Carbon network's goal is always about helping ordinary crypto users gain back financial control from trusted and centralized institutions, to create a world where trust is optional.

Carbon has achieved this so far by creating a suite of non-custodial financial dApps that empower users. From easy-to-use orderbook liquidity pools for users to earn trading fees like a market maker, to decentralized spot, perps and dated futures for users to trade and invest safely with funds in their own hands.

Today, we are adding yet another amazing dApp to our financial suite of DeFi dApps that will further enrich the DeFi experience for our users.

Say hello to Nitron - a Cosmos money market built on Carbon. Read our guide on Nitron if you are new.

But in short, it is a non-custodial lending and borrowing platform where anyone can earn additional yield on their idle assets by lending it out in a fully on-chain transparent and overcollateralized manner.

But that's not all. On Nitron, users will acquire a power that only centralized exchanges and bots have - participating in liquidations.

What are liquidations?

Before liquidations occur, a user must first deposit assets into the money market and pledge it as collateral in order to take out a loan against it.

This is to secure the loan so that in the event that the borrower defaults, the collateral can be seized as a failsafe to repay the loan value.

Liquidations occur when the value of a borrower's collateral drops a certain percent below the loan value, also known as the liquidation threshold, the loan position becomes undercollateralised.

For example, a liquidation threshold of 80% means that if the loan value rises above 80% of the collateral, the position is undercollateralised and is open to being liquidated.

When this happens, liquidators are allowed to step in to pay back the borrower's loan while receiving a portion of the borrower's collateral until their loan is above the liquidation threshold again.

What is Nitron Liquidations?

Nitron Liquidations is a Cosmos liquidation platform and marketplace where users can liquidate loans that are undercollateralized and earn a bonus on it.

Nitron provides users the option to add or remove collateral at anytime to stabilize their position. This can affect the user's health factor, hence users need to be careful while adjusting their collateral.

Health factor refers to the numerical scale of the safety of a user's collateral against their borrowings. The health factor aggregates the user's position across all assets to assess the point at which the user is subject to liquidation.

Liquidating Undercollateralized Loans

Whenever the health factor drops below 1.0, a user's loan becomes undercollateralized and anyone can liquidate the loan by repaying the debt and taking the borrower’s collateral at a discounted rate.

This discounted rate is also referred to as liquidation bonus, which is the discount that liquidators receive when bidding on collateral.

Liquidation Example

A liquidator bids on $100 of collateral backing an undercollateralized loan. If the bonus is 10%, the liquidator uses $90 to pay down the undercollateralized loans and receives $100 of collateral. The liquidator can immediately sell the $100 of collateral received on the open market and pocket $10 risk-free if market prices remains the same. A liquidator can keep repeating this until the undercollateralized loan is fully paid off.

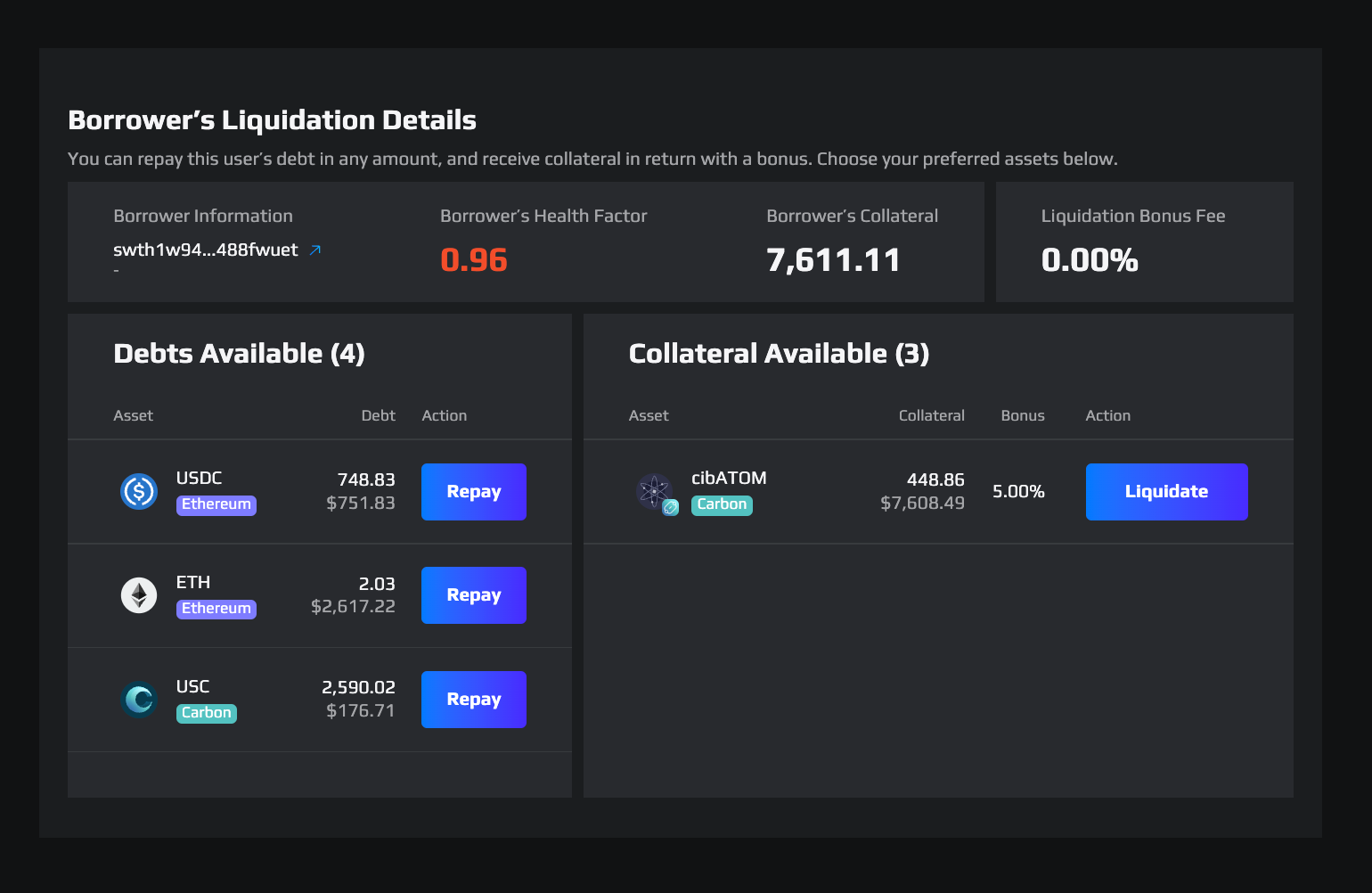

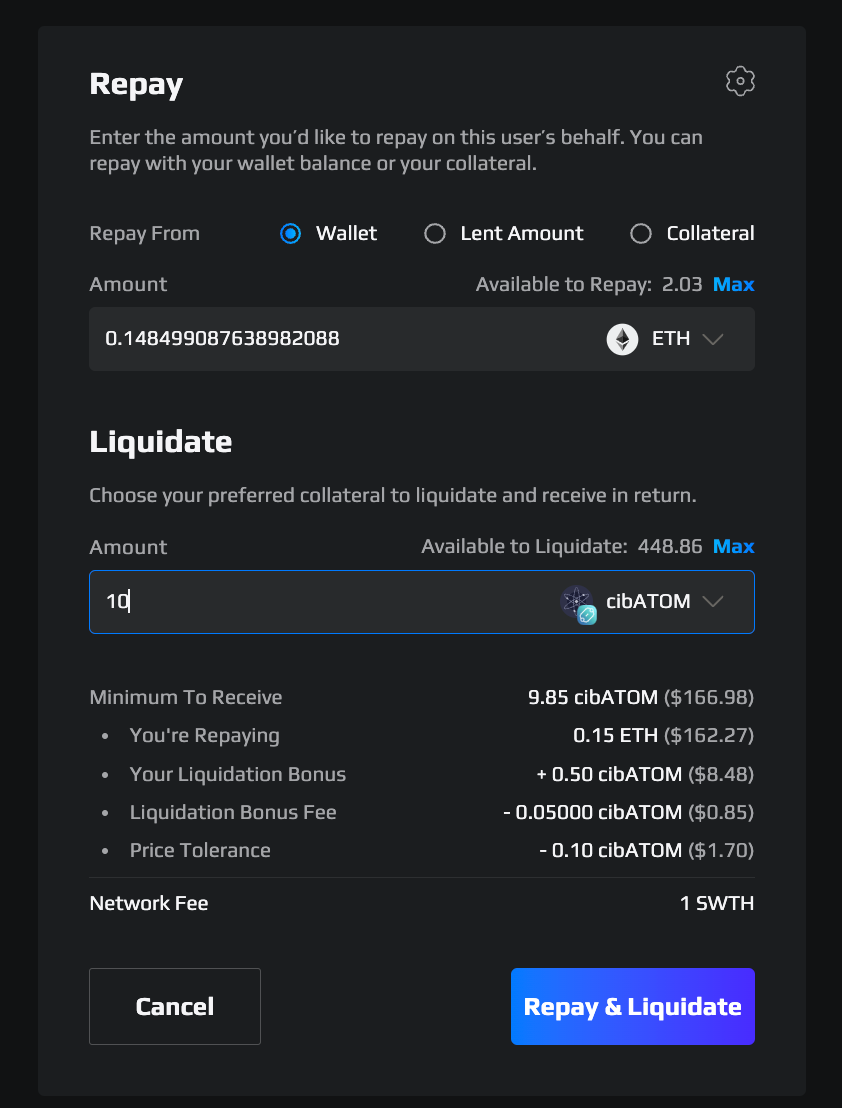

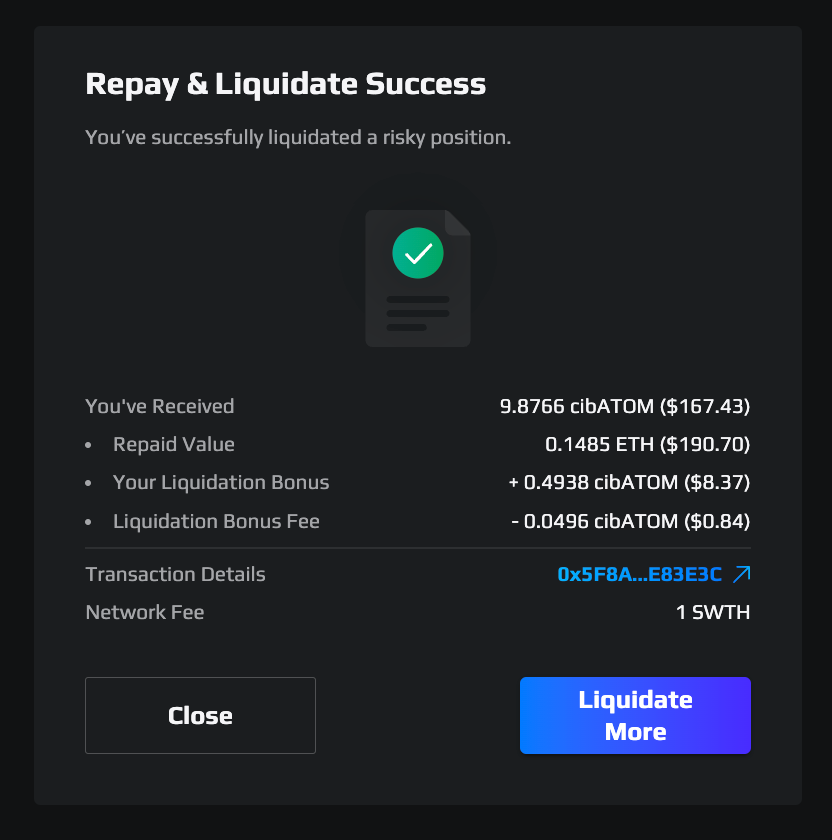

The user can select the debt they want to repay as long as they have sufficient amount in their wallet, and which collateral they want to receive in exchange for repaying the debt.

Using Nitron's Liquidation Interface

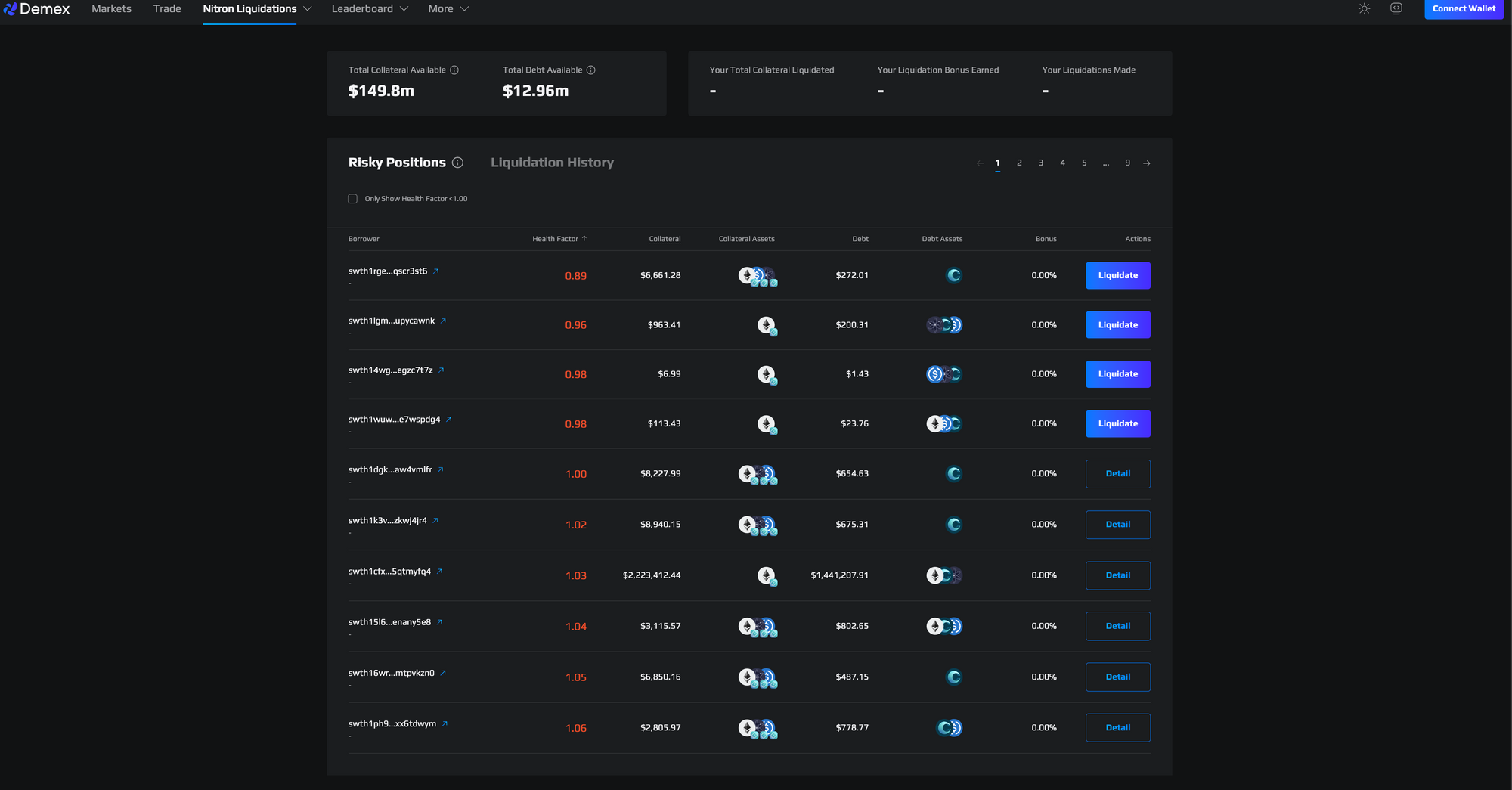

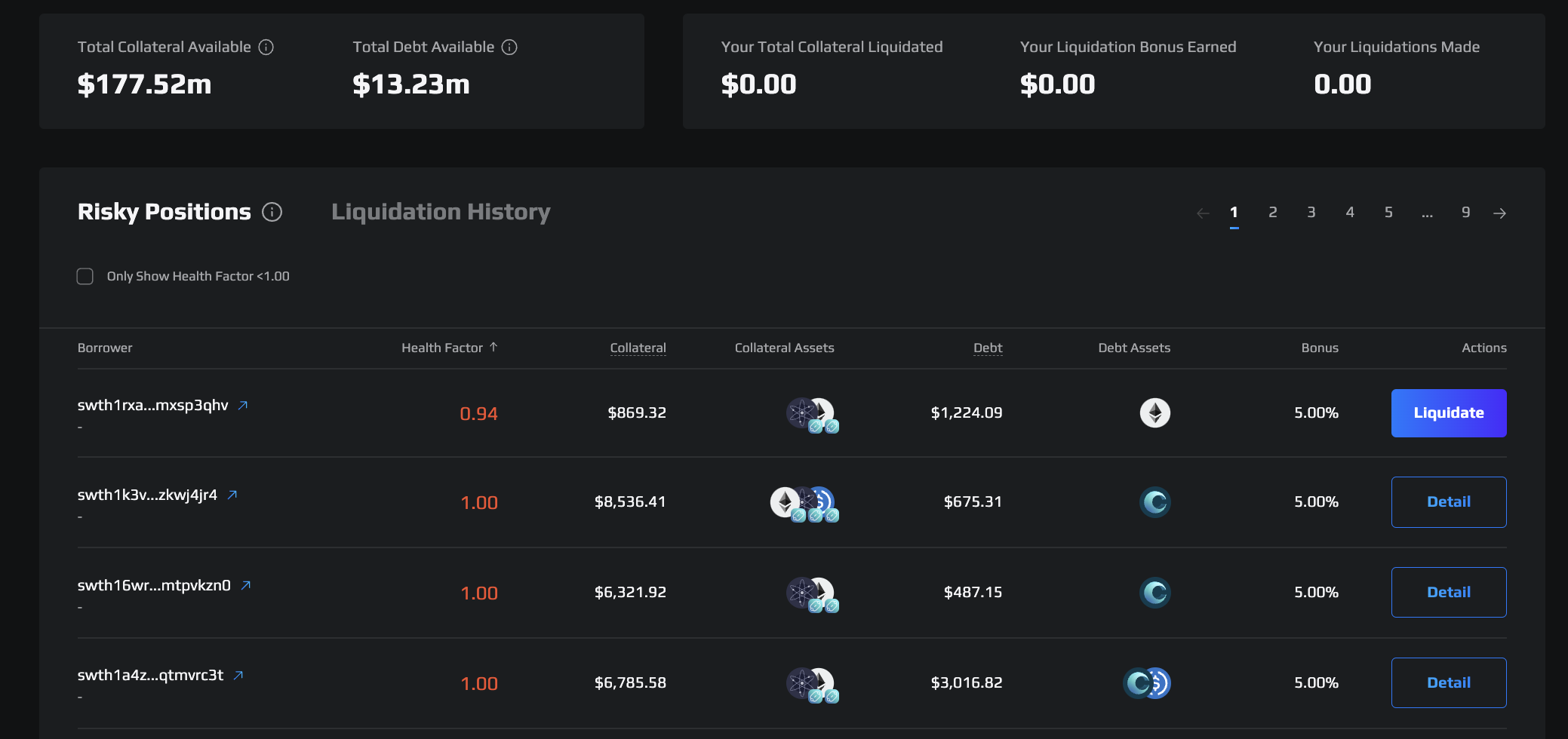

Nitron is currently live on testnet and the below values are not accurate due to testnet price fluctuations.

1. Go to app.dem.exchange/liquidations and connect your wallet (Keplr or Metamask and more in the future).

2. Choose the undercollateralized loan you want to liquidate represented by health factors of below 1.0, health factors that are near 1.0 will also show up for users to prepare to liquidate.

3. Select the debt you want to repay or the collateral you want to liquidate and receive.

4. For example, if you select ETH to repay, you will be asked to repay from your wallet or other places, and you will receive the same value you are repaying in the collateral you are receiving, with an additional liquidation bonus.

5. Once you click 'Repay & Liquidate" you will receive the asset in the deposited form. If you wish to sell it, you will need to withdraw the collateral from Nitron money market first then sell it.

Nitron Liquidation Roadmap

Set and forget liquidations

Currently users are not able to select their preferred discount/bonus levels. In the future, Demex will introduce a "Set and forget" feature inspired by the concept of stability reserves and will also allow users to set those bonus levels.

With this, users can make bids on their preferred collaterals (multiple collaterals can be selected) at their preferred bonus from 1% to 30% and wait for undercollateralized loans to occur and Nitron will queue their bid perform the liquidation on behalf of users when their preferred collateral becomes undercollateralized.

For example, liquidators that deposited ETH and selected ATOM as one of their preferred collateral, will be queued up and be the first to use their ETH to repay the loan and take the user's collateral, which in this case is ATOM.

This may also be done with USC, the Carbon stablecoin. Users would deposit USC and select which collateral they want to receive and which undercollateralized loans they want to liquidate. If the user selects a loan option that is not USC, the protocol would swap their USC on a DEX into the undercollateralized loan asset to repay it, and then receive their preferred collateral.

With this feature, liquidations will be done from the lowest to highest bonus, evenly between everyone bidding at the same bonus rate.

At the moment, there will be no additional fees intended for this feature, but this parameter can be changed through a governance vote.

In summary:

- Bots cannot front-run users in liquidation queues

- Anyone can earn a bonus in liquidations, even without a large capital

- More capital participation helps avoid cascading liquidations

- Borrowers can get liquidated at better rates due to game theory

Overall, this results in a win for the ecosystem, for regular users, and for borrowers.

Auto convert

This feature will allow users to directly market sell the collateral that they liquidated into their preferred asset, such as the Carbon stablecoin.

This would enable users to lock in their liquidation bonus as profit.

There can also be a toggle to deposit back into the stability reserves, creating a source of constant passive income for users.

Integration with more networks and collaterals

In the near future, the team intends to add new collateral markets to Nitron, especially liquid staked derivatives and even LP positions or other value-accruing tokens.

This will open up more collateral types that users can liquidate and acquire at a discount.

Conclusion

Nitron is crucial in helping the Cosmos ecosystem become more capital efficient, especially with the up and coming liquid staking derivatives which will generate additional staking APR for users.

However, capital efficiency creates leverage on the ecosystem which must be cared for. Nitron's public liquidation platform will assist deleveraging events, to ensure that Cosmos remains healthy and decentralized.

Once more collateral are introduced to Nitron, and Carbon opens up more chains to Arbitrum, Polygon and more, the possibilities are endless.

Summary:

- Carbon is a Layer 1 protocol with a suite of financial dApps to empower investors affordable and easy-to-use DeFi investment tools

- Nitron is a Cosmos money market to improve capital efficiency and its liquidation platform allow users to acquire distressed assets cheaper