Crypto and equity markets have rallied significantly off the lows in June, and calls for a new bull market are rising. However, many market participants still believe that this is simply a bear market rally. If that is you, here are some strategies to short this market.

Note that this article is purely for educational purposes and is not financial advice nor is it representative of Switcheo's view of the market.

Before jumping into shorts, let's explore what a bull market means for crypto and the current state of the market.

What is a bull market?

To keep it simple, a crypto bull market can be signalled with 3 basic indicators:

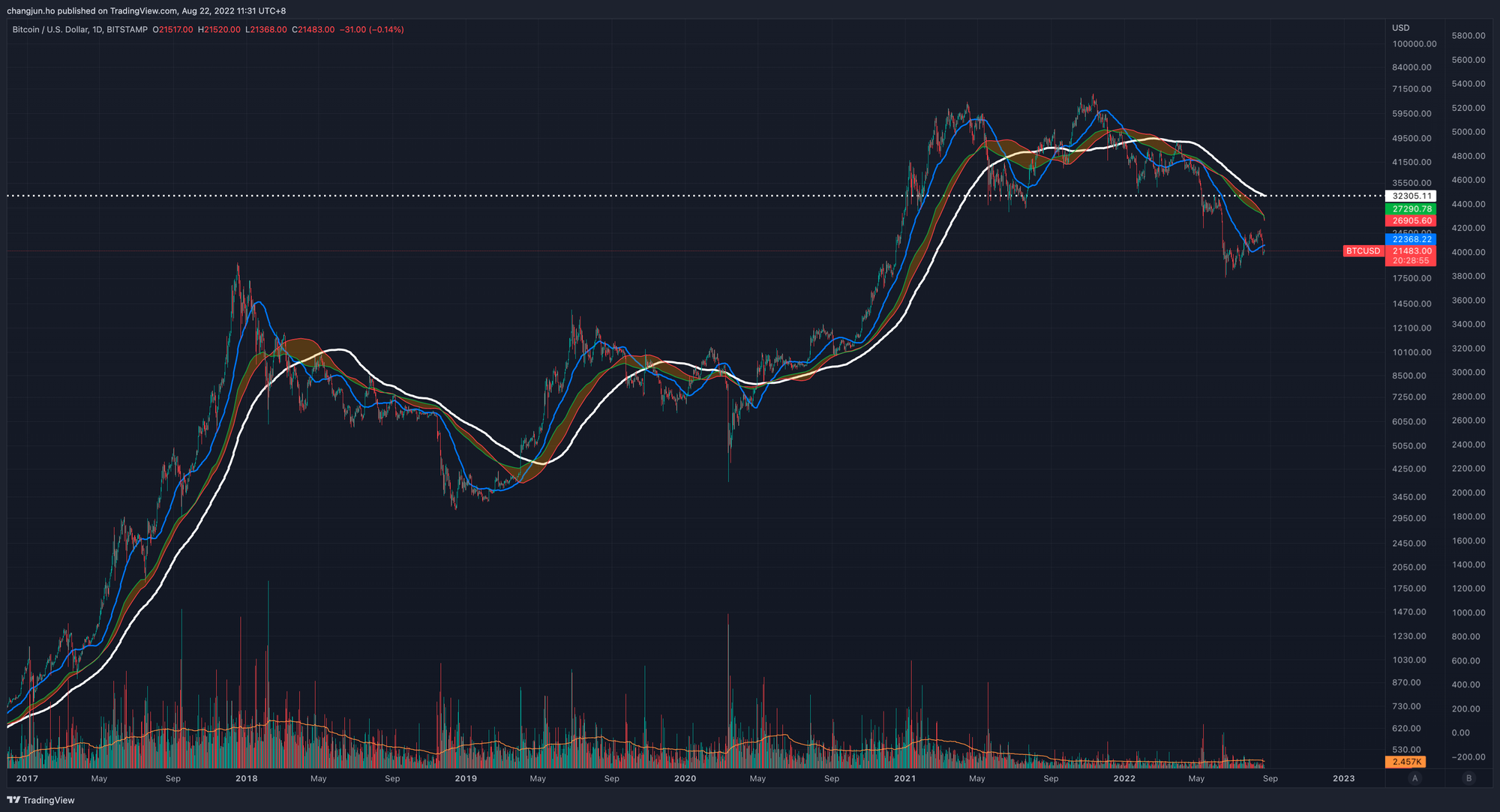

- The market is above its 20 weekly moving average (the yellow band wrapped by red and green lines is currently around $27k)

- The market is above its 200-day moving average (the white line is currently around $32k)

- The 50-day moving average (represented by the blue line) is above the 200-day moving average and both of them are clearly pointing up

Note that these are lagging indicators, but if these conditions are met, it is likely that crypto remains in a bullish trend, and if they are not met, it is likely that crypto remains non-bullish (it can just go sideways too).

As you can see from the chart below, the bull market ended last year and now all conditions are not met, hence the chart is non-bullish. This coupled with the recent Fed actions that we will talk about next makes the crypto environment a bearish one, which is great for shorting.

Note that shorting is not for everyone, bear markets are a great time to simply DCA and accumulate as well.

Don't fight the Fed

'Don't fight the Fed' was a common saying during the March 2020 crash.

A quick recap, the Fed digitally printed money to increase the liquidity in the credit market while reducing interest rates to near zero, creating a strong tailwind for risk assets to go up non-stop. This caused a market wide frenzy and basically, every asset that you bought went up. Everyone was a genius.

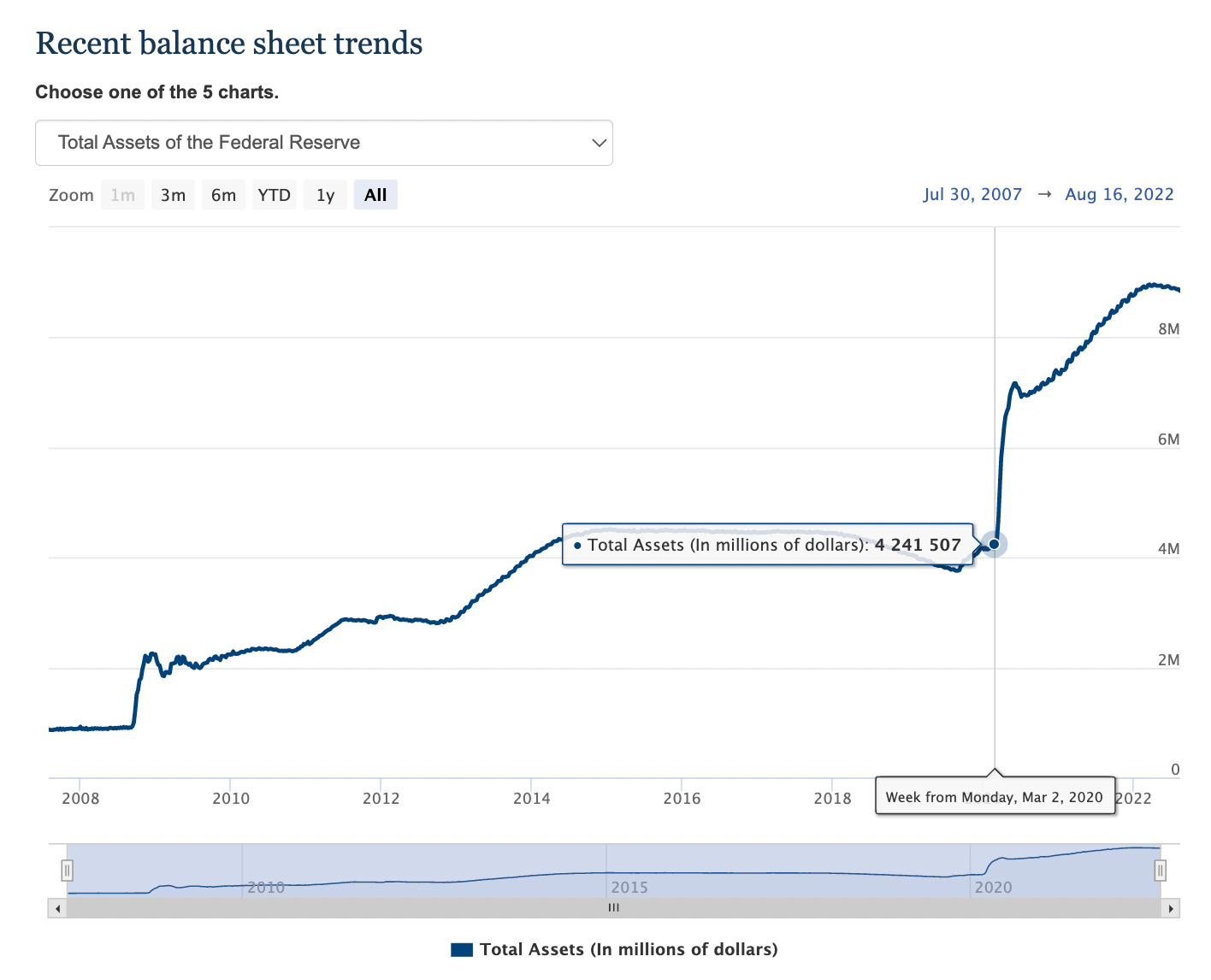

However, on the 1st of June in 2022, the Fed officially started its Quantitative Tightening (QT) measures to suck back liquidity while increasing interest rates. This is to combat the high inflation that is around 6-9% YoY at the moment.

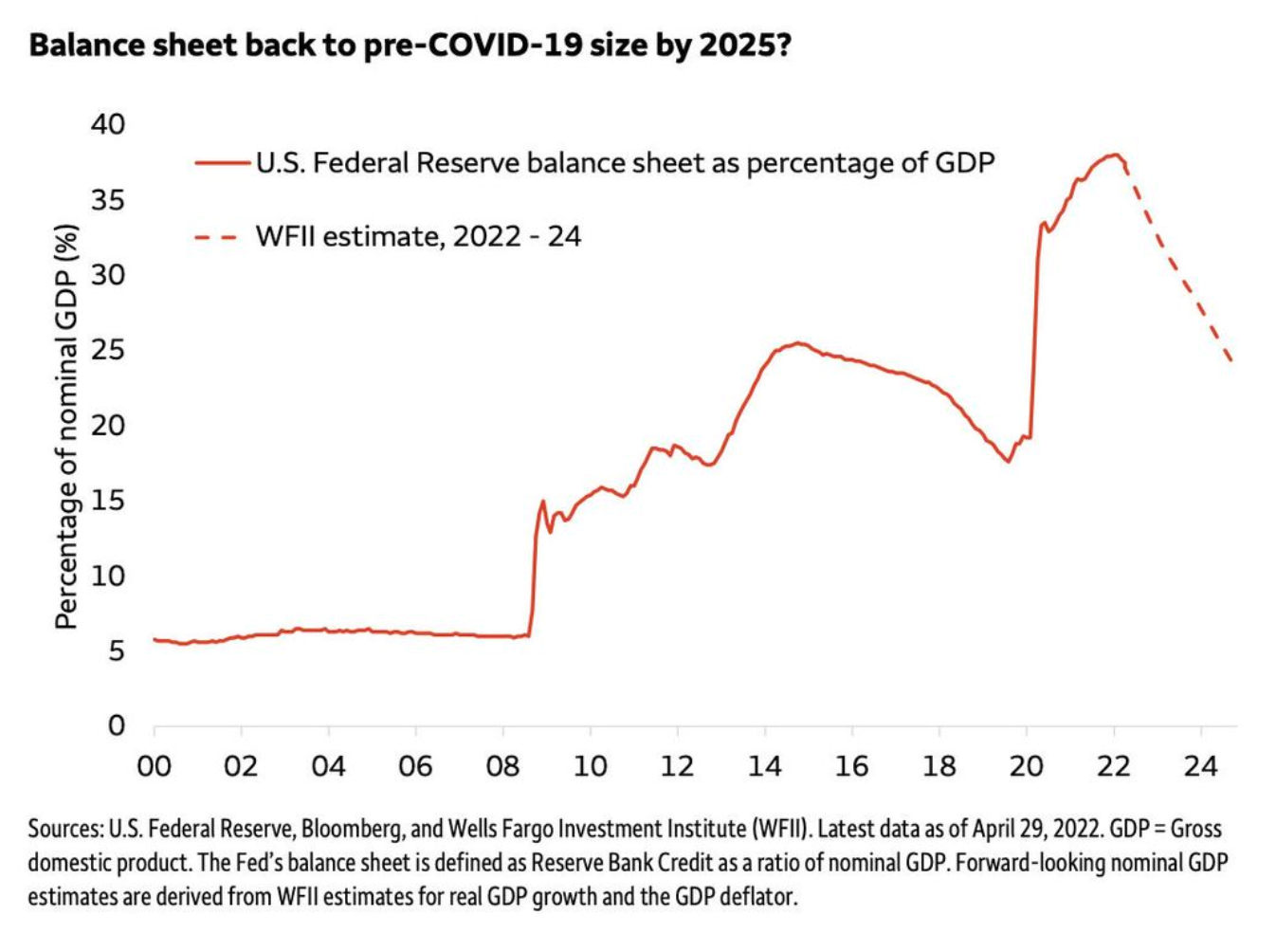

This means the FED will reduce its balance sheet of around $9 trillion by $47.5 billion per month for 3 months (from June to August), and further ramp up reductions to $95 billion/month from 1 September 2022 onwards. They are expected to remove roughly $1 trillion a year, or at least until another crisis happens where they may change their stance again.

If don't fight the Fed was true back in 2020, it is also true now as risk assets have dropped significantly and are expected to continue to be bearish rather than bullish if the Fed decreases its balance sheet according to plan.

As a result of the Fed's actions, the dollar, often seen as an inverse indicator for risk assets, has also been on a parabolic rising trend, which in theory should cause most risk assets to drop. So how are risk assets performing right now?

How is the current market performing?

Bitcoin

If we analyzed how bitcoin performed during the previous QT in 2018, it fell from top to bottom by around 84%, and currently, we’ve fallen about 74% from the highs of around $69k just as QT begins to the lows of $17.7k but has rebounded 40% from the lows to around $25k before being rejected and falling about 17% back to the 21k as of this writing.

BTC has already broken the uptrend but dropping below the 21k range would be a complete break of market structure, which means a new bear run might be starting, possibly sending BTC to new lows below $17k if macro indexes and conditions continue to worsen.

With the potential MtGox release of some of the BTC soon (not all of the 137,000 BTC will be released this year), this could be the straw that breaks the camel's back, creating a new downtrend.

Ethereum

With crypto markets being largely fuelled by narratives, the downturn during the May-June contagion and liquidation crisis has caused the markets to be filled with fear and devoid of strong narratives.

The market had a large narrative void and was looking for a narrative to fill this gap, so when the ETH merge narrative started coming around again fuelled by prominent Crypto Twitter influencers, many market participants latched onto the trade idea and sent ETH flying upwards.

However, upon hitting the key resistance of the 20 weekly moving average, commonly known as the bear market resistance band, it was rejected and retraced by around 21%, breaking the existing uptrend but not completely breaking the market structure yet.

The Ethereum merge has been confirmed to be on 15-16 September, where Ethereum transitions to Proof of Stake and has lower emissions, potentially making ETH a deflationary currency. However, reducing emissions does not translate to a higher valuation for ETH immediately as it would take some time for its disinflationary or deflationary effects to meaningfully boost ETH valuation.

Want to find out more about The Merge?

Read some of our risk-free strategies to profit from the Ethereum Merge.

Moreover, the CME Group may also be releasing ETH options on 12 September, which is more likely to have bearish pressures rather than bullish pressures, The Merge, may very well be a classic buy the rumour and sell the news type play.

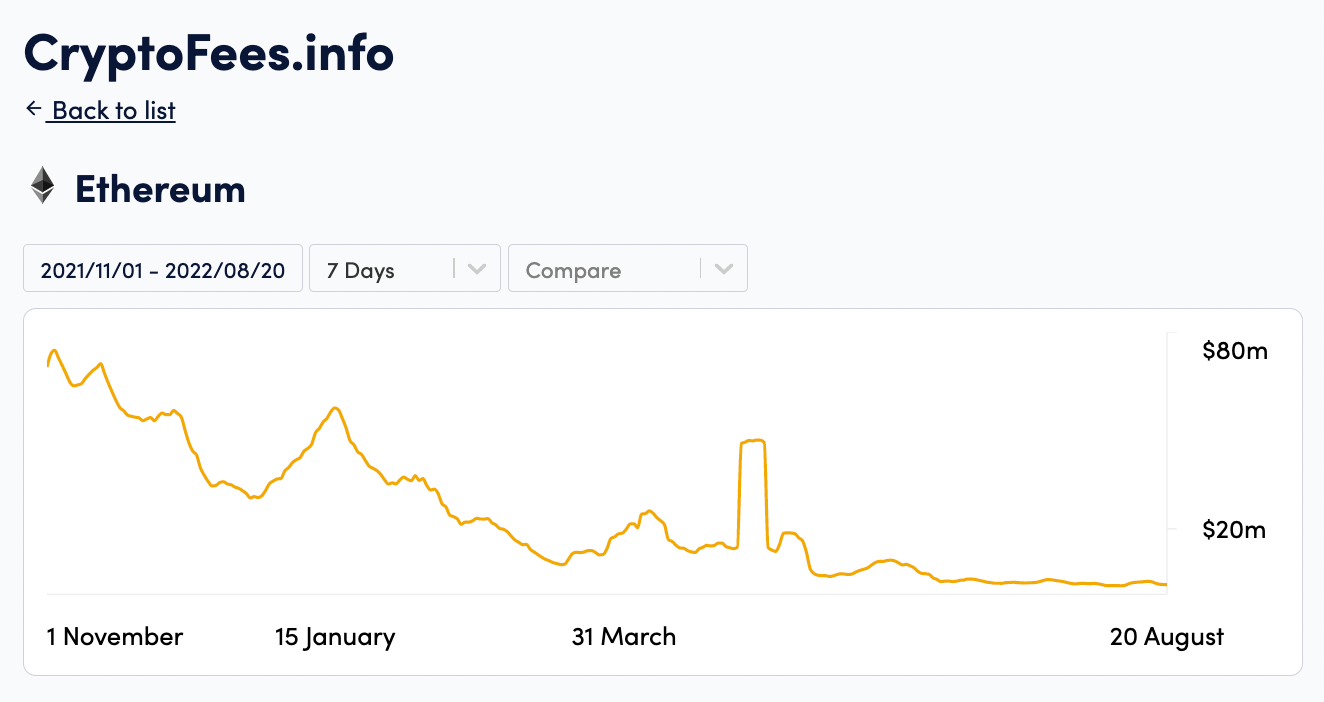

This is further substantiated by the decreasing amount of revenue generated on-chain, reducing the intrinsic valuation of ETH. Due to the negative growth in users during a bear market, the prospect of ETH price and valuation continues to look like it is capped to the upside but continues to have room to fall.

Additionally, the recent increase of government regulations may require more bluechip DeFi protocols to have certain permissioned features, turning them closer to Fintech companies and limiting their growth prospects which further cap valuations as well.

In fact, most of the DeFi protocols are still in a downtrend and are rejected from their 20 weekly moving averages. This downtrend in crypto is likely to continue until the equity market ends its current downtrend.

Equities

The equity markets are not performing well too, with Nasdaq falling up to 34% from its highs to the lows, and then rebounding more than 50% of the down move and going above its previous resistance, it is now deviating back under.

This steep drop before QT even started may also be a factor of the markets being more efficient and front-running the QT, as they have learned from the previous cycle that QT usually drags the market down. However, the crypto market is still very inefficient such as certain protocols still pricing improbably growth and are likely overvalued if macro conditions continue to worsen.

With Nasdaq, BTC, and ETH being largely correlated now, crypto largely acts as a leveraged equity tracker, and most altcoins are leveraged BTC trackers. This means that if Nasdaq falls 5%, then Bitcoin may fall 10% or more, and altcoins may fall 20% or more on a single given day. Such drastic drops may be scary but also highly rewarding for short strategies if they play out.

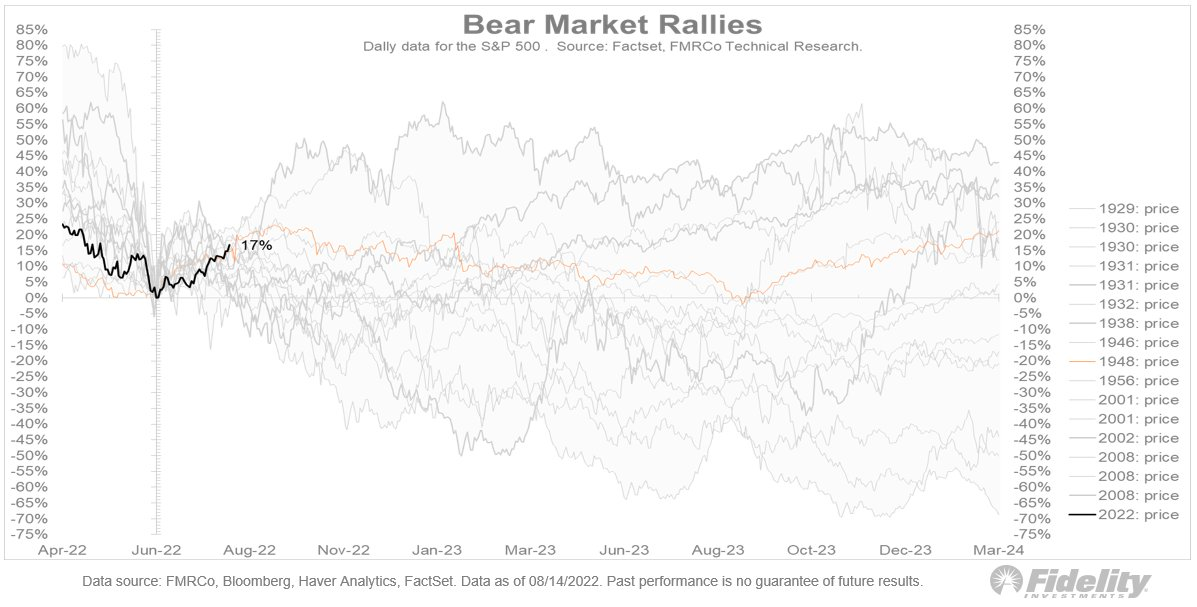

Although S&P and Nasdaq have rallied and retraced 50% of their downtrend which historically marks a bottom, it is still possible to revisit the bottom prices. The chart below shows all the bear market rallies since 1920s, with prices rallying 20% from their lows and still going back down to revisit them.

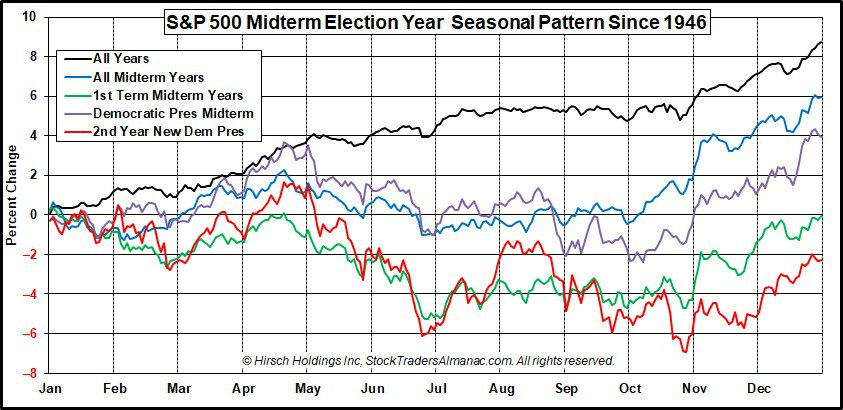

Additionally, looking at previous midterm election years, we are currently in the 1st Term Midterm years (green line), which typically tops out in the 3rd week of August before dropping further down in the September to November period, and generally rebounding well in December.

This is the S&P chart, and as previously mentioned if S&P revisits the lows, it could mean that Crypto drops much more. This means we have a couple of months where shorting rallies and pumps could be a profitable strategy.

It is possible that next year will continue to be a bad year for crypto if inflation continues to be sticky, thus it is useful to know how to short so you can make money in a sustained downward market as well.

In this series, we will explore some bear market strategies you can take advantage of to make money while prices are falling.

What is Shorting?

Shorting is to bet that the price of an asset is going down. For instance, if you short a token and it goes down by 50% from its current price, you earn 50% of your position size.

What actually goes on behind the scenes is that you will borrow the asset from a platform and sell it immediately. When you want to take profit, you will buy back the asset and return it, capturing the difference between when you borrow and return as your profits.

Nowadays we short tokens through perp contracts and they have a funding rate we need to take note of when we short. Some funding rates can go as high as 1000% a year and those are more suitable for quick trades as the funding fee will eat into your profits. Shorting is even riskier because prices can only go down by 100% (double your investment) but they can go up multiple times (you can quickly lose your initial capital if they double). It may be easy to make money shorting initially in a bear market, but it is also easy to bankrupt your account when a bear market rally occurs which has often led to more than a 100% increase in the prices of some tokens that are short squeezed. Thus, risk management and stop loss strategies are extremely important.

An alternative strategy that may be safer than naked shorting if done correctly is to perform spread trades. This is where you long a relevant token that is stronger while shorting the token that you deem is weaker. This allows you to hedge your short in case the market rallies up, pumping the token that you are shorting too. A spread trade is a powerful but advanced strategy but we got you covered in this spread trade strategies article.

All these being said, shorting is not for everyone and most people are better off just gradually accumulating fundamentally strong tokens over time when it is relatively cheap and waiting for it to rally up eventually.

Now that you understand what shorting is, let us explore some categories of crypto that may not do so well in a crypto bear market.

If we think about what went well in a crypto bull market during a time of lowering interest rates which we just got out of, we can probably inverse this logic to see what will do poorly in a bear market. Another angle is to look at large token unlocks that will be coming in the future which presents shorting opportunities.

We will go through some short ideas and maybe explore more in the future.

Disclaimer: Switcheo have nothing against any of the protocol or team mentioned in this article, and shorting these tokens is not guaranteed to be profitable. This is purely for educational purposes.

Strategy 1: High PS Ratio

One of the most popular crypto protocols is AMM DEXes. During a bull market, money becomes cheap or nearly free to borrow to speculate on assets due to low interest rates. This means trading volume and liquidity go up, and AMM dexes tend to do better when volume and liquidity are high.

Additionally, AMMs have achieved a product market fit (PMF) with a clear business model of charging a percentage of swaps, making it easy to calculate their user growth, revenue figures, etc which helps to determine valuations.

If we look at AMM protocols with the highest number of users from Dappradar, we can see a number of AMM DEXes such as Pancake, Orca, Quickswap, Uniswap, and Raydium. These are the popular AMM DEXes and should fare better during a bear market.

However, many other AMM dexes have low usage, poor tokenomics, high PS ratio, poor value accrual, and they inflate their token supply to attract liquidity. This leads to a ‘down only’ chart after the initial demand phase.

PS ratio is an important metric that in TradFi shows how much investors are willing to pay per dollar of sales for a share. Crypto has a similar use case and generally the higher the PS ratio, the more overvalued a token is and if you think it is not justified, you can consider shorting it.

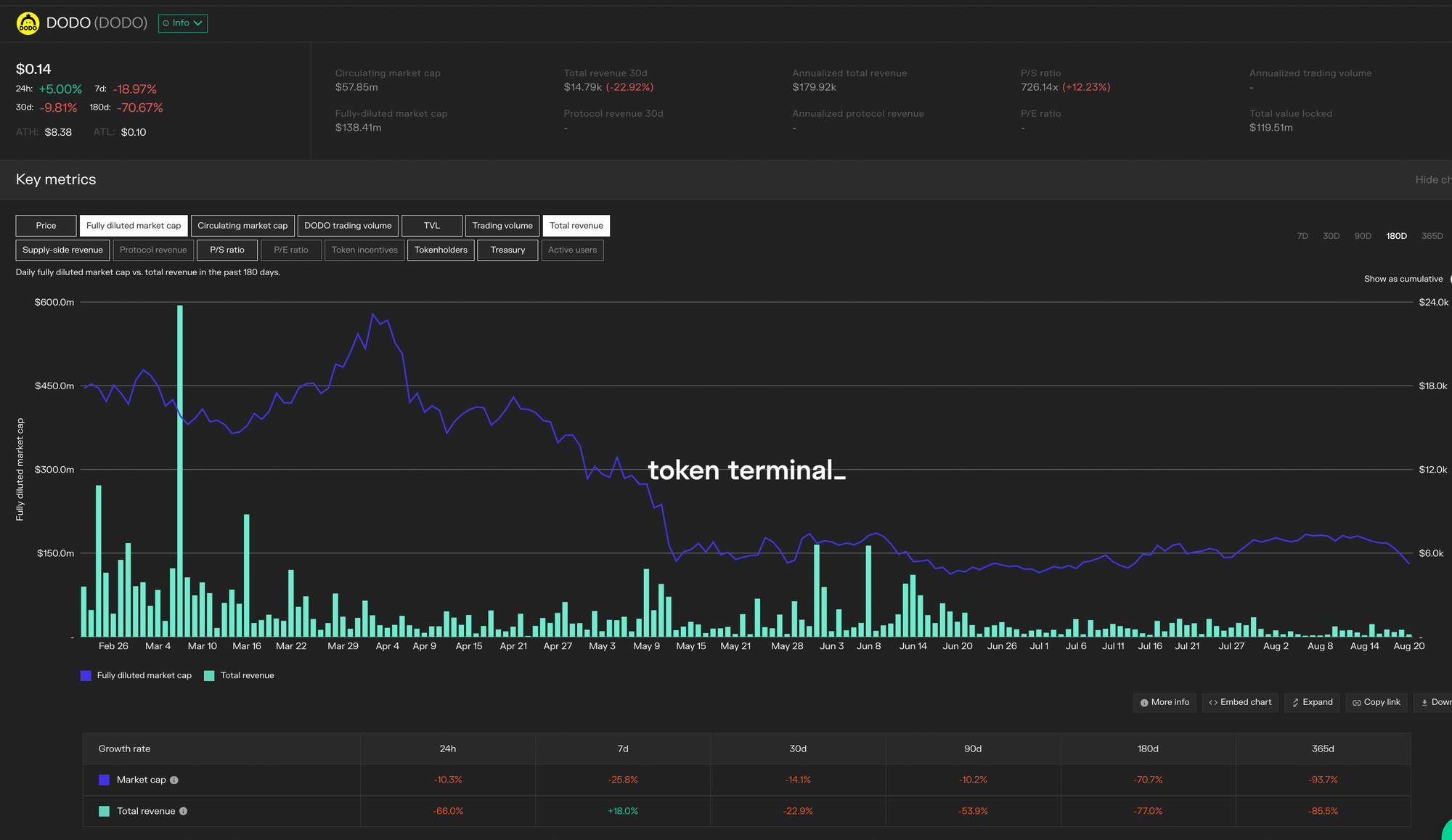

You can use token terminal to check the important metrics of AMM protocols and those with high PE or PS ratio and low circulating supply are unlikely to outperform in a bear market.

Strategy 2: Dead tokens

There are many tokens that are dead, this means the developer or the founding team has abandoned the project. If you are wondering if a token is dead, we wrote an article on how you can check if a token is still alive.

There are also many tokens that have poor or no value accrual and are unlikely to outperform in a bear market. DAO tokens are one such example. DAOs were one of the big narratives in crypto, having a decentralized organization where the community can contribute collectively to grow the protocol.

In reality, many DAOs are centralized with figureheads and the members are not interested in governing and are just speculating that the DAO tokens go up in value. There were many DAOs that were formed during this bull market that has already publicly announced that the leadership is leaving or has announced plans to migrate to a new token, leaving the old token in a questionable state and are unlikely to perform well in a bear market.

Some of these dead tokens are listed on exchanges and can be shorted.

However, these tokens can often have a high negative funding rate (you pay to short it) and still have a high market cap largely due to speculation and PvPing. PvP stands for person vs person where the token has little to no value but there is still buying demand primarily for the purpose of liquidating or triggering stop losses of other market participants and profiting from it. PvPing is one of the main reasons why shorting can be so difficult as many of the obviously overvalued or worthless tokens.

Strategy 3: Bear market resistance band

Many DeFi tokens may have strong fundamentals, but most are unlikely to go above their bear market resistance band (20 weekly SMA) due to the current bearish environment.

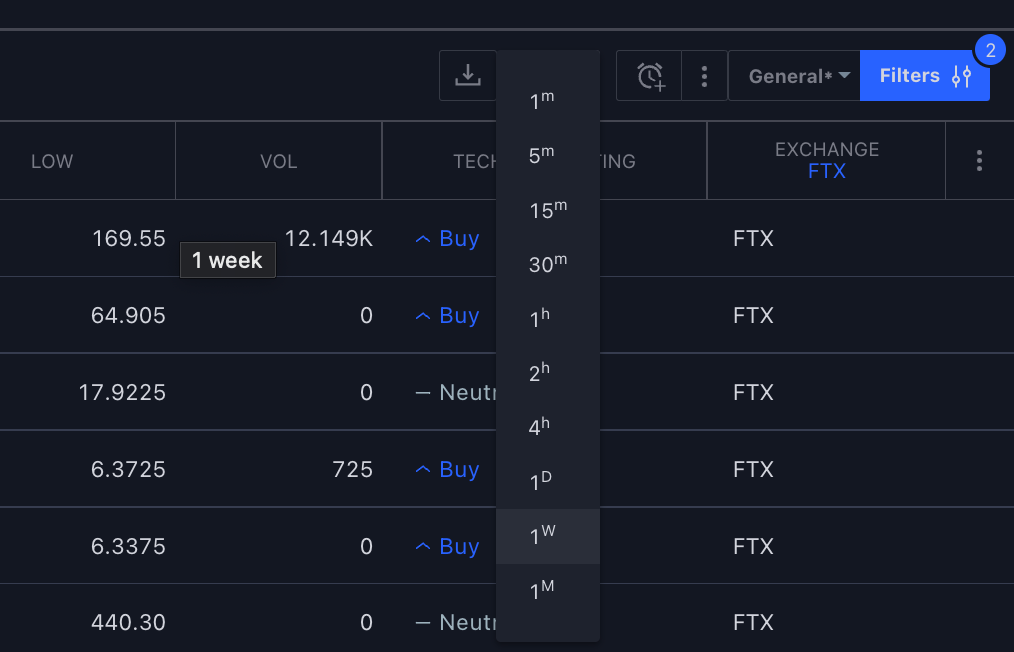

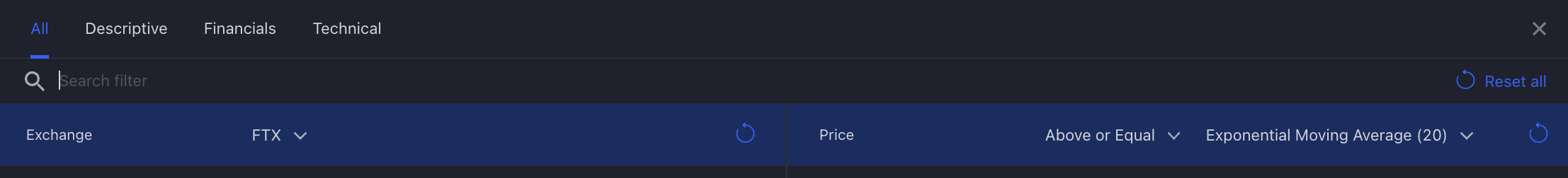

You can go to Tradingview's crypto screener, change the time range to 1w (weekly) and screen tokens that have a price above or equal to the 20 weekly moving average, then assess if you think these tokens can sustain their uptrend, most probably they can't unless they are not so correlated to crypto or they have a new feature that can drive sustainable growth in a bear market.

Conclusion

As many tokens in the crypto market have been strongly rejected off their bear market resistance bands while macro conditions worsen and the dollar remains strong, many people will further reinforce their beliefs that this is a bear market rally that can be profitable shorting.

We have shared some of the reasons why we think shorting may be a profitable strategy in this market, outlined the risks of shorting crypto, and shared some short ideas as well. We hope you find these insights and strategies educational and if you do wish to try them, we hope they play out well for you.

We may expand on this article and talk about other shorting ideas in the future so be sure to follow us on Twitter here!