Trading cryptocurrencies has jumped in popularity over the years contributed by the many rags-to-riches stories.

It has inspired many to look into cryptocurrency trading as a means of earning a side income or completely replacing their income. Many people do not treat trading seriously and end up losing money.

In order to be a profitable cryptocurrency trader, a proven system of rules is needed before you begin your trading journey.

Let's explore 3 beginner rules for trading cryptocurrencies.

Trading vs Investing

Before we begin, it is important to clarify the difference between trading and invest. In investing, you analyse assets to determine their potential valuation and you invest if you believe it is fairly or undervalued depending on your belief of their growth potential and your time horizon.

Investing is similar to a long-term committed relationship. Just like when your relationship is dropping, you would put in more effort, when the price of an asset that you understand deeply drops, you would put in more money. This is assuming your view has not changed, that the asset remains attractive (undervalued) in terms of the potential reward (or happiness) it can bring you in the future.

It is important to note that, because cryptocurrencies are so nascent, this emerging technology does not have a standardized valuation framework, and are largely driven by narratives and speculation, largely from influencers. Thus most cryptocurencies may not be suitable for investing as there is no clear established ways to value them, thus many investments are actually closer to speculations.

Unlike investing, trading is more similar to dating which are generally shorter-term and if things are not going well, you need to cut your position and move on to the next attractive and hot trade. With so many hot narratives popping out frequently, trading cryptocurrencies is more suitable, and can even be more profitable, and exciting, which brings us to our first rule of trading.

1. Creating a Trading Plan

Before we go into the tools and strategies of trading, it is important to have a goal and timeframe in mind so that you can follow this plan to remain disciplined.

A trading plan is a way to help you make better decisions when it comes to trading. As everyone has different motivations and risk profile, your trading plan will always be tailored to you, but you can use this outline as a guide.

1. Knowing your motivation for trading

Why do you want to become a trader? Is there a financial goal you want to work towards? Write down these reasons and numerical goals, and have a plan on how to get there.

For example, if you want to earn an additional $6k a month. That amount can replace a lot of full-time income. Because crypto is 24/7, you can divide that amount by 30 days, thus you need to earn $200 everyday to make about $6k a month.

This amount may be difficult in TradFi, but because crypto is full of opportunities and volatility, it is possible to find a profitable set up that can earn you this much everyday.

One important thing when making financial goals is not to shift the goal post further too quickly. If your goal is to make $200 a day, and you have already hit that amount and taken profit, it is best to call it a day and trade again after you have rested.

And if your goal is to make $1 million by 30, and you hit it early, do not shift it to $2 million immediately. It is best to cash everything out into your bank account and take a well-deserved break before you get complacent and lose it all.

I cannot count the amount of friends that have reached their financial goal and eventually lose it, time and again, because they did not cash out and take a break.

2. Knowing your financial situation

What is more important? Limiting your risk or maximising your earnings? Managing your risk is more important as it allows you to stay in the game so that you can eventually hit your goals. If you maximise your earnings but lose it all eventually, you are out of the game and it may be tough to make it back.

Knowing this, how much money can you allocate to trading? Keep in mind that this amount should be something that you can afford to lose and will not immediately change the financial conditions of your life.

This is because it is highly possible that you lose this entire sum so you want to do the math and determine what is the maximum loss you are willing to take before you even start trading.

Once you know your maximum loss for your entire trading account, you want to set what is the maximum loss you are willing to lose per trade? It is recommended to keep this to a small amount such as 1% and no more than 3% of your total trading account.

For example if you are willing to set aside $10k, keep your maximum losses per trade to $100-$300. This is especially true if you are a beginner as it helps you to stay in the game until you improve.

3. Deciding your time commitment

Trading can be highly time and energy intensive, so knowing how much time you can spend trading is important in determining the type of trading strategies you apply.

Can you trade during work, or is your occupation that of which you can only trade in the morning and night time?

If you have more time and flexibility, you can apply day trading strategies that can be executed with higher frequency or look at a shorter time range such as 15 minutes or an hour, but if you have less time, you may want to look at swing trading strategies that can take place over days or even weeks.

4. Having a trading diary

As you trade, you make mistakes and learn along the way. A trading diary makes you far more conscious of the decisions that you take and you remember your mistakes more.

This can be done on excel and an entry to your diary can include things like your entry and exits as well as your rationale and emotions for doing so. If things awry and you deviated from your plan, it is also useful to note it down.

This can be a very time intensive process, and it favours longer term traders more as they will spend less time inputting entries if the frequency is lesser.

Now that you have a better understanding of your trading plan, it is time to move on to trading strategies.

2. Using proven trading strategies

A trading strategy is primarily a set of rules that determine when you enter and exit a trade.

This is important because half the battle is won in trading if you have a well defined trading strategy that is proven to work.

If you are a beginner, it is best to just focus on one proven trading strategy until you are very familiar with it, from the setups it is looking for, the type of environment it does best in, etc. I recommend trading only in an uptrend because the R/R for going long is far better than going short especially if you are new.

But what is a proven trading strategy? There is no one strategy to conquer the market and you should apply a different strategy work for depending on the market, whether it is a bull trend, sideways trend, or a downtrend.

Trading is hard enough, so realistically you should start off with a pattern you can easily distinguish just with your eyes.

Knowing the market structure

The first step to trading is to know your environment. This is sometimes also known as market structure. If you were to look at this chart, where do you think it is more likely to go, up or down? Without any other info, the answer is down, simply because the trend is down.

'The trend is your friend, until it ends.'

Let's take a look at another example. Where do you think this chart below is going to go? Your eyes can see an uptrend, so it is more likely to the top and to the right.

This is what we mean by market structure, and breaking the uptrend is also known as breaking market structure.

It is recommended to trade only when you have a clear understanding of the market structure, as the market structure tells you where the price is more likely to go next, and that is quite literally half the battle won.

Now that we know how to identify the current market structure, we can move to be implementing a trading strategy.

Uptrend market strategy

Assuming we are currently in an uptrend, a simple trading strategy could be to go long on the dips when price touches an area of previous support.

Note: Even if we are in a macro downtrend, we can still have pretty strong uptrend relief rallies where alts can go up 100%. This is why waiting for the market to break up form the downtrend and going long instead is more favourable for beginners as it is much more difficult to earn 100% shorting the market.

This support can be a moving support such as a moving average or an upwards trendline in an uptrend. It can also be a fixed support on a horizontal line that was tested previously.

It is best not to complicate this and just use one or maximum two indicators.

If you're looking at the daily chart, I recommend the 20 exponential moving average (EMA). We use exponential for crypto because it is more volatile and it the EMA will give us more trigger signals, and thus more opportunities.

Using a moving average indicator is suitable when clear horizontal lines of support and resistance cannot be found due to the volatility of the asset.

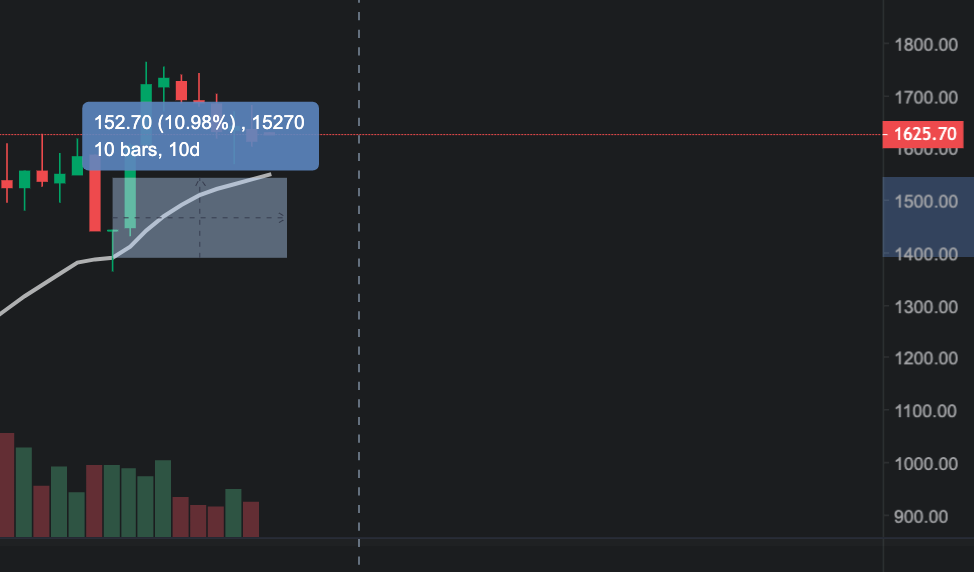

Taking a look above, you can see that this indicator can give you an edge as it has been retested successfully a couple of times. During the previous downturn, the 20 daily EMA acted as resistance, and now it is looking to act as support. Hence the next time $ETH goes down to the 20 EMA, you may consider going long, with a tight stop loss below the EMA.

This stop loss can either be based on another indicator like the average true range or as simple as using your maximum loss that you are willing to take each trade.

If you were to buy when it touched the 20 EMA, you would at least be up 10%. Knowing when to buy is only one part of a strategy. Knowing when to take profit is just as important. A simple profit taking strategy can be to sell when your entry condition is voided.

For example, you can set a stop loss 1% below the 20 EMA.

Stochastic RSI strategy

Another indicator you can use the stochastic RSI. This is an indicator that oscillates over time within a band. It is used to discover short-term overbought or oversold conditions.

This is a highly reflexive indicator which means that it is better for active traders but it can also print more false signals. A false signal is a signal that doesn't result in a successful trade.

I like to change the settings such that the lower limit is 10 or 15, and the upper limit is 85 or 90. This results in lesser false signals but it does not eliminate them fully and you still have to be nimble and discipline, cutting loss when needed.

Here's an example. In the chart below, we are on the 6 hour time range in a bullish market structure, hence we wait for a buy trigger. The buy trigger using this indicator would be when the stochastic RSI points up and crosses the lower limit. The profit taking trigger is when the indicator goes up and then goes back down below the upper limit of 85.

In this case, we were lucky that ETH went up 40% before the take profit occurs. This is a rare case and we should typically expect 5-10% moves instead.

3. Defining your risk-reward ratio

Because a lot of crypto tokens do not have clear intrinsic value models, they are highly speculative. This means that many market participants use technical analysis instead of fundamental analysis.

The great thing about using technical analysis (TA) is that you can focus on setting stop loss and take profit levels that are sensible to you from a TA point of view.

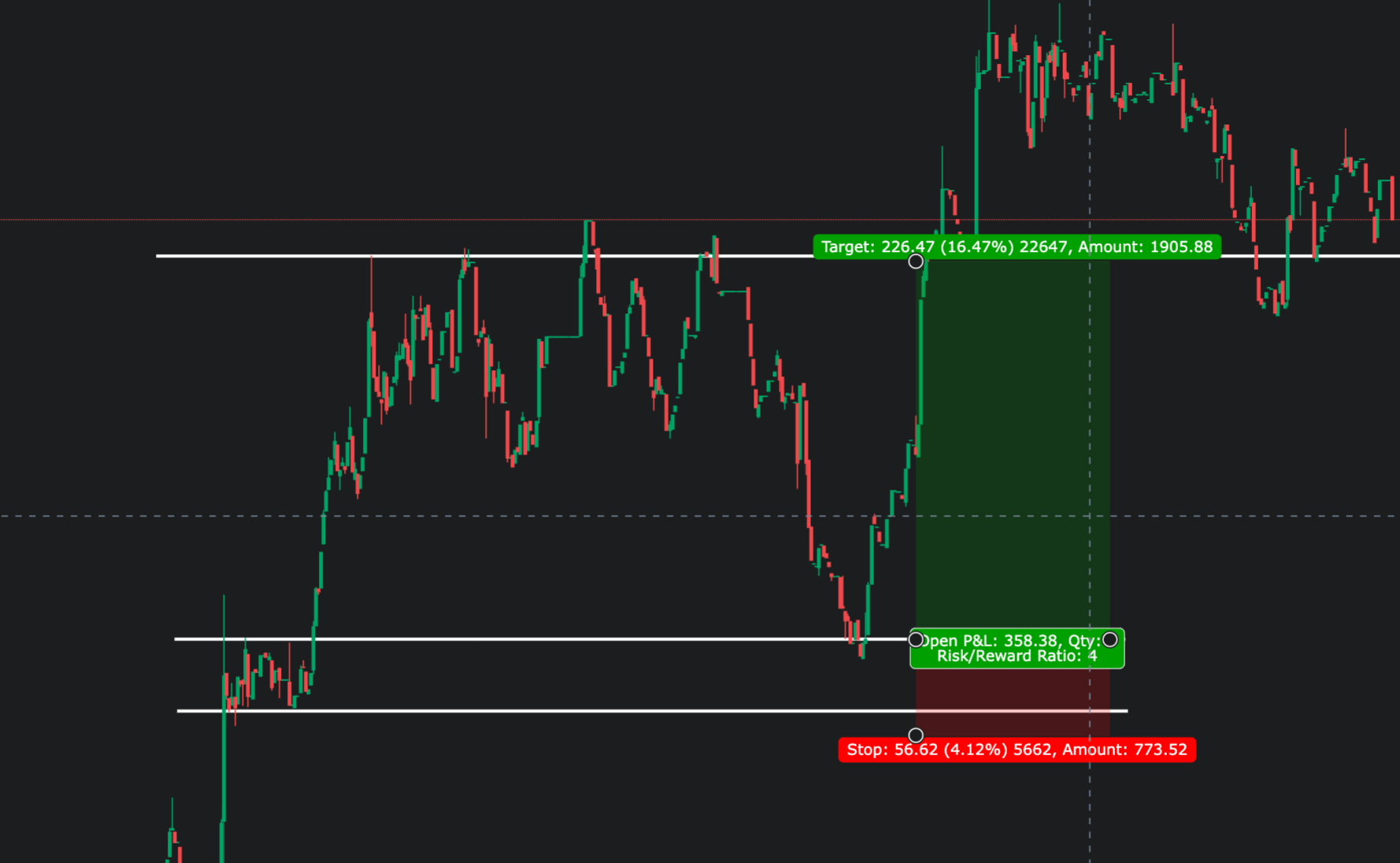

Let's use the below chart as an example.

Risk reward ratio is easier to calculate when looking at fixed horizontal levels instead of moving levels or using slanted lines. Once you determine an area of horizontal support and resistance, you can set a long entry when price approaches the support level. Your profit taking price will be the area of resistance.

You can look at the next support level to determine your area where you want to cut loss, as it could mean that the trend may be changing if it breaks multiple supports. Now you can use the 'long position' tool to calculate your stop and your target to see the risk/reward ratio. Anything more than 2x is preferred and in this example we have a 4x which is excellent.

Being a successful trader is also being a disciplined and patient trader. If you do not see an opportunistic setup that can give you at least a 2x in risk reward, you should not force a trade, and instead wait patiently.

A volatile market like crypto will almost always give you the opportunity to have an at least 2x risk reward setup multiple times a week.

Conclusion

As long as you have a trading plan in mind so that you can learn as you go, and you are using a proven trading strategy that has an above 50% win rate, and entering trades with a risk reward ratio that is at least 2x and above, you're likely to make money over a period of time.

Don't give up, start with smaller sums of money and slowly scale up, and you will find that trading may be a great supplement to your existing income!