Over the past few months, the NFT space has experienced a period of explosive growth. To the uninitiated, it might seem ludicrous that millions of dollars are being spent on online jpegs and pngs which can just be copied/saved by anyone on the internet. However, anyone familiar with the concept of on-chain ownership knows that the world of digital ownership is quickly evolving - an evolution made possible by the incidence of trustless and permissionless blockchain technology.

This NFT boom represents a significant development in the crypto industry. Art and culture are becoming irreversibly entwined with blockchain technology and on-chain ownership.

Crypto-natives are already familiar with ownership of boring, replaceable, fungible tokens. These nameless tokens are devoid of any character and story, with each being exactly the same as the next of its kind.

With Non-fungible tokens however, each token is unique and tells its own story. NFT collections such as Cryptopunks or Bored Ape Yacht Club mark significant points in the development of internet art, community, and culture. The immutability of smart contracts on Ethereum ensures that no more than 10,000 NFTs from both of these collections will ever exist. Crypto-technology has created the possibility for digital scarcity, which is required for any kind of online ownership to truly exist.

This tweet thread by Twitter user @punk6529 neatly lays out the monumental potential and societal importance of NFTs:

1/ On NFTs 2030

— 6529 (@punk6529) October 1, 2021

However bullish you are on NFTs, you are wrong.

You are insufficiently bullish.

6529 has gone to the mountaintop and there is almost nothing in life that 6529 is as sure of as this

@Punk6529 theorises that in the future, NFTs will be central to the formation of decentralised organisations and that the addressable market for NFTs is not just art, but all societal intangibles’ (brands, culture, Metaverse, governance etc.).

How to evaluate NFTs - A Framework

Even if NFTs are here to stay, that does not mean that ALL NFT projects will survive. As with most cases of explosive Cambrian growth, it is likely that most projects will not survive the next couple of years.

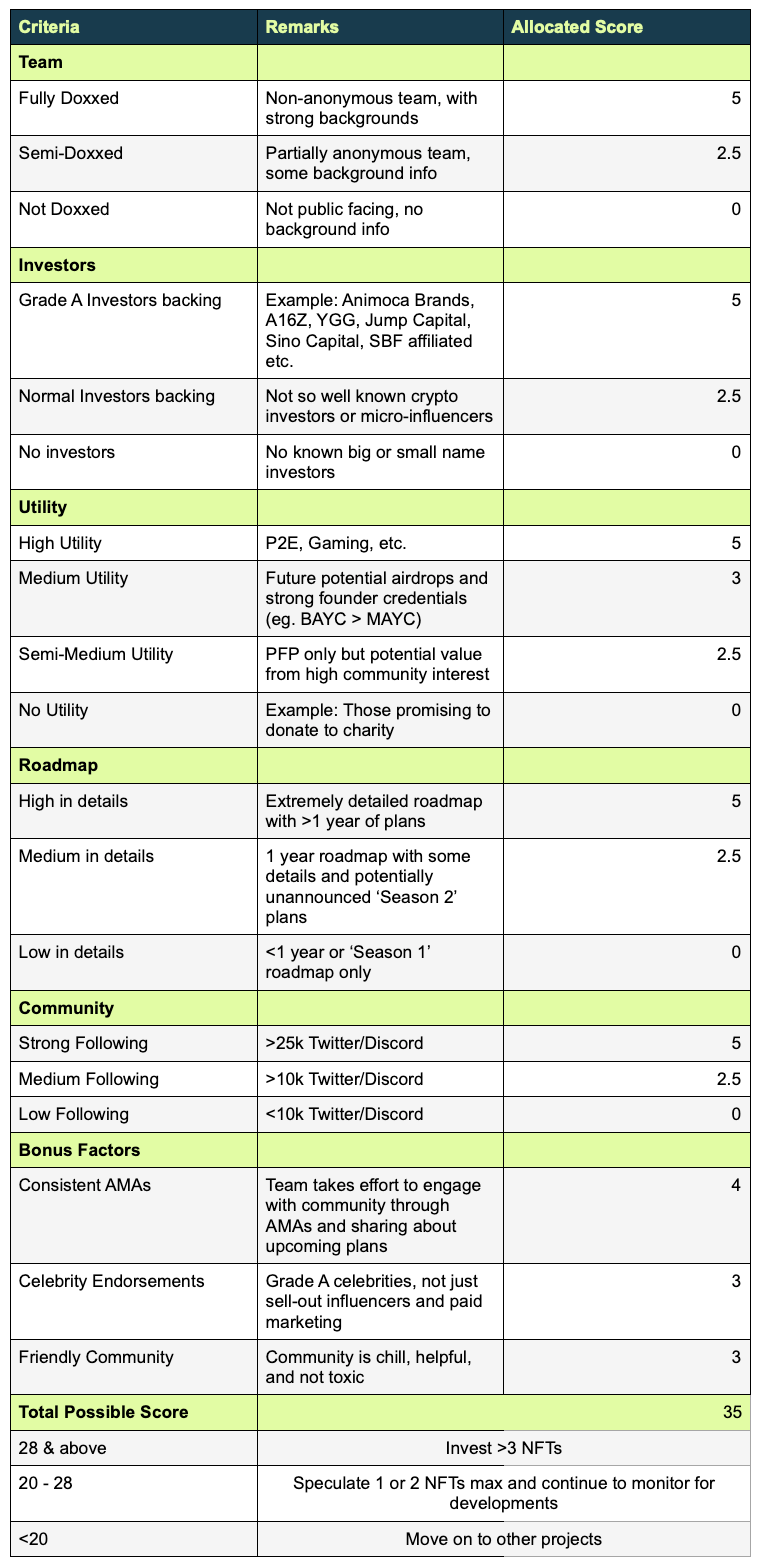

When choosing which NFT projects to invest in, it is always helpful to have a form of framework to determine the quality of each project. Twitter user @cloudDeFi created a framework that might be useful to the beginner NFT investor:

Are NFTs on all chains created equal?

If you adopt the mindset that the future is multi-chain and cross-chain, then the natural assumption would be that NFTs on different chains will each have their own historical significance. Just as CryptoPunks were the first profile picture NFTs on Ethereum, projects like Solarians on Solana, The Bear Market on Zilliqa, or GalacticPunks on Terra could also eventually be viewed as historically and culturally significant.

Solarians

Solarians are a collection of 10,000 NFTs on the Solana chain, and the first generative on-chain NFTs on Solana. The team behind Solarians is also responsible for building DigitalEyes, an NFT marketplace on Solana. The team has stated that Solarian holders will collectively receive a cut of the royalties generated from sales of Solarian NFTs on the DigitalEyes platform.

The Bear Market

The Bear Market is a collection of 10,000 randomly generated NFTs on the Zilliqa blockchain. It is one of the first NFT projects to launch on Zilliqa, and the first profile picture project. The Bear Market marks a significant point in Switcheo x Zilliqa history, and allows purchasers to own a piece of Switcheo x Zilliqa culture.

Our Switcheo team is also building a decentralised NFT marketplace on Zilliqa. Stay tuned for more updates 👀

Galactic Punks

Galactic Punks is a collection of 10,921 NFTs, and the first NFT project to launch on the Terra blockchain. It had its public mint on October 2 2021, at a mint price of 3 $LUNA. Since then, the floor price for Galactic Punks has skyrocketed to 62 $LUNA (at the time of writing). According to the Galactic Punks roadmap, holders will be airdropped 1/1 spaceship NFTs to go along with their Galactic Punks.

3 NFT projects on Ethereum to look out for:

Bored Ape Yacht Club | NFT Score: 33/35

Total number in collection: 10 000

Mint Price: 0.08Ξ

Current Floor Price: 35Ξ

If you know anything about NFTs, you’ve likely come across the Bored Ape Yacht Club. The project was available for mint on 30 April 2021, and quickly grew to become one of the most prominent NFT projects. With a total market cap of over 396,000 Ether (over $1.4 billion USD), BAYC is second only to CryptoPunks (valued at a market cap of around $2.5 billion USD) in terms of total valuation. In just 5 months since its creation, BAYC has firmly claimed its spot as one of the top NFT PFP projects, second only to CryptoPunks.

BAYC was the first project to introduce the concept of NFT ownership granting access to a members-only online club - a concept that was picked up and used by hundreds of projects which came after. BAYC holders began to use their Apes as profile pictures on Twitter, which led to massive amounts of organic marketing for the brand and strengthened the bonds amongst the BAYC community. Numerous hashtags like #apefollowape and #apestrongtogether propagated quickly on Twitter, which contributed to the virality of the BAYC brand.

In terms of brand strength, BAYC is definitely one of the top NFT projects on the market right now. Prominent celebrities and online figures such as The Chainsmokers, Stephen Curry, Logan Paul, KSI, and many more are known to be holding Apes. Many of them have also changed their public-facing Twitter profiles to one of their Ape.

Leveraging on the strength of their brand, the BAYC team has also been able to provide financial utility to Ape holders. So far, the team has airdropped Bored Ape Kennel Club and Mutant Serum NFTs to Ape holders. Due to demand to be a part of the BAYC brand, these NFTs command a high valuation. The cheapest BAKC on the market is currently going for 2.69Ξ, and the cheapest Mutant Ape (acquired by using the airdropped Mutant Serum on an existing Ape) is going for 4Ξ. These airdrops add up to a total of 6.69Ξ worth of value given to Ape holders at no additional cost (around $23,000 USD at current Ether prices!).

With the release of their Season 2 roadmap, the BAYC team promises to bring even more value and utility to Ape holders. Real-world events like ApeFest and the Miami Clubhouse blur the lines between online and offline culture. As NFT culture continues to permeate into the real world and vice versa, NFTs will begin to play a significant role in the wider global economy.

Season 2 Roadmap:

SIPHΞR | NFT Score: 29.5/35

Total number in collection: 10 000

Mint Price: 0.1Ξ

Current Floor Price: 0.329Ξ

For readers who are looking for a lower entry point into the world of NFTs, there are plenty of other projects to look at. In particular, there has been increased attention directed towards NFTs which are linked to online games. By some metrics, the PFP market seems rather saturated. Popular PFP projects such as CryptoPunks, BAYC, Cool Cats and the like, already command floor prices above 10Ξ. This is perhaps above the average budget for an investor who is just looking to get started with NFTs.

On the other hand the market for game-linked NFTs is still relatively small, and growing at a rapid pace. The explosive growth of Axie Infinity has demonstrated the high demand that exists for blockchain games. However, we have yet to see an NFT-gaming project firmly take the second place spot behind Axie Infinity. SIPHΞR is one of the many game-related projects which is looking to capitalize on this area of growth.

The project had its public mint of 10,000 SIPHΞR INU NFTs on 9th September 2021, and was sold out within 20 minutes. According to the project’s roadmap, the team is building an online MOBA-style mobile game which will be playable in June 2022. Players will be able to use their NFTs as in-game characters.

The team plans to release 4 more collections of NFTs in addition to the initial 10,000 INUs. Depending on the number of SIPHER INU NFTs held, investors will also be eligible for pre-sales and free mints for these 4 additional collections. This will be determined in accordance with their Guildmaster Program.

The usage of NFTs within virtual games is perhaps one of the most straightforward utilities that NFTs can provide. Axie Infinity has already laid the groundwork for this area of expansion. Axie Players can purchase Axie NFTs, which can then be used as in-game characters that players can use to duel in a turn-based strategy game. In a similar vein, SIPHΞR NFTs will be used as playable in-game characters in an online MOBA-style mobile game. The gaming industry is massive, currently valued at over $300 billion USD. If NFT game projects can even capture a sliver of this enormous market, that would easily be a 100x-1000x growth from its current total valuation.

Cool Cats | NFT Score: 31.5

Total number in collection: 9 999

Mint Price: 0.02Ξ

Current Floor Price: 7.98Ξ

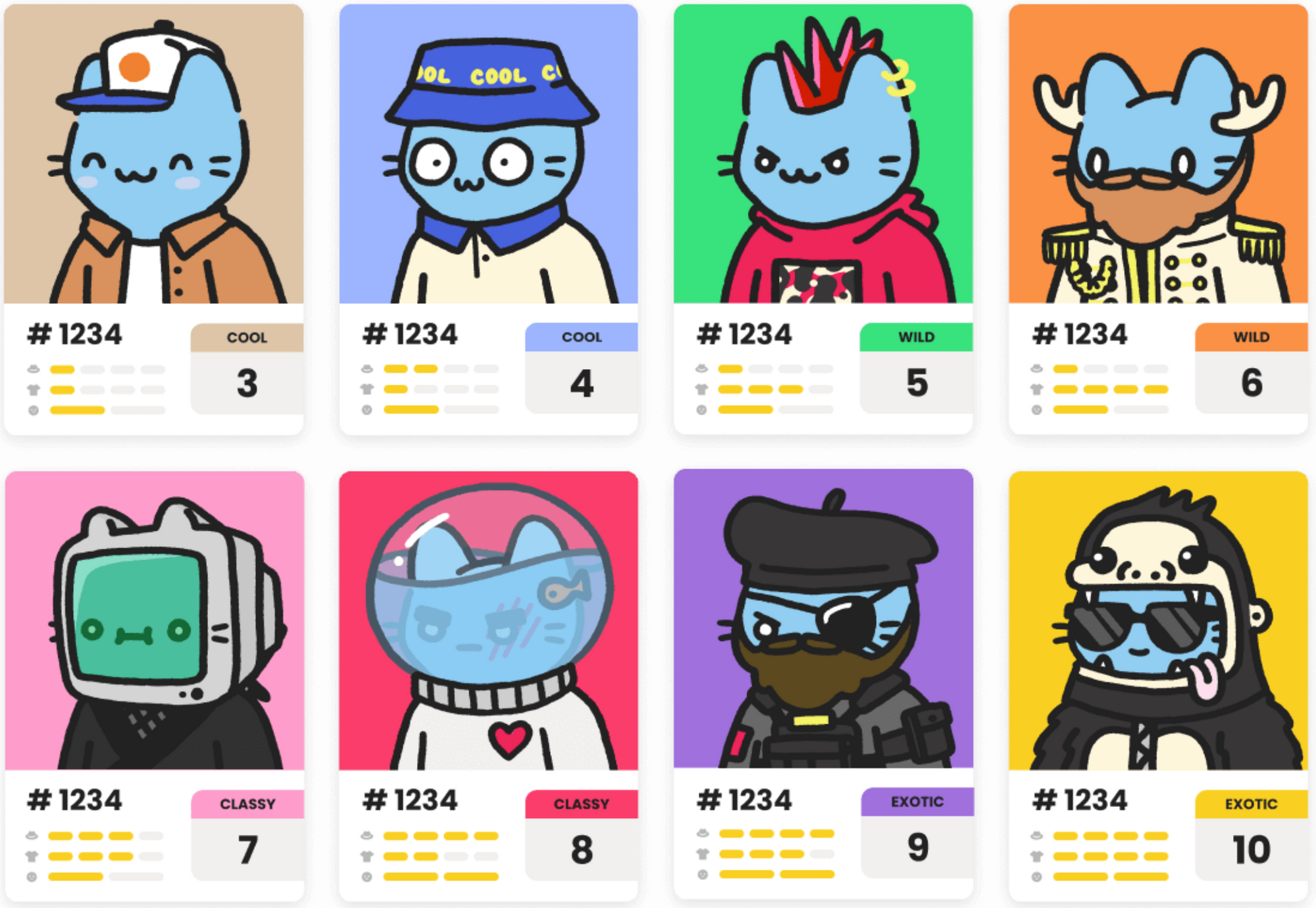

Apart from BAYC, another profile-picture project that has risen to popularity is Cool Cats. This collection of 9999 NFTs was randomly and programatically generated from over 300k total options. Depending on the items each cat is wearing, they are assigned a rarity score between 3 and 10 (10 being the rarest, and 3 being the least rare). The 'coolness' rating of cats can be broken into 4 categories:

- Cats with a rating between 3 to 4 points are 'Cool'. There are 4,599 of these cats.

- Cats with a rating between 5 to 6 points are 'Wild'. There are 3,000 of these cats.

- Cats with a rating between 7 to 8 points are 'Classy'. There are 1,750 of these cats.

- Cats with a rating between 9 to 10 points are 'Exotic'. There are 650 of these cats.

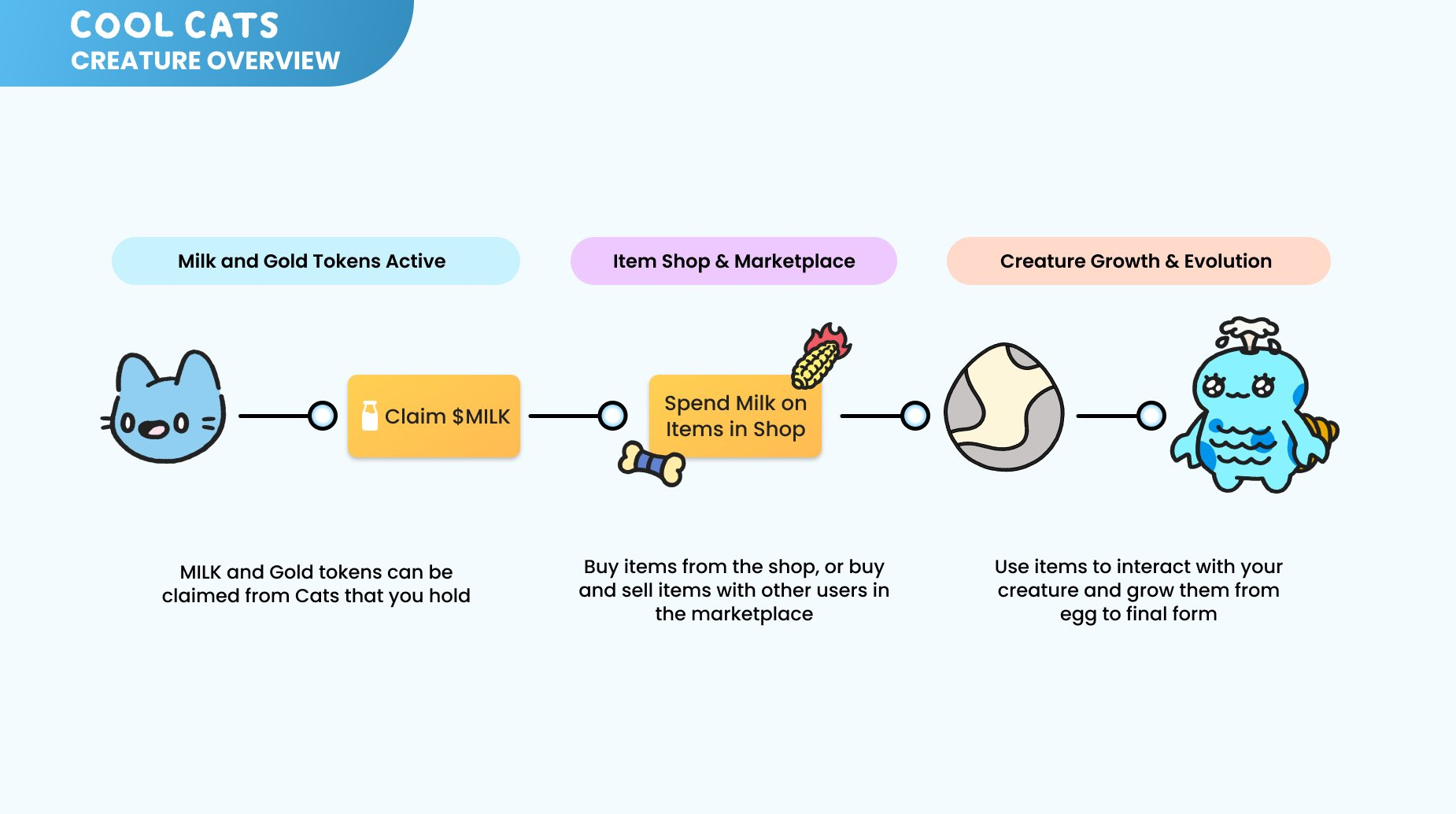

The cats' coolness rating will have some kind of effect on breeding once the Gen 2 plans are fully released. In regards to Gen 2, the team has only released this brief roadmap so far:

The Cool Cats project has a wholly different vibe from other popular profile picture projects like BAYC or Cryptopunks. Rather than the somewhat dystopian, 'punky', and blasé attitudes which underpin these 2 projects, Cool Cats brings a more lighthearted and cheerful tone. As the NFT space continues to grow and mature, we can likely expect to see new projects with all kinds of different vibes and attitudes rising to popularity. Profile pictures are quickly becoming almost central to building a lasting online personality. With so many people of different mindsets, attitudes, and personalities, it seems only right that there should be an equal variety of profile picture NFT projects to match.

Artblocks Curated | NFT Score: 32.5

Artblocks Curated is an NFT project that algorithmically generates original pieces of digital artwork on the Ethereum blockchain. So far, there are 40 different collections by 40 different artists which have been included in the official Artblocks Curated Collection. The Artblocks team has implemented an extensive onboarding process for artists who aspire to have their collections featured in the Curated Collection. This ensures that only the highest quality projects are featured on the collection, which is meant to be representative of the artworks which best represent the vision for the Artblocks Platform.

Certain collections within Artblocks Curated have experienced incredible success, accompanied by enormous valuations. Fidenza by Tyler Hobbs, currently has a floor price of 150Ξ. There are a total of 999 Fidenzas. Fidenzas were available to the public to mint on June 11 2021, for a mint price of 0.17Ξ.

On August 23 2021, a Fidenza #313 was sold for 1,000Ξ - the highest Artblocks sale at the time.

Another collection from Artblocks Curated that has risen to fame is Ringers by Dmitri Cherniak. This collection of 1000 NFTs was first minted on January 28th 2021. The current floor for Ringers sits at 105Ξ. The initial mint price was 0.1Ξ.

On 2 October 2021, Ringer #109 sold for 2,100Ξ. A whopping $7 million in dollar terms at the time (almost $7.5 million USD at today’s Ether prices).

NFTs from the Artblocks Curated platform have seen some of the highest sale prices to date. Artblocks has carved out a place as the top online curator and gallery for generative NFTs. The high demand for these pieces clearly demonstrates the demand that art collectors have for artwork that exists wholly online and on-chain.

Conclusion

Over half of the world's population have access to the Internet, and this number is only increasing. As humans begin to spend more and more time interacting with the Internet, it only makes sense that the prevalence of societal intangibles like culture, art, and entertainment which exist online will continue to grow. NFT and blockchain technology is perfectly positioned to facilitate this area of growth by allowing Internet users to digitally own property in a way they never could before, without needing to rely on any trusted third parties.