Valuations are important in uncertain market conditions to create speculation based on the future growth of protocols. This article will briefly discuss and compare what Demex and SWTH could be worth against some of the biggest leveraged trading protocols in DeFi.

Introduction

Most users prefer leveraged trading via centralized platforms that typically provide a simple user experience and clean user interface. So why do we need decentralized perpetual exchanges?

This is similar to all things DeFi where users are looking for self-custody of their funds which cannot be controlled by a centralized party and the anonymity that comes with not having to reveal your identity through KYC. On top of that, we’ve seen popular centralized platforms plagued with issues during periods of high trading demand while DeFi platforms have weathered those conditions much better.

Despite current market conditions and volume pulling out, the volatility of crypto makes it a tradeable asset class during both bull and bear cycles. Whether you are a trader or not, you may still be able to profit through tokens relating to those trading platforms.

I will not be diving into the different protocols but rather evaluating their current valuation based on various numbers such as volume or revenue and project a realistic growth for speculation.

This article assumes that you understand what leveraged trading or perpetual swaps are. If you would like to read more about them, you can do so in our previous article on perps. I have used many of these platforms myself but only a handful of times as I am not an active trader.

Let’s get started.

Intro to Demex

Since not many people are aware of Demex (short for Dem Exchange), let's expand on the protocol before looking at their numbers.

Demex is a decentralized exchange (DEX) built on the Carbon blockchain. It offers spot, futures and perpetual derivatives for users to trade with.

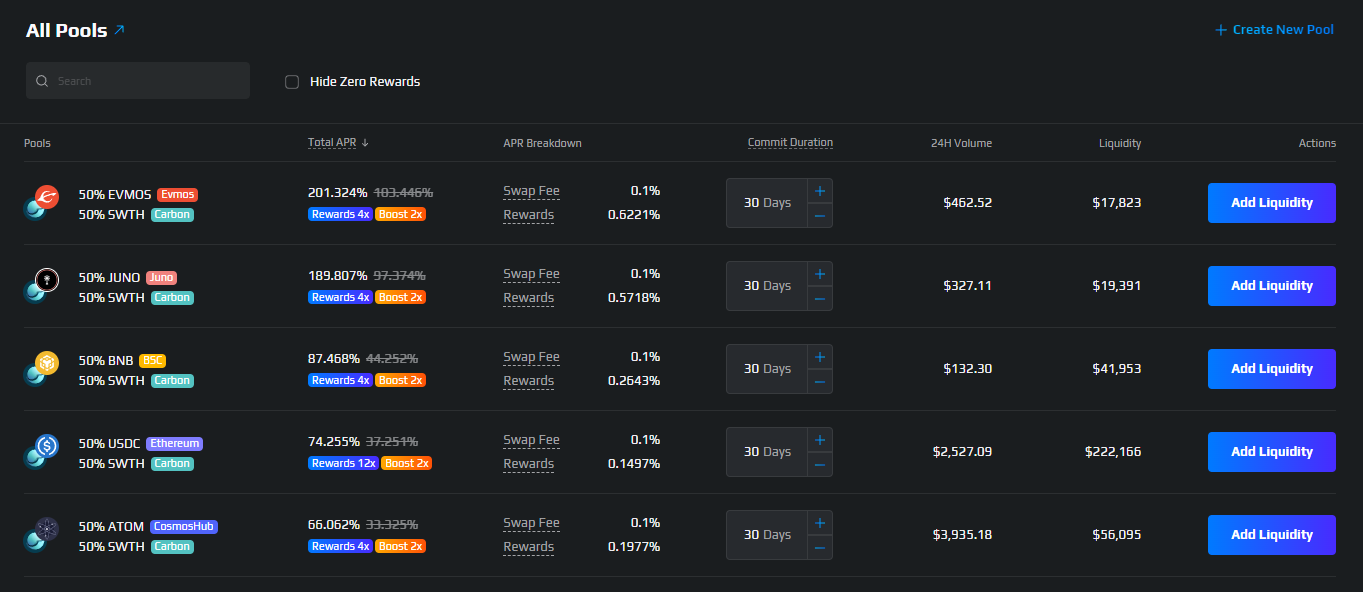

Unlike most CLOB DEXs like dYdX that use pre-selected market makers to provide liquidity, Demex stands out by utilizing an algorithm that takes liquidity from its liquidity pools and spread it across the order book on its platform. This means anyone including you and I could be market makers by providing liquidity on Demex.

This unique approach allows anyone to list new assets easily, without any permission. Currently, there are 57 trading pairs among the 42 cryptocurrencies listed. This includes popular tokens like ETH, BNB, and ATOM. What's even better? These assets are native to their blockchain as Demex supports multiple different networks on top of Carbon such as:

Ethereum, BNB Smart Chain, Cosmos IBC Chains, Evmos, Neo, Zilliqa

The exchange also offers up to 150x leverage (currently set to 50x), which would be the highest amount of leverage offered among both CEXs and DEXs. This allows traders to maximize their profits with little capital; super capital efficient as we like to call it.

Demex might even include stocks, forex, commodities and indices as their user base grows to a greater size. The Carbon team has plans to branch out and build a money market (Aave model) that comes with its native Carbon stablecoin (MakerDAO model), which would be a perfect suite of products to onboard retail users.

Now that you have a better understanding of Demex. Let's look at some numbers.

Demex Numbers

Demex shares its native token with Carbon known as SWTH, similar to Helix (DEX) and Injective (Chain) where they both use INJ as the native token.

SWTH has a maximum supply of 2.16 billion tokens. This is hard capped unlike some of the other tokens on certain exchanges (ahem DYDX) and will be 100% released by Q1 2025.

The circulating supply of SWTH is around 79%, of which the team owns 20% (bonded). For the other 59% in the ecosystem, 80% of SWTH is either staked on Carbon or used to provide liquidity on Demex. We wrote an article on the various use cases of SWTH here.

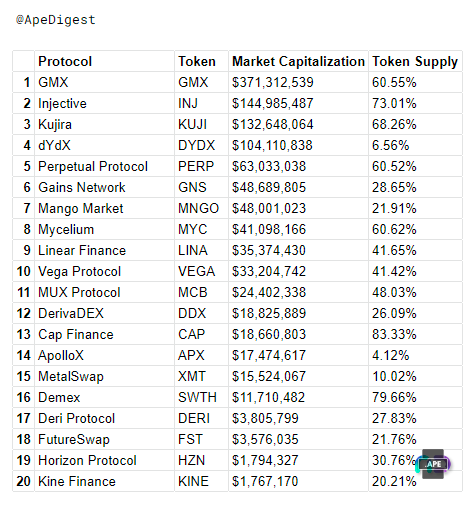

Despite its great features, SWTH only has a market cap of $10.5 million, the lowest among Cosmos perpetual DEXs and one of the lowest in the entire crypto market.

Derivatives Volume

Derivatives make up a majority of the market value in traditional finance. Estimates suggest a gross derivative market value of $12.4 trillion in 2021. It is only natural for the crypto markets to experience a similar sort of impact following that of traditional markets.

Derivatives in crypto are currently dominated by centralized exchanges (CEXs) that trade over $100 billion in daily volume across all exchanges. Compared to decentralized exchanges (DEXs) which have only seen an average of $200 million in daily volume over the last year.

dYdX has been leading the derivatives market in DeFi since its inception and is able to garner an average of $1 billion in daily volume due to its ongoing incentives that encourage traders to utilize the platform in return for DYDX rewards. This is unsustainable in the long run as traders will eventually dump these tokens which will lead to massive selling pressures on DYDX and eventually lose its user base once the incentives are gone.

Comparing the Numbers

Now let's compare what happens if Demex reaches dYdX volume. For some context, dYdX has a circulating supply of 6.56% (aka 93.44% of future dumping), with a soft-capped total supply of 1 billion DYDX.

This means there would be inflationary selling pressure even after all their tokens have been unlocked, which gives them a valuation of roughly 16x of their current market cap.

For tokens with high growth potential (10x or more), we want to look at those with a low market cap (SWTH) and a high token supply circulating in the ecosystem (also SWTH).

Demex vs dYdX

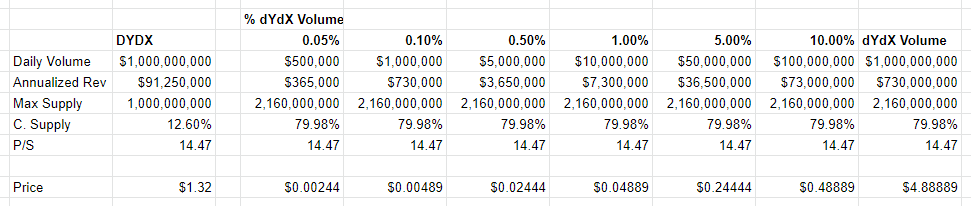

Starting with dYdX, the exchange consistently averages 900 million to 1 billion in daily volume. Demex would be able to achieve this with 7.5x less capital trading on their platform due to the 150x leverage that they offer, as compared to only 20x leverage on dYdX.

If we speculate on Demex growing to a percentage of dYdX daily volume while matching their current P/S ratio, you can see that SWTH has a lot of upside potential especially if Demex is able to gain some market share on the leading perpetual DEX.

In an extremely fortunate scenario when Demex matches dYdX in daily trading volume at $1 billion and 14.47 P/S (assuming their valuation makes sense), SWTH would be worth a whopping $4.89 which is worth 800x of its current value.

How is this possible? As trading volume increases on Demex, so does the revenue from trading positions. This assumes 100% of SWTH will be in circulation and rewards to SWTH stakers will be generated from the real yield on Demex.

Carbon Money Market vs Aave

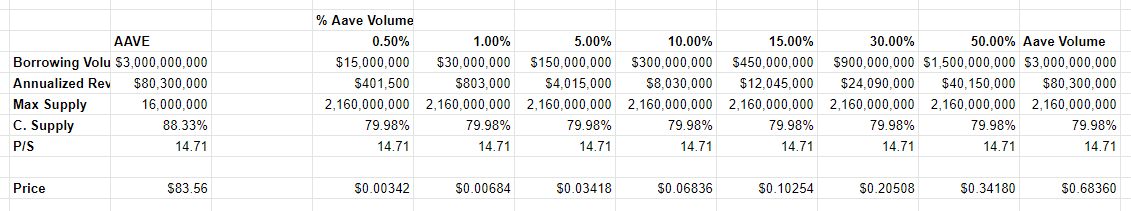

In our previous article, we mentioned Carbon will be launching a money market in line with our very own decentralized overcollateralized stablecoin (following the DAI model). For this, we will be projecting how much SWTH could be worth if our money market is able to reach that of Aave, the leading money market in DeFi. Now let's compare Aave with our upcoming money market to project future valuations.

Since the money market is not live, we can only speculate on the potential volume of activities. Based on my estimates, if we take 1% of Aave's daily borrowing volume the current P/S ratio of 14.71, SWTH is easily undervalued by 2 times its current price. This is definitely possible as Carbon is compatible with both IBC chains and EVM chains like Ethereum, BSC, etc.

Assuming that one day the Carbon Money Market would gain enough traction to surpass Aave in market share, SWTH would be worth an additional $0.68 which is worth 100x of its current value on top of other streams of revenue.

Final Thoughts

With so many upcoming developments like options and money markets, Carbon is set to become a multichain DeFi hub, with Demex at the forefront of utility. This will improve liquidity and capital efficiency across multiple chains, bringing both IBC, EVM, and non-EVM compatible networks together.

Based on the projected valuations, SWTH definitely seems to be undervalued based on projected valuations. If you are looking to purchase SWTH after reading this article, you can do so directly on Demex, or pick them up on Uniswap / Osmosis.