A fully decentralized exchange relies on more than just smart contracts. It needs network participants like validators to perform computing tasks, and stakeholders to guide the growth of the network in issues that cannot be automated. In return, the exchange needs a currency to align the various actors so that they act in the interest of maximizing the net benefits for all network participants. This is where the Switcheo Token (SWTH) comes in.

We're sharing with you a 3-part blog series about how the Switcheo Token is being restructured. The first post of the blog series highlighted the new basic mechanics for SWTH. This will help to ensure that Switcheo TradeHub is sufficiently secure and decentralized with the necessary incentives.

A well structured token economy also ensures the token’s value grows in a stable manner with its network usage. In part 2 today, we'll explore additional incentive mechanisms and other advanced ways SWTH can be used on Switcheo TradeHub.

Rewards from the TradeHub Insurance Fund

Currently, Switcheo Exchange provides spot market trading and atomic swaps for cross-chain trades. The fully collateralized, “one-to-one-backed” accounting nature of non-custodial spot trading means that the counterparty risk is essentially zero.

With Switcheo TradeHub, we will be introducing more sophisticated financial markets via an upcoming platform, called Demex. This platform will offer derivatives contracts for traders whereby users will also be able to trade on margin. A traditional margin facility allows users to trade with a value that is multiple times the capital they deposit, thereby amplifying their profits and losses.

For example, if trader Bob deposits 100 USDC for trading, the margin facility will provide him with up to 100 times the amount deposited. Bob can now open a much higher value position than his initial capital.

Let’s say Bob now takes a long BTC position of 1 contract at $10,000. If the price of BTC moves to $10,100, Bob would achieve a profit of $100, effectively doubling his initial capital. In this instance, Bob has achieved a profit of 100% when the underlying has only moved by 1%, through a 100x leverage of his capital.

However, in the event the price of BTC moves down to $9,000, Bob would be in the red by $1,000 and the collateral he deposited would not be sufficient to cover his losses even if he exits at this price.

With this type of trading facility, a traditional exchange would require traders to immediately top-up their collateral if their remaining collateral drops below a certain limit (maintenance margin). This is known as a margin call. If the margin call is not satisfied in time, the trader’s position would be forcefully closed by the broker (liquidation).

In this case, the trader’s losses can exceed his deposits, and if the funds for some reason cannot be recovered by the exchange, the legal system would be used to resolve the dispute.

However, it doesn’t work the same way for cryptocurrency derivative exchanges. Crypto markets are more volatile, are open 24/7, and have fewer layers of intermediaries to cover losses, making it difficult to ensure the system will be sufficiently collateralized at all times. The pseudo-anonymous and distributed nature of traders coming from various countries make it impossible to physically pursue traders for losses as well.

Instead, the trader’s position would be liquidated the moment it drops below the maintenance margin so that it can be closed before the trader goes bankrupt and begins losing more than he deposited. However, if the underlying moves too quickly and the trader goes bankrupt before his position can be closed by the exchange, some form of socialized loss, such as Bitmex’s auto deleveraging system (ADL) is used. This system may deleverage traders in profit in the event a losing trader’s position cannot be closed above bankruptcy in time during a liquidation event. In this case, the exchange ensures the system is collateralized by deleveraging the profiting trader’s position at the losing trader’s bankruptcy price.

Note: Bankruptcy price is when a trader's losses exactly equals the collateral they've deposited while liquidation price is when the exchange begins to automatically closing a trader's position, which will arrive slightly before the bankruptcy price is reached.

This is obviously not ideal, as it limits the profiting traders’ upside, who may have wanted to close it at an even better price. In fact, without an additional system in place, the maximum profit for any trader is constrained by the total deposits of all parties with an opposing position.

To avoid that, a separate system known as an “insurance fund” is typically set up by such exchanges. The insurance fund holds a pool of monies that the exchange can use to cover such losses and avoid deleveraging winning traders.

The insurance fund is typically funded by positions that were liquidated; Rather than returning the remaining funds to the trader after liquidation, any excess funds are instead pooled into the insurance fund to cover losses in future liquidations.

Switcheo TradeHub has an insurance fund feature that is able to collect funds from liquidated positions that were closed above their bankruptcy price. It will not only cover losses from losing trades but will also payout potential black swan events.

A downside of insurance funds is that, in a low volatility environment, they can grow beyond the needs of the exchange quite quickly. This results in the open interest of the exchange being “over-insured”, with no way to effectively use or withdraw the pooled insurance fund.

Switcheo TradeHub will payout over-insured “premiums” to stakers once it exceeds a threshold that is based on trading volume and open interest. This allows traders to take an interest in the fund through SWTH, using it as a passive earning mechanism, or a hedge against their trading downside.

In order to bootstrap the insurance fund quickly, SWTH holders will also have an option to directly contribute to the insurance fund when it launches. These underwriters are eligible for a preference share of the fund, and they will receive a larger proportion of each insurance fund payout, and will also receive it first.

To sum up, there are 2 ways to benefit from the insurance fund. Firstly, SWTH stakers will automatically accrue a baseline payout by the proportion of staked tokens. Secondly, those who wish to underwrite the insurance fund directly by contributing SWTH directly to the fund can do so, forgoing staking benefits but potentially earning the lion’s share of each payout.

Benefits From Participating in Liquidity Pools

Having sufficient liquidity is fundamental to an exchange. Traditionally, liquidity is provided by market participants and market makers.

In DeFi, creating liquidity is a collective effort. Users may lend their tokens to liquidity pools to boost liquidity, or mint new types of tokens by locking in collateral in the form of an existing token.

Let’s discuss these methods in detail and how it relates to SWTH token holders.

Earn From Providing Liquidity

On-chain DEXs have eliminated the need for intermediaries and human market makers to a good degree. Instead, automated market makers (AMMs) are used to fill orders without a counterparty. AMMs determine prices for trades using a mathematical formula that takes into account token supplies in the pool to automatically price trades. This concept was first proposed in a Reddit post by Vitalik Buterin a few years ago. A project inspired by that proposal is Uniswap, which currently the most active on-chain DEX in DeFi at the moment.

However, for AMMs to function, they need liquidity. The larger the liquidity pool the better the price AMMs can fill (with lower slippage). This is done by allowing anyone who has the tokens in their wallet to deposit them into shared pools. In return, trading fees collected from trades are paid out to them. This creates a natural market selection in DeFi as users get to choose which tokens they would are willing to lock up.

For example, Alice has $500 and wants to provide liquidity in the ETH/USDT market. She will have to mint an equal proportion of both tokens, i.e. $250 worth of ETH and USDT respectively. When there is a trade for this market, the exchange charges the trader a small commission as trading fees. Assuming the liquidity provided by Alice is 5% of the entire ETH/USDT liquidity pool, she will earn 5% of the trading fees charged by the exchange.

Similarly, to boost liquidity on Switcheo TradeHub, we have designed an incentive model for users who provide liquidity to our native liquidity pools. Liquidity providers will share the maximum maker rebate. They will also earn a percentage of the block rewards, weighted by the trading volume of each pool. Finally, an additional liquidity pool reward based on pool size (smaller pools will earn more) will be issued off-chain by Switcheo. We are giving liquidity providers multiple reward channels to ensure that Switcheo TradeHub will have the best incentives for them, which will translate to liquid order books.

Switcheo TradeHub will implement multiple types of AMMs that use these liquidity pools. For example, novel AMMs that newer exchanges such as Futureswap use will also drive our perpetual derivative markets. The bonding curves for each market will also be flexible so that higher efficiency in the usage of liquidity can be achieved. All of these native liquidity pools will be used in addition to those already on Ethereum, such as Kyber and Uniswap.

Get Instant Liquidity With SWTH

In order for you to easily provide liquidity without losing exposure to SWTH, Switcheo TradeHub will introduce a Collateralized Debt Position (CDP) mechanism. CDPs, made popular by the Maker protocol, is a permissionless lending mechanism that requires borrowers to deposit crypto assets in return for borrowing another type of asset, such as DAI.

This mechanism can be applied to decentralized exchanges to create a stronger demand for their native token while also providing liquidity to the exchange.

With the launch of Switcheo TradeHub, SWTH holders can lock their tokens into a CDP and mint USD at a 500% collateralization ratio.

For example, when a SWTH holder deposits and locks in USD1,000 worth of tokens through a CDP, USD worth $200 is minted. This $200 is considered a debt that has to be repaid in an event the user wishes to withdraw the $1,000 locked in as collateral. The USD minted can only be used for depositing into Switcheo’s native liquidity pools at the start.

Eventually, we will also allow staked tokens to be used in CDPs. However, these tokens will be automatically unbonded and sold at a greater discount during a CDP liquidation event.

More details on our CDP mechanism will be available prior to the launch of this feature.

Governance Voting Rights

New Financial Markets

We have spoken extensively about the need to have diversified financial markets.

When TradeHub launches, we will have a mechanism for anyone to create markets where the underlying are crypto assets, by paying some SWTH as a network fee (to prevent spam markets) and backing a minimum amount of liquidity into the market’s liquidity pool.

However, it is important to support markets not limited to cryptocurrencies such as real-world assets like commodities, currencies, indexes, and more. To that, we will transition Switcheo Foundation into a full-fledged Decentralized Autonomous Organization (DAO), powered by the SWTH token. Switcheo TradeHub will then accept on-chain proposals for the creation of new derivatives markets not limited to crypto assets. This will be voted on by token holders through the DAO.

The market creator pays a fee in SWTH to have the market created on Switcheo TradeHub once it has been approved.

All market creation fees are automatically distributed to SWTH stakers as with other network fees.

TradeHub Improvement Proposals

Moving to an on-chain order matching engine with Switcheo TradeHub will also require consistent protocol improvements in order to support the growth of different market types and platforms running on this blockchain. To ensure users in our network are able to make proposals for protocol improvements, we will also be structuring a governance model for this purpose through the Switcheo Foundation DAO.

The participants in our network will be empowered to make TradeHub Improvement Proposals (TIP) using our transparent system and vote for changes they wish to see in the blockchain’s protocol. Other than proposals for protocol improvements, TIP relating to collateral and specific types of grants can also be made in the future.

Users’ voting rights and weight of their votes will rely on the number of tokens they hold / stake and their voting reputation in the ecosystem. A clear set of guidelines will be published when we commence the governance feature on Switcheo TradeHub.

Other Incentives from Staking

Apart from the incentives discussed above, stakers will earn 100% of the network and trading fees collected from the various transactions on Switcheo TradeHub.

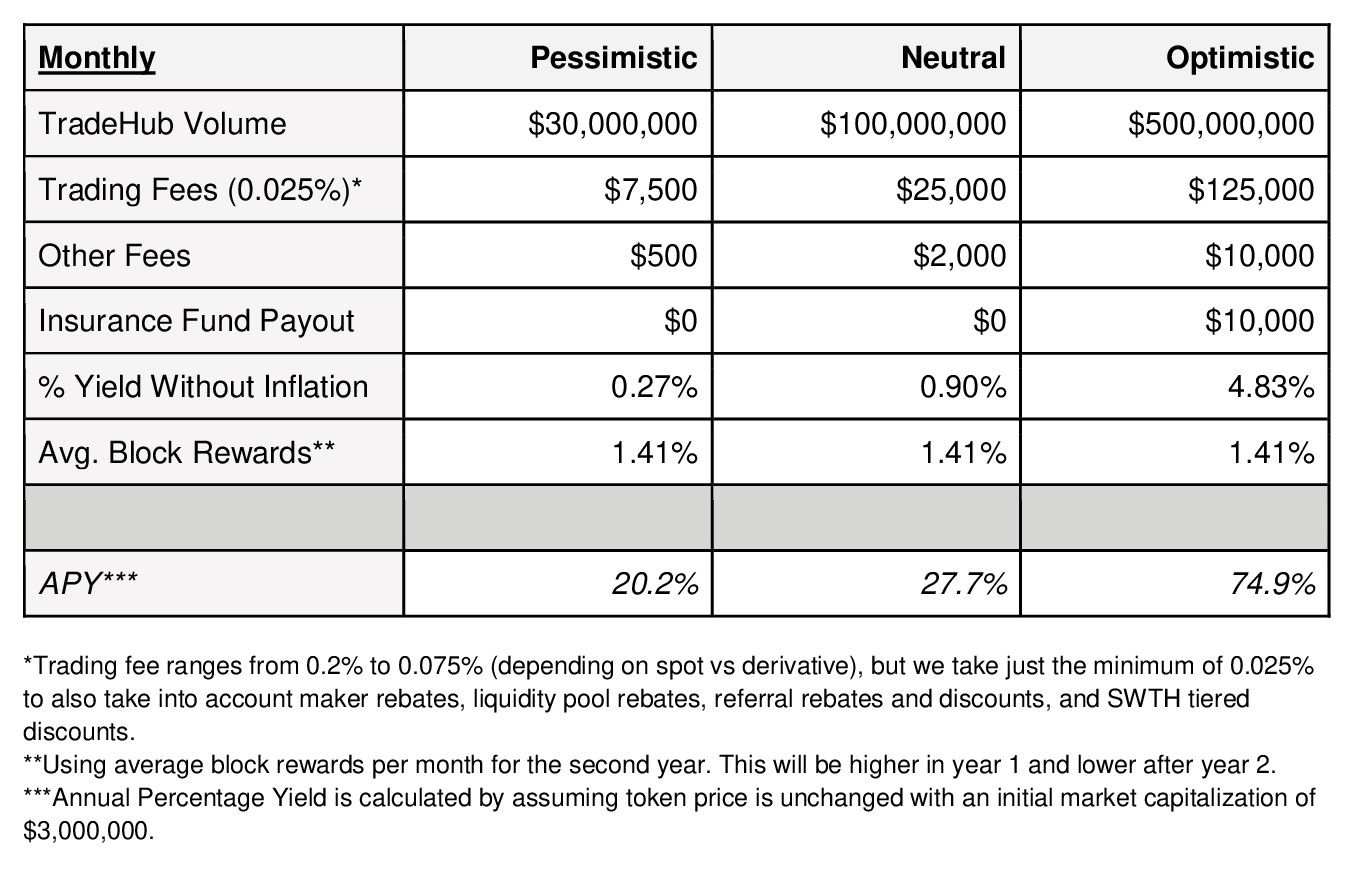

The table below gives a better visualization of the reward and incentive schemes. Note that all numbers are for illustrative purposes only and are not guaranteed in any way or form.

Conclusion

To sum up, here’s a recap of all the different ways SWTH holders can participate in, or earn rewards with the launch of Switcheo TradeHub;

Staking SWTH

- Earn rewards from validating transactions

- Accrue fees automatically accrued from insurance fund

Holding SWTH

- Receive Tiered Trading Fee Discount

- Earn higher payout by underwriting insurance fund

Staking or Holding SWTH

- Receive voting rights & staking incentives for new market creation

- Participate in governance via TIP

- Receive liquidity through CDP

- Earn rewards for providing liquidity

We hope this post sheds some light and gives you clarity on our plans for the Switcheo Token. Thank you for your support in our collective journey towards building a fully decentralized exchange!

Notice

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product, cryptocurrency, digital token or financial instrument, to make any investment, or to participate in any particular trading strategy.

Switcheo does not take into account your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Switcheo. Switcheo also does not warrant that such information and publications are accurate, up to date or applicable to the circumstances of any particular case.

Cryptocurrencies and digital tokens are subject to high market volatility and risk. Please apply your own due diligence before buying or selling cryptocurrencies and digital tokens. Switcheo will not be responsible for monetary losses.

For more information on Switcheo: