversified across Borrower pools, and protected by Backer capital.

Backers are incentivized to assess the viability of the Pools as they will be the first to miss repayment and will also be the last to get repaid in the event of a default. Due to the complexity of being a Backer, for the average DeFi user, being a Liquidity Provider is the simpler and recommended choice.

However, both Backers and Liquidity Providers have to go through a KYC process which will be kept confidential, and produces an on-chain NFT representing the ID of the lender.

Thus the protocol does not support truly permissionless lending unlike Maple, TrueFi, Ribbon, and Clearpool, but can be useful for Borrowers that require KYC requirements in order to borrow funds.

Although the terms of the business loan is provided on-chain, the health of the business and the off-chain collateral provided is not clearly stated on the website and requires further off-chain digging.

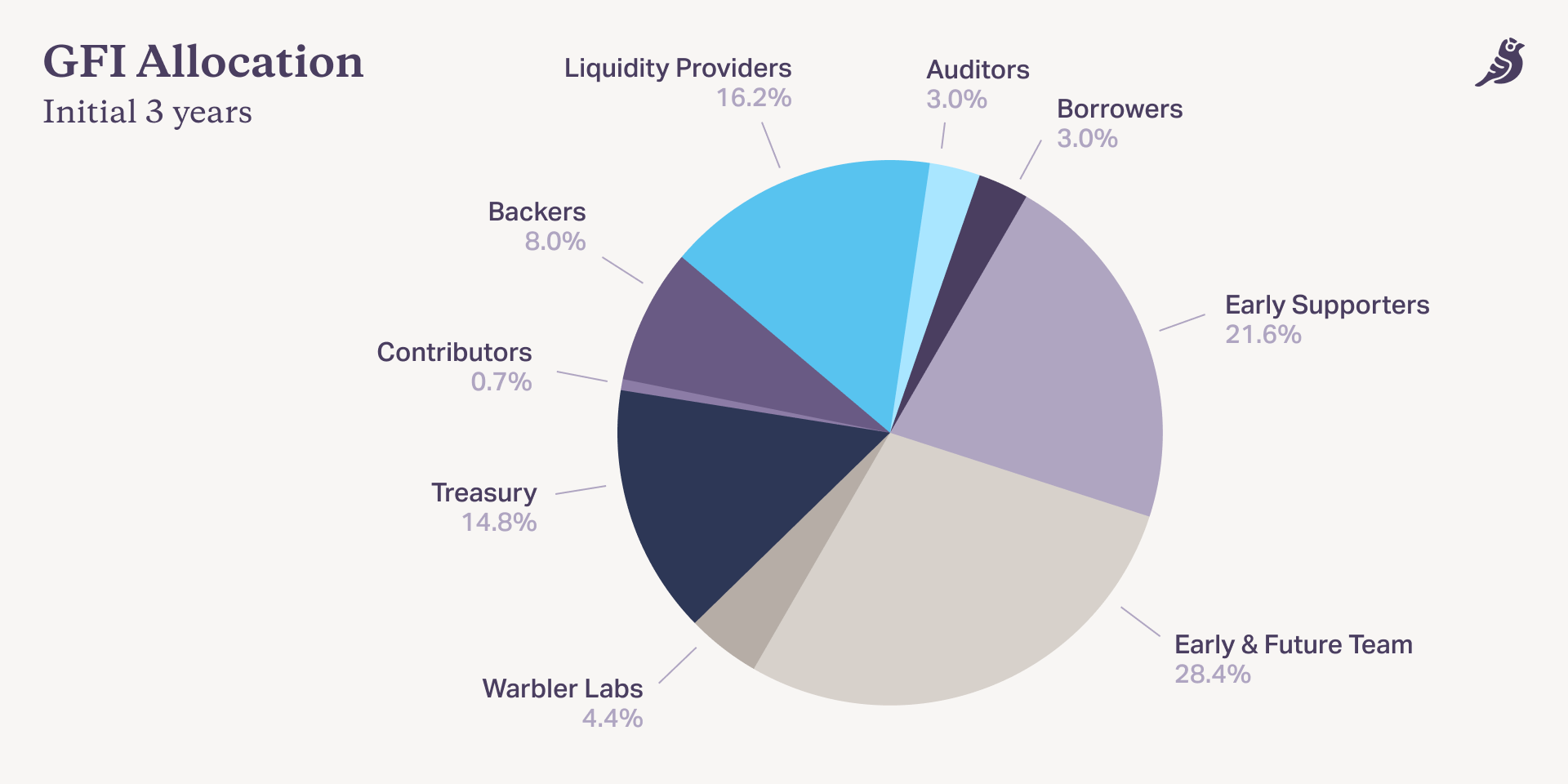

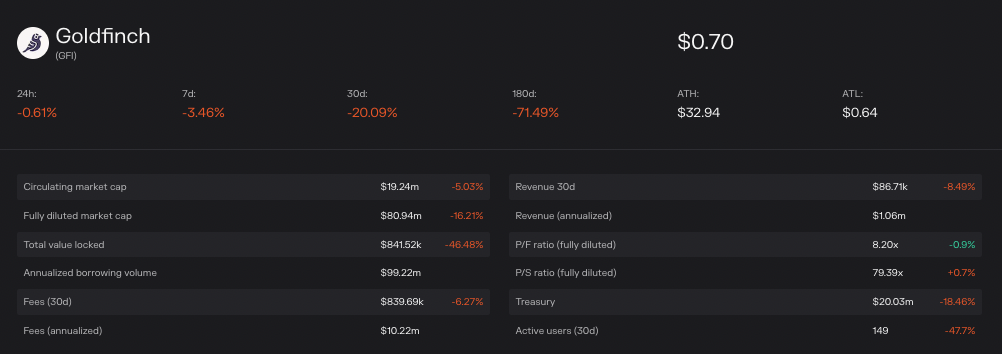

Tokenomics

The initial token supply is capped at 114,285,714 GFI tokens. There is currently no inflation, but it is expected that it will be beneficial for the protocol to incorporate modest inflation after 3 years in order to reward future active participants but it will be up to the community to discuss and decide.

Overall the tokenomics are heavily weighted towards insiders more, which is a common trend in tokenomics in this sector.

The curernt market cap is about $20m with an FDV of about $80m and a treasury of about $20m, with a PE and PS ratio of 8.2x and 80x.

Clearpool and Ribbon Finance

Both of these protocols offer a similar model to Maple Finance with some important differences.

Both do not have locked up or exit fees as Lenders may withdraw liquidity at any time subjected to availablility.

They also have in-built insurance by directing a portion of interest generated (5% currently) toward an insurance pool, which is to be used towards repaying lenders in case the borrower defaults.

However, this method would take ages for the insurance fund to grow to a size that can cover large defaults from borrowers, and will be largely insufficient until a long period of time. Lenders should thus assume that they will lose almost the entirety of their deposit in the event of a default.

Risks of Undercollateralized Lending

Yields between overcollateralized and uncollateralized protocols have increased, reflecting higher risk premiums. Lenders expect to be compensated more for providing riskier uncollateralized loans as compared to an overcollateralized loan.

These risks are justified as they have happened a number of times this year. Wintermute have been exploited and is a huge borrower on multiple protocols in this article.

Some protocols such as Clearpool have a high utilization warning, where if utilization reaches a high figure such as 95% for example, Borrowers will not be able to remove liquidity, and interest will continue to accrue and increase the utilization rate. Lenders may still provide and withdraw liquidity, however, withdrawals for lenders will also be halted should the utilization rate reach 99%.

Wintermute hit a utilization rate above 95% during news of an exploit but was able to bring the pool back down to 75% utilization. Since the incident, Credora have reduced their rating to an A but this was only done after the hack – too late for lenders if Wintermute had defaulted.

In terms of default, each protocol has their own way of handling it but it often involves a buffer period, usually 5 days, before issuing a notice of default. This happened to Maple lenders when Babel Finance defaulted and they suffered a loss of 3.2% on their principal deposits and earned interest.

Although defaults are hard to predict, it is important to assess these risks:

- How much insurance the unsecured lending protocol can provide

- How much each protocol is exposed to a single borrower and avoid lending if multiple protocols are exposed to a single large borrower

ClearPool and Ribbon are completely exposed to counterparty risk, whereas Maple's pools such as the Orthogonal USDC pool is the most diversified.

Conclusion

There are many factors to consider when deciding how to lend out your stablecoins, from borrower concentration to default insurance.

Ribbon and Clearpool currently have the highest counterparty risk and have the lowest insurance. Goldfinch's Senior pools help to distribute counterparty risk but instead of relying on highly reputable crypto companies, it lends out to real world companies which requires constant due dilligence to understand the counterparty risks and it is cumbersome to calculate the overall Backer insurance.

Between TrueFi and Maple, borrower concentration depends on which pool one is lending to. For instance, TrueFi’s USDC pool is more diversified than Maple’s Maven 11 pool, but TrueFi’s USDT pool is far more concentrated than any pool on Maple. Maple also has the most generous insurance, as the entire amount of cover provided can be used to offset a default, versus only 10% of staked TRU for TrueFi.

If undercollateralized loans were in the form of a smart contract proposal, it could be possible for the Carbon community to assess the risk and reward of the loan, ultimately providing undercollateralized loans without any form of KYC and introducing more users to Carbon.

Hopefully, with blockchain technology, on-chain credit scores integrated together with KYC or off-chain credit scores can improve the health of such loans and other crucial factors can be tracked better, reducing risk and allowing more of DeFi to capture this $8 trillion dollar industry, even creating DeFi's own internal credit engine without relying on outside capital flowing in, and transition unfair and untransparent real-world loans to fairer on-chain protocols, enabling a world where trust is optional, which is the mission for us here at Switcheo.