A quick look at staking history

To understand where liquid-staked derivatives come from, let's take a quick look at the history of crypto tokens first.

The first mainstream tokens like Bitcoin and Ethereum used the consensus algorithm of proof-of-work (PoW).

However, PoW consensus is a slow, energy-intensive process using expensive and fast computers to verify and validate new blocks to the blockchain. They have been criticized for their environmental impact and slow transaction speed.

The next generation of blockchains uses a consensus algorithm known as proof-of-stake (PoS) which requires users to stake their tokens in the network, locking it up to be used by validators to validate transactions and secure the network.

In exchange for staking, users are rewarded with staking rewards. However, they have to go through an unbonding period between 14-30 days if they are withdrawing their tokens from the network in order to transact with it.

Why hasn't Cosmos's DeFi ecosystem exploded like in Ethereum?

There are a couple of reasons, from staking rewards to lack of composability, let's go through them.

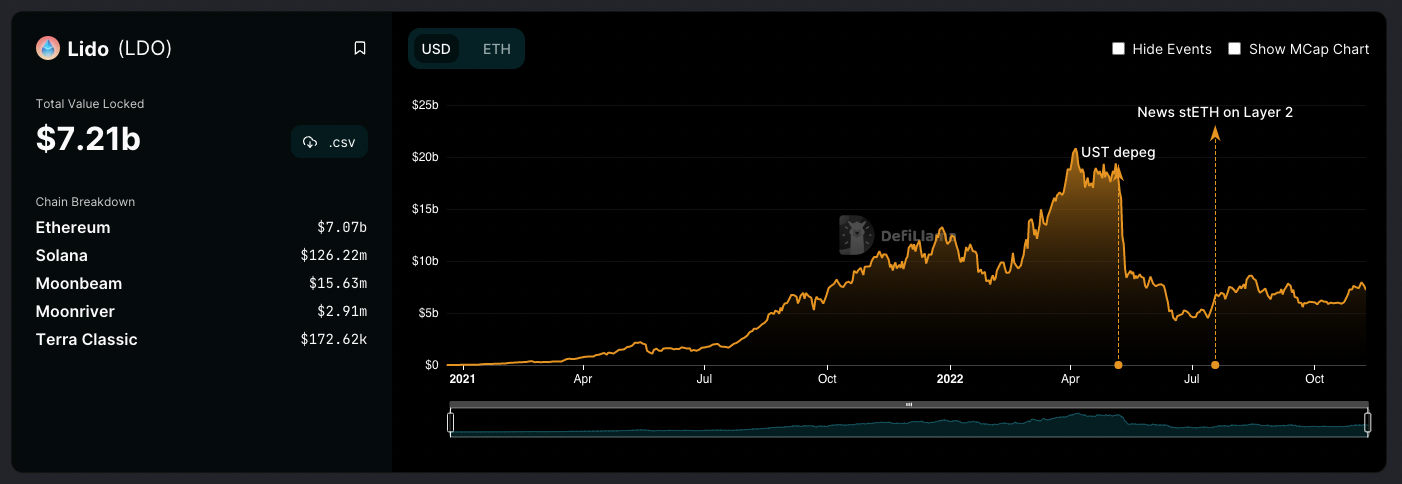

Cosmos tokens have high staking rewards

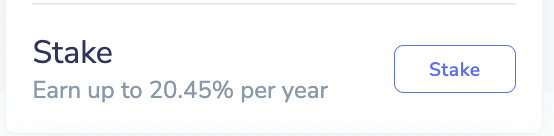

On Cosmos, the staking rewards are often far higher than Ether's staking reward of around 5% a year.

ATOM staking APR ranges from 0% to 30% depending on the amount of ATOM staked, and is currently over 16% which is quite significant.

Looking at most tokens in the Cosmos ecosystem, the staking APR is generally high with most APRs above 20%. In this article, we talked about why Cosmos's PoS tokens have high APR as they need to incentivize validators in their early stages.

This staking APR is essentially a risk-free yield apart from price action, which is very attractive for passive investors. However, although users can earn sweet staking rewards, it is not capital efficient as their tokens are locked up and cannot be used in DeFi activities to possibly earn higher yields.

Simply put, before liquid staking, users had to choose between:

- Staking and locking up their tokens to get passive staking rewards and securing the network, but miss out on high yield through DeFi

- Using the tokens for active DeFi activities to earn a higher yield, but miss out on passive staking rewards and not helping to secure the network

Cosmos ecosystem did not have many DeFi activities to do

This choice was really easy for users as looking at DeFi on Cosmos, there are not many interesting protocols, and most can't compete to give a higher yield than the staking yield to attract users. Trying to generate higher DeFi yield may also come with more unsustainable ponzinomics, or additional smart contract risks for users.

Additionally, before the implementation of interchain features, the Cosmos ecosystems were fragmented and there were not many interesting DeFi protocols and activities that can be done on Cosmos, compared to monolithic chains like Solana and Ethereum where protocols were more composable.

In the end, the lack of interesting protocols, composability, and DeFi opportunities led to most users preferring to simply stake and earn passively instead of using their ATOM for DeFi activities, stifling the growth of DeFi in Cosmos.

Liquid staking to the rescue

Thus to promote DeFi growth in Cosmos, liquid staking is a key factor as it enables users to stake to secure the network and still earn the high staking reward, while still using their staked assets to participate in DeFi, bringing their liquidity to various protocols on Cosmos ecosystems and allowing for more DeFi activities such as lending, liquidity provision, etc to be possible.

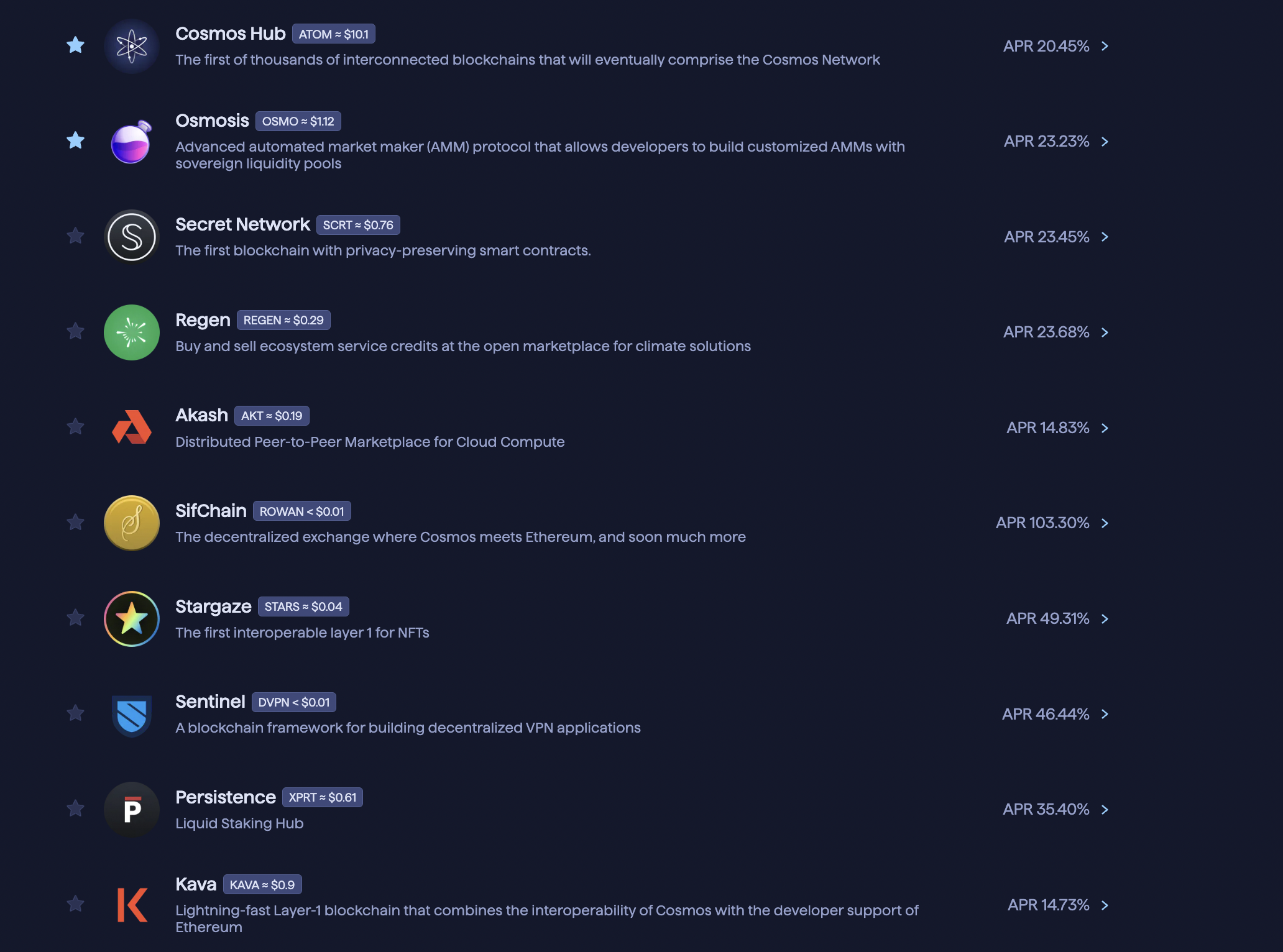

This is where liquid staking providers (LSP) come in to solve this inefficiency in DeFi by giving users a liquid token in exchange for their staked token. This is known as a Liquid Staked Derivative (LSD) as it derives its value from the underlying staked token.

What can you do with liquid-staked derivatives?

Essentially, with liquid staking and liquid-staked derivatives, users can:

- Be more capital efficient as users can use their staked assets for liquidity, helping the Cosmos ecosystem be more robust with more liquidity

- Have a better user experience as it is easy to deposit PoS tokens for higher APR, or redeem them if they need more liquidity for the native PoS token

- Continue to secure the network while enjoying DeFi activities

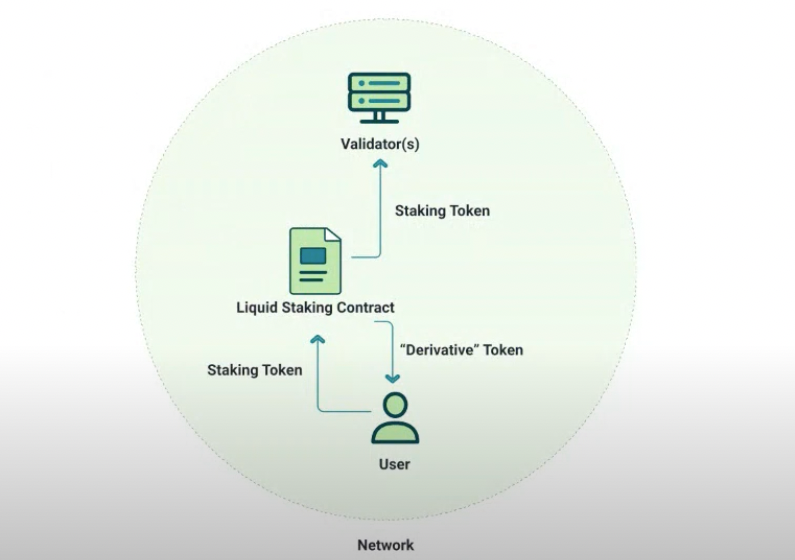

As an example, liquid staking was popularized by Lido protocol on the Ethereum network with their creation of the first LSD - liquid staked ETH, or stETH, which is backed by staked Ethereum, a proof-of-stake token, earning around 5% a year.

Lido was popular as independently you would need 32 ETH locked up to be a validator, which is a lot of capital that is being locked up. Lido's stETH token allowed users to deposit any amount of ETH to be exchanged for stETH and can then be used in DeFi for lending, borrowing, liquidity provision and more, allowing users to earn additional DeFi yield on top of staking rewards.

Lido is so popular that as of this writing they lock up over $7 billion in liquid staked assets across various EVM chains, and have over 200,000 different users.

Therefore, LSDs helped to solve this dilemma, allowing users to earn both staking rewards and DeFi yield with their holdings.

To know more about liquid staking, here’s a video by Cosmos.

There are a few liquid staking providers (LSPs) that are being built, with Stride Zone and pSTAKE being live already.

We will be covering Cosmos's liquid staking providers in another article.

Why will liquid staking change Cosmos's DeFi ecosystem?

Currently, over 200 million ATOM are staked (about 64% of the circulating supply) according to atomscan.com, and most of them are locked up and unable to participate in DeFi.

Currently, the liquidity of Cosmos is mainly in Osmosis with a liquidity of about $200 million. With the help of liquid staking, this massive staked ATOM capital, over $2 billion of market cap as of this writing, is beginning to be unlocked and enter DeFi protocols, all without being unstaked, providing strong security to the ATOM network still.

More ATOM holders are likely to stake their ATOM in liquid staking protocols as well to receive additional yield, further increasing the security of the ATOM network. Coupled with the upcoming interchain security feature, not only can liquid-staked ATOM be used in DeFi, the staked version of ATOM can still help to secure other app chains, promoting more rapid prototyping of interesting DeFi app chains, creating more DeFi activities within Cosmos.

Additionally, Cosmos is now even better equipped for DeFi activities to flourish due to fast transactions, low fees, scalability, security, and a slew of upcoming interchain features that promote seamless cross-chain interoperability.

To facilitate this transition, a Cosmos liquid staking module was created so users can migrate to the liquid-staked version of tokens without going through the long unstaking period which can take 2-4 weeks, and keeping networks secure during the entire transition.

The combination of unlocking capital through liquid staking, ease of launching new app chains that are secured by an increasing amount of staked ATOM, and overall improvement in composability with more interchain features coming, will make Cosmos DeFi thrive in the near future.

There are lots of benefits with liquid staked derivatives, but what are some challenges with LSDs that we should take note of?

Challenges with LSDs

Switching Cost

Currently, users are required to unstake / unbond if they have staked tokens before they can stake with Stride. During this unstaking period, users will not be able to obtain the staking rewards which can be viewed as a switching cost.

To tackle this, some liquid staking protocols like Stride can have a Switching Cost Rebate Program which would calculate the amount of staking rewards missed out and compensate users, perhaps with their governance tokens.

Additionally, many liquid staking protocols like Stride and Persistence can also use the Liquid Staking Module (LSM) made by Iqlusion which allows staked tokens to be converted into liquid staked tokens without the need to unstake and miss out on staking rewards during the unstaking period which would improve the user adoption and experience.

Security and Risks

Liquid staking involves smart contracts and with that comes additional security risks. To mitigate this risk, liquid staking protocols can introduce rate-limiting capability, i.e. Stride will be able to temporarily halt activity should there be any suspicious fluctuations, safeguarding the deposits.

Additionally, an LSP can choose to focus on simplicity to minimize attack vectors, such as having an app chain that only does liquid staking and does not support smart contract deployments to reduce attacks vectors, or decides not to launch any other dApps on the platform such as a money market or a dex, making it harder for an attacker to depeg an LSD as they need to bridge it out.

Risk of Centralization

If a particular LSP becomes really popular, it could gain more liquidity and utility, creating a positive feedback loop that increases its market share against competitors. This could lead to an LSP that monopolizes most of the liquid staking for multiple networks, making it susceptible to censorship demands or other abuses of power and undermining the integrity of the network.

Even if an LSP has a wide validator set in the beginning, it is possible that over time, the validator set can become more exclusive, either due to governance tokens getting concentrated by a few whales, leadership changes, or certain behind the scene deals happening. Therefore it is important for the community to keep a constant close eye on how the validator sets are being included by LSPs.

As LSPs are still new on Cosmos, a validator set framework is still being standardized, so it is important that LSPs continue to get input from their community to ensure they are fair to validators.

Leveraging on low liquidity liquid-staked Tokens

With the introduction of lending and borrowing money markets coming into Cosmos, such as Carbon's own money market called Nitron, it will be easy to leverage up on LSDs to get higher staking returns.

The summary is, a user would deposit liquid-staked ATOM as collateral, borrow stablecoins against it and use it to buy more liquid-staked ATOM, and loop it till a risk level and liquidation price that they are comfortable with.

The more times they loop, the higher the staking reward, but the tighter the liquidation price as well. Degens being degens, many will try this without thinking about the consequences if it all comes crashing down.

Right now the liquidity of stATOM/ATOM on Osmosis is less than $10 million. If just 5% of all ATOM stakers leverage stake, it will be over $10 million additional $stATOM created without increasing the publicly available liquidity.

If a black swan or crypto market crash occurs liquidating stATOM leverage stakers, the liquidation of $10 million stATOM will crash stATOM price temporarily on Osmosis due to liquidation bonuses, and due to arbitrage, ATOM price will follow suit, potentially creating a big red candle on ATOM. This impact would be even worse for other PoS tokens with even lesser liquidity.

The ecosystem will still live on as nothing fundamentally broke, but the price may take time to recover, and the community and public image may be damaged if many retail degens are caught in the liquidations. Cosmos money market protocols should thus take note of this but due to game theory, it will be hard to avoid.

Despite this, we will be showing how Nitron users can achieve over 50% staking reward on liquid-staked ATOM, and the risks of doing that in another article.

Conclusion

LSPs like Stride, Persistence, Quicksilver and others, are building a desirable service that help users unlock the capital of their staked token, allowing them to participate in DeFi, further growing the Cosmos ecosystem.

Each LSPs are taking their own unique approach, at least at the start, and it is interesting to see how they play out and differentiate from each other, not just in terms of technology, but also how they integrate with other dApps to improve the utility of their LSDs.

At Carbon, the hope is that Cosmos will have multiple successful LSPs, and will integrate with as many LSPs as possible to democratize the playing field, as long as they pass the security audits, so we can all enjoy greater yield and liquidity while securing our favourite networks.

If you enjoyed this article, stay tuned as our next article will talk about synergies and strategies of LSDs on Carbon as the money markets and stableswap pools gets launched which will increase staking rewards further!