What is investing?

The difference between crypto trading and investing is the time frame. Cryptocurrency investing is typically a long-term strategy. Investors believe in the long-term viability of their coins. They minimise trading on the short-term price movements of cryptocurrencies. A typical investor will buy a cryptocurrency asset based on its long-term potential, with the hope of selling it for a tidy profit after periods lasting perhaps years.

Investors rely on fundamental analysis since they bank on the long-term viability of a coin. The fundamental analysis primarily evaluates the long-term potential of a coin by establishing an intrinsic value or worth for the asset. There are various metrics that can be used, such as analysing the project and team, adoption rates, user growth, TVL and many others.

Types of investing strategies:

Dollar-cost averaging:

Dollar-cost averaging is a crypto investing strategy that focuses on investing fixed amounts of your money into cryptocurrencies at regular intervals. Essentially, dollar cost averaging spreads your investments over time to insulate you from rapid price movements. That means the cost of your investment will get averaged out over time.

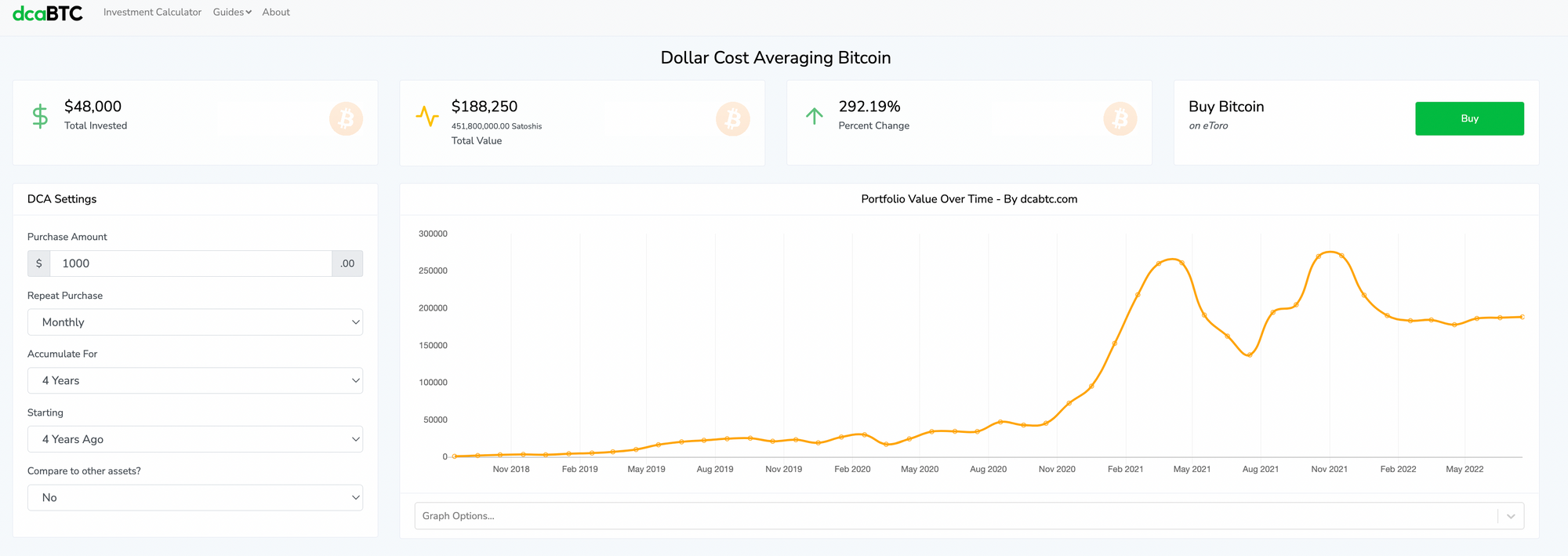

If you are wondering how lucrative DCA can be, you can use this website dcabtc.com.

If you started depositing $1k every month to BTC 4 years ago, you would have invested $48,000 but it would have been worth a whopping $188,250 today, up almost 300%. That is the power of dollar cost averaging.

Value investing:

Value investing is a crypto investing strategy that looks for assets that are undervalued, which means their actual worth is higher than the assets are trading for.

Once you find an asset you think is trading for less than it’s worth, you’d buy that asset under the assumption that the price will go up over time. The challenge here is figuring out which assets are genuinely undervalued. This strategy takes a lot of time, research, and practice in order to generate a profit as crypto is still highly speculative and it is hard to value most tokens.

However, there are certain projects with protocol-owned liquidity (PoL) that have a public treasury. Hence, you can determine the book value of the token, which has claims on the treasury. When the token market cap valuation drops below the book value of the treasury, it can potentially be undervalued. Some examples include $TEMPLE, $OHM, $wMEMO, etc.

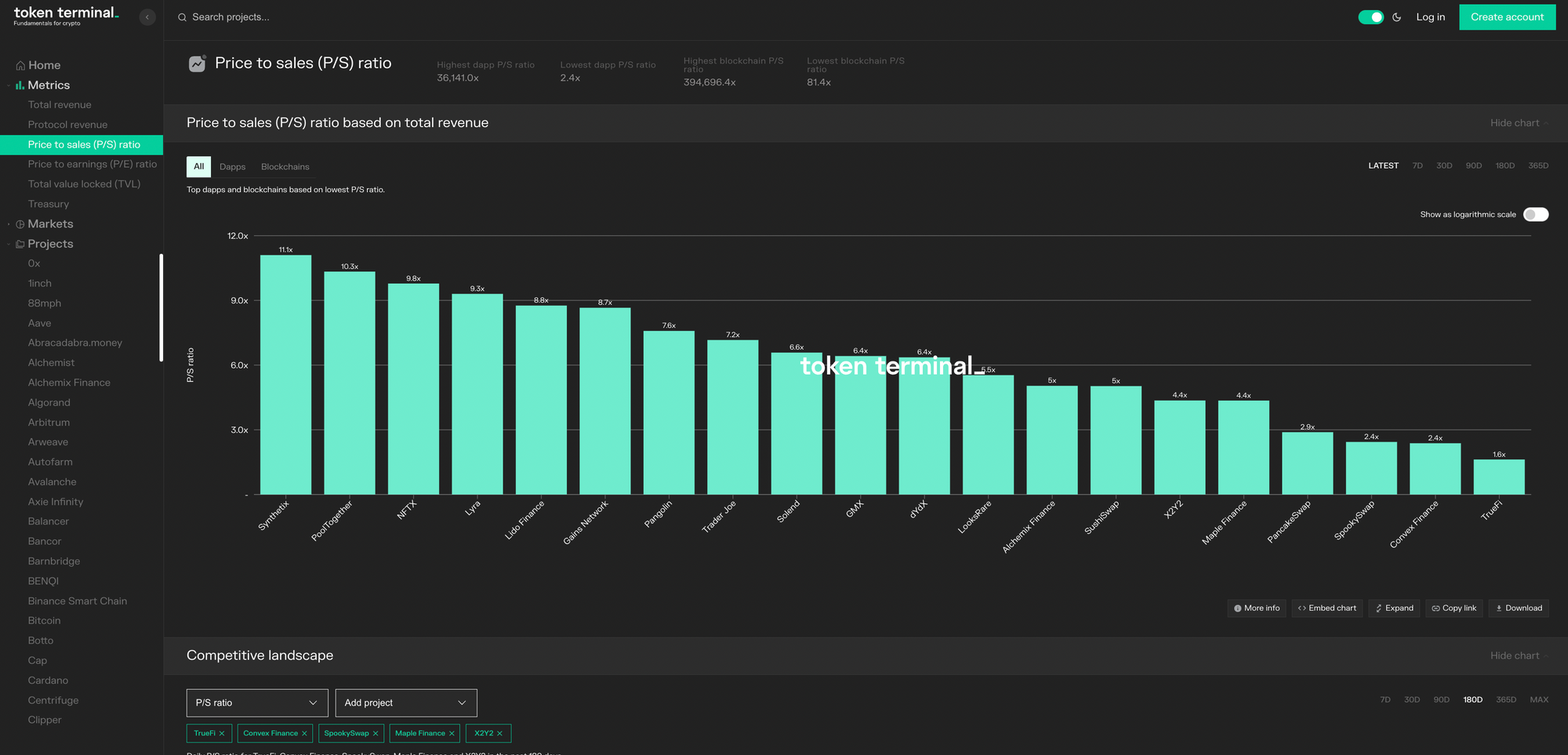

Additionally, one common valuation method in the traditional equity market is to look at certain metrics like the price-to-sales (PS) ratio, or if the token has enough history, the price-to-earnings-to-growth (PEG) ratio. One website that helps to track these fundamental metrics is tokenterminal.com.

Earning yield:

Another common crypto investing strategy is earning yields, mainly via liquidity providing, lending it out, or staking. The difference between earning a yield and HODLing is that when earning a yield, you’re only holding onto your crypto for a certain amount of time. A benefit of this investing strategy is that you can often earn passive income while you hold assets, which is sort of like how a savings account pays out interest on your existing balance.

Here are some popular platforms for earning yield.

- Staking: Lido and Stader

- Lending: AAVE and Compound

- Liquidity provision: Uniswap and Sushiswap

What is trading?

Trading is a short-term strategy. Trading leverages the short-term volatility of crypto asset's price changes for profit. Typical trading time frames range from minutes to days. Although the rewards are faster, trading crypto requires a lot of effort. For those that have a well-constructed trading plan, cryptocurrency trading can be very profitable due to the high volatility of the cryptocurrency market.

Types of trading styles:

- Scalping: Scalping is one of the more fast-paced trading strategies. Scalpers trade small price movements for small profits but execute so many trades that the small profits add up.

- Day trading: Day trading refers to attempting to profit by buying and selling an asset within a single day.

- Swing trading: Swing traders will hold onto an asset for a longer period of time, usually days to weeks. Markets go through upward and downward trends, so swing traders look for signals that a shift is about to happen and time their trades accordingly.

- Position trading: Position trading is a form of trading that is a bit closer to investing. It's similar to swing trading but usually involves a deeper analysis of long-term trends. For example, a position trader might hold a position for months before selling.

Alternatives to Investing and Trading

Trading and investing are not the only ways to make money with cryptocurrencies. There are other alternatives.

Mining: Cryptocurrency mining secures blockchains using the proof-of-work (PoW) mechanism. Mining activities solve complex mathematical problems, which verify transactions for addition to the public ledger or blockchain. Mining requires expertise and considerable investment in specialized mining equipment, and miners are rewarded for their work with newly generated coins.

Delta neutral strategies: This is a portfolio strategy that utilizes multiple positions so that you are directionally neutral. An example could be buying a cryptocurrency, such as Ethereum, staking it for a yield, and then shorting the cryptocurrency for the same amount through a perpetual contract, and pocketing the yield minus the funding rate for the perpetual contract.

Are You an Investor or Trader?

Trading and investing are different approaches to earning in the cryptocurrency market. Deciding which one is better for you depends on your risk appetite and time availability.

If you’re comfortable with taking on frequent risks and have the capacity to monitor markets constantly, trading might just be the right strategy for you. If you prefer a more laid-back approach, then you should consider investing for the long term. Doing a bit of both is also an option.

Conclusion

The cryptocurrency market is super volatile, so be careful and tread with caution. Understand the key differences between investing and trading crypto before deciding the approach that suits you best.

A smart investor tends to recognize the different parts of market cycles to take advantage of the market conditions and HODL in the hope of the asset’s price appreciation. In contrast, traders tend to profit from a bull or bear market from short-term price movements. Still, both investors and traders need to deploy a proper risk management system or contingency plan to exit the market when the market goes in an unfavored direction.