It's finally here! Demex has launched perpetual futures, a core pillar of activity in the crypto markets.

This in-depth guide will explain how perpetual works, share some strategies, and showcase why Demex perpetual futures is primed to create one of the best experiences for DeFi traders (you don't want to miss this).

What are perpetual futures?

Before perpetual futures were invented, futures derivative contracts were used.

They are an agreement to buy or sell an asset at a fixed price and a fixed time in the future between two parties. If the expiry date of the futures is reached, the contract can either be cash settled where cash is traded and is more convenient or physically settled where the underlying asset is traded and it can be cumbersome.

Perpetual futures, also known as perpetual contracts or just perps, is a type of futures derivative contract that doesn't have an expiry date.

Here is a summary table between spot, futures contracts, and perpetuals.

Let's explore some of the important metric and strategies while using perps, starting with the funding rate.

Funding Rates

As a perp is also a derivative contract, where the value is derived from the underlying asset and not the contract itself, there needs to be a mechanism to ensure that the perp price stays close to the underlying asset.

Funding rates is a balancing tool that balances out the difference between the perpetual price and the spot price by incentivizing the non-dominant position in the market to receive the funding fee. For Demex, this occurs every hour.

Funding Rate Strategies

Funding rate helps to tell what the general trend of the asset is. If funding is positive, it means many traders are long or bullish on the asset, and if funding is negative, it means many traders are short or bearish on the asset.

For example, if the price is an uptrend and the funding rate is positive, when price stops making upward progress, traders may cover their long or sell / short it, resulting in price going down, potentially creating a long squeeze down. Likewise, if the price is a downtrend and the funding rate is negative, when price stops going down, traders may cover their short, or buy / long it, resulting in price going up, potentially creating a violent short squeeze up.

Therefore, funding rates can also help contrarian traders to look for opportunities to countertrend trade once the trend ends, leading to a squeeze, where overleveraged traders get liquidated causing market orders that lead to large price movements, resulting in a cascading liquidation.

Funding rates can also allow you to get paid while having exposure to your desired asset. For instance, let's say you are bullish on an asset. It just crashed a lot and you want to buy it, but you saw the funding rate is negative, instead of buying spot to gain exposure, you can long it to get exposure and get paid at the same time.

Alternatively, if you are holding a spot position and you are happy beacuse the asset has gone up a lot, but because many people are bullish on it, you decide not to be greedy and you want to take home your profits. But instead of selling it, if the funding rate is positive, you can choose to short it with the same notional value that you hold. This is known as a synthetic short, and you can get paid from the funding fee off other people's bullishness (read: greed and euphoria), while still locking in your profits. When the price finally crashes and funding fee turns negative, you can close your long and sell your asset, taking on an additional bonus depending on how long the positive funding fee lasted.

Volume

Another important metric to look at for perps is volume, which accounts for all contracts that have been traded in a given time period and can be used to tell the strength of a trend. A rising volume may indicate that the trend is strong while a falling volume may indicate that the trend is weakening.

Combining this together with funding rate is a powerful tool. If funding rate stays positive in an uptrend that looks like it is rolling over while volume is decreasing, it might be a sign to derisk, and vice versa.

Open interest

Lastly we have open interest, which is the total number of open contract positions held by the market at any given time. For Demex's perps, both long and short contract is worth $1 of the asset at any price. Unfortunately, open interest combines both longs and shorts into one number, but it can still be used to to determine bullish or bearish trends to a certain degree.

Open interest strategies

- If open interest increases while price is going up, it may mean that capital is flowing in to go long which is bullish.

- If open interest goes up but prices go down, it may mean that capital is coming in to go short which is bearish. However, once the shorts begin to cover as open interest goes back down, it turns bullish.

- If open interest goes down while price goes up, it means that long interest is decreasing or that shorts are leaving and covering, which means they need to buy back their position which creates a temporary price pump or a short squeeze up but the uptrend is often unsustainable.

- If open interest goes down while price goes down, it may mean that longs are getting liquidated and shorts are closing, which may mean that the current downtrend is soon to be over.

- High open interest at market tops is a bearish signal if price drops suddenly since this will liquidate many overleveraged and potentially cause cascading liquidations.

- High open interest at market bottoms is a bullish signal if price pumps suddenly since this will liquidate many overleveraged and potentially cause cascading liquidations.

- Generally the greater the rise in open interest during a price consolidation, the greater the magnitude of the move when price breaks out from the range. This is because many traders will be caught on the wrong side of the market when the breakout finally takes place and are forced to abandon their positions causing a bigger move.

Combining funding rate, volume, and open interest can tell you a lot about what direction and how big the next subsequent move can be and it can be used to differentiate average traders and seasoned traders.

Now that we understand some of the tools and metrics of perpetual swaps, let's explore why you should trade them, and why you should trade them on Demex.

Why trade perpetuals?

- No expiry date. This means that traders can hold their positions indefinitely and do not have to reopen positions unlike in futures contracts.

- Non-custody convenience. Traders do not need to create different wallets to store different tokens and can better focus on trading.

- Short the market. If you think prices are going to drop, you can short-sell (bet that prices go down) without borrowing and selling the underlying asset.

- Leverage and liquidity. Perpetuals allow you to leverage, increasing the efficiency of your capital but with liquidation risks. Thanks to leverage, the volume and liquidity is often a lot higher on perp pairs than spot pairs.

- Hedging your exposure. Because you can short, you can also short existing holdings to hedge, especially if you are providing liquidity on Demex.

Why Trade Perps on a DEX instead of a CEX?

This topic has been covered plentifully online so here's a link to a comparison table that summarizes it. We will instead focus on why you should trade perpetuals on Demex vs other platforms in our next section.

For a quick table of differences between trading, security, service, and fees, you can view the neat table that we created by visiting our homepage.

Why is Demex the Best Platform to Trade Perpetuals?

Now that we have explained the advantages of perps, let's explore the advantages of trading perps on Demex and why it's your one-stop shop for all your DeFi and trading needs.

Cheap, Fast, and Secure Multichain Ecosystem. Demex is hosted on the Carbon network, a cheap, fast, and secure L2 sidechain that has been around since 2020 and integrates with multiple networks from Ethereum, Binance Smart Chain (BSC), Cosmos, Neo, Zilliqa, and more in the future! This means no matter what chain you are on now, onboarding and trading on Demex will be seamless, affordable, and pleasant! Now let's explore the various unique features.

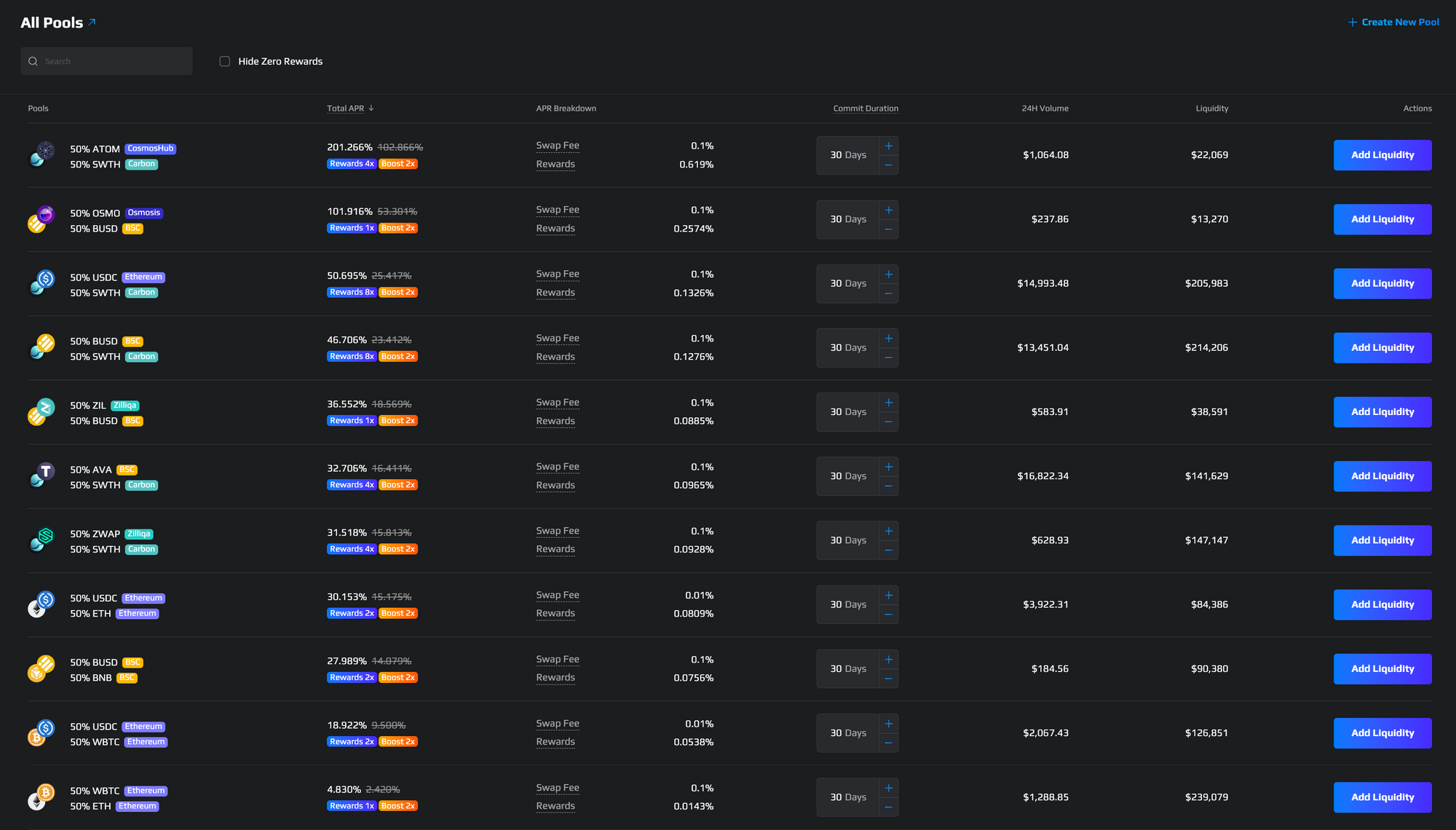

Liquidity Provision. Are you a DeFi farmer? Demex is the only perpetual protocol that has liquidity pools in crypto at the moment. This means you can yield farm with your idle assets in these juicy pools to generate over 100% APR (not constant) in the form of $SWTH liquidity incentive rewards.

Permissionless Market Making and Listings. Demex's proprietary engine takes the liquidity provided in pools and spreads it across its orderbook. This means that anyone can be a market maker and also trade in that market. This is unlike many perpetual platforms that rely on exclusive third-party market makers where they take all the fees. Additionally in the spirit of DeFi, anyone can create a market with just a little $SWTH to list their own pairs and perpetual swaps.

Supercapital Efficiency. In the future multi-asset collateral and cross-margin will be enabled, allowing any IBC asset (not just stablecoins), as well as your provided liquidity (LP) position to be used as margin. This means you can hedge your LP without any additional capital. For instance, if you provide ATOM/USDC liquidity, you can use that as margin to short ATOM and hedge that position without topping up any additional capital. DeFi and trading can be done all on a single platform. Efficiency like never seen before.

Up to 50x Leverage. Demex will start off by offering up to 50x leverage, the highest leverage in the Cosmos ecosystem. This allows for even higher capital efficiency, a powerful tool for traders as well as hedgers.

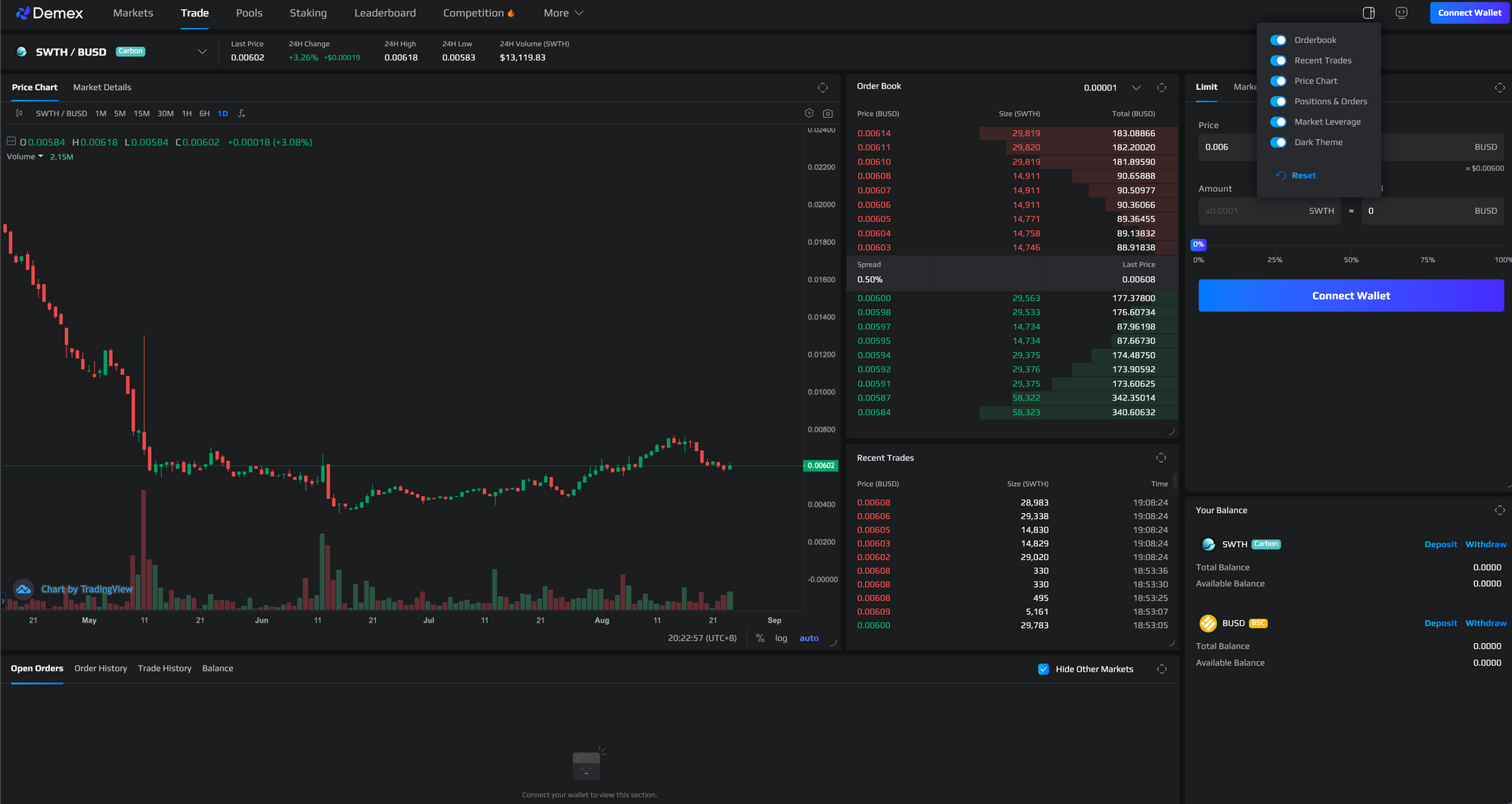

Sleek and Fully Customizable UI. Demex is not only powerful but friendly to use. Every UI panel that you see can be adjusted in size and drag anywhere you want, so you can start trading with the layout you are comfortable and familiar with, no matter which other trading platform you come from.

Futures Contracts. Demex is the only trading platform in DeFi that offers dated futures. This allows you to do the popular cash and carry arb-trade commonly done in CEXes, where you buy a spot position, and short a futures contract in contango, earning risk-free profit as there is no funding rate for futures.

On-chain Referral Module. Users can generate referral links tied to their addresses on Demex, gaining referral rewards when new traders join and trade using their link. This module can also be used by other dApps or UIs built on the Carbon network, and a portion of the referral rewards can also be directed to a common shared pool owned by a DAO, so come build your app on Carbon!

Flexible Network Fees. Say good bye to gas problems. On Demex, you can select any L1 token or even USDC as your network fee, so when you bridge funds over you can start trading immediately without asking your friends for gas. This together with multi-asset collateral makes trading on Demex even more seamless than trading on a CEX.

Money Market, CDPs and stablecoins. Demex will be launching a decentralized money market feature that is similar to AAVE, allowing users to lend or borrow crypto from various chains permissionlessly. Additionally, Demex will be launching $USC (USD Carbon), its own overcollateralized and decentralized stablecoin similar to MakerDAO's DAI. This means you can deposit your favourite assets from multiple chains, earn yield on them, borrow or mint $USC against them, borrow assets to short-sell them, or whatever strategy you can think of.

Permissionless and Decentralized Liquidations. With leverage, money market and CDPs comes liquidations, and this too will be fair and public. Demex will be launching a liquidation platform with an easy-to-use interface with no coding required. Anyone can put up a bid with varying levels of discounts on distressed assets to liquidate them, allowing you to hunt whales together with friends instead of liquidations always being monopolized by bots.

Decentralized Options. The holy grail of derivatives is options where if properly used, options can offer unique opportunities to market participants. Options together with perps allow for many creative and hedging strategies. We will be working hard to integrate this onto our platform in a future update but for now this is Coming Soon™.

Conclusion

Combining our Orderbook + Liquidity Pool/Automated Market Makers (CLOB+LP/AMM) + Money Market system, and eventually Options as well, Carbon is primed to be the most advanced trading protocol in existence.

Are you hyped up after reading this and you are looking to buy some $SWTH while our market cap is just slightly over 10 million still?

Definitely not financial advice but you can head to Demex or click here to buy.