Similar to single staking vaults, Single Staking Option Vaults (SSOVs) allow users to lock up tokens for a predetermined duration and earn yield on their staked assets. They are known as a rolling options strategy vault, which is not the same as an LP vault.

Context

Defi options vaults have exploded in the second half of 2021, attracting not only retail Defi investors but also the largest institutional players. Options protocols have grown exponentially to become the dominant part of the $700 million Defi option TVL, with notionals trading in billions of dollars each month.

Source: QCP Capital

Introduction

SSOVs are a strong catalyst to increase TVL into platforms by incentivizing users with additional yield while utilizing fair option pricing and white-labeled, easy to use and non-sophisticated UI. By doing so, they are attempting to onboard more protocols and increase user adoption.

Especially during a bear market, the SSOV option pools would allow anyone to earn a yield passively by offering value to both option sellers and buyers while ensuring fair and optimized option prices across all strike prices and expiries.

With SSOVs, users can deposit assets into a contract which will then be sold as call options to buyers at fixed strikes that they have chosen for end-of-month expiries. The SSOV options can either be at the money, out of the money, or far out of the money.

There are currently quite a few key players that run the SSOV strategy, but we will be focusing on the following today: Ribbon Finance, Katana, Dopex & Thetanuts.

Ribbon Finance

Introduction

Ribbon Finance is a new protocol that helps users access crypto structured products for DeFi by combining options, futures, and fixed income to improve a portfolio's risk-return profile. Their core product is the Theta vault, a yield-focused strategy on ETH and WBTC.

Users can simply deposit their assets into the vault, which will generate yield on its deposits by running a weekly automated options selling strategy and collecting premiums through writing out of the money options. Thereafter, it will reinvest the yield earned back into the strategy, effectively compounding the yields for depositors over time.

The Theta vault strategy alleviates most gas problems by socializing the gas costs across all the vault depositors. This is because rather than doing 3 to 4 transactions per week per user, the vault will perform that for thousands of users at once. This makes things straightforward and relatively cheap for Ribbon Finance’s users — deposit, wait for yields, and withdraw.

Ribbon Finance plans to offer structured products for all majors (BTC, ETH, L1s) and DeFi bluechips. To achieve this, the Ribbon team has introduced their automated V2 vaults. The first roll out of its V2 covered-call vault was $AAVE.

Products

The Theta vault operate two types of options strategies to generate yields:

- Covered call: Vault writes out of the money covered calls.

- Put selling: Vault writes out of the money puts.

To lower the risk of Theta Vault options getting exercised, their initial vaults will sell weekly call options. This is so that they can adjust their expectation of prices on a weekly basis, which also has the nice side effect of letting them compound their premiums more frequently.

Next, the team also intends to select strike prices that are far enough from today’s spot price in order to reduce the risk of exercise. Their current methodology for strike selection and backtests show that they only get exercised less than 5% of the time, even throughout the entire run up of ETH from $80 to $2000.

Theta Vault - Covered Call

Currently, Ribbon Finance allows users to deposit ETH and WBTC in the Theta Vault to generate an APY of 20%-30% (depending on option pricing). In order to generate this APY, Ribbon Finance adopted a Covered Call strategy, which allows one to earn yield for selling potential upside of an asset. Essentially, the vault will help to sell out-of-the-money OTM options against the underlying asset to charge weekly premiums.

This strategy is suitable for investors who intend to hold the asset for a long time. In options trading, this is usually seen as a neutral or slightly bullish strategy.

For instance, if someone is willing to give up potential upside of ETH going above $25k by year end, he or she can get paid yield for selling a $25k call option. In the unfortunate event if ETH actually goes up to $30k, he or she would have forfeited $5k but we will still be up in terms of USD. This is a win-win scenario for them because they only risk getting exercised when ETH absolutely moons.

Payoff diagram for covered call strategy

Theta Vault - Put Selling

With the Put Theta Vault, put options are sold instead of covered calls. This means that if the price of an asset is expected to increase, users can earn high yield in the meantime by selling downside protection. Users can simply deposit USDC into the vault and Ribbon will automate this process for them on a weekly basis.

Ribbon has launched the first Puts Theta Vault on ETH and it will be capped to $20m USDC. This is to make sure that the market makers that Ribbon is working with are able to buy up the put options being sold.

This Puts Delta Vault is essentially an accumulation strategy for the ones who wish to automatically buy on dips and/or generate income through their USDC. The fund pool runs an automated strategy to sell ETH put options and earn income from USDC deposits. The fund pool sells OTM put options on Opyn weekly, earning premiums and reinvesting every week to obtain a compound rate of return. In the event when the option expires, the treasury is obliged to purchase the underlying asset at a predetermined strike price, that is, “buy on the bargain”.

Moving forward, the Ribbon team is planning to expand this product line by offering Puts Theta Vaults on various assets such as BTC or other ERC20s. They are also planning to offer Puts Theta Vaults that can be collateralized with non-USDC assets, e.g. ETH or WBTC.

Theta Vault Yearn

As of now, funds held in Theta Vaults do not generate any yield, apart from writing options. Every Friday, the vault will convert all USDC balances into yvUSDC by depositing them into the Yearn USDC yVault. This is to help depositors gain exposure to the yield generated from Yearn in addition to the options strategy.

Ribbon Treasury

Ribbon Finance also plans to serve the long-tail ERC20s by introducing a new product, "Ribbon Treasury". This is aimed at allowing DAO treasuries to sell covered-calls on their deposits and earn USDC weekly, which essentially gives DAOs cash for expansion plans.

Read more here: https://ribbonfinance.medium.com/ribbon-treasury-ee311f7ce7d8

Open Auctions

The options that are minted by the Theta vaults will be sold in a batch auction conducted on the Gnosis Auction platform. A batch auction would mean that there will only be one clearing price.

Utilizing an auction allows for price discovery on-chain, ensuring that the options sale process is decentralized.

How batch auctions on Gnosis would work: https://gnosis-auction.eth.link/#/docs/batch-auctions

Tokenomics

The total supply is 1,000,000,000 $RBN.

The current model of Ribbon Finance is to first allocate tokens through Mining and airdrop, and then gradually announce the complete token economic model. The team only began to announce the details of token airdrops and mining rewards on 25 May 2021, and declared that the value of the tokens is not empowering.

- Airdrop: Held on 25 May 2021, 3% of the RBN token supply (30M RBN) will be allocated to the community.

- Liquidity mining activity: Officially concluded on 19 July 2021, a total of 10 million RBN (1% of total supply) rewards were issued.

Team & Investors

Ribbon Finance was founded by Julian Koh & Ken Chan and launched in 2021.

Julian was previously working on research and due diligence for a top cryptocurrency hedge fund. He then moved on to become a software engineer with Coinbase, focusing on crypto integrations, custody and staking.

Ken was previously a software and blockchain developer before moving on to become a software engineer with Coinbase, focusing on coinbase custody, prime brokerage and asset additions.

On top of this, they are backed by top-tier investors like Coinbase VenturesDragonfly Capital, Joseph Lubin, and Kain Warwick.

Roadmap

Products

In the future, Ribbon plans to launch four major module products: betting on volatility, increasing returns, principal protection and compound interest.

Principal protection products combine fixed income and options to provide upside, while making sure that investors receive their principal investment return. This will likely be realized using a mixture of cryptocurrency native zero coupon bonds and call options on related assets.

One of the most exciting roadmap projects that is set to come soon is the use of interest-bearing assets as collateral. Ribbon’s plan is to focus on Yearnytokens in the initial product. For instance, imagine that your assets locked in an annual vault can enjoy an APY of 10%. Ribbon plans to use the assets that have already generated income and sell options on this basis to create the highest rate of return in all DeFi.

Tokens

The team have also unveiled three main plans for their RBN tokenomics:

- RBN Staking Cut of meat

- Vote locking & Reward Boosting Lock

- Protocol Backstop

Read more here: https://ribbonfinance.medium.com/ribbonomics-b070e269fbb3

Risks

The primary risk of SSOVs is that depositors could potentially give up upside in exchange for guaranteed yield. By selling a call option, users are basically promising to sell the asset at the strike price, even if it goes above it. As a result, if the price of the asset moves up significantly in a short period of time, it is possible for depositors to have "negative yield" on their ETH. Of course, this only happens if ETH/USD appreciates significantly, so depositors will still be up in USD terms.

The vault also sells call options that are very out of the money, which means there is a relatively low chance of the options getting exercised. The price-feeding mechanism and tokenomics of Ribbon Finance is also unclear as of now, which is rather risky for investors.

Although the smart contracts are audited by Peckshield, ChainSafe and Quantstamp, users are advised to exercise caution and only risk funds they can afford to lose.

Katana

Introduction

Katana is a yield generating protocol on Solana that provides a suite of packaged yield products across the risk spectrum from a variety of different sources and assets. This allows users to passively access the best risk-adjusted yields in the ecosystem.

In response to DeFi’s fast-paced nature, Katana’s suite of products will constantly adapt and evolve to capture the best yields available in the Solana ecosystem. A recipient of the Grand Prize at the Solana Ignition hackathon, Katana aims to transform the yield generation business for the better.

How Katana works: https://youtu.be/v60a4_MBK7M

Products

After only two months since its inception, Katana has officially launched their first product on Mainnet on 20 December 2021. They are none other than structured products — consisting of covered calls and put selling strategies — followed by automated vault strategies. Users can now place deposits in the first sizable round of SOL + ETH Covered Call vaults and NFTs will be rewarded to all depositors in this round.

Structured Products include:

- Covered calls and put selling strategies for popular assets

- Sustainable yield, generated by expressing a market view

- Abstracts away the complexity of the underlying derivative strategies

- Fully automated for the user, automatically rolling over positions at the end of each period

Automated Vault Strategies include:

- Passive method to earn yield on a chosen base asset

- Span a wider array of yield farming opportunities

- Strategies will be changed as new opportunities arise, enabling depositors to consistently earn the best yields available

- Fully automated execution for the user

Katana currently offer 2 covered call strategies, the ETH covered call and the SOL covered call.

ETH Covered Call

Users can deposit ETH into the ETH covered call vault when they are bullish on ETH and want to earn passively with time. Once deposits are made, the vault will automatically use these deposits to put them into PsyOptions. PsyOptions will mint out-of-the-money ETH calls with a specified strike and expiry in return. The goal here is to not get exercised and these options are sold to earn a yield. The profit will then be used to purchase the underlying asset, ETH in this case, once again. Essentially, we are trying to maintain upsider exposure to ETH and earn this yield on top.

SOL Covered Call

Users can deposit SOL into the SOL covered call vault when they are bullish on SOL and want to earn passively with time. Once deposits are made, the vault will automatically use these deposits to put them into PsyOptions. PsyOptions will mint out-of-the-money SOL calls with a specified strike and expiry in return. The goal here is to not get exercised and these options are sold to earn a yield. The profit will then be used to purchase the underlying asset, SOL in this case, once again. Essentially, we are trying to maintain upsider exposure to SOL and earn this yield on top.

Tokenomics

Katana does not have a token at the moment. Any mentions of a token, airdrop, or pre-sale are fraudulent and should be ignored.

Team & Investors

Ayush Menon is the founder of Katana and an experienced Solana developer. He's a two-time Solana hackathon winner and an undergraduate student at Harvard where he studies computer science and economics. He was previously at Delphi Digital where he worked as a founding engineer on Mars Protocol, a money market on Terra.

Eric Nie is a founding engineer of Katana and a seasoned DeFi developer. Eric previously built a DeFi protocol on Ethereum, managing the full-stack from idea to product execution. He used to partake in math competitions and placed in the Putnam Top 500. He graduated from Carnegie Mellon with a degree in computer science and math and previously worked as a software engineer at Addepar and Jump Trading.

Roadmap

- Expanded strategy suite

- Exotic products

- Complete automation

- Full decentralization

Risks

The vault may incur a loss if the price of the underlying asset of choice is above the strike price of the call options at the time of expiry. If so, the options are deemed to have expired in the money and can be exercised for the asset locked by the vault, resulting in a potential loss in the selected asset terms for the period. Strike prices are chosen such that these events are exceedingly rare.

Dopex

Introduction

Dopex is a decentralized options protocol on Arbitrum, supported by Tetranode. They aim to maximize liquidity, minimize losses for option writers and maximize gains for option buyers. All these are fulfilled in a passive manner for liquidity contributing participants.

Products

Option Pools

Option pools allow users to earn a yield passively by providing base asset and quote asset liquidity for users who wish to purchase call and put options respectively.

As an incentive for liquidity providers in the initial stages, they will be able to collect their pool holdings plus any premiums paid for all options relative to the pool size on top of $DPX rewards at the end of each epoch.

In the event of losses incurred by the pool when purchasers make a net profit on their option purchases, pool participants will be given rebate tokens, $rDPX, which will be minted equivalent to 30% of all losses incurred by the pool.

The option pools are either weekly or monthly pools - with different levels of token incentives for liquidity provision considering the varying wait times to epoch expiries. All these makes Dopex a much more enticing platform as compared to vanilla options writing on other platforms.

SSOVs

They have added the SSOV feature into their architecture. Apart from DPX and rDPX, they now have an ETH SSOV, which has been live since 5 December 2021.

Users can now:

- provide liquidity to SSOV and write ETH call options

- buy call options on ETH

Essentially, the underlying token ($ETH in this case) is deposited into the vault and locked for the duration of the epoch. This underlying token will be used to write covered call options and users will pick the strike. APR varies by strike.

A useful infographic for the ETH SSOV

The current epoch

Each of the SSOVs have their separate reward pool:

- DPX SSOV routes the deposits via the DPX farm

- rDPX SSOV routes the deposits via the rDPX farm

- ETH SSOV routes the deposits via a separate, special rewards pool.

Puts are said to be coming soon on Dopex.

Tokenomics

Dopex makes use of two tokens, $DPX and $rDPX.

Utility

$DPX serves as the limited supply governance token for Dopex, which allows holders to vote on protocol and app level proposals. Furthermore, $DPX accrues fees and revenue from pools, vaults and wrappers built over the protocol after every global epoch.

$rDPX serves as a rebate and utility token for options writers. Essentially, they are minted and distributed for any losses incurred by pool participants. The amount of tokens minted are determined based on the net value of losses incurred at the end of a pool's epoch. The percentage rebate is determined by a governance process based on votes by DPX holders within the protocol. $rDPX is required for usage across the protocol including initial token distribution via yield farming, minting synthetics, fee payment and more, giving it intrinsic value for long term sustainability.

Emissions

The TGE was held on 21st June 2021, with a total supply of 500,000 $DPX.

- Operational Allocation (17%): Distributed across 5 years. This allocation is used to initially handle governance, incentivize development of community suggestions and help grow the platform with newer features/upgrades and account for other operational costs.

- Liquidity Mining (15%): Farming period is set to 2 years with an initial boosted rewards period of 4 weeks.

- Platform Rewards (30%): Distributed over a period of approximately 5 years. These rewards will incentivize the use and upkeep of the Dopex platform.

- Founders Allocation (12%): 20% initially staked in liquidity pools, 80% vested for 2 years distributed using a drip system via a smart contract.

- Early Investors (11%): 50% vested over 6 months

- Token Sale (15%)

Price Action

Since their TGE, Dopex has observed a significant increase in their price, from about $100 up to as high as $2,500 in just a few months. Currently, the price is around $1600.

Team

The founder of Dopex is @tztokchad, with the lead developer being @witherblock.

Tz is the main founder of Dopex and has been building it over a few iterations internally for a couple of years originally. He has been in the crypto space since late 2016 as a developer and investor, although he first got exposure to Bitcoin 2012.

Witherblock is the lead developer at Dopex. He first got involved in crypto a couple of years back thanks to Tz and then Dopex again thanks to Tz.

Roadmap

Risks

While SSOV depositors users will not be at risk of losing any notional USD value by staking their assets, they could lose potential upside in the event that the token increases rapidly. If call buyers are in net profit at the end of the epoch, depositors will lose their staked tokens but will make a profit in USD notional.

Thetanuts

Introduction

Thetanuts is a cross-chain protocol currently deployed on Ethereum Mainnet and BSC, offering vaults with various options strategies. Their products are designed with the everyday person in mind who does not have the tools or ability to take advantage of these strategies.

Options are complex financial tools with different strategies suitable for different market conditions. As of now, Thetanuts’ vaults allow for structured products to be deployed in a strategy such as a covered call or covered put to earn yield.

As the market matures, derivatives such as options, forwards and futures will naturally accomodate more sophisticated demands and promote liquidity. There are many strategies that structured products can perform so as to maximize yield for all market conditions.

Products

Covered Call:

When one deposits into a covered call vault, the vault will hold a long position in the underlying asset and then sell call options on that same asset. The main source of revenue from this strategy is from earning options premiums.

The ones who go for the covered call strategies are typically those who intend to hold the underlying asset for a long time but do not expect a big price movement in the short term until the relevant expiry date. Essentially, this usually leans towards a more bullish sentiment.

More can be found on: https://thetanuts.finance/vaults#

Put Selling

When one deposits into a covered put vault, the vault will hold a short position in a coin and also sells a short put position. By maintaining both positions, it allows the vault to hedge its risk and receive a premium.

The ones who go for covered puts are generally those who are neutral with a very slight bearish bias. This means that they believe there will be sideways movement in the short run till the period of expiry. Options are created to hedge risks and it is possible to take profit.

More can be found on: https://thetanuts.finance/vaults#

Tokenomics

There is currently no Thetanuts token in circulation. There are currently also no fees levied in Version 0 of Thetanuts.

Team

Darius is the founder of QCP Capital, which was established in 2017. Together with 80 other team members, they are now running an options trading book in excess of 2 billion dollars across exchanges. He is also part of the early investors in the space, Fantom, Avalanche, Algorand, Terra and so on. He is a general ecosystem builder who is eager to get more involved with the Fantom ecosystem.

0xUsagi is the growth lead at Thetanuts. He was first exposed to the crypto space by the CTO of Thetanuts, Pecan.

Risks

Although the strategies offered can be highly profitable, there are still possibilities that one can obtain zero yield or even suffer losses should the options expire against the vaults strategy.

The risk of covered calls is missing out on coin appreciation in exchange for consistent premium. If the value of the underlying asset appreciates significantly, the vault strategy will only benefit up to the strike price but no higher as a call was written.

Covered options strategies prevent profit from significant movements as one would have already established the minimum buying price at the time of writing of the covered put. This means that the potential upside is capped in exchange for the certainty of receiving a premium.

Ultimately, one should be mindful of the risks involved and do your own research.

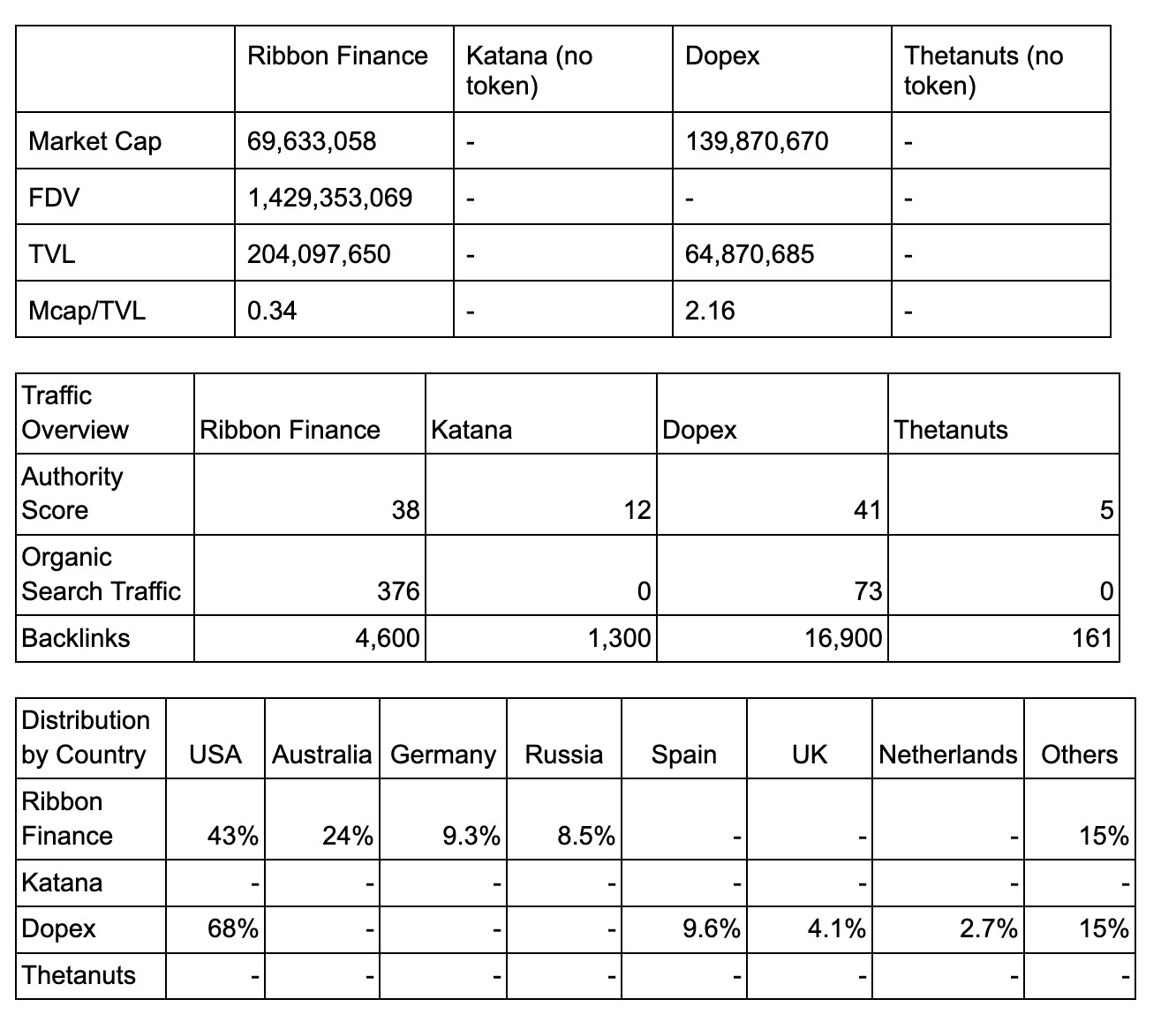

Comparing Key Stats

Source: Semrush

Multichain SSOVs

In the future, there will definitely be multi-chain SSOVs too, likely on AVAX, etc.

Solana - Chest Finance

Chest Finance has recently been launched on Solana on 25 November 2021. It is a protocol that has its very own SSOV product which helps users boost their yield by composing complex structured products into simple stakes and earning chests.

Every week, Chest vaults run automated call cover and put cover options to earn yield for its users.

As the protocol is still new, they have yet to launch their own token.

Conclusion

All in all, SSOV products are still underrated as of now. However, they are gradually allowing high conviction, long term holders to slowly compound their stack, directly from those trying to make it in a single epoch. The ultimate goal is to develop a healthier base of long term investors for all protocols utilizing SSOVs.

We saw how Dopex played out over the months and once more SSOV protocols launch their tokens, there will be many potentials for investors.