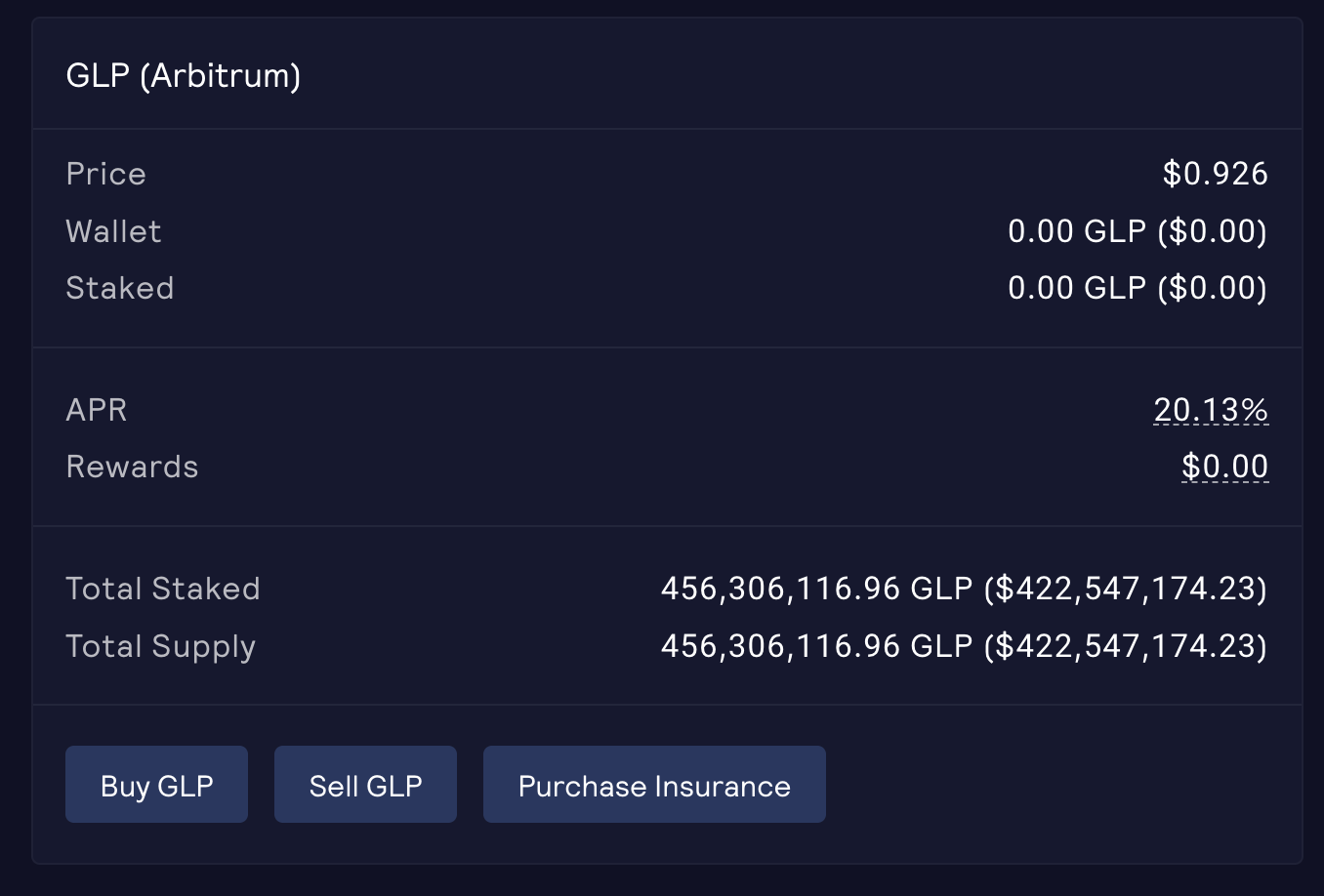

GLP, the liquidity provider token of GMX, is a relatively stable token in price as it's made up roughly of half stablecoin and half BTC and ETH.

It is a popular token during this period and on top of that, it is currently earning fees that is around 20% APR, and can fluctuate as high as 40% at times!

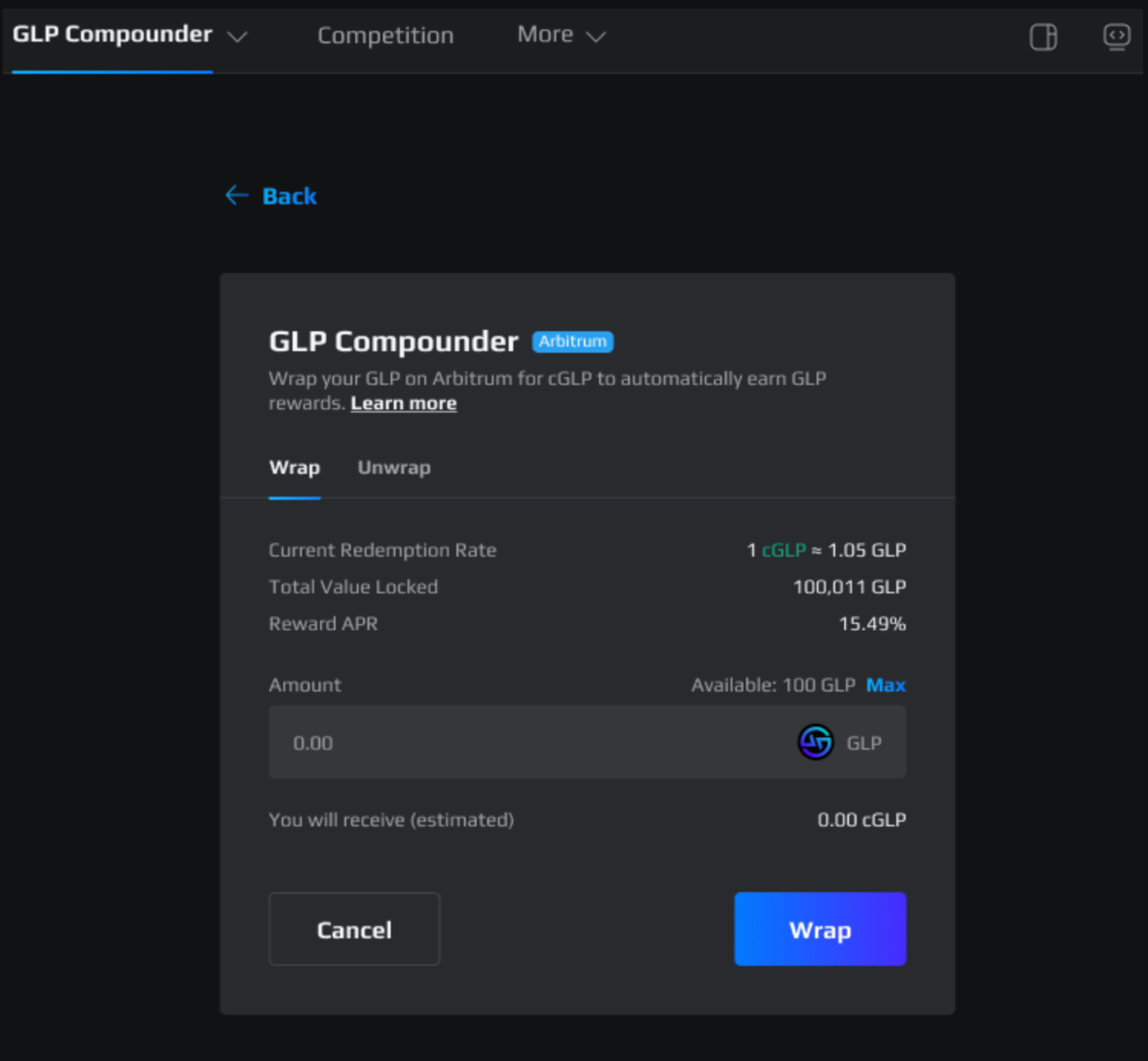

There are many ways to increase GLP yield, the most common is to use our auto-compounding vault that wraps GLP into cGLP to autocompound rewards.

In this strategy, we explore a few ways how you can earn more with GLP through a synergy with Demex, a cross-chain money market and perp DEX that is also the first Cosmos dApp to directly integrate with Arbitrum.

All strategies require cGLP. If you are not familiar with it, read our article here. Essentially, cGLP is an autocompounding GLP public good that we created for Arbitrum GMX's community that freely compounds GLP fees.

The first step is to convert your GLP on Arbitrum to cGLP, a zero fee auto compounding vault on Arbitrum.

Pre-requisite: Getting cGLP into Nitron

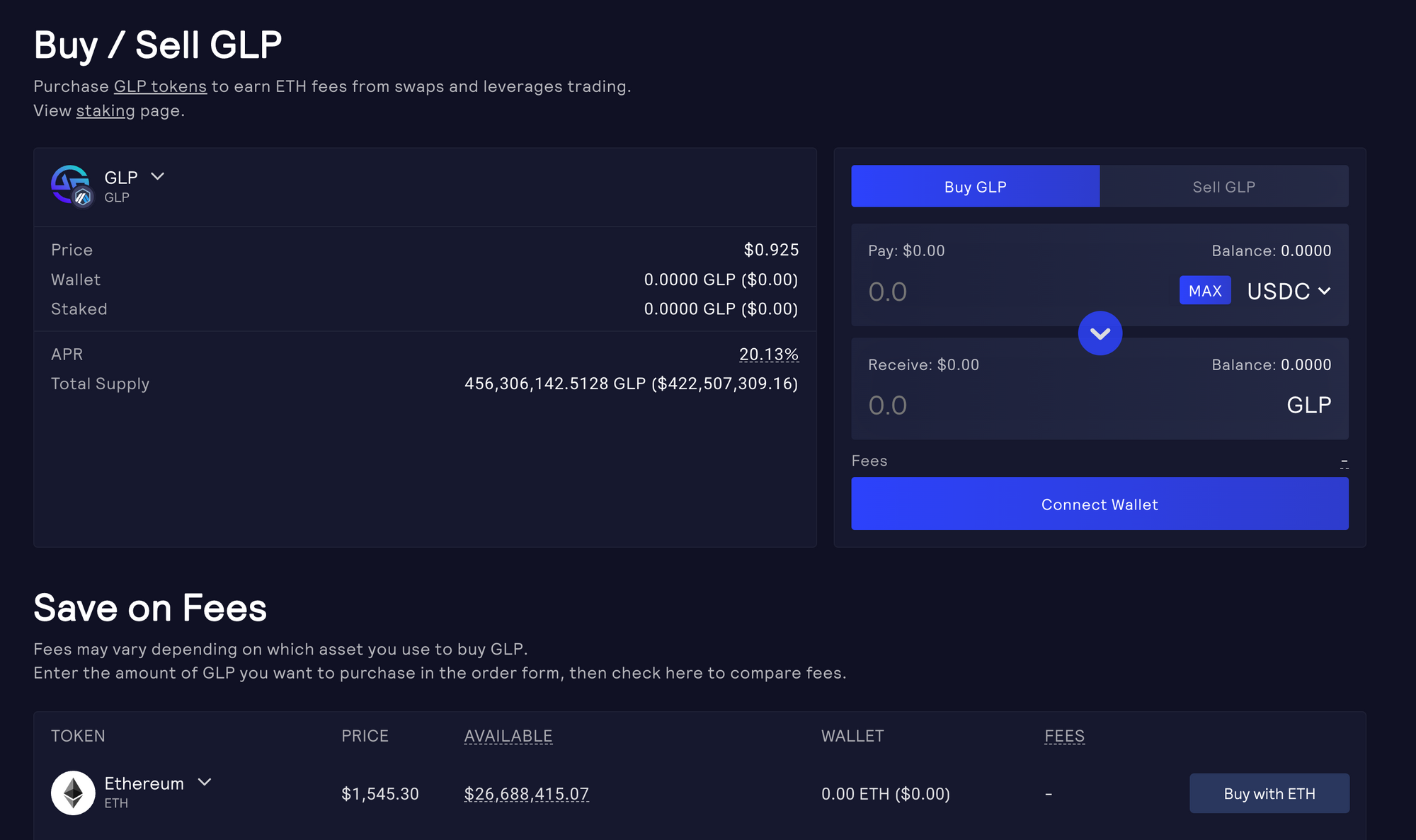

Step 0: Acquiring GLP

You will need GLP to convert into cGLP. If you do not currently have GLP on Arbitrum, you can get it on the GMX website here.

Step 1: Wrapping GLP into cGLP

Once you have GLP, stake it into the Arbitrum cGLP autocompounding vault on Arbitrum by going to the GLP compounder page here.

The cGLP token will accrue GLP's real yield fee rewards into itself currently.

Public Good: Most autocompounder charge some kind of fee, such as a 10% performance fee or withdrawal fee. Carbon's cGLP is the only autocompounding vault with zero fees, no deposit or withdrawal fees, no penalties, etc.

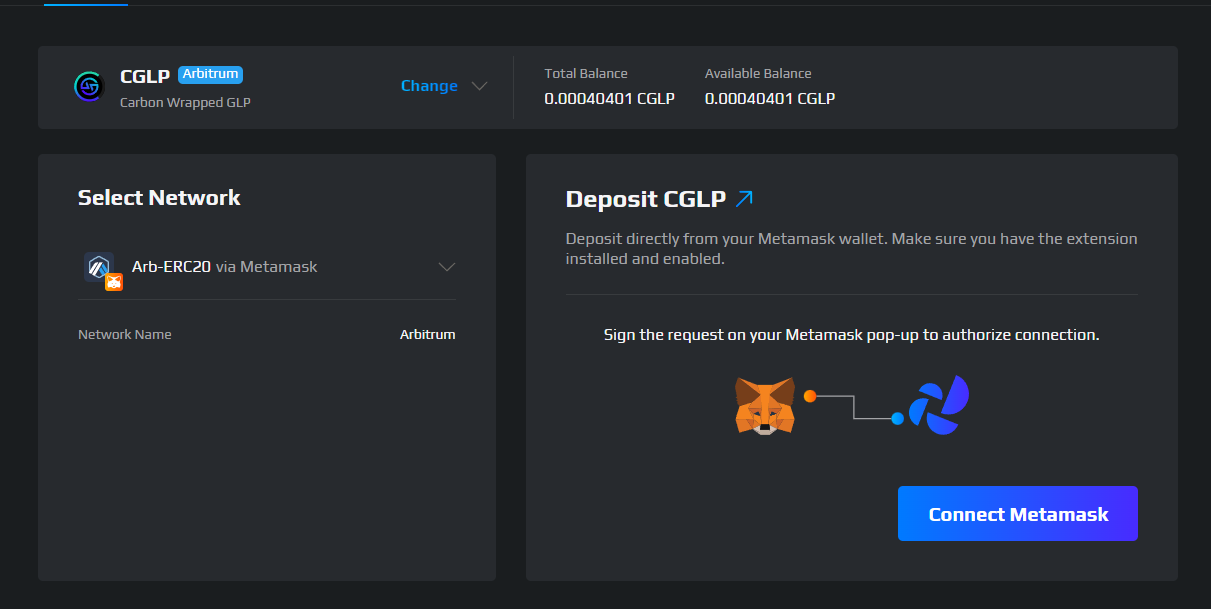

Step 2: Depositing cGLP to Carbon Network

Once you have gotten cGLP, deposit cGLP from Arbitrum to Carbon network using this deposit link.

It should take about 5-10 minutes due to security reasons.

Step 3. Deposit cGLP into Nitron for more yield

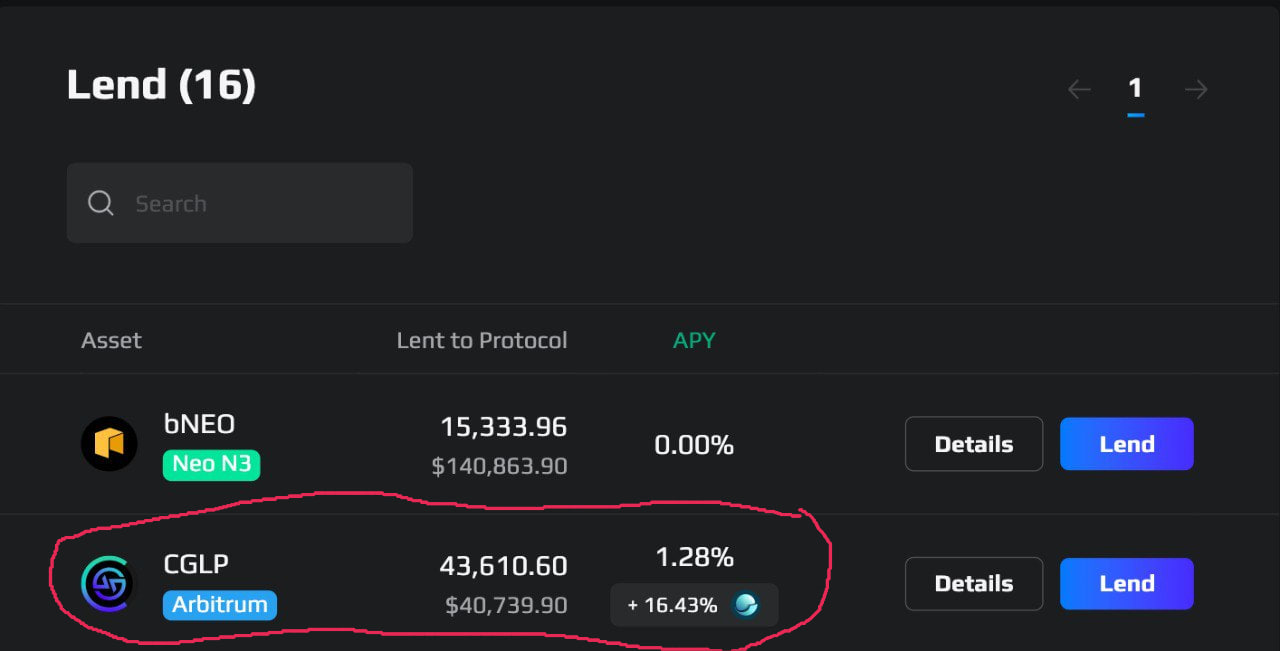

Now that you have some cGLP, deposit it on Demex's Money Market, Nitron and enable it as collateral (ticked by default). Now you have borrowing power (health factor) to start trying out various yield strategies.

Bonus: Carbon is encouraging cGLP deposits by having temporary $SWTH incentives, giving an extra yield of over 10% as of this writing, on top of the real yield APR that GLP is earning.

Now that you have cGLP as a collateral, here are some strategies to help you can earn even more return on your GLP!

Strategy 1: Stablecoin LP Farming

This strategy involves obtaining stablecoins such as USD (Carbon's USD grouped token) and USC to LP and earn trading fees and additional SWTH incentives.

To learn more about USC, Carbon's overcollateralized stablecoin that follows MakerDAO's DAI model, you can read our article here.

Step 1: Minting or Borrowing USC

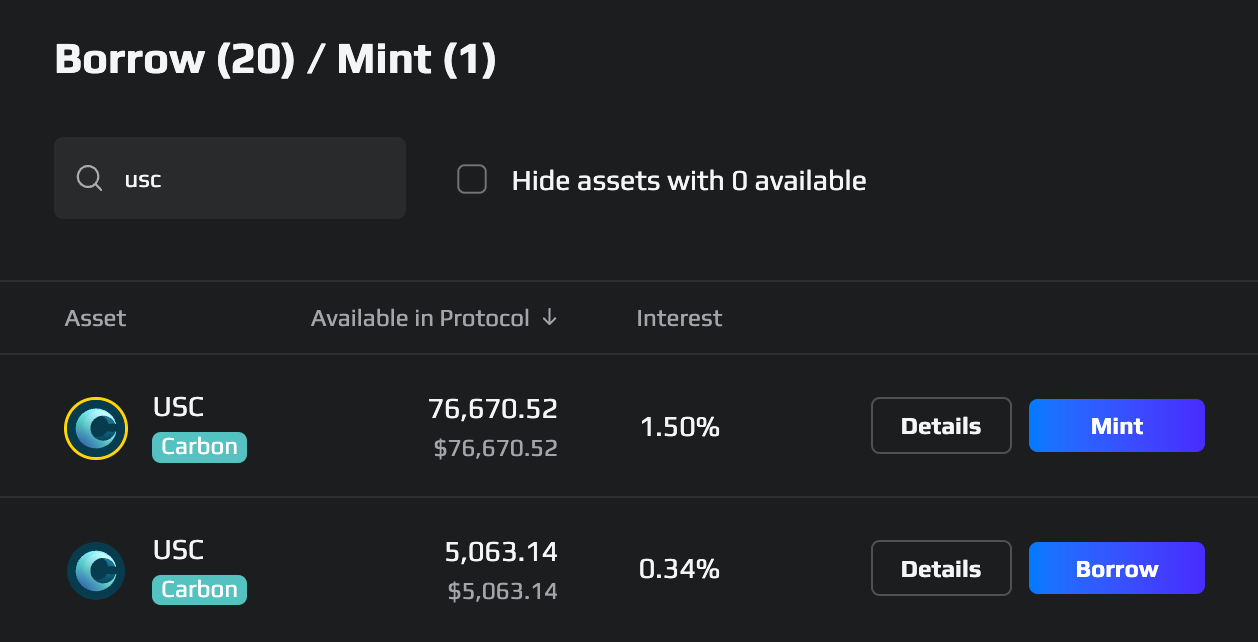

With cGLP as collateral, you can mint USC which has a fixed interest APR of 1.5%, or borrow USC if the variable interest is less than 1.5%, but note that the interest is variable and can increase to above 1.5%.

It is usually cheaper to mint USC as 1.5% interest rate is low, and additionally there are also no minting or redemption fees.

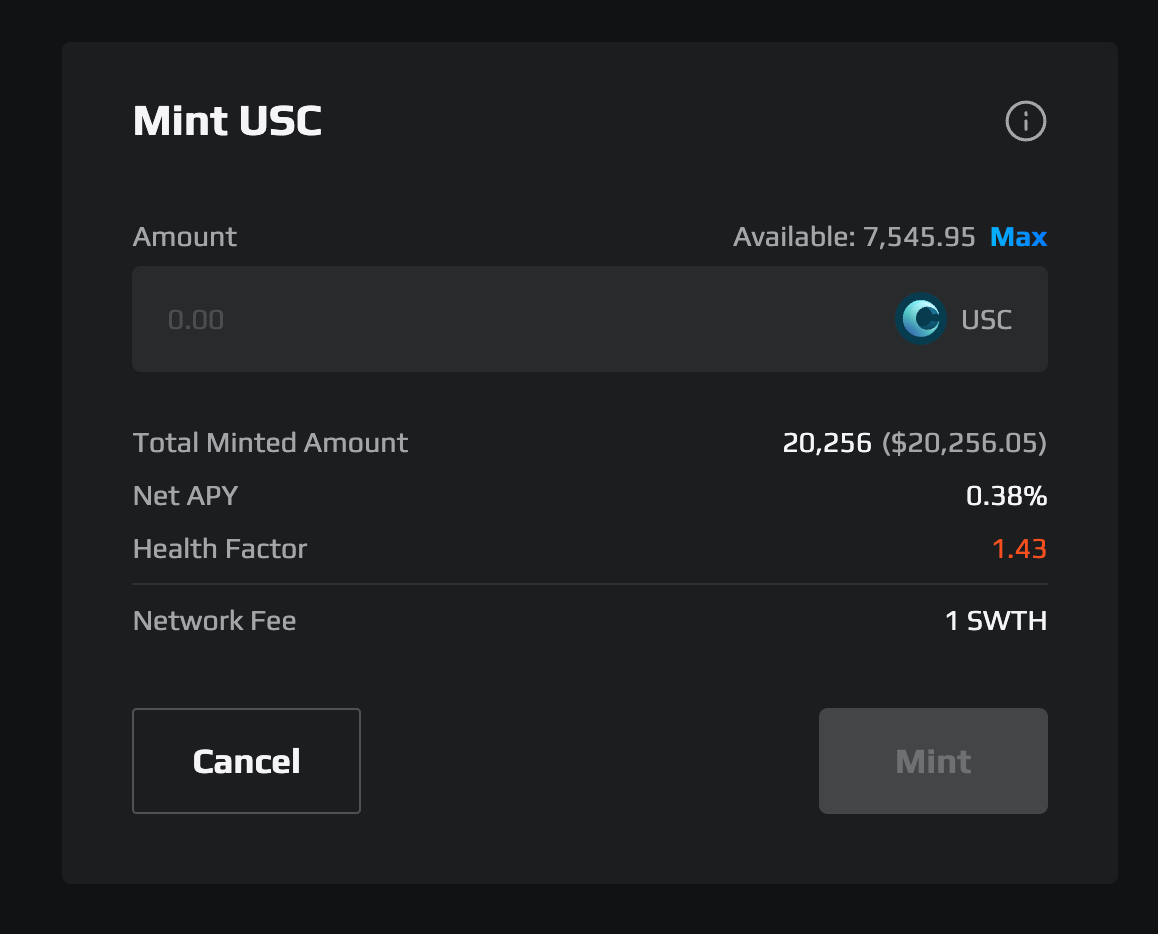

It is recommended to keep your health factor well above 1.0 as that will expose your collateral to liquidation.

A health factor of 1.4 is relatively safe as cGLP has to drop about 40%, which is unlikely to happen suddenly, giving plenty of time to react.

Step 2: Providing USC-USD Liquidity

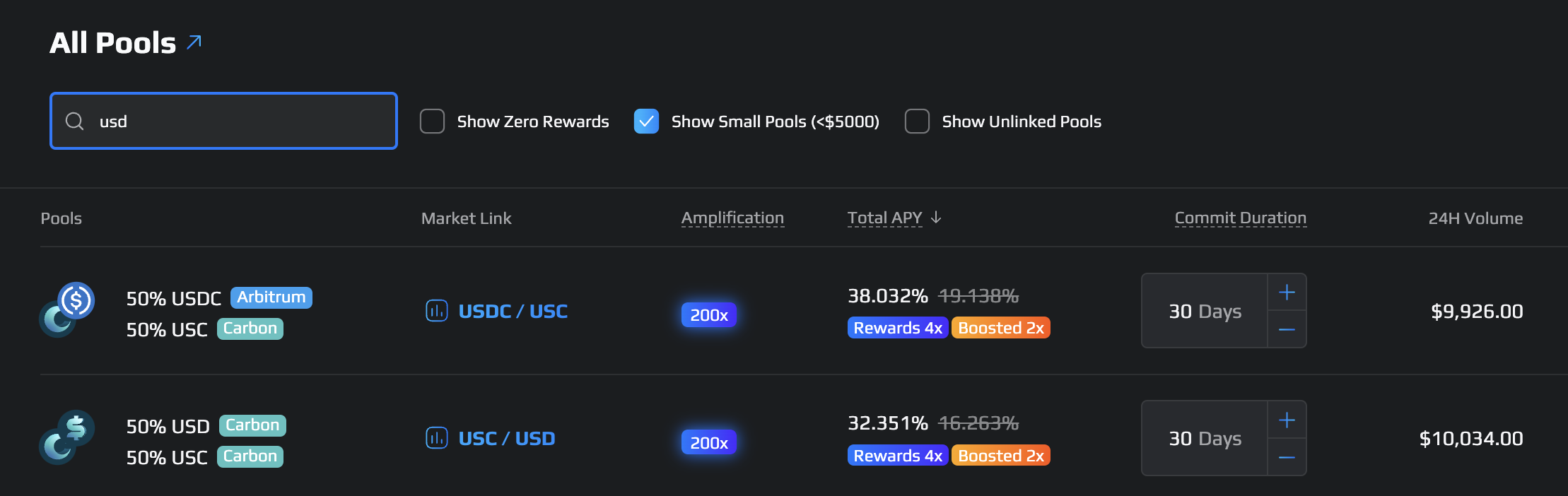

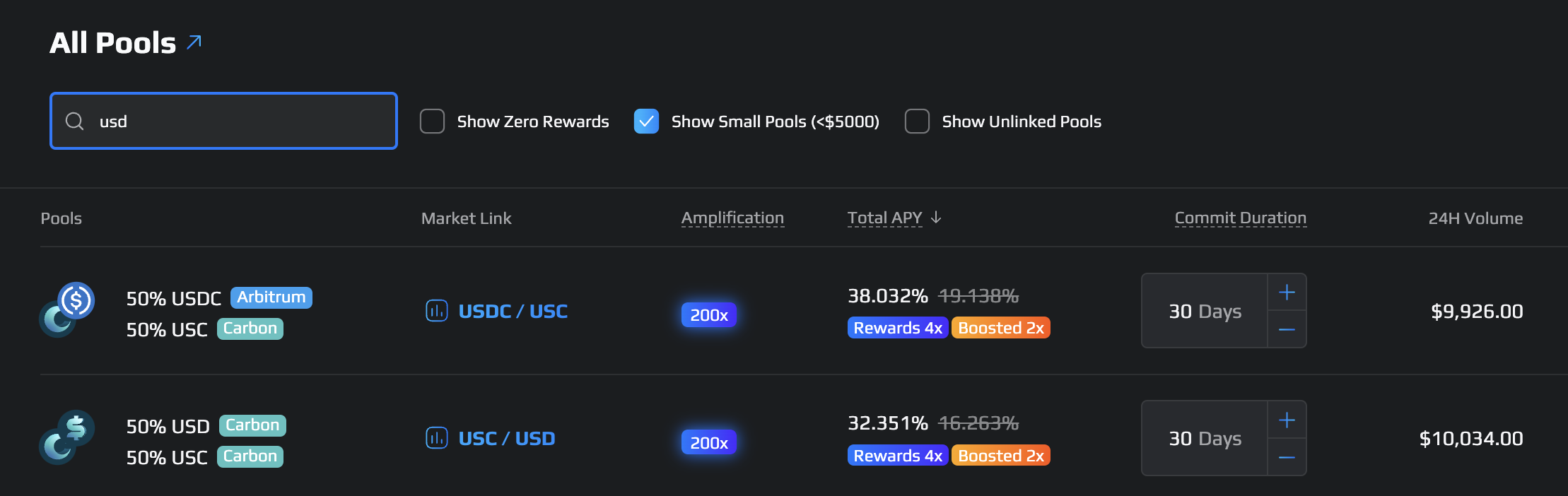

Now that you have USC, you can choose which pool you want to add it to, usually the one with the higher APY.

For this example, I will select the USC-USD pool, which you can deposit here.

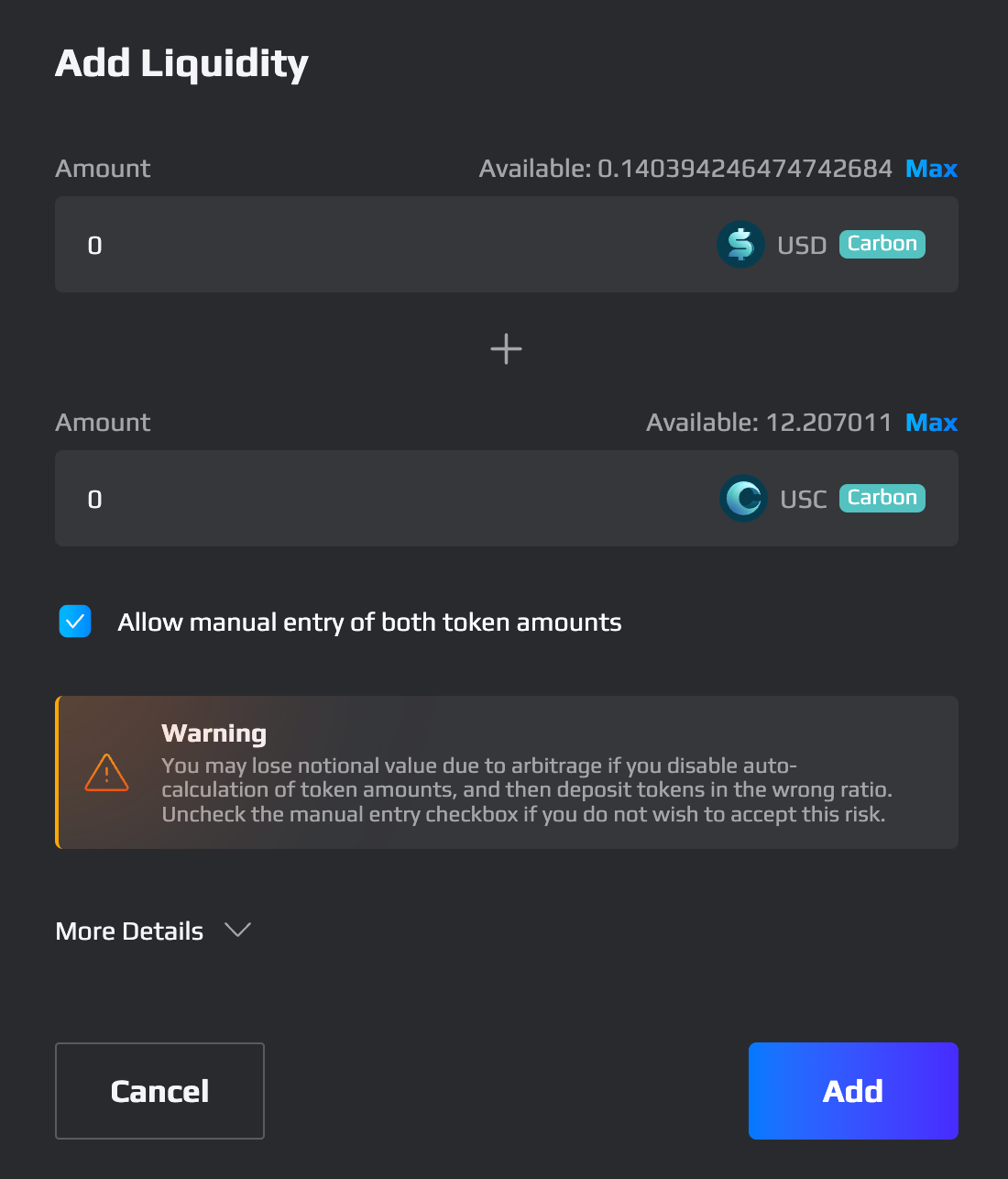

For the other half of the stablecoin, USD, you can choose to tick "Allow manual entry of both token amounts" to allow the platform to automatically swap half into the other stablecoin, however some slippage may occur.

If you want to avoid slippage, you can obtain USD by depositing stablecoins such as USDC (except Arbitrum USDC), BUSD, or axlUSDC onto Demex here to be autoconverted into USD, which you can then pair with USC.

Learn more about USD Autoconversion Grouped Token here:

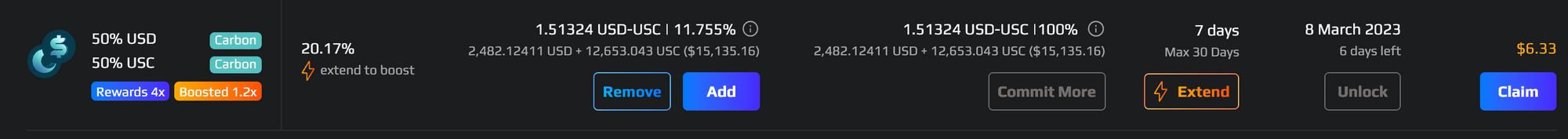

Once you have added the LP, commit for a period of 0 days and you will begin earning additional yield! This LP position is instantly redeemable and you can use it to return your loan at anytime and withdraw your cGLP collateral.

Bonus Step: Committing your LP to increase APR

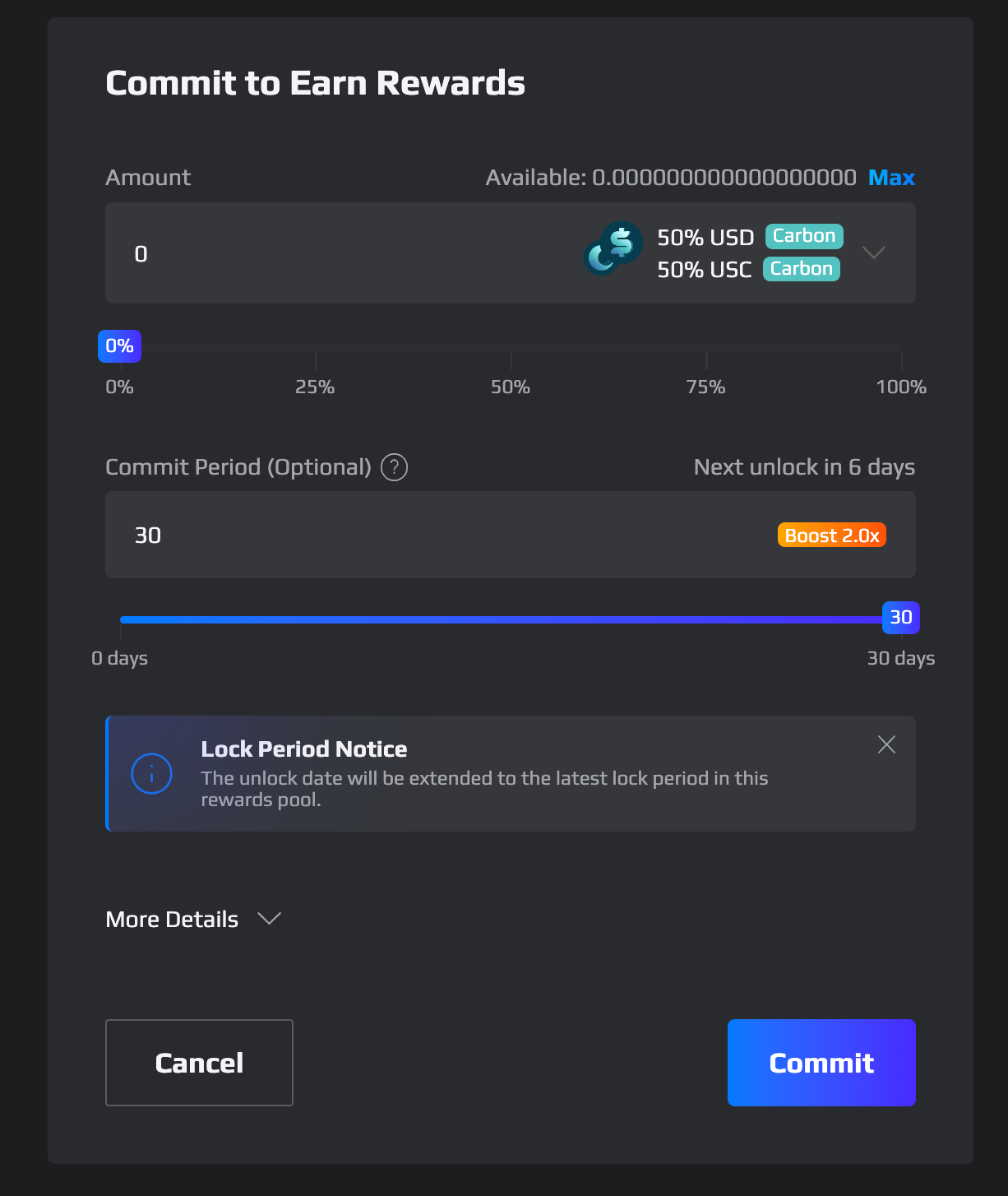

You can commit your USC-USD LP for up to 30 days to increase the APR as well.

Before committing, you should be confident of managing your collateral's health factor as you will not be able to retrieve the underlying stablecoins to repay your USC loan during the commit period.

Congratulations! You are now earning additional yield on cGLP by using cGLP as collateral for this stablecoin yield farming strategy. Let's explore more strategies that utilizes cGLP to generate more yield.

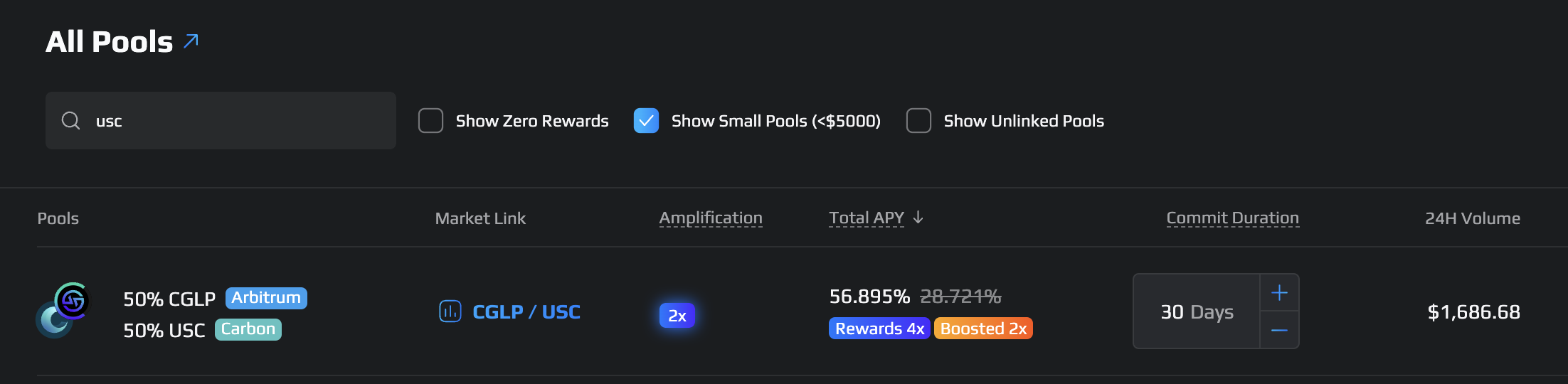

Strategy 2: cGLP-USC LP Farming

This strategy involves providing cGLP-USC liquidity to earn trading fees and additional SWTH incentives.

Step 1: Obtaining USC and cGLP

To obtain USC, use your cGLP collateral to mint/borrow USC here.

USC can also be obtained through the following ways:

- Depositing other collateral into Nitron and mint/borrow USC here

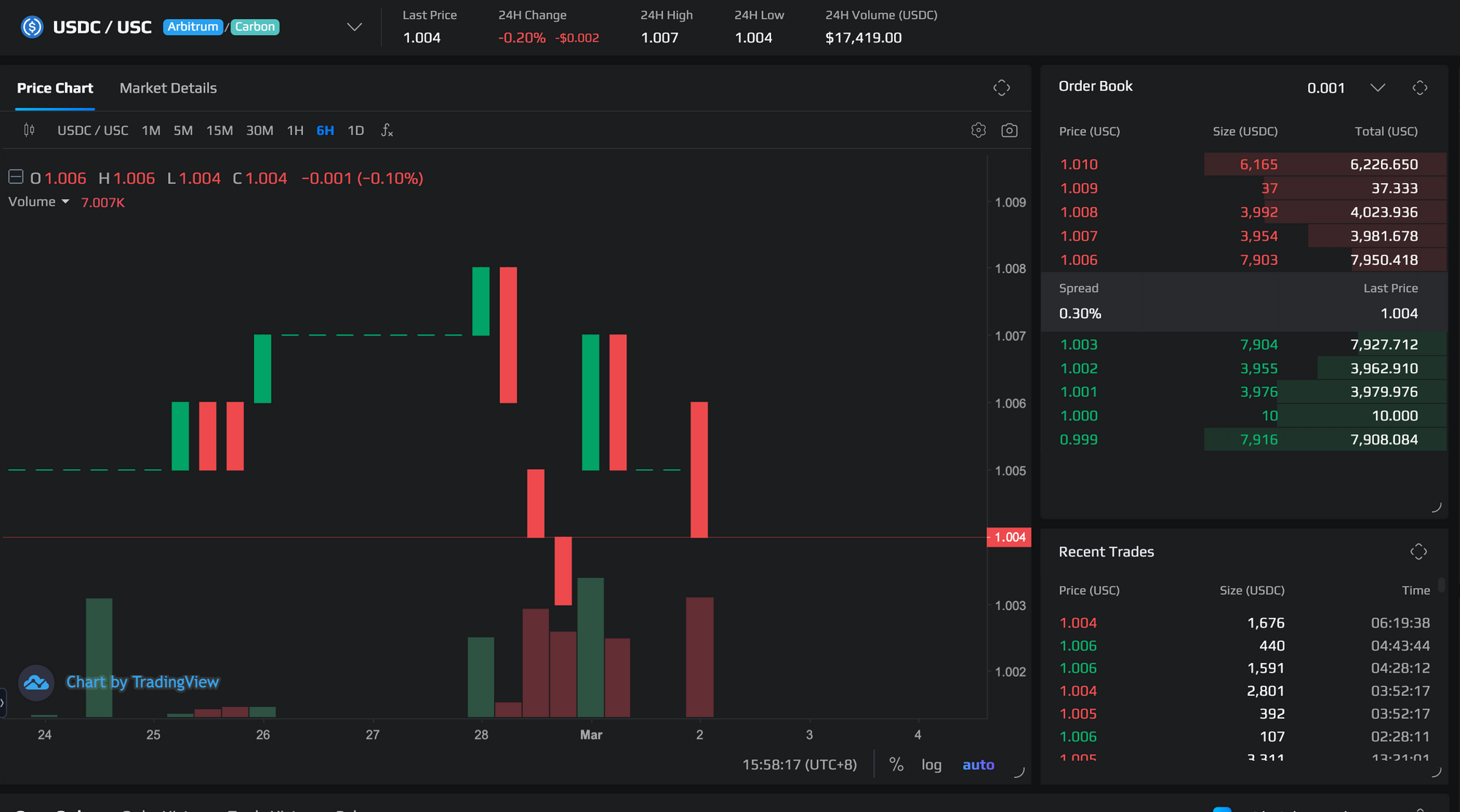

- Depositing USDC from Arbitrum and selling into USC here

- Depositing USD and selling to USC here

To obtain cGLP, you can either withdraw some of the deposited cGLP, or obtain more cGLP through the normal route.

Step 2: Providing cGLP-USC Liquidity and Committing

Now that you have both cGLP and USC, you can deposit it into the cGLP-USC spot LP and start earning an additional >20% APR. As per the previous strategy, you can also commit your LP to increase your APR.

You can commit your USC-USD LP for up to 30 days to increase the APR as well.

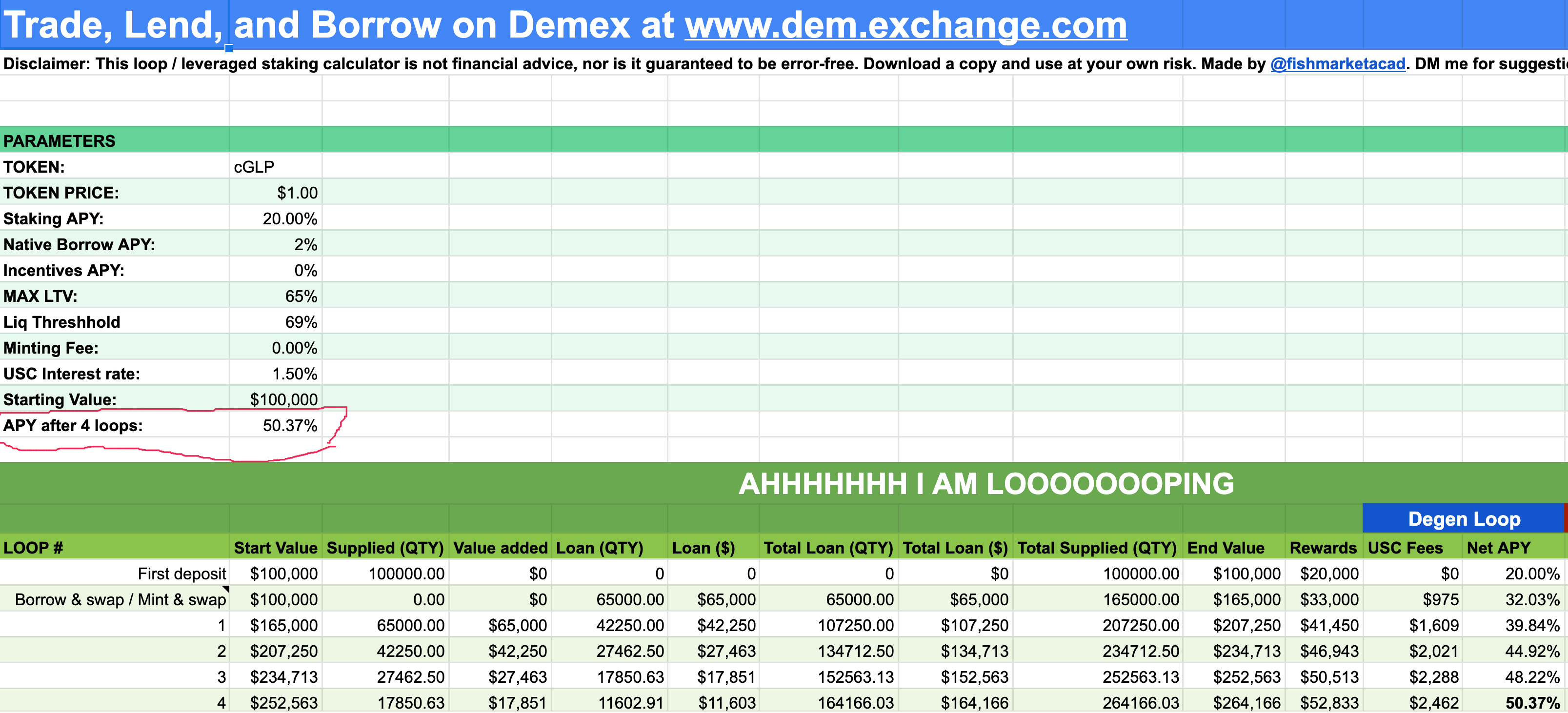

Strategy 3: Leverage cGLP's Real Yield

This strategy involves looping cGLP real yield by minting USC to obtain more USDC on Arbitrum to obtain more cGLP to maximize GLP's real yield. .

Step 1: Obtaining USC

To obtain USC, use your cGLP collateral to mint/borrow USC here.

Step 2: Obtaining Arbitrum USDC

Sell USC to Arbitrum USC here. Watch for slippage if your size is size.

Step 3: Use USDC to buy more GLP and stake into cGLP

Firstly, withdraw Arbitrum USDC to Arbitrum network here.

Next you can use USDC to buy more GLP on GMX's website, and stake the GLP into cGLP, then send it to Carbon and deposit into Nitron as collateral.

Step 4: Loop for More Leverage

Repeat steps 1-3 for moar leverage! If you loop it 4 times, you can get an APY of 50% on your GLP!

This does expose you to liquidation risk if cGLP drops a lot. However, because cGLP grows in value at about 20% a year based on the average real yield APR, and is also made up of about 50% stablecoin, cGLP price is expected to be stable during normal market conditions (although crypto is anything but normal!).

Conclusion:

GMX's real yield reward going to GLP is a very attractive and sustainable product that generally earns about 20% APR.

By synergizing with other protocols like Nitron, a cross-chain money market, it is possible to increase this APR even further such as 50%!

Explore these strategies and understand their risk profiles and decide which strategy is more suitable for you.

Not financial advice

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Switcheo. Switcheo does not take into account your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. Switcheo also does not warrant that such information and publications are accurate, up to date or applicable to the circumstances of any particular case.