After years of delays, the "Merge" (previously ETH 2.0) has finally been confirmed and Ethereum will transition from Proof of Work (PoW) to Proof of Stake (PoS) on 15 September 2022.

The Merge is one of the most significant upgrades in the history of Ethereum, with the underlying blockchain undergoing a major change where the creation of new ETH becomes less energy-intensive.

Here's what you can do to prepare and possibly profit from The Merge. You can scroll all the way down for the tldr as well.

Brief History of PoW forks

Before we talk about the Ethereum merge, lets explore the previous PoW forks.

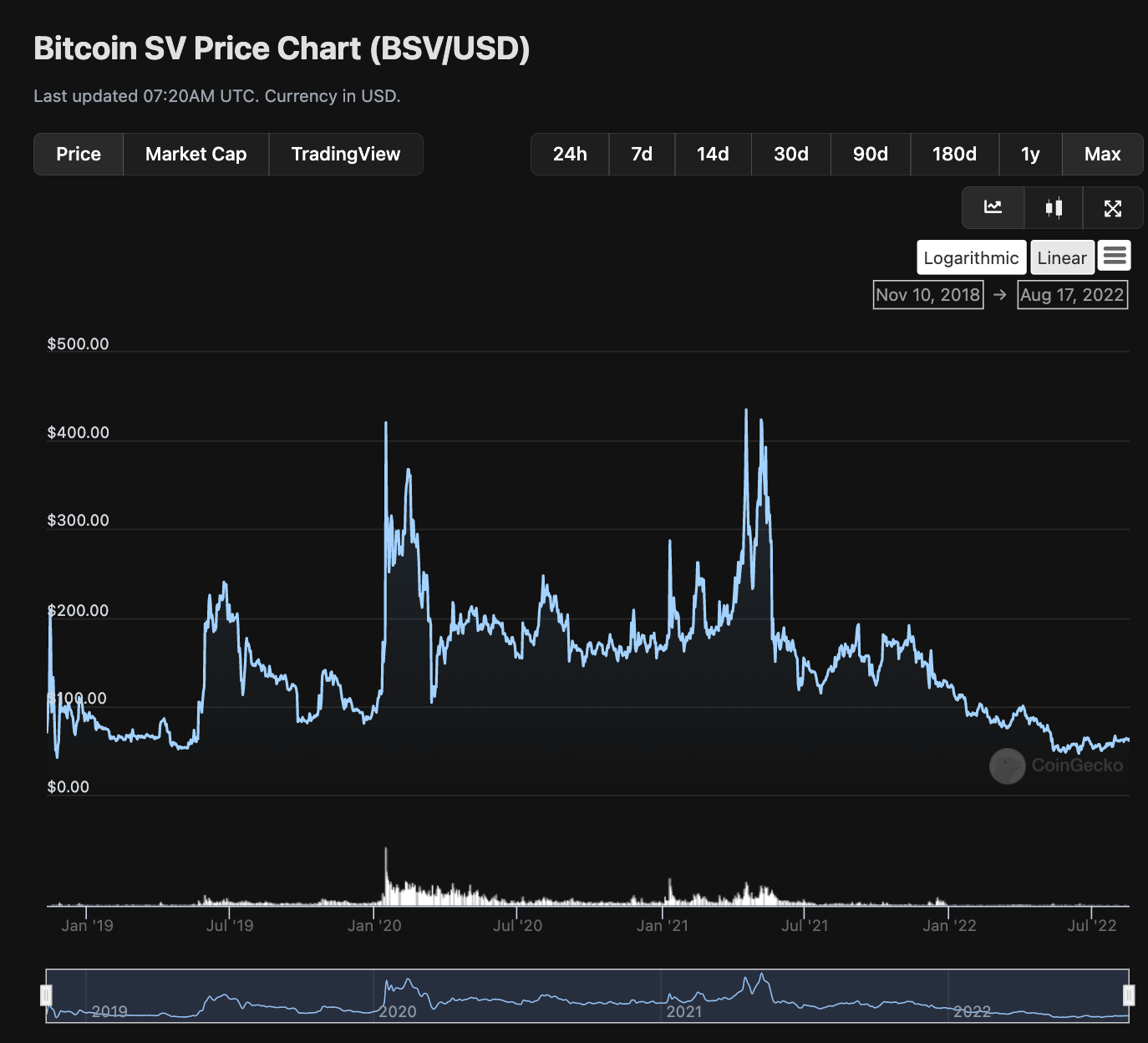

There were two popular PoW forks from Bitcoin, Bitcoin cash (BCH) and Bitcoin SV (BSV). These forks aimed to improve the transaction speed and reduce the transaction cost of sending Bitcoin but had other important drawbacks.

These created contentious forks with their own separate chain and own miners. If you had held Bitcoin on an exchange, you would have received these tokens as an airdrop after the chain forked. As you can see from their charts, there is usually an initial spike at least on the day itself before finally dying off.

Now let's explore what we think will happen when Ethereum merges.

What happens when Ethereum merges?

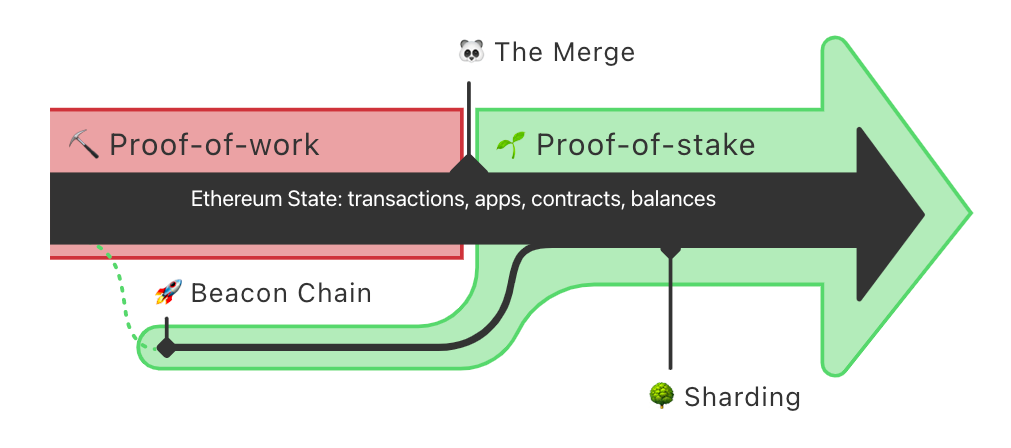

The network we are using before The Merge is known as Ethereum which is the execution layer that uses proof of work (PoW) to validate transactions and blocks. Right now there is another network running parallel to Ethereum chain which is known as the Beacon Chain and it is a proof of stake (PoS) consensus layer.

When the current PoW Ethereum chain merges with the Beacon Chain, Ethereum's blocks will only be produced through the Beacon Chain which uses a Proof of Stake consensus model.

However, there will be at least two chains, the new PoS ETH chain, and the old PoW ETH chain.

This is because The Merge is being rejected by miners as they will lose all their ETH mining revenue as the new PoS chain does not support mining. Hence, the miners will try to squeeze every last drop of value before selling their expensive mining hardware. As long as miners continue to mine and validate transactions on the ETHPOW chain, the old chain remains alive, resulting in two chains.

This means that everything you own on the existing Ethereum chain will be split into the new POS chain but still remain on the existing Ethereum POW chain.

This includes assets such as:

- All your NFTs including the ones listed for sale (Opensea, Sudoswap etc)

- All your assets in your wallet

- All your assets in smart contracts such as money market dapps (AAVE etc)

- All the liquidity you provided on uniswap or autocompounding platforms

And most importantly, almost all the above assets from other users will split as well, including NFTs and stablecoins.

USDC has already agreed to support the PoS chain and it will be unlikely that USDC on the PoW chain has any value, hence all the POW USDC and many other assets will be swapped out immediately to ETHPOW which will likely be the only token that has some sort of value due to the miners backing it.

Thus many people would maximize their on-chain value of your ERC20 assets on the Ethereum chain in order to double their assets and swap all assets to ETHPOW to be sent to a CEX to sell it.

However, it is not so simple, because everyone will be doing the same. Bot activities, MEV sandwiches, and gas prices will be insanely high on the first couple of blocks.

Here's how you can prepare to profit

Connect to the ETHPoW chain once the merge happens, you will likely need to find the RPC details and connect to it as it will not be the default chain for your wallet. A good website to use is chainlist.org but even they may not have it so you might need to do some research beforehand.

Cash and carry trade

Right now ETH futures are lower than ETH spot prices, presenting a possible arbitrage trade. Cash and carry trade is a popular arbitrage strategy that involves buying the underlying asset of a futures contract in the spot market and carrying it for the duration of the arbitrage.

This is a pure arbitrage trade if you do not care about The Merge. Right now, because there is a huge selling pressure on the ETH DEC futures, the price is in backwardation, meaning it is lower than the spot price. Thus you would buy ETH DEC futures, it is about $30 lower than ETH spot prices as of this writing. Next, you would short ETH perp contract for the same amount to delta neutralize the position, so you do not carry any directional risk.

For every ETH position you do, you will earn the difference between the futures and perp contract, once the ETH futures expire, it will go towards the ETH spot price, capturing this $30 spread. However, it is possible that after The Merge on Sep 15, most of the shorts on the ETH DEC futures will close their short / hedge position by buying back, causing it to go into contango, increasing your profit margin to more than $30.

However, take note that you will be paying negative funding rate for shorting ETH during this period as well, thus you should weigh the cost and reward for doing this trade and determine if it makes sense. For these trades to be properly profitable, it usually requires a large amount of capital.

Buy cheap stETH on Curve.fi

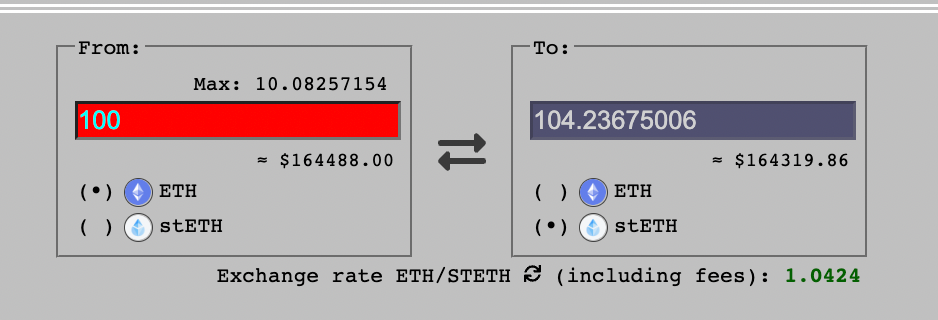

A straight forward strategy is simply to buy stETH. At the moment most people are selling their stETH into ETH on Curve, creating a discount on stETH.

As of this writing, the discount is about 4%, so if you have 100 ETH that you have no urgency to sell, you can now have 104 stETH, earning you 4 ETH when the Shanghai upgrade finally arrives where you can withdraw your stETH into ETH.

If you are worried about a sell-the-news event, you can also hedge your ETH exposure by shorting ETH on perps or futures. This is useful as your hedge can be opened for the short-term or all the way until the Shanghai upgrade, but take note that the funding fee may eat into your profits the longer you hedge.

Shorting ETH can be done at Demex as well, on our new ETH perps pair.

Maximize your ETH holdings

You want to maximize your ETH holdings because you will receive ETHPOW on a CEX, or on your metamask depending on where you hold ETH. ETHPOW will likely be worth something hence you want to maximize this amount.

If you are holding asset-backed collateral that will lose its backing on The Merge such as stETH, USDC or USDT, you may want to consider lending it on AAVE and borrowing ETH to maximize your ETH holdings.

These assets will get dumped the fastest, however many others will be doing this as well hence you should monitor your health factor closely and the borrowing APY fee is expected to skyrocket as well. On The Merge day, you can probably ignore your health factor and get liquidated as the collateral you provided (stETH, USDC, USDT, etc) is effectively worthless but the ETHPOW you have will likely hold some value. You will want to send your ETHPOW to an exchange that supports it which brings us to the next point.

If you don't want ETH price exposure as we are potentially still in a bear market, a popular strategy to benefit from The Merge is to buy ETH spot and short ETH futures or perps either partially or fully, so you still receive the airdrop without taking the directional risk. This is the reason why the ETH DEC futures are in backwardation.

If you are an absolute degen, and we don't recommend this obviously (none of this is financial advice by the way), you can leverage using real-world loans to do this strategy to maximize your airdrop without much directional risk.

Create accounts on multiple CEXes that support ETHPOW

This is important for two reasons, you want to be able to send your ETHPOW to sell it to USD or ETH, and you want multiple choices in case the CEX of choice is down for maintenance or disable deposits temporarily.

Coinbase recently announced that they will pause deposits and withdrawals during The Merge but Poloniex has announced that they will be supporting ETHPOW. Other exchanges that support include Bitmex, MEXC, Gate, and Okex.

If you are holding ETH on a CEX through The Merge, you need to check with them if they will airdrop you immediately and that it can be sold. It would be disadvantageous if your airdrop comes days after The Merge as the price may have dropped a lot by then.

Liquidity pools

Because everyone will look to swap out to ETH, you want to make sure you unpair your liquidity. Use a wallet scanner like Debank or Apeboard and withdraw all your liquidity from every pool. Do this earlier because gas fees might get very high towards The Merge and especially the initial period after The Merge.

If you are lucky you can probably still get some liquidity and swap into ETHPOW but there's no guarantee.

What could go wrong?

Assuming The Merge goes well, what else could go wrong? Listing your ETHPOW NFTs to sell on Opensea after The Merge to get free ETHPOW can potentially get your NFTs on the PoS Etherum chain stolen through replay attacks.

Let's explore what replay attacks are.

When a hard fork (The Merge) takes place, the existing chain splits into two. ETHPOW will potentially use the same chainID as ETHPOS as well. Thus, if a person had a wallet before the fork, a transaction processed on one chain by a person will also be valid on the other one.

As a result, a malicious actor who received NFTs from someone else who listed them on the POW chain could switch to the POS chain, replicate the transaction and fraudulently transfer the NFT away on the POS chain.

This is unlikely to happen as Opensea will probably have some security measures.

To avoid this, before The Merge, you need three wallets. Wallet A (can be your main wallet) first sends assets to a secondary wallet (B), and your third wallet (C) can stay idle first.

After The Merge, the assets from wallet B can be sent to wallet A for the PoS chain and the assets from wallet B can be sent to wallet C on the PoW chain. This would break the connection and allow you to mess around with the PoS chain safely, including selling your ETHPOW NFTs.

Replay attacks cannot happen now as the new wallet is not part of the shared history of the chain. Take note that wallet A should not be used on PoW and wallet C should not be used on the PoS Ethereum chain.

TLDR Conclusion

- Maximize your ETH amount before The Merge

- After The Merge, swap all your assets to ETHPOW

- Send ETHPOW to an exchange and sell it

We hope everyone remains safe during The Merge and even get some value out of this event!