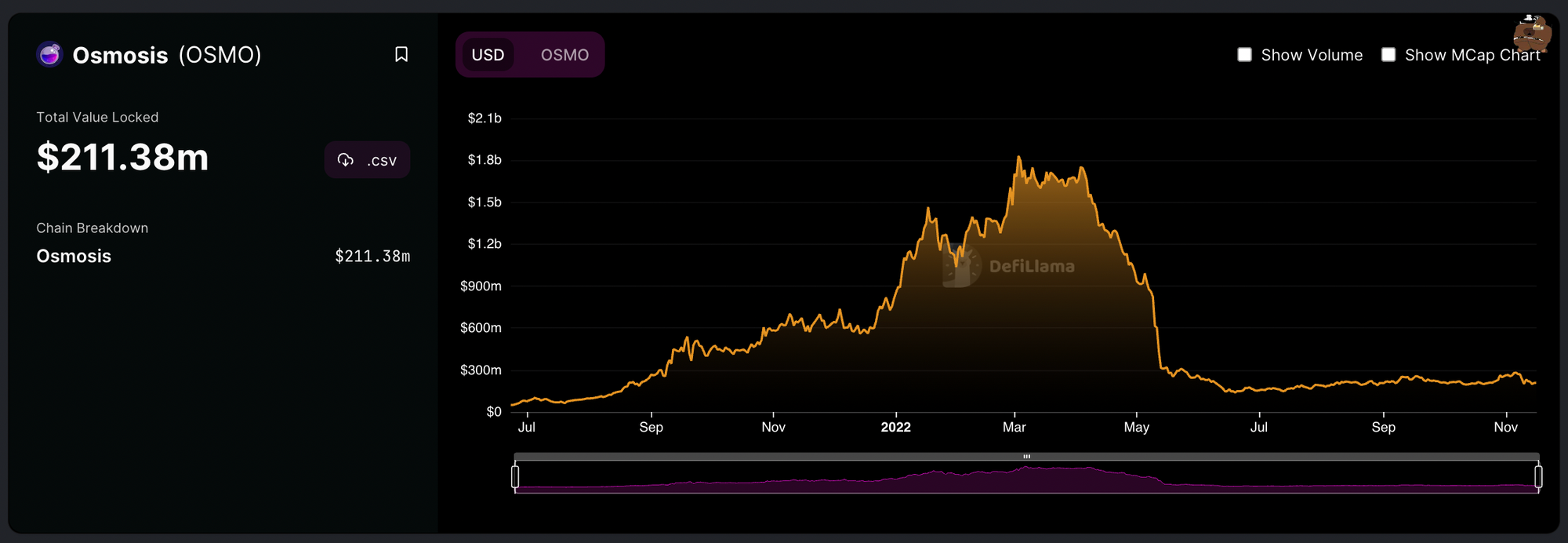

If you have made big value swaps on Osmosis recently, you will know notice that slippage is much higher compared to other ecosystems. This is despite most of Cosmos's liquidity currently being in Osmosis.

This is because the liquidity in Cosmos has dropped significantly from the highs of the bull market.

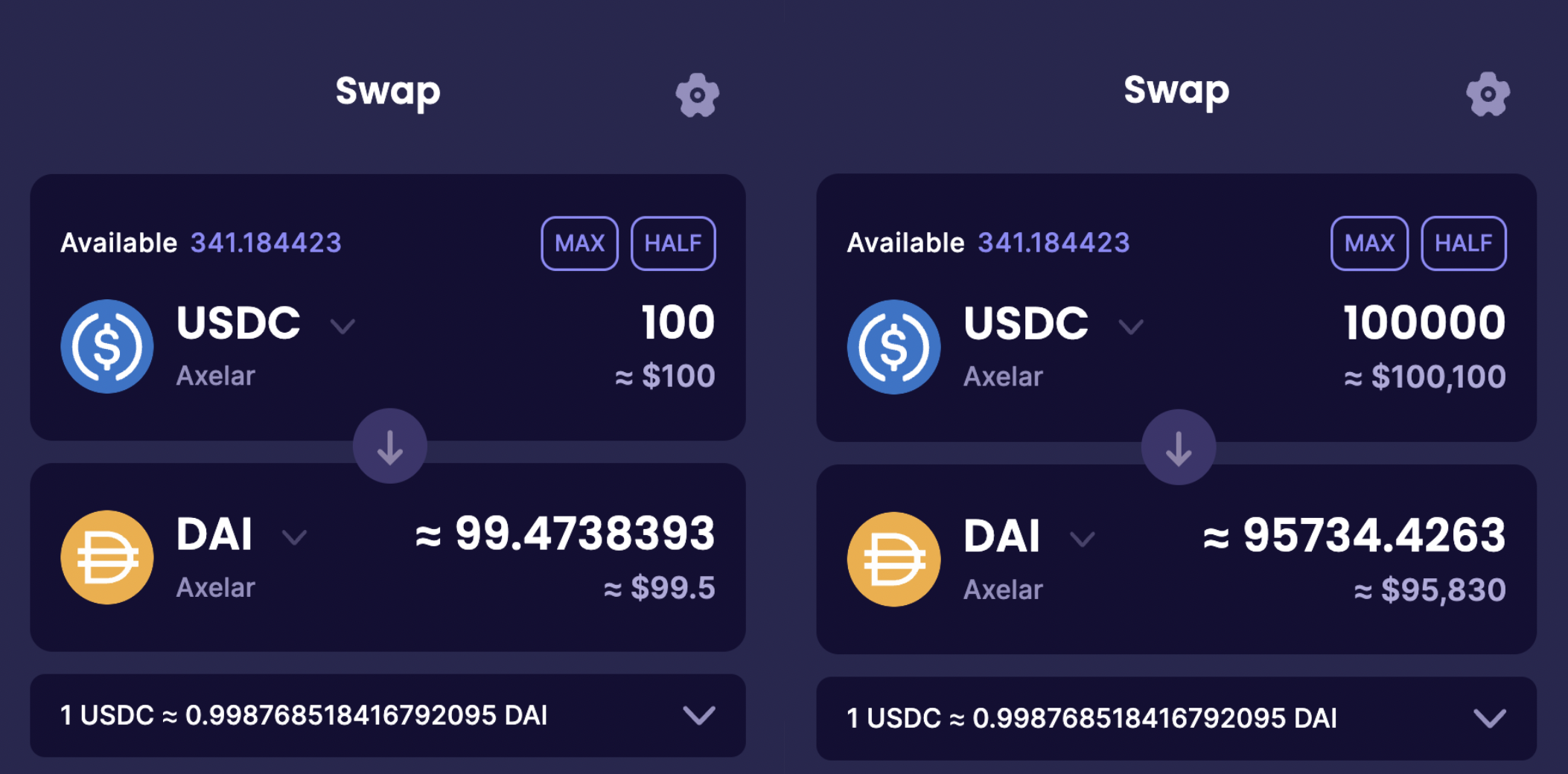

Even the currently most popular Cosmos stablecoin, axlUSDC, only has a liquidity of less than $20 million on Osmosis, a small amount compared to other stablecoin liquidity in other ecosystems.

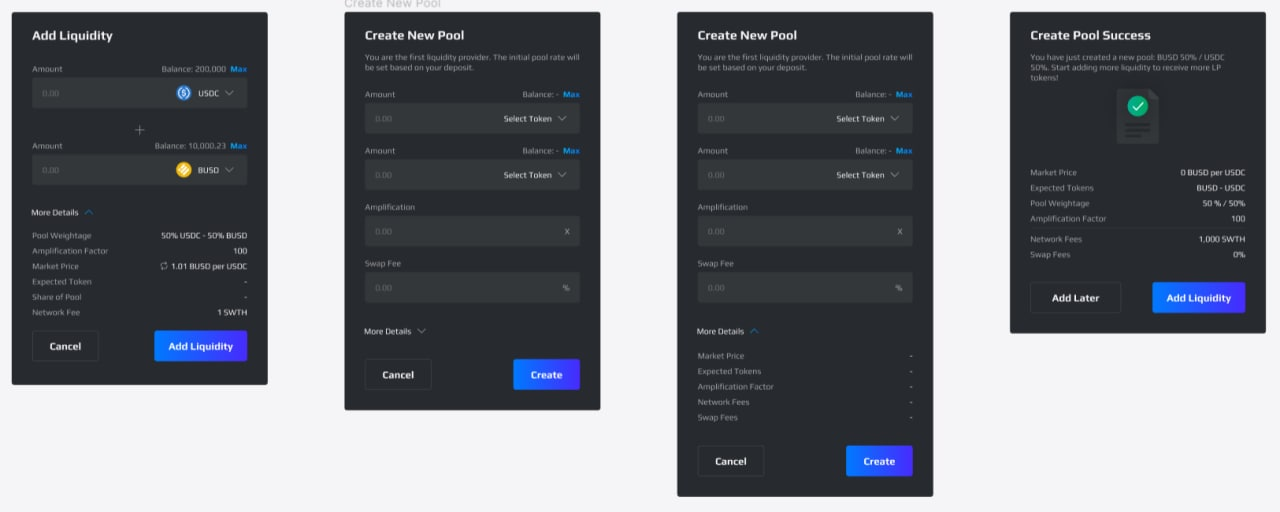

The launch of Carbon's amplified liquidity pools will allow for greater capital efficiency and lower slippage between stable and similar assets, as well as volatile assets. We believe that this can help alleviate some of Cosmos's liquidity issues which are blocking Cosmos's DeFi ecosystem from thriving.

In this article, we will explore how amplified liquidity pools work and why this can help Cosmos achieve a more vibrant DeFi ecosystem.

Why does Cosmos need stable swaps?

After the fall of Terra Luna's UST stablecoin, there is now an increasing amount of USD stablecoins coming into the Cosmos ecosystem to replace the void that UST has left, with the most popular stablecoin currently being axlUSDC.

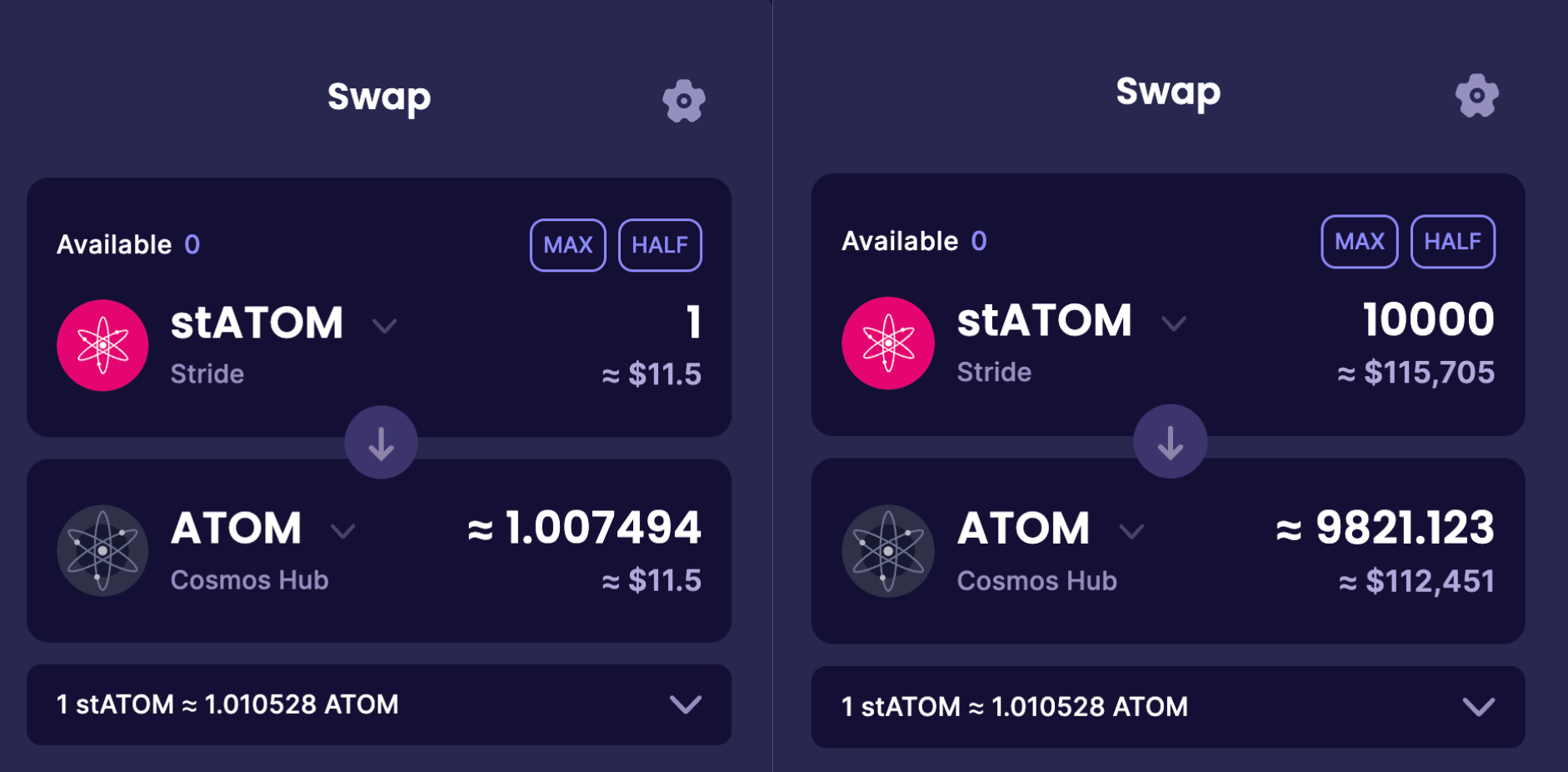

There is also another trend in Cosmos which is liquid staking derivatives (LSDs) where Cosmos proof-of-stake (PoS) assets are staked with a liquid staking provider in return for a token whose value is derived by the underlying token with the addition of accruing the staking reward over time, growing in value against its non-staked counterpart.

For example, one stATOM overtime will be worth 1.1x compared to regular ATOM but its value is still derived based on the value of ATOM.

Both of these trends, stablecoins and LSDs, require a stable swap that can allow users to effectively swap in and out of other similar valued tokens, and without a stable swap, current AMM formulas result in high slippage, making it expensive for users to swap tokens that are supposedly similar value.

There are no stable swaps that exist on Cosmos at the moment and Carbon is hoping to be the first to fill that gap with the introduction of amplified pools.

What are Amplified Liquidity Pools?

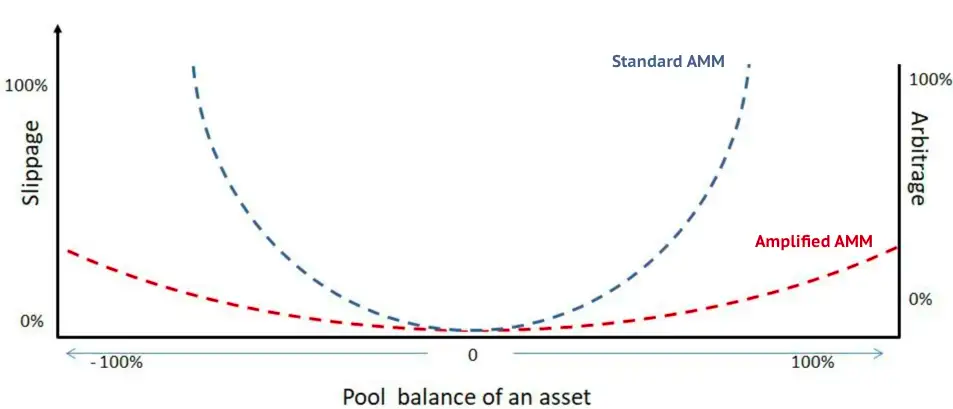

Simply put, amplified liquidity pools take the standard AMM formula and amplify them to maximize the capital efficiency of that pool between a certain price, in order to offer lower slippage and better prices for traders.

This is a different formula from Curve's stable swap as Curve is implemented only with stablecoins and wrapped-asset pairs and is not meant for assets that change steadily in value over time like LSDs.

This method, created by Kyberswap, will amplify the balance of each pool asset, via an amplification factor, and update the pool's price curve to achieve lower slippage using amplified virtual balances.

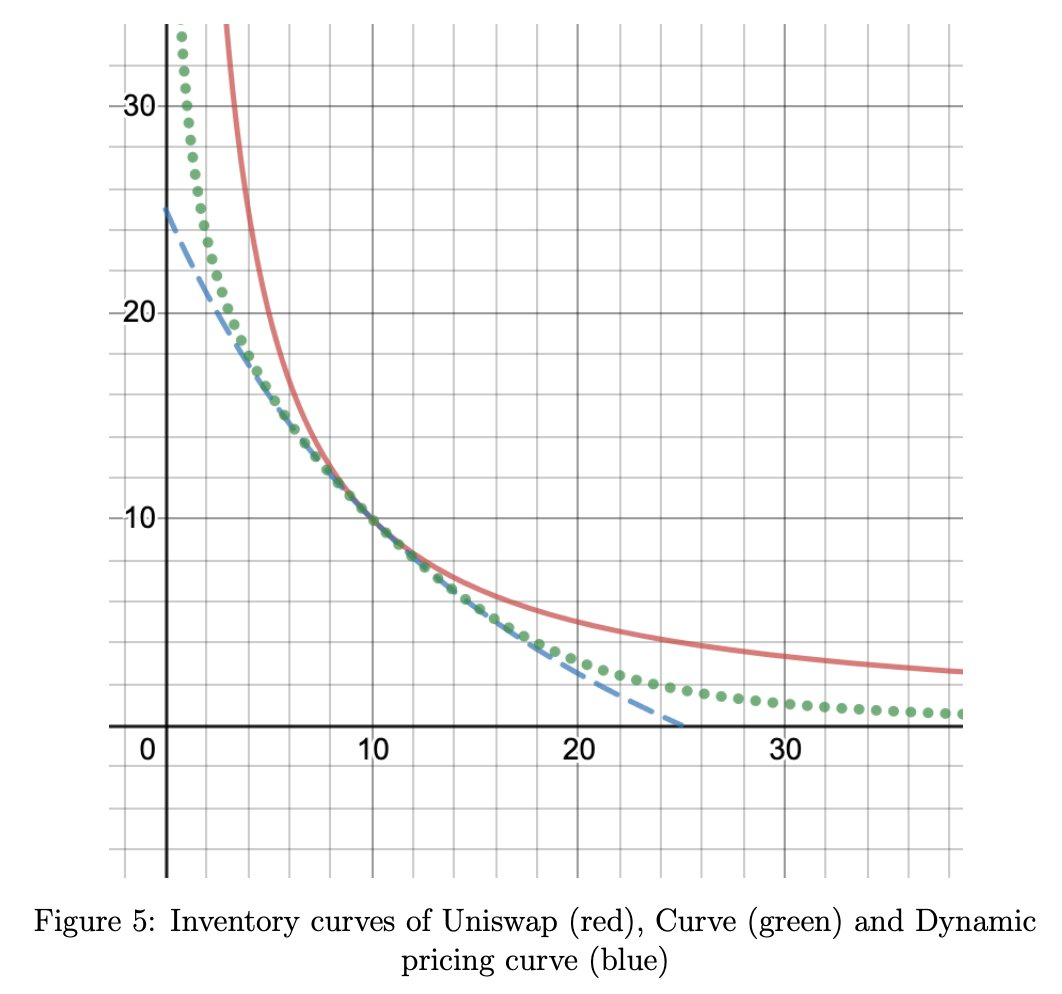

For example, if amplification is 100x, a $1M pool will provide the same slippage as a $100M pool, and the slippage is actually lower than Curve as seen from the image below.

Drawbacks of Amplified Liquidity

With great power comes great responsibility.

One drawback is that the higher the amplification, the tighter the price range for the pool, and if the price goes out of the price range, the liquidity cuts off as the two asset merges into one asset.

The price has to fall back into the price range for liquidity to return, or a new amplified pool with liquidity will need to be created for the new price range.

This means that if you are a liquidity provider who wants to achieve capital efficiency with amplified pools, you will have a more active responsibility of moving your liquidity to different pools as price changes.

This may involve sending your asset onto another platform with greater liquidity to swap back and sending both assets back to Carbon.

What is a good amplification factor to set?

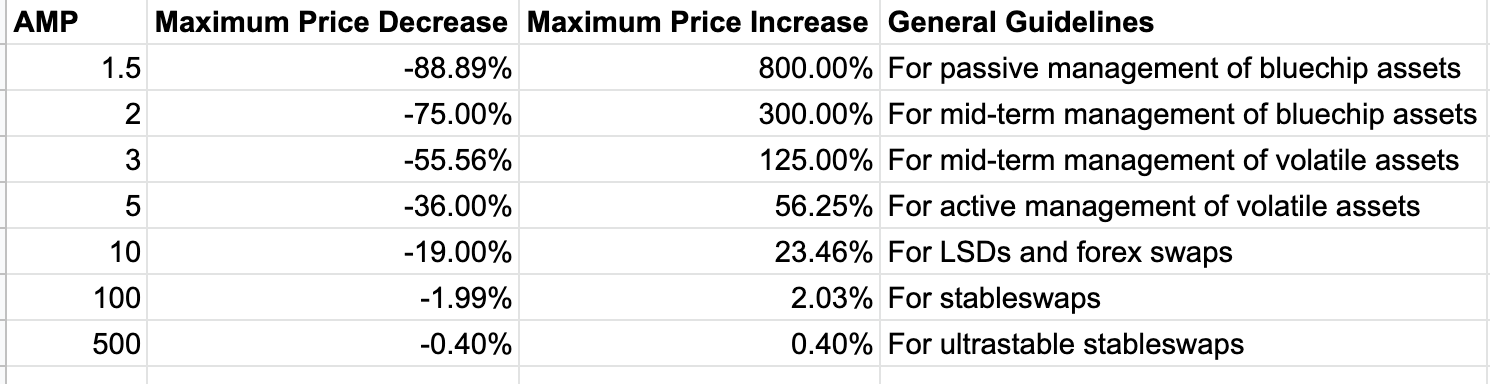

The amplification factor determines how much price volatility a pool can handle before it becomes inactive (one-sided).

We have created a table of guidelines depending on what type of asset is being pooled and how active of a liquidity manager you wish to be based on their maximum price movement, but they are just guidelines.

Generally, for stableswaps, it will be between 100 to 500 amplification as there should be no long-lasting change to the underlying value.

For volatile assets, it can be anywhere from 1.5x to 10x or even higher, depending on how active a user wants to manage the liquidity when it goes out of the range, which can be very often if the range is very tight and the market is very volatile.

For forex or LSDs, it will depend greatly on the forex pair and the staking APR.

The minimum and maximum percentage price change formula can be abstracted from Kyberswap's DMM whitepaper here.

Additionally, with a higher amplification, there is also higher impermanent loss as the price range is tighter. Once the price goes past the price range, the LP will effectively only be holding one asset until the price goes back into the price range. During this period, the LP will earn no fees as the liquidity is not used.

To counteract this, each pool can also have its own swap fee that is set by the liquidity provider.

For more volatile pools, LPs will probably use a higher swap fee such as 0.3% to 1%, which will help them to reduce impermanent loss when it happens.

For more stable pools, LPs will probably use a lower swap fee such as 0.01% to 0.05% to encourage more swap volume to make up for the lower swap fee.

Conclusion

With the introduction of amplified liquidity pools to Cosmos, we are hoping to be the Curve of Cosmos, turning more idle capital into not just productive capital but hyperproductive capital that can generate higher real yield to liquidity providers while providing tighter spreads to traders.

The better slippage and tighter spreads would attract more traders in Ethereum and Cosmos to Demex, allowing us to compete better with centralized order books and standard AMM swaps as well.

It is also possible to add external incentives to our amplified pools, allowing us to easily partner with other Cosmos protocols that are looking to incentivize a stableswap pool, increasing our users, TVL, and volume traded.

In the future, we can also introduce a gauge voting and bribing feature similar to Curve and Convex to introduce bribe wars to Cosmos, increasing the value of SWTH as governance power is needed for voting and bribing.

Overall, we believe that the introduction of our amplified liquidity pools will help to further fuel the growth of the Cosmos DeFi ecosystem.