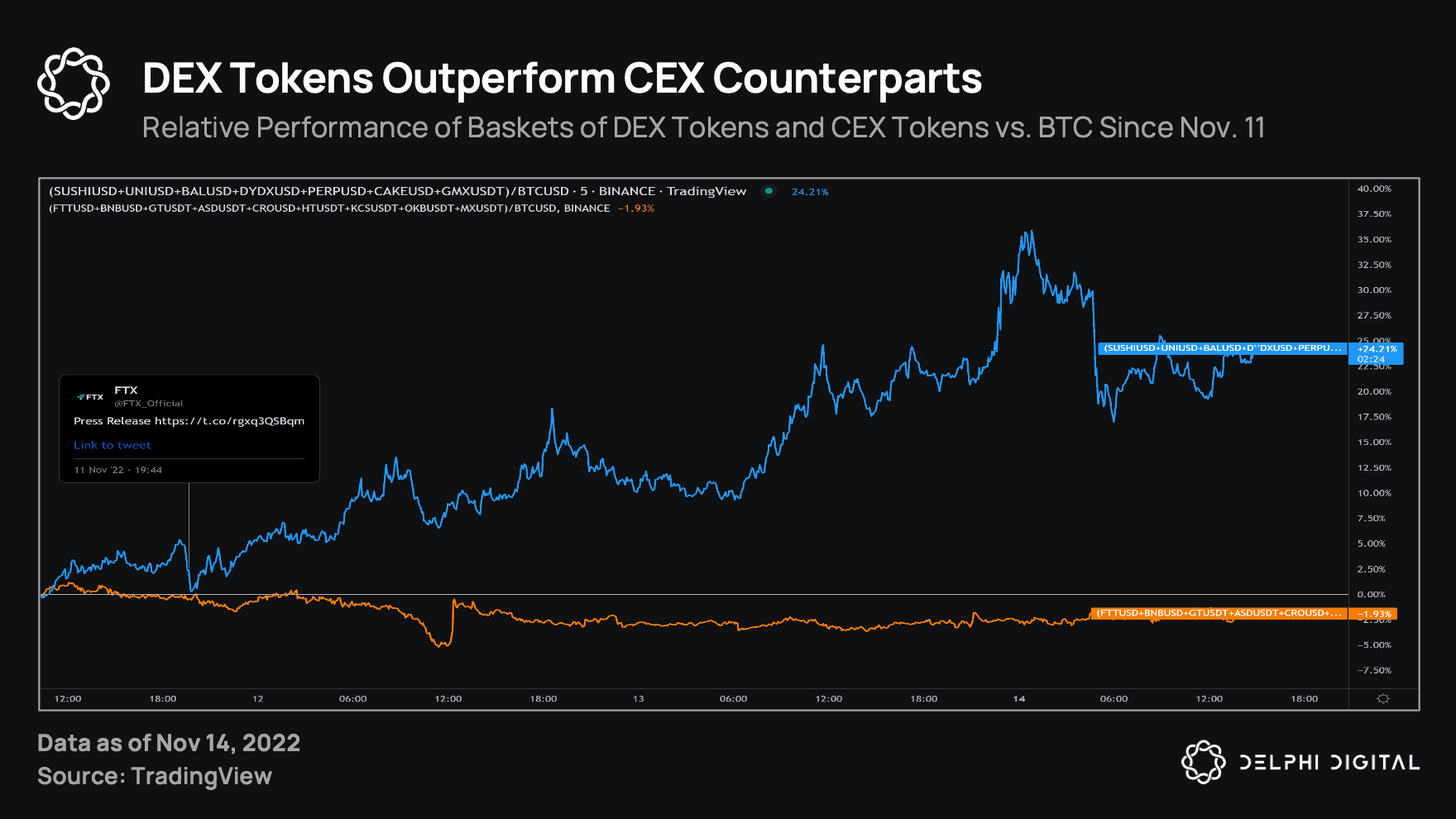

The fall of several centralized crypto companies, from trading to lending platforms, has increased the demand for decentralized and non-custodial trading platforms, which is possibly a sustained trend change.

What made FTX popular apart from their trading platform, was also their in-built lending platform where users can lend out idle assets with just a few clicks. FTX was a trading platform and money market in one.

There is currently no available perpetual protocol with an in-built money market, until now.

Carbon has launched Nitron, a Cosmos money market that is part of Demex, an orderbook dex with spot, perps, and futures.

What is a Cosmos Money market?

A Cosmos money market, also known as a lending and borrowing market, is a dApp on Cosmos that primarily has two functions:

- Lend: allow users to deposit assets and earn interest from lending it out

- Borrow: allow users to borrow against whitelisted collateral assets

Lenders are users who deposit their assets and are supplying liquidity to the protocol and can earn an income if their assets are being borrowed, and can also withdraw their collateral at anytime.

Borrowers are able to borrow assets that lenders supplied in an overcollateralized way. Overcollateralized means that borrowers have to first supply a higher value of whitelisted collateral than they borrow, otherwise it will be an undercollateralized loan which can lead to bad debt if the borrower defaults. This means that all borrowers are also lenders. Borrowers can also repay their loans at anytime without penalty.

What is Nitron?

Money market

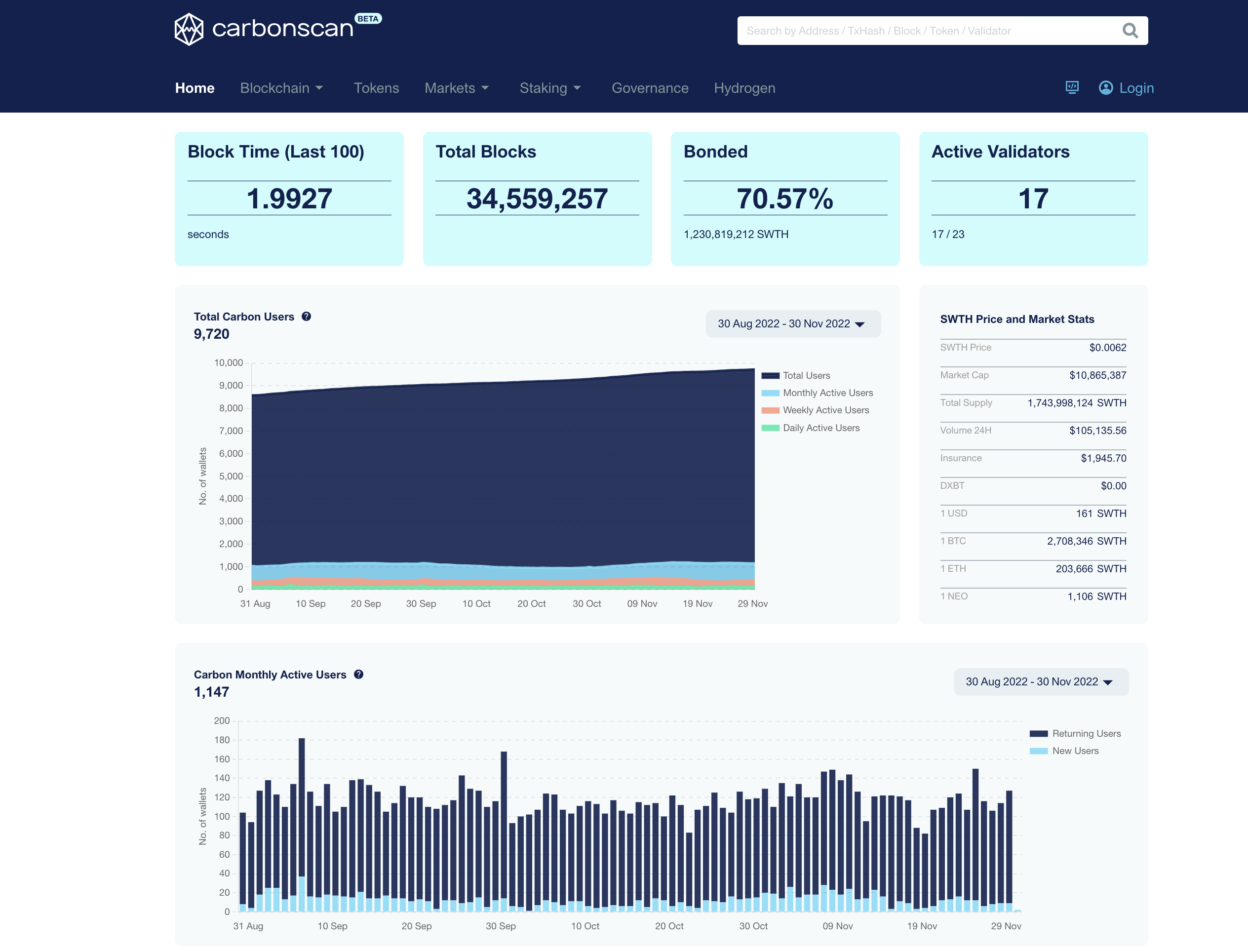

Nitron is a Cosmos money market built on Carbon. It is also a cross-chain and non-custodial platform where users lend and borrow permissionlessly.

This allows users who have idle assets to making the most out of it, either by loaning it out or borrowing against it.

Unlike centralized finance platforms, aka CeFi, every loan is done on-chain and can be tracked with the Carbon scan explorer.

Permissionless listings

Currently Nitron will launch with only public pools. These pools are shared and are similar to AAVE. Adding and removing assets and adjusting risk parameters would require governance vote as they are public pools that will have lots of TVL. However, governance vote adds friction to adoption and is not truly permissionless.

In the next big update for Nitron, we will be launching private pools which are permissionless listings.

Private pools would give the ability for anyone to create a lending and borrowing market, such as a pool for liquidity pool bootstrapping, etc, all done permissionlessly in the spirit of DeFi.

Anyone can create a private pool for any assets as long as there is a DEX listing, and customize parameters such as interest rate, oracle, risk parameters, and fee structures.

Carbon stablecoin

Carbon will also be introducing its own Cosmos-native stablecoin called USC. It will be an overcollateralized and decentralized stablecoin backed by assets deposited into the public pools.

This means that apart from depositing collateral to borrow other assets provided by lenders, users can also deposit whitelisted collateral to mint USC. This can include liquid staked derivatives to enable leveraged staking to allow users to earn higher APR on their staking rewards.

To redeem the collateral, the protocol would burn the USC from users and return back the user's collateral.

Carbon stablecoin is expected to increase the revenue for SWTH stakers as well. Read more about USC increases the value of SWTH in this article.

Liquidation platform

On Nitron, borrowing is done in an overcollateralized manner. But what happens if the deposited asset is insufficient to cover the borrowed sum due to market movements?

The loan becomes undercollateralized and is up for liquidations.

Traditionally, bots have dominated liquidations on money markets like AAVE due to their inhumane reaction time as a bot. Additionally, there isn't a public interface for ordinary users to liquidate loans that are undercollateralized.

This isn't fair in the DeFi spirit.

To make it simple for everyone to take part in liquidations, Nitron will also have a front-end liquidation interface for anybody to participate in liquidations and get their favourite assets at a discount.

For more information about our Cosmos money market, you can read our previous blog article on why the Carbon money market is more than an AAVE of Cosmos.

Stability reserves

In the future, Nitron may also introduce a stability pool feature inspired by Vesta Finance to provide more buffers to liquidations for public pools.

The stability pool will allow for users to deposit assets that are borrowable into the reserves to act as liquidation buffer whenever those assets have loans that are undercollateralized. Those reserves will be used first to liquidate underwater loans and reduces the possibility of bad debts.

For example, a user borrows ETH against his ATOM collateral, and the price of ATOM drops, causing his ETH loan to be undercollateralized. Stability pool providers who deposited ETH and selected ATOM as one of their preferred collateral, will be first to use their ETH to repay the loan and take the user's collateral, which in this case is ATOM.

Why is it the right time to launch Nitron?

With a push towards non-custodial dApps, there will be countless protocols and tokens created, from governance, tokenized yield, tokenized synthetics, and more, all with their own set of risks and characteristics.

The Cosmos ecosystem together with the Cosmos SDK and IBC module, has allowed developers to continue to create high-throughput protocols with low fees with standardized consensus mechanisms, allowing different Cosmos networks to communicate with one another without having to 'bridge' or 'wrap' their native assets. With seamless interoperability, Cosmos is likely one of the leading ecosystems in the next bull market.

One popular trend is Cosmos liquid staking, where PoS assets can be staked and a receipt token is given instead, known as a liquid staked derivative. Carbon is partnering with liquid staking providers to accept their liquid staked derivatives and will be the first to allow for leveraged staking in Cosmos, attracting lots of users of TVL over to Carbon.

Additionally, ETH Layer 2 scaling solutions such as Arbitrum (and in the future ZK-rolls ups), has resulted in low fees and fast transaction times, attracting users and developers to create and use more DeFi protocols, growing the amount of users and protocols gradually.

Carbon, being a cross-chain layer, is already connected to Cosmos through IBC and will be connected to other EVM chains like Arbitrum and Polygon shortly.

Nitron is created to help support the increasing amount of protocols coming into crypto across the various chains as DeFi continues to build.

The combination of Nitron money market and Demex perp dex will open up amazing synergies and strategies that we will share in future articles.

P.S. If you are a protocol on Cosmos or EVM chains and want to partner with our money market, do reach out to us at marketing@switcheo.network, or on our telegram at https://t.me/carbon_ecosystem. If you want to read the Nitron docs, click here.