The recent Cosmosverse event from 26 - 28 September is finally here and with it came the announcement of the highly anticipated Cosmos Hub Atom 2.0 whitepaper which you can read here.

If you are interested in knowing more about Cosmos and Inter-Blockchain Communication (IBC), you can refer to our previous article here.

The whitepaper goes through several key changes to the Cosmos Hub, and how this would impact the $ATOM token, as well as the new role that the Cosmos Hub will play in the Cosmos ecosystem.

Let's explore them in this article.

Cosmos Hub's Original Vision

Cosmos Hub, with the governance token of $ATOM, is the Layer 0 blockchain that other app chains built on Cosmos can connect with. It started with the vision known as the 'Internet of Blockchains', and it is coming to fruition.

The Cosmos Hub first needed to create the technologies and components needed to kickstart the internet of blockchains vision. To accomplish this, they created the Tendermint consensus algorithm, Cosmos SDK, IBC, and various interchain modules, which are core open-source primitives for the blockchains that are now part of the Cosmos ecosystem.

The technology, idea, and vision caught on and many developers went to build on it to create their own customized blockchain. These blockchains are Cosmos chains and are built with the Cosmos SDK, a developer toolkit that makes it easier for programmers to create customized PoS blockchains tailored to their needs without reinventing everything from scratch. They are also known as app chains.

For example, there are chains that are tailored for trading and DeFi like Carbon, Kujira, Osmosis, Sei Network etc, and chains that do NFTs like Stargaze, or chains that do liquid staking like Quicksilver and Stride.

What makes app chains interesting is that, because they are their own modular chain, activities that happen on each chain won't congest other chains unlike in Ethereum, which is a monolithic chain. This means if a hyped NFT mint is happening on Stargaze or Secretnetwork, or another chain, users can still do their trading, yield farming, liquidations, etc in peace on another chain such as Carbon or Kujira, without having to pay insane gas fees like on Ethereum.

Today, multiple sovereign blockchains are able to communicate with each other and improve the interoperability of the Cosmos ecosystem, and it is time for the Cosmos Hub to move on to a new vision.

Cosmos Hub's New Vision

With the ecosystem now having multiple blockchains working together, and billions of capital locked across multiple chains, the Cosmos ecosystem has matured.

Thus the role of the Cosmos Hub is moving from building the foundations, to helping the Cosmos ecosystem and all its app chains to grow and prosper, and that requires the Cosmos Hub to evolve itself as well.

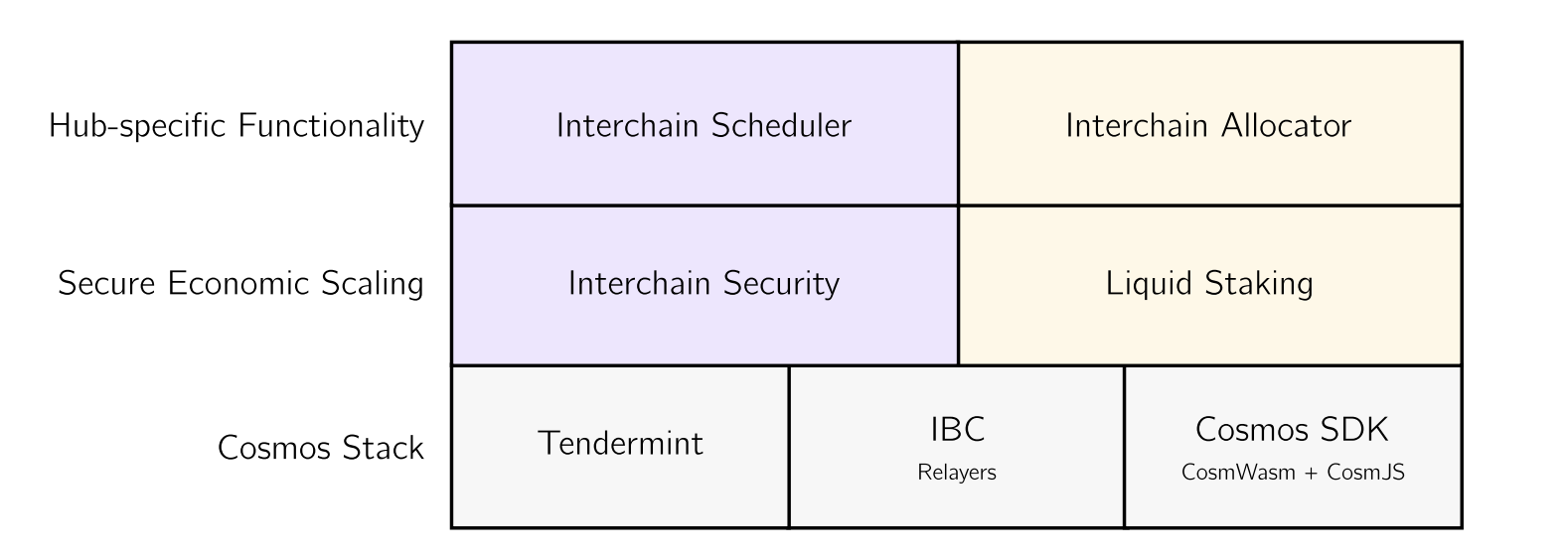

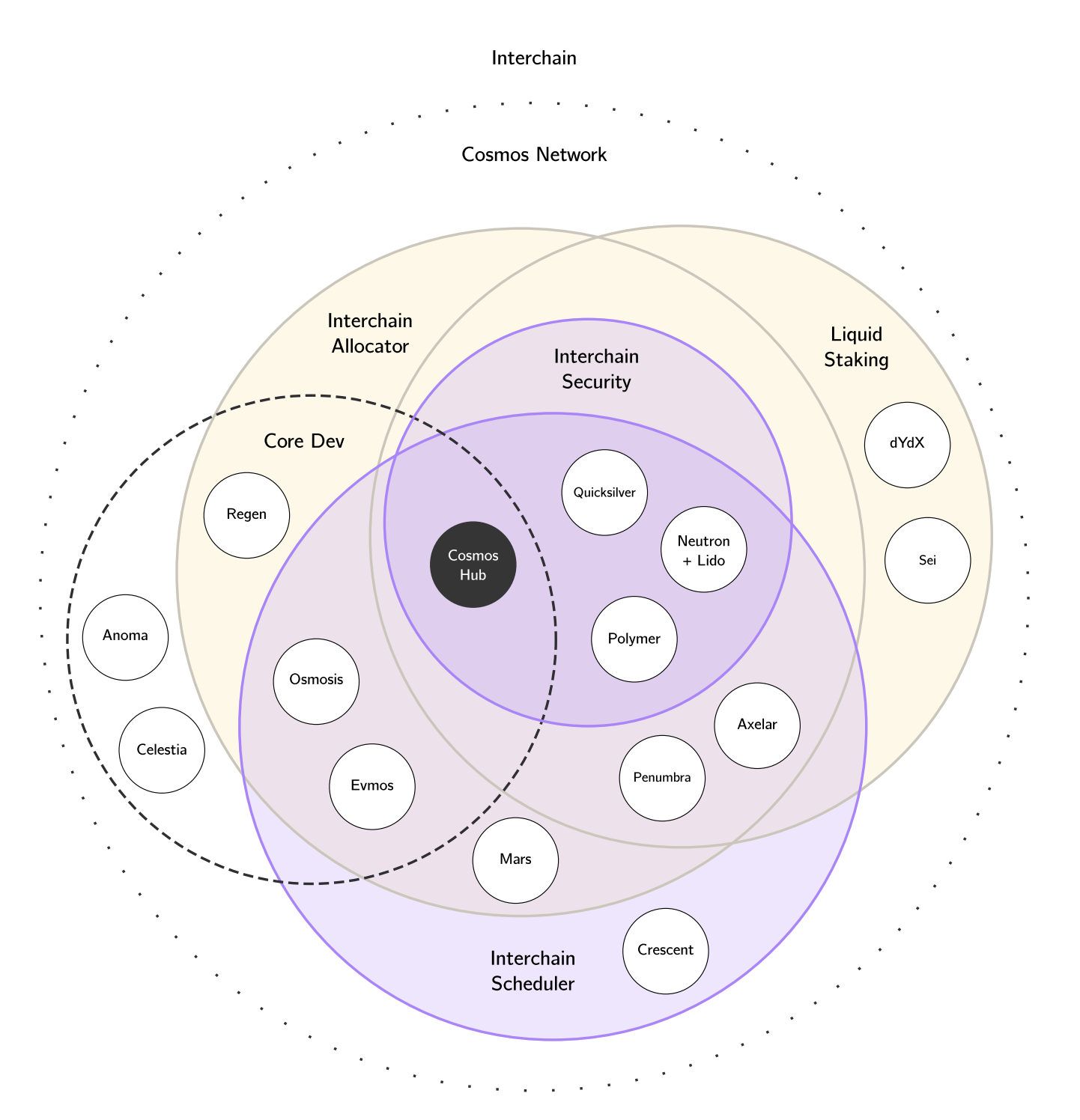

This will be done using four new technology which sits on top of the Cosmos Stack: Interchain Security (ICS) and Liquid Staking will help with secure economic scaling, and the Interchain Scheduler and Interchain Allocator which will help with hub-specific functionality.

Securing the Cosmos with Interchain Security

Starting with interchain security (ICS), it will transform the Cosmos Hub into a secure platform for others to build the next generation of interchain-native infrastructure and applications, paving the way for new cross-chain opportunities and innovation.

To explain what ICS is, we first need to understand how blockchain security for Cosmos app chains works.

Cosmos blockchains are Proof of Stake, and thus their security is determined by the financial value of the staked assets of the chain validators. Basically, the higher the market cap of the token, the safer the chain is as an attacker would require more money to attack the network.

However, the issue is that maintaining a high market cap is not easy, especially for newer blockchains. When a new chain is created, they often struggle to find a community and product-market fit, and market participants may not invest their capital to buy the chain's PoS asset and stake it to secure it. To solve this dilemma, many new Cosmos chains initially offer high inflationary rewards to incentivize validators to buy and stake.

However, this is not a good long-term solution as it creates high selling pressure on the token price over time. It may also dissuade investors from buying the token due to the selling pressure. And over time, if the token market cap drops too much from all the inflationary selling, it again faces an increased risk of attack and it is back to square one again.

The solution - Interchain security. This is where Interchain Security helps as it allows the validator set of a bigger chain, known as a provider chain, to provide security to the smaller chain, known as a consumer chain. In exchange for providing security, the provider chain receives some of the chain's gas fees and staking rewards.

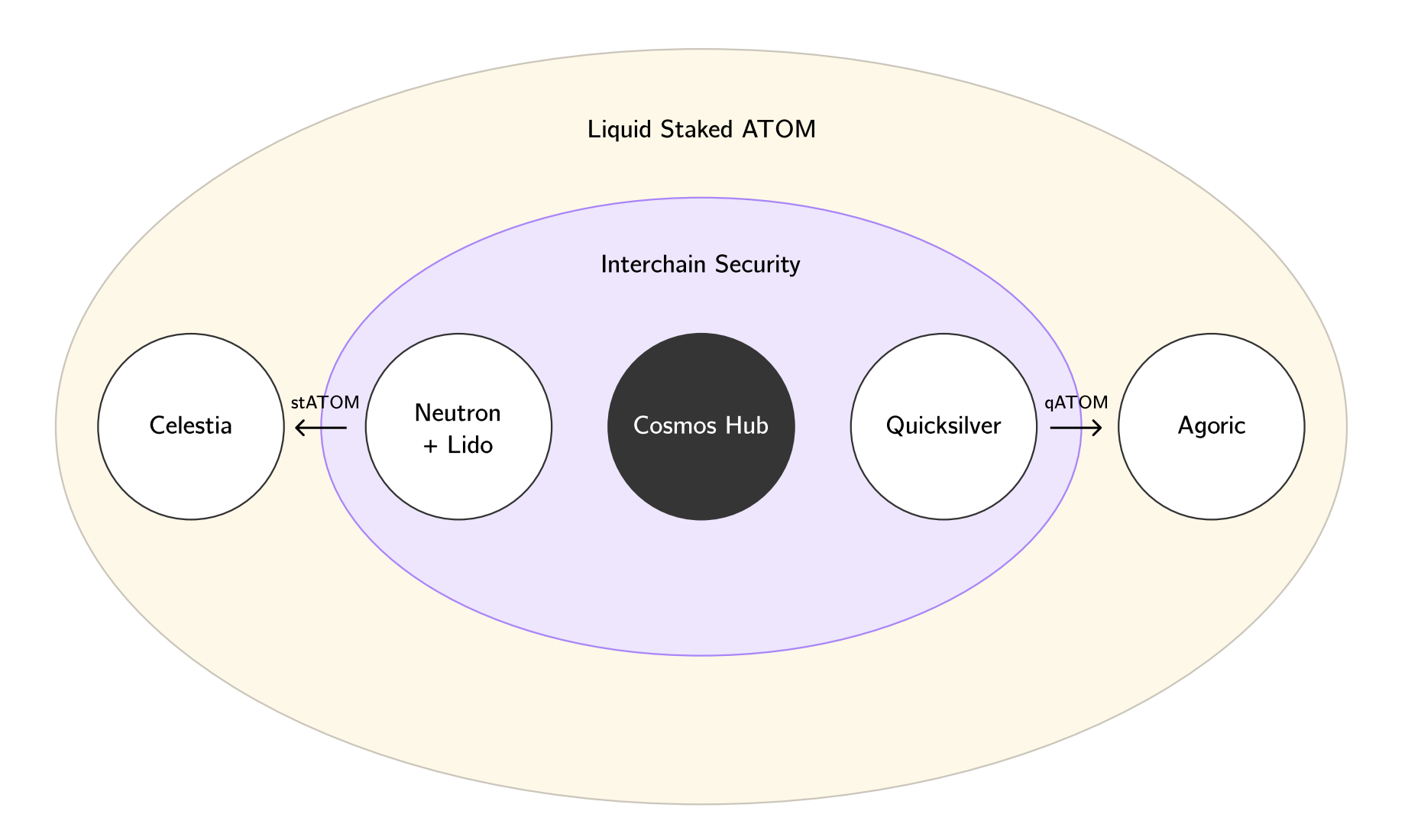

For example, Cosmos hub, an established chain, can secure a newer chain, such as Quicksilver, an up-and-coming liquid staking chain. This mechanism would allow the Cosmos Hub’s validator set to produce blocks on Quicksilver's chain. It would also use $ATOM as a staked asset, and so if users misbehave on the Quicksilver Zone, their $ATOMs would automatically be slashed on the Cosmos Hub.

The provider chain may also have its core functionality built on a consumer chain allowing it to cut down on its own development cost and time.

Therefore, Interchain Security helps Quicksilver to import the entire economic security of the Cosmos Hub, which is secured by billions worth of staked $ATOM, one of the most secure validator sets. In exchange, transaction fees as well as staking rewards from Quicksilver will go to $ATOM stakers as well, increasing the value accrual and return for $ATOM stakers, as well as allowing the Cosmos Hub to use and integrate with Quicksilver's liquid staking functionality.

In the future, just like how there are thousands of apps that people all over the world are using right now, if there are thousands of app chains that appear that are being secured by $ATOM's validator set, it could generate a lot of value back to the $ATOM token.

It is important to note that ICS is purely optional and can be opted out of even after using it. Quicksilver has said that they will adopt this mechanism for the early stages of their protocol to provide stakeholders with maximum security from day one, but once the Quicksilver chain is more established, they plan to move to a layered security arrangement with the Cosmos Hub.

This will be done via a future update of Interchain security where the Cosmos Hub validator set would be supplemented by a validator set from the Quicksilver community as having both validators sets securing the zone would bring the community and chain even greater security. This idea of sharing security is similar to Mesh Security which was proposed by Osmosis.

Interchain Security also reduces the barriers and costs of entry for consumer chains and enables a number of potential applications, including:

- Rollup Settlement — A canonical rollup settlement system and scaling solution in which external data availability providers (such as Celestia) can publish fraud proofs and resolve fork-choice disputes.

- IBC Routing — A market for IBC relay contracts and multi-hop connections, aggregating relay providers to create a simple, cost-effective, and reliable IBC connectivity subscription for a wide coverage area.

- Multiverse — An application deployment utility for projects to permissionlessly launch consumer chains within a sandboxed environment such as CosmWasm. Infrastructure automation would make creating a blockchain secured by the Hub as easy as deploying a smart contract.

- Chain Name Service (CNS) — A secure identification and authentication service for IBC-connected blockchains would provide a single location for chains to permissionlessly manage information about themselves.

One minor drawback to ICS is that staked $ATOM is put at risk for consumer chain faults in exchange for securing the chain. Although seemingly impossible right now, if a chain grows too big and is worthy of being attacked even while being secured by the largest chain, it would be similar to $ATOM being attacked itself.

At the end of the day, the financial success of this feature is still largely speculative and remains to be seen if it will generate significant revenue back to $ATOM stakers.

In summary, Interchain Security gives smaller chains a faster, easier, and cheaper path to market, helping to foster innovation, allowing more integrations and collaborative opportunities with other chains in Cosmos.

The other technology layer is called Liquid Staking which will also help to provide secure economic scaling.

Security and Capital Efficiency with Liquid Staking

In Proof-of-Stake blockchains like Cosmos Hub, its staked assets are not able to be used, which affects cross-chain composability. Liquid staking would allow users to use their staked collateral, such as staked $ATOM, as a liquid token that can be traded with and sent across other Cosmos chains. Note that liquid staking would likely extend not only to $ATOM but other PoS Cosmos assets as well.

This increases the user's capital efficiency by unlocking additional capital, while still securing the network as their $ATOM remains staked, improving the overall user experience.

The concept is similar to liquid staked ETH, $stETH, which was popularized by Lido and is used as collateral by multiple DeFi dapps such as AAVE!

It is easy to imagine how a liquid-staked $ATOM can achieve a similar level of popularity in the Cosmos ecosystem as well, allowing users to earn $ATOM staking rewards while using their staked $ATOM on other DeFi protocols.

While Interchain Security reuses the same validator set and staked collateral to secure additional state machines, Liquid Staking reuses the same staked collateral for other purposes.

Together, Interchain Security and Liquid Staking creates a secure base layer for other Cosmos chains to build on, helping with secure economic scaling and furthering the growth of Cosmos app chains and activities.

Price Efficiency Across Cosmos with Interchain Scheduler

The Cosmos ecosystem is made up of multiple app chains and many of them list the same assets. For example, $ATOM can be on multiple chains, and as they trade in the market, the price of $ATOM can vary from one chain to another, similar to how $ATOM's price varies slightly across different CEXes.

This introduces a lot of arbitrage opportunities, where arbitrageurs will find DEXes offering the same token but at different prices, and will arbitrage the token prices so that they average out and earn a profit for doing this.

This is a type of maximal extractable value (MEV) opportunity. There are two other common forms of MEV apart from arbitrage:

- Liquidations - MEV bot searchers will compete to be the first to submit a liqudation transaction to earn liquidation fees in protocols that have liquidations such as derivative protocols and money market protocols.

- Sandwiching - A searcher bot would watch the mempool for large trade transactions and sandwich the transaction, effectively buying the asset at a lower price before the buyer buys it, and then immediately selling it back to the buyer at the higher price. This is a bad and unwanted type of MEV as it worsens the user experience for regular users as transactions would cost more.

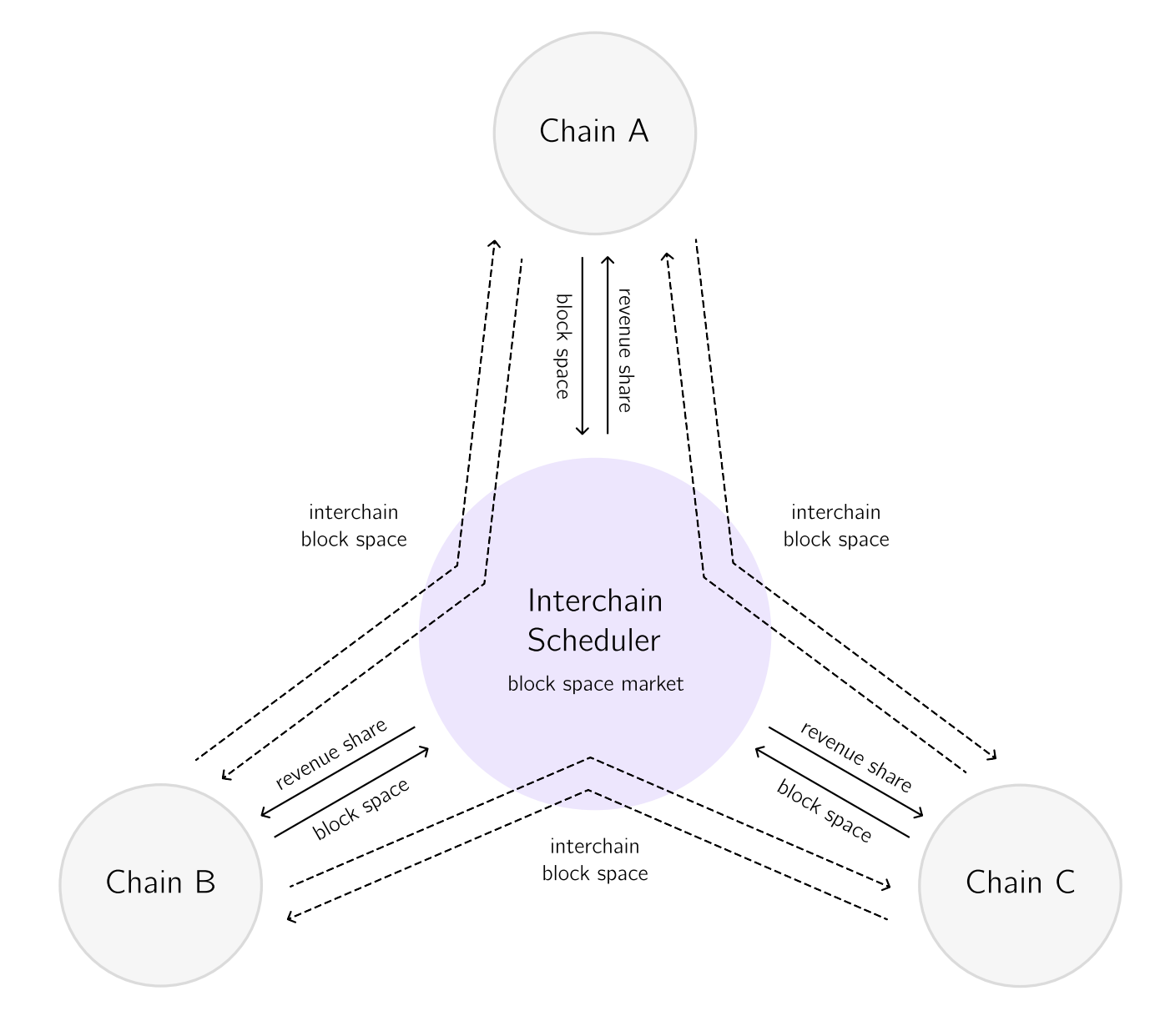

These types of transactions make up the MEV market and it can be made more efficient, more secure, and more lucrative for Cosmos chains and their users. The interchain needs a secure block space market to avoid off-chain cartelization and more options for chains seeking to optimize the use of block space.

While MEV is a large and growing market on Ethereum, MEV in the Cosmos ecosystem is still small.

According to Skip Protocol, a protocol focusing on MEV products on Cosmos, more than $6.7 million in arbitrage MEV has been extracted from Osmosis alone since its launch. Compare this to MEV on Ethereum, where gross extracted arbitrage MEV by Flashbots reached over $490 million (data collected from August 2020, pre-Merge). Existing MEV solutions on Ethereum like Flashbots’ are off-chain markets, however it lacks on-chain transparency.

Interchain Scheduler brings MEV markets on-chain, facilitating a fairer and more transparent system.

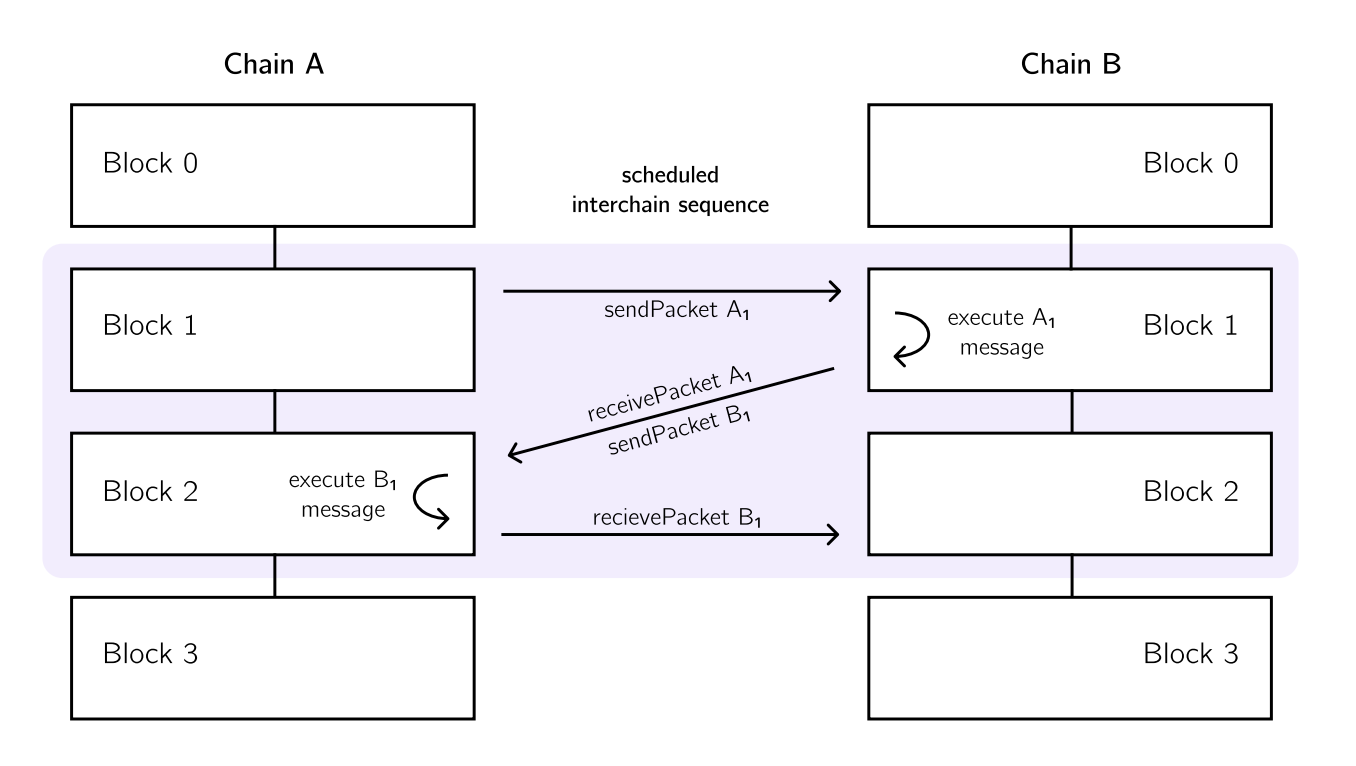

The Interchain Scheduler system works as follows:

- When the consumer chain enables the Scheduler module, it can enter into a cross-chain contract to provide a portion of their block space (e.g., one block every minute). Chains may sell as much blockspace in the marketplace as they wish, above some minimal threshold.

- Once the agreement is in place, the Scheduler issues non-fungible token reservations representing each future block region on the consumer chain. Reservation tokens from all participating chains are then periodically auctioned in batches.

- Optionally, tokenized reservations may be traded on a secondary market. This is possible until the reservation is redeemed to the appropriate validator on the partner chain, along with the desired transaction sequence.

- Upon successful block execution, a split of proceeds from the Scheduler auction are sent back to the partner chain.

Capitalizing Cosmos Ecosystem with the Interchain Allocator

$ATOM was used by the Cosmos Hub to fund the development of Cosmos' core components to reach the success that it has today. Funding is key during the initial phases of any ecosystem.

Thus, when the next bull market begins, the Cosmos ecosystem may have many new chains appearing. In order to sustain and see the full impacts of the rapid growth, the current approach to on-chain monetary coordination may not be efficient enough to facilitate the needs of these new chains.

Hence the Interchain Allocator was created.

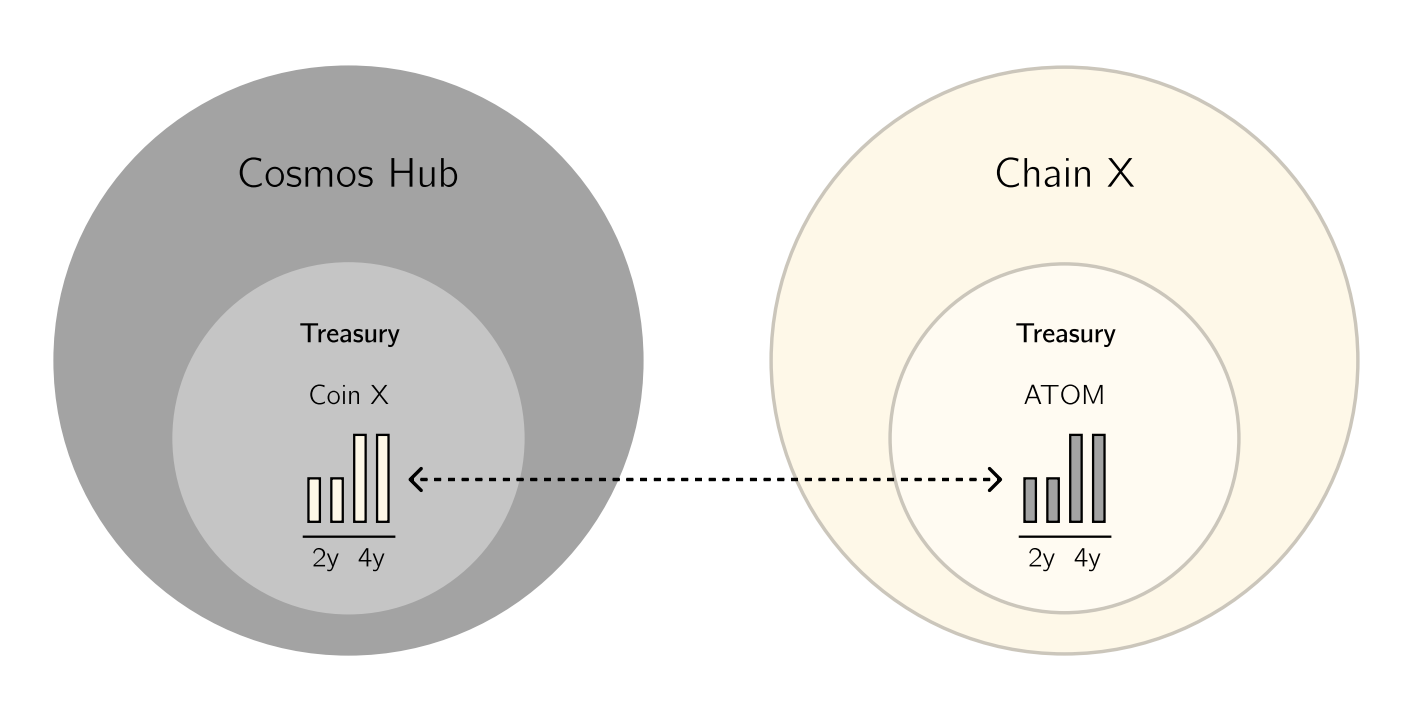

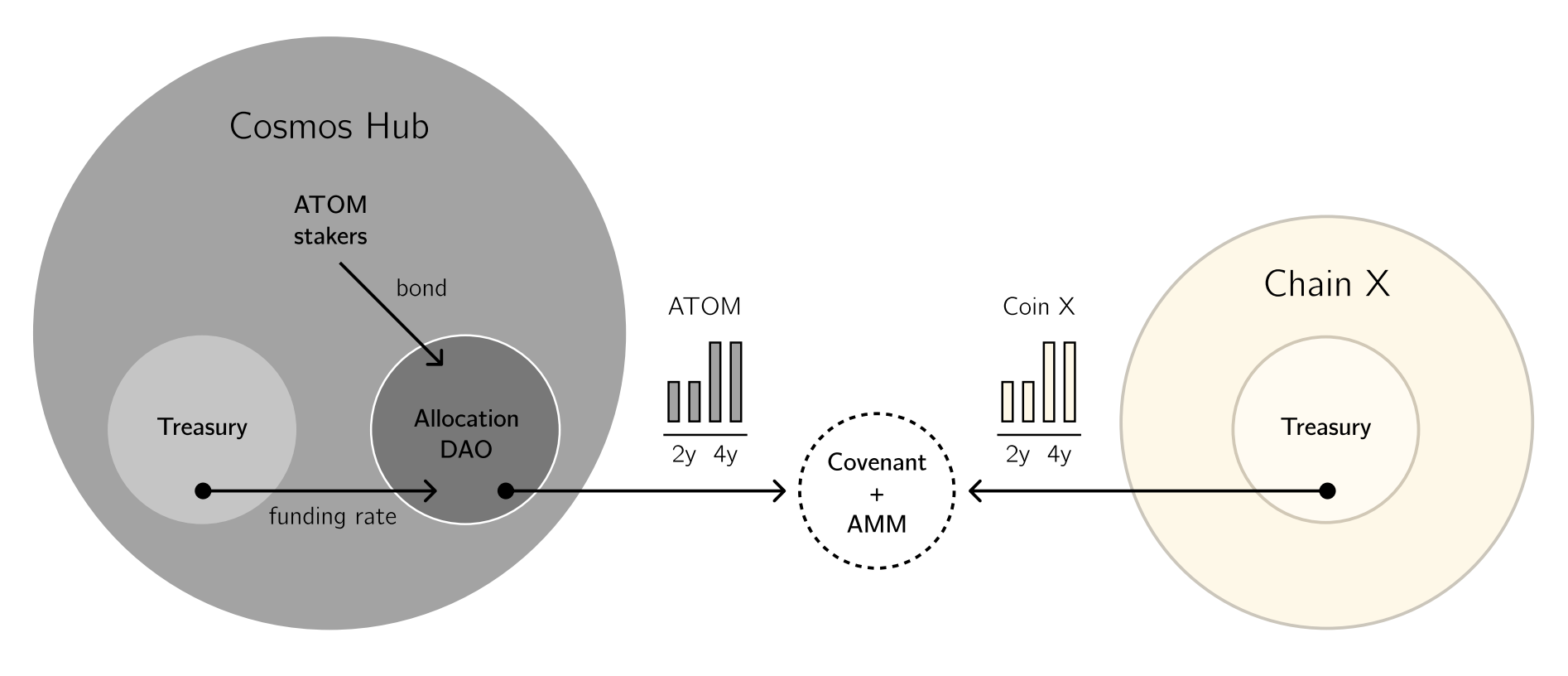

It is a platform for allocating capital to delegated parties to incentivize long-term alignment by bootstrapping users and liquidity for new chains.

Essentially it attempts to create a symbiotic relationship where the more 'Coin A' that Cosmos Hub holds in its treasury, and the more $ATOM that 'Chain A' holds in its treasury, the more aligned they are in incentives and goals.

The Allocator provides two tools that enable incentive-aligned communities to develop strategies for economic coordination on behalf of the Cosmos Hub:

- Covenant: A system for establishing multilateral agreements with designated chains and IBC-enabled entities. Basically, it allows DAOs to enter into on-chain agreements with other chains, fostering more cross-chain activities.

- Rebalancer: A system for automatically managing asset portfolios with public liquidity. Basically, it allows for more efficient execution of portfolio strategies by streamlining the buying or selling of assets on a fixed basis.

ATOM stakeholders could form DAOs and use the Interchain Allocator to achieve its goals, which include:

- Increasing velocity of new Cosmos projects

- Accelerating project growth and sustainability

- Expanding economy for cross-chain blockspace

- Aligning incentives between new projects and Cosmos Hub

Atom 2.0 Tokenomics (Still TBC)

Current Tokenomics

The $ATOM token is known to not have a maximum supply with pretty high inflation, and this inflation has caused investors to be concerned about the price of $ATOM.

The inflation is needed to incentivize a target supply of the amount of $ATOM staked. When many $ATOMs are being staked and the ratio is above two-thirds of its total supply, it will reduce the inflation to a minimum of 7%, and if lesser $ATOMs are being staked and the staking ratio is below two-thirds of the total supply, it will increase the inflation to as high as 20%.

At the time of writing, $ATOM inflation rate is around 18% and a total supply of 311.8 million tokens with a market cap of $3.6 billion.

To address the inflationary concerns, the upcoming liquid staking feature will increase the capital efficiency of staked ATOM by allowing it to be utilized while still being staked.

Thus, the current monetary policy is being modified as users do not have to choose between staking their ATOM or using it in other DeFi protocols. As such, a new tokenomics is proposed.

New Tokenomics:

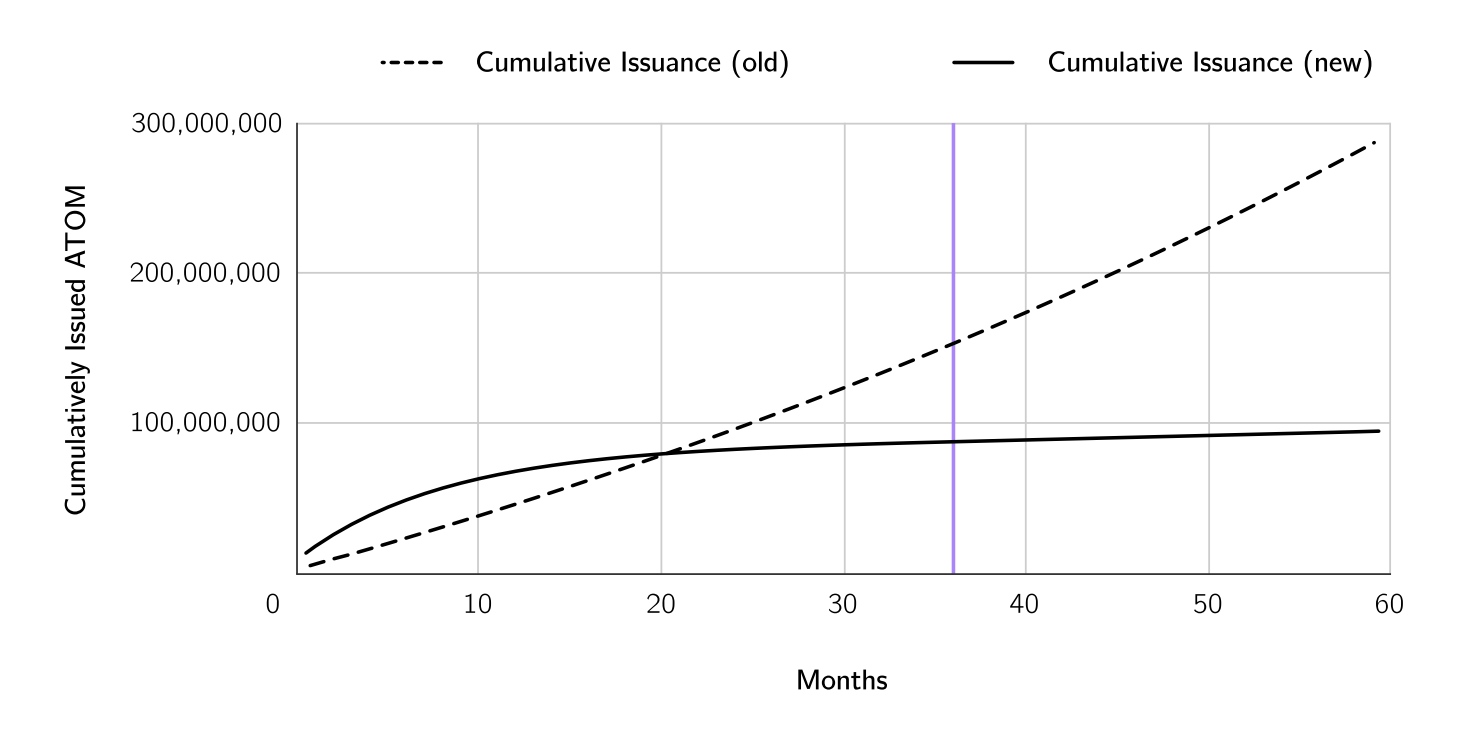

The new tokenomics that are proposed involves two phases:

- Transitory phase - start with high inflation that decreases over 36 months

- Steady phase - low constant inflation after the transitory phase

Note: As of this writing, the tokenomics have not been confirmed and are still being discussed by the community.

The transitory phase begins with a significant increase of issuance that lasts for 3 years before reaching a steady issuance rate that lasts indefinitely. The issuance rate starts at 10 million ATOM per month before declining until an issuance rate of 300,000 ATOM per month.

The goal is to gradually remove security subsidies, starting from the current rate and decreasing by 10% every month for 3 years. By the end of this period, the hope is that the revenue from Interchain Security will meet or exceed the original subsidy and that the inflation of 300,000 ATOM per month is negligible.

This initial jump in token issuance is meant to bootstrap the Cosmos Hub treasury that will be used to support and expand the network for the next few years.

However, there are arguments that this new issuance is bad for $ATOM stakers as 2/3 of the inflation will go towards the treasury and only 1/3 of it will go to stakers. On top of that, during the steady phase, all of the $ATOM issuances will go to the Cosmos Hub treasury and none to stakers.

Although the bulk of the newly issued token goes into the treasury and will not be circulating the proposal is questioned as the existing treasury has at least $60 million according to their public wallets, and issuing 10 million $ATOM at the current price is over $100 million in market cap which is causing existing $ATOM investors to worry about dilution. This has stirred up some debates which will hopefully be addressed before the proposal gets implemented.

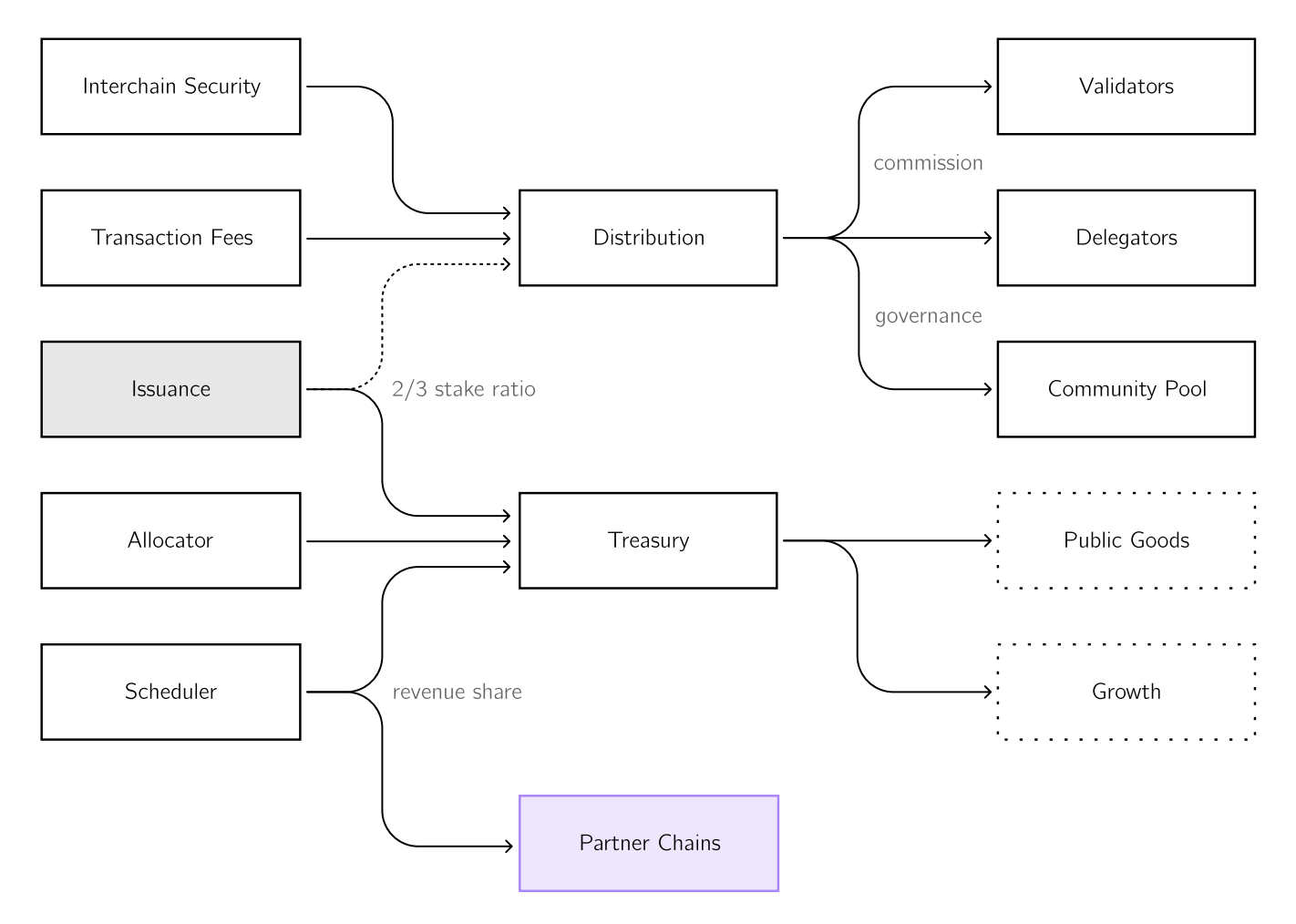

Currently, Cosmos Hub’s transaction fees are sent to the distribution module and divided between the Community Pool, delegators, and validators.

In 2023, the implementation of Interchain Security will add another stream of revenue from each consumer chain to the distribution module, which will replace the current security subsidy.

Technical Analysis on $ATOM

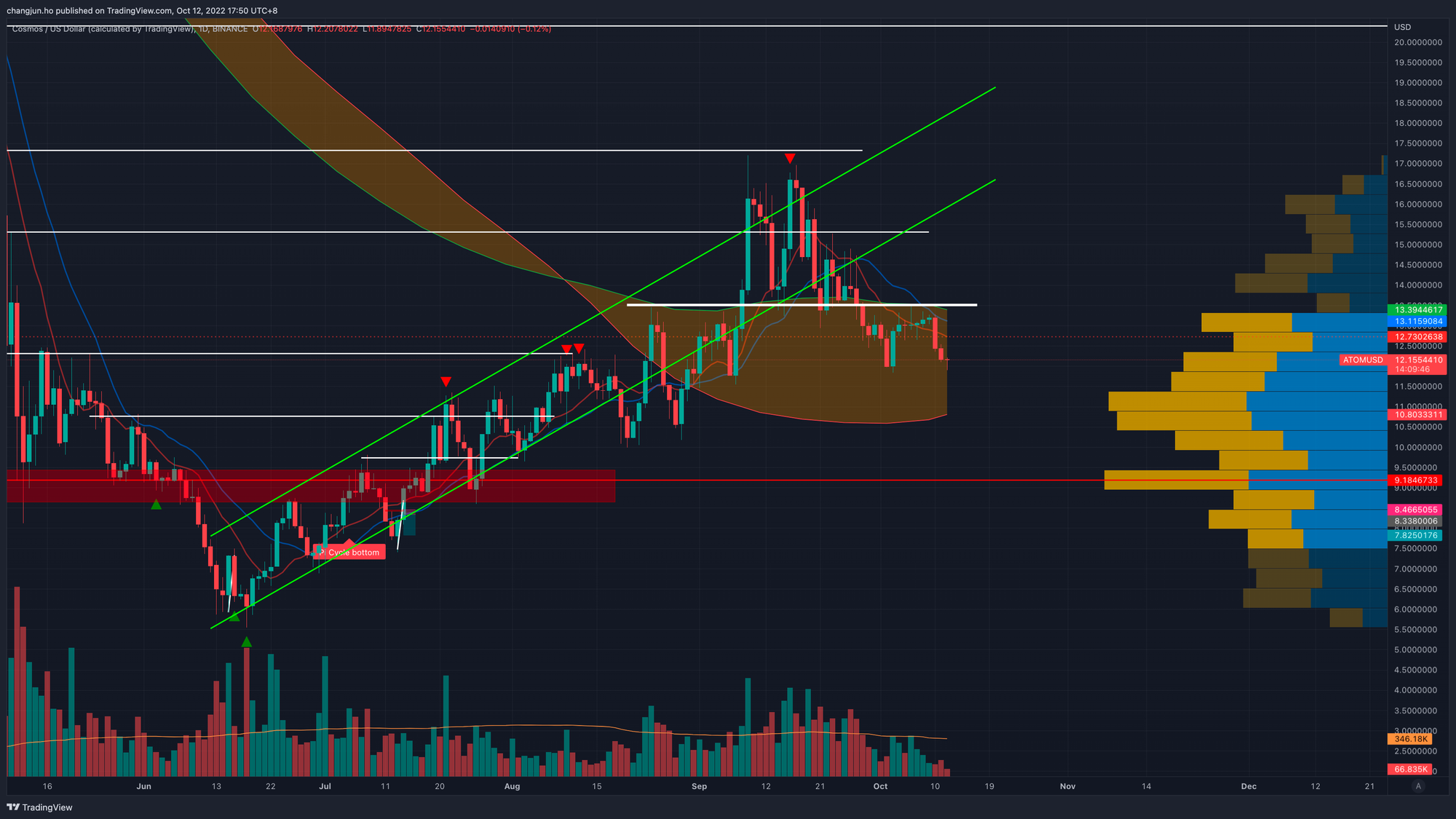

There was a strong ascending channel as $ATOM rallied close to 200% from the bottom of June leading up to the Cosmosverse event, crossing above the 20 weekly moving average which is commonly referred to as the bear market resistance band/bull market support band.

Now that the event is over, like most crypto events, it was a 'buy the rumor and sell the news' and the price of $ATOM broke below its ascending channel and has fallen about 30% from $17 to $12, and is currently sitting at its bull market support band again.

In the current macro and crypto environment, it is hard to see how $ATOM can continue its upward trajectory in the short-term after such a strong rally, and a retracement towards its Fib's golden ratio at $10 is likely eventually.

From a long-term perspective, anything below $5.60 should be a good entry looking at the significance of the Cosmos ecosystem on the crypto markets in general when the bull market comes again.

Any rally in the meantime towards $20 is likely to be met with strong selling pressure due as it would be a key resistance level, and existing $ATOM holders should look to take some profits towards the $20 range.

Conclusion

The Cosmos Hub and the Cosmos ecosystem have made great progress and are one of the more vibrant ecosystems in crypto today.

As Cosmos grows, the amount of cross-chain transactions, interoperability, and composability will only increase as more innovative apps and features are made, which presents a bright future for Cosmos.

However, the proposed tokenomics is rather disappointing as we were hoping for a revamp that would make $ATOM disinflationary to follow in the narrative of ETH's ultrasound money ideology.

In fact, the tokenomics design to remove the infinity inflation is similar to the Carbon protocol's $SWTH tokenomics that was already done 2 years ago.

Funny this is the exact design that @0xcarbon came up with 2 years ago. We modified the cosmos-sdk inflation module specifically to remove infinity inflation. https://t.co/vICbSulcpX

— Ivan Poon (@ivan_switcheo) September 27, 2022

Overall, the ATOM 2.0 whitepaper presents a solid roadmap and shows why the Cosmos Hub is here to stay. Although the proposed tokenomics are being debated, even if $ATOM price acts more as a public good than an investible token, if it helps to develop the rest of the Cosmos ecosystem's modular blockchains, those are the areas where investors can look to invest in for better financial returns.

Final Thoughts

The Cosmos ecosystem with individual app chains reminds me of the computing world when it first started.

When computers were first made, there was the idea of a single powerful computer that would run all the world's computing needs. Back then, the idea of individuals having their own personal computers for their own computing was laughed at.

Fast forward to today where everyone has their own computer, we probably can't imagine a world where we are all relying on a single computer (but you could argue that AWS becomes the only server that is used and all websites are just dapps connecting to it haha).

Bringing it back to crypto, the world computer idea is similar to Ethereum, while the idea of personal computers for individual needs is similar to individual app chains, and it is easy to see how it can work out. If the idea is adopted on a global scale, it would be very bullish for the Cosmos ecosystem and $ATOM's value proposition and it will be a very exciting journey for us #cosmosnauts.