With the upcoming launch of our Carbon money market, the features will help the entire Cosmos ecosystem be even more vibrant.

From earning income on idle assets, stablecoin swaps, isolated pools, spot leverage, and more, let's walk through some of its features and possibilities.

What is the Carbon money market?

Carbon money market is a lending and borrowing protocol where users can deposit and borrow assets on-chain, in a decentralized and non-custodial way.

Depositors who deposit their assets are providing and supplying liquidity to the protocol and can earn an income if their assets are being borrowed.

Borrowers are able to borrow the assets that depositors provided but in an overcollateralized way and instantly.

How can Carbon help Cosmos shine brighter?

All modern financial ecosystems have a money market, and it should be no different for the web3 ecosystem.

Money markets allow for savers to lend their idle assets for income to those who need them for short-term or long-term loans.

These loans can be made by arbitragers looking to improve market efficiency, market makers or defi farmers who need to borrow liquidity, fund managers who need to hedge their portfolios, traders looking to leverage up on their positions, or everyday folks looking to borrow against their assets instead of selling them so that they can spend on their day-to-day activities.

Currently, the vibrant and rapidly growing Cosmos ecosystem does not have an established money market yet. This lack of a money market has created inconveniences for users ranging from:

- Unable to hedge their Cosmos assets exposure

- Unable to earn additional income on idle assets

- Unable to leverage against their idle assets

- Unable to easily take advantage of arbitrage opportunities

- And more...

All of these challenges can be solved with a money market, but Carbon's money market will give you even more benefits than just a traditional money market!

Let's explore this further.

Why should I use Carbon's money market?

Carbon's money market is heavily inspired by AAVE's design, but thanks to the modularity of Cosmos SDK, we have full control over the Carbon protocol blockchain design, and have tailored it further to suit the needs of our users.

Let's go through some of the benefits.

Financial blockchain - designed for financial products:

We have created a blockchain that is purpose-built for trading and financial products, with ultra-highspeed transactions and ultra-low transaction fees.

How fast? Carbon can process up to 10,000 transactions per second.

But let's go deeper. Many blockchains talk about large TPS numbers, but finality is important too. Finality is the time it takes a blockchain to confirm a transaction with other nodes on the network, and how reliably those transactions cannot be changed after their completion, which also helps to prevent soft forks and outages from happening.

So how fast is Carbon's finality? 2.1 seconds. Not the fastest, but it is faster than Solana's 2.3 seconds finality and should be fast enough for now, but we can make it go even faster with a future upgrade.

How about the network fees? Less than a cent, literally negligible, and we even have a pleasant quality-of-life feature in the next section.

With all these features, Carbon network offers one of the best user experience and is ideal for all your DeFi and trading activities, from spot trading, borrowing and lending, derivatives, and even options.

No gas no problem - flexible network fees:

You've probably experienced this - you bridge your assets over to a new chain and be like 'dang it i don't have gas, i need to dm my friends'.

But what if you don't have friends? One big hassle when using different chains is the need to get the gas token, and sometimes there isn't a faucet or it isn't working. Well, Carbon network has got you covered! Also, if you don't have friends, you should totally join the Carbon telegram here.

At Carbon we're developers but also regular DeFi users and know how annoying gas can be, that's why we have made it easy for everyone to bridge their assets to our money market without needing $SWTH our native token as gas.

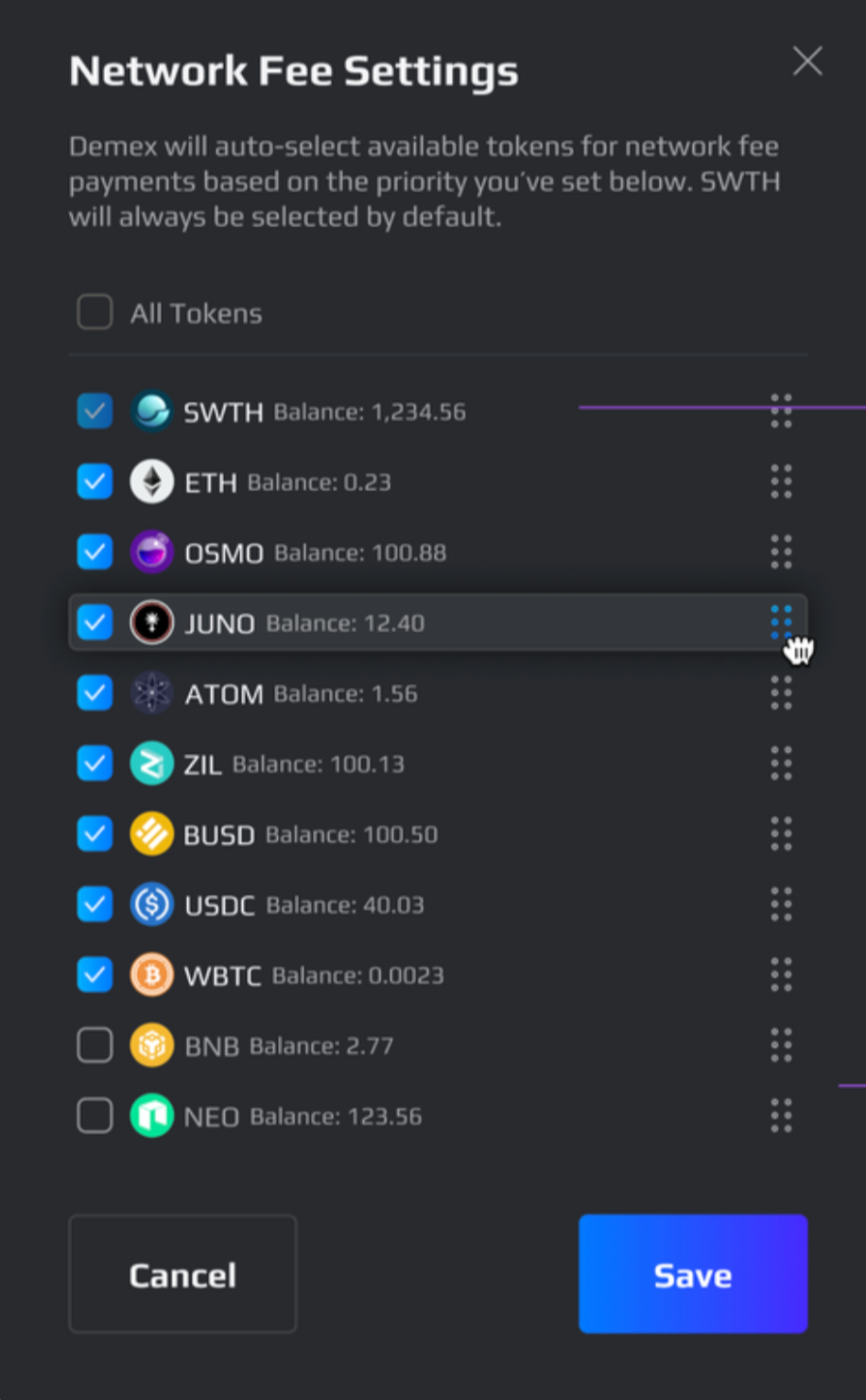

With flexible network fees, you can select from a wide range of assets as your network fee.

If your asset is not listed, just get some $SWTH and do a proposal to vote to get your asset whitelisted to be used as network fees!

This means that Demex can have one of the BEST onboarding user experiences for everyone! No KYC, and start your financial and investing journey with us with ANY asset, not just our native token or stablecoin.

We take risks seriously - mitigate risks with isolated pools:

Cosmos is always brimming with life, and new tokens appear very frequently.

We want these tokens to be in our money market as well, but to avoid risk of introducing riskier assets to our money market which can result in systemic risk and bad debt, we will also have isolated money market pools.

These are pools that are separate from our core pools that have large TVL and a lot of money at stake, basically isolating the risk to smaller, more niche pools. Having isolated money market pools will drastically reduce systemic risk and bad debts.

More info on isolated pools can be found in our docs in the near future.

Everyone loves incentives - multiple community rewards:

Carbon money market can have liquidity mining rewards enabled through a community proposal, this means on top of earning income from lending out your asset, you can also earn $SWTH as well, as long as our incentives are active!

But more than that, Carbon aims to be the default money market for all chains on Cosmos. We do this by easily allowing other protocols to offer liquidity mining rewards in our money market so that they can incentivize their community to borrow and lend!

Not only that, we can also allow for multiple rewards per pool, which means that various protocols can partner with each other (with us too!) and incentivize multiple communities together.

For instance, Atom and Osmosis can partner and offer $ATOM and $OSMO rewards for borrowing and lending $ATOM or $OSMO on our money market, creating more opportunities for partnerships!

New chains, protocols, and tokens can also bootstrap liquidity with our money market by incentivizing people to provide liquidity by borrowing their tokens.

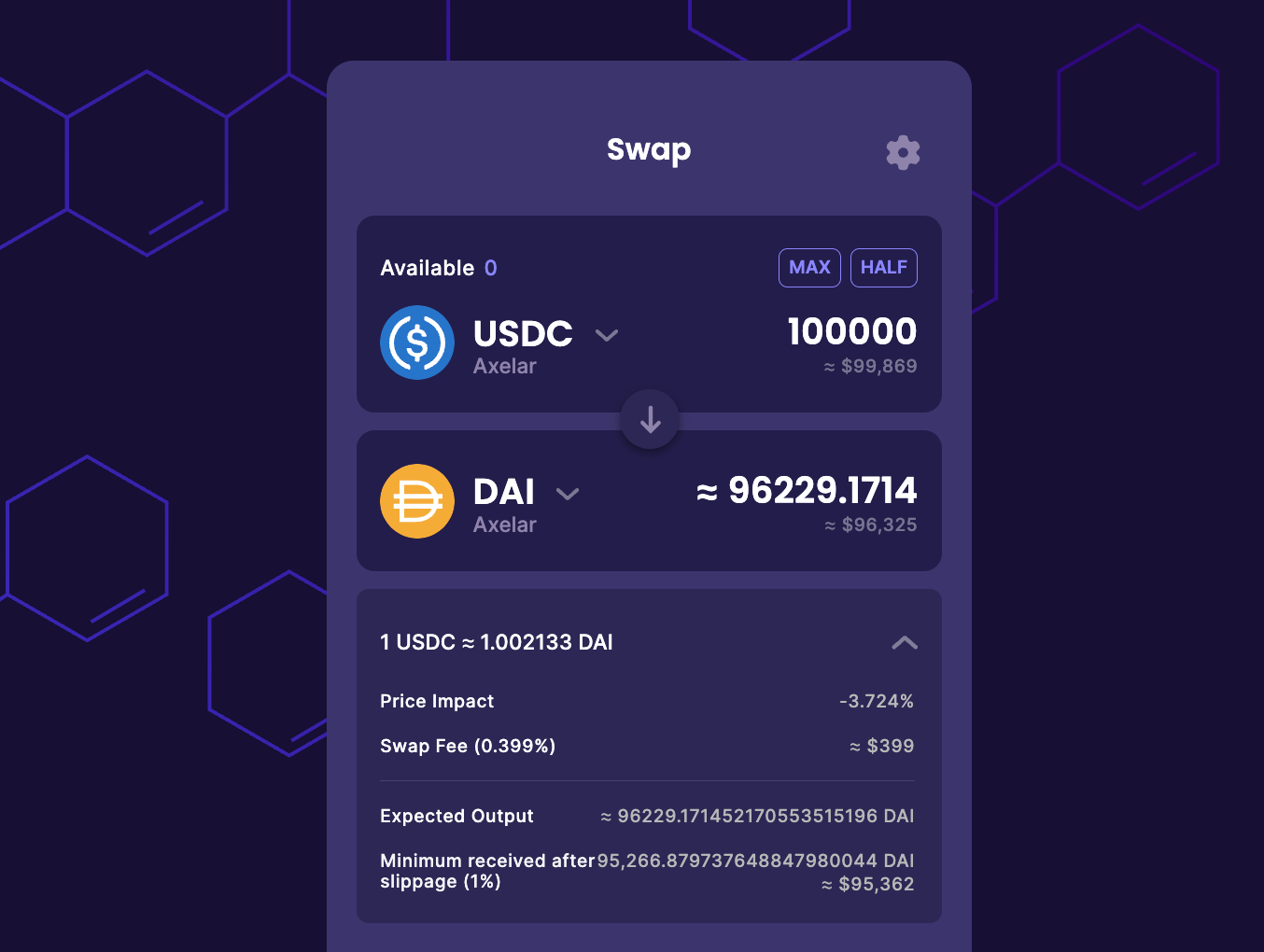

Yield-bearing stablecoins - increase your income:

What if your assets and stablecoins could be earning yield passively?

Yield-bearing stablecoins are stablecoins deposited in a money market and generate yield as borrowers pay interest for borrowing them.

For instance, you can deposit Carbon stablecoin onto our money market to lend to users who want to pay you to borrow Carbon stablecoin. Thus your Carbon stablecoin is earning yield.

But it doesn't end there. You will receive a receipt token for your deposited Carbon stablecoin, and that receipt token can also be used to trade on our exchange.

This is not limited to only Carbon stablecoin, all of the upcoming cosmos stablecoins can have their own money market pools as well!

*UST PTSD Alert* This might sound similar to Anchor protocol where you deposit UST and earn a yield of up to 20%, but the difference is our model is totally sustainable albeit we can't guarantee a fixed yield of 20% as it is completely determined by organic market demand and also it will not depeg from $1 as it is OVERCOLLATERALIZED!

Wow many stables but much slippage - use our stableswap:

With the fall of $UST, there is now a big gap for a cosmos native stablecoin, but in just a few months, many of them are now appearing.

However, their use is very limited at the moment as there is no cheap way to swap large quantities of stablecoins without incurring high slippage.

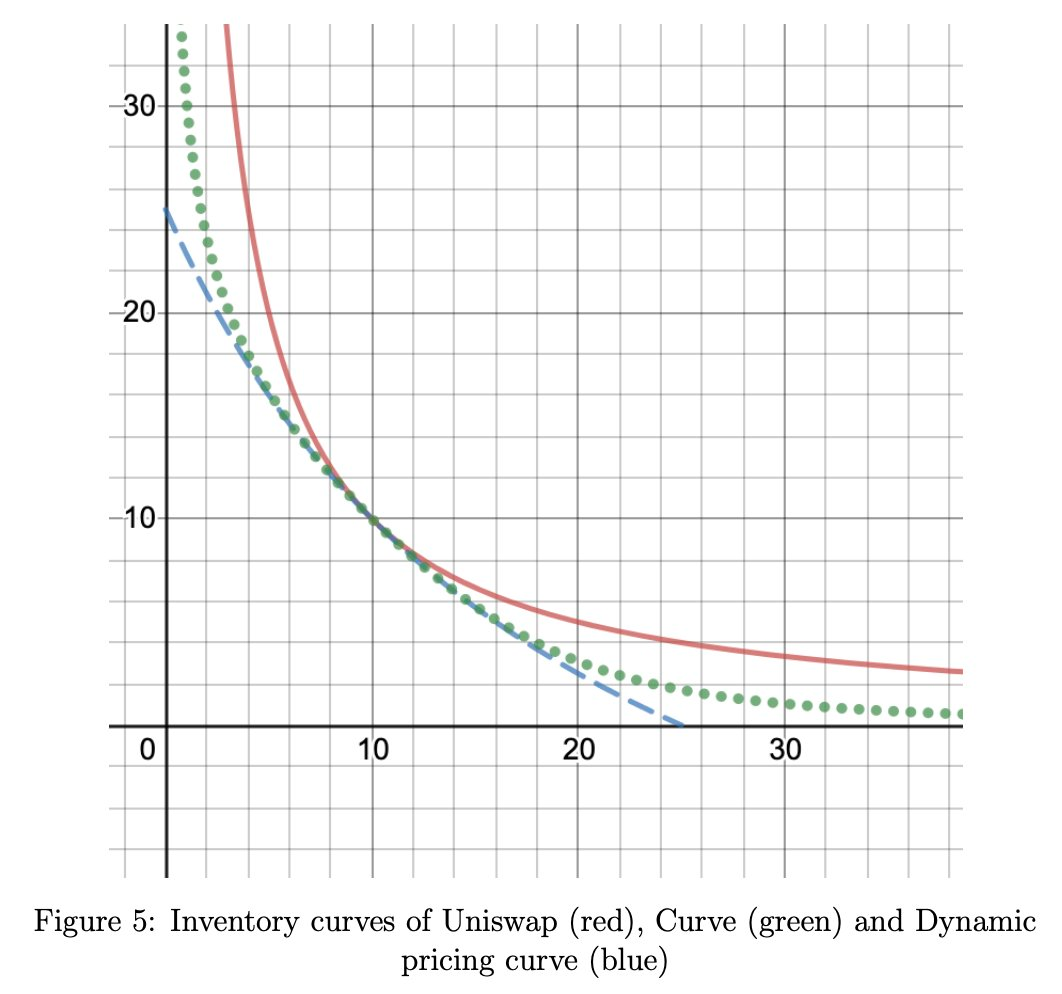

That is why we are introducing stableswap as well, a capital-efficient way to swap stablecoins without incurring much slippage. This is a similar idea to curve but not entirely the same under the hood as we will use a dynamic pricing curve.

Here's a visual representation (ours would be blue). Meaning it has even better capital efficiency than Curve but there's a max limit to the pool.

This stableswap feature combined with our money market feature means you can create yield-bearing stablecoin pools that earn triple yield from LP fees + interest fees + incentive fees.

In addition to this already awesome feature, this yield-bearing stablecoin LP pool can be represented as a token as well, which you can also trade with!

As if that's not amazing enough, to top it off, this LP can count towards your portfolio collateral margin once our multi-asset collateral feature goes live, giving you even more advantage trading on Demex!

More info on stableswaps can be found in our docs in the near future.

Free liquidations for everyone - buy assets at a discount

When you borrow on Carbon, it is done in an overcollateralized way.

This means to borrow $100, borrowers need to deposit more than $100. Because crypto is anonymous, this is done so that depositors will not have to worry about the borrower running away. But what happens when the deposited collateral falls below the borrowed amount? Liquidations occur.

Traditionally, liquidations on money markets like AAVE are monopolized by bots who can act at lightning-fast speeds.

But in the spirit of DeFi, we feel that this isn't fair. Therefore, we are launching a front-end user interface so that everyone can easily participate in liquidations and buy liquidated assets at a discount using our Carbon stablecoin, or the yield-bearing version of our Carbon stablecoin!

If you've been liquidated before, you can now enjoy liquidating others.

But we're not stopping here, we believe that this should be done for FREE. That's right, there will be NO FEES when you successfully liquidate assets on Carbon! And to go one step further, we can also have a toggle for automatic selling on those liquidated assets that you bought at a discount, allowing you to enjoy liquidating others and profit without any risk or stress!

P.S. Would be funny if you ended up liquidating your own loans if you aren't paying attention to your own health factor!

The Bottom Line and More to Come

As you can see, money markets help unlock a wide array of opportunities and will help create a much more vibrant ecosystem for Cosmos.

Traditionally, money markets are considered among the safest ways to invest one's money and we are bringing this safe investment vehicle to Cosmos users. But because we are on DeFi, we are also bringing all the advantages of DeFi, as mentioned above, and we are really going all out on leveraging all its advantages!

And that's not all, there are many possibilities with money markets we are working hard to build more features, such as capital-efficient borrowing and lending for stablecoin pairs, leveraged yield farming, risk-hedged yield farming, self-repaying loans, borrowing against LP pairs, and more, to give you a one-stop shop for everything DeFi.

This is why Carbon and Demex will provide the best user experience for traders, far better than a CEX (and a sex too maybe)!

The Actual Even More Bottomest Line

Okay guys, real talk, we're all here to make some money speculating on crypto, so let's talk about the token price and upside potential as well, it's all about expected value (EV) and risk-reward right?

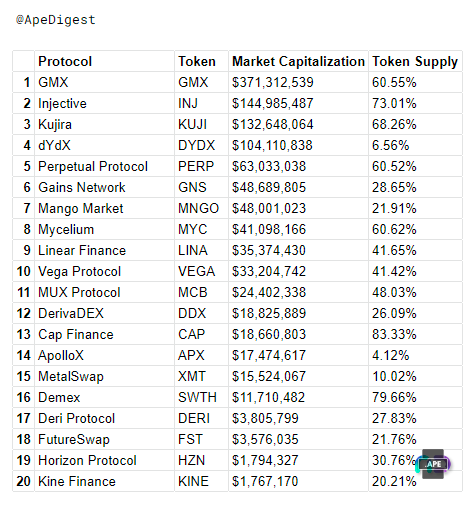

Here's a list of derivative dex.

Demex has one of the lowest market cap at $11m, with one of the highest token supply at 80% (our token inflation is basically negligible already).

Look at dYdX and their 6.56% token supply with $100m market cap, $SWTH market cap is about 10x lower, and 100x lower than their FDV (no hate, i loved the airdrop but @degenspartan has a point).

On top of that, all of the features and use cases I've mentioned will help to skyrocket our transactions, volume, and network activity.

This basically increases the #realyield generated to $SWTH stakers. Our #realyield is the real deal because as I mentioned earlier, our token supply is basically negligible, which means NO INFLATIONARY SELLING PRESSURE, only real #realyield.

And on top of that, for all our degen friends out there, our price has an amazing unit bias with many zeroes as well. If #SWTHTO1DOLLAR hashtag catches on, that's MORE THAN A 100X from here. If enough people request, we can even create a wrapper to add even more zeroes just so we can have as many zeroes as $LUNC or even $SHIB just like what $YFI did with $WOOFY.

So we have the vision, the development team, a low market cap, great features, meme price, and a low market cap (did I say this already), if all of these sound like a decent asymmetric bet, you can head on over to our demex website here to buy some, or go to Osmosis here to buy, or at Uniswap on Ethereum as well.

Editor's note: This article was written at 3am and I get high when I lack sleep. Talking about price is taboo, so to clarify this article is meant to be educational, please do your due diligence. If this article trends on Twitter, I've no idea if it's good or bad for me, but Carbon $SWTH needs as much publicity as possible so if you enjoyed this article, do me a huge favour and go retweet it!

Stay tuned for more as we cover another article on $SWTH's valuation potential. Sneak peak below. See you guys again soon.