For those who are looking for an introduction to THORChain, you can view our past article here: https://blog.switcheo.com/switcheo-research-an-introduction-to-thorchain-written-29-july-2021.

What is THORChain?

THORChain is an independent Layer 1 blockchain built using the Cosmos SDK that enables swaps between native assets across different chains, eg. native $BTC with native $ETH.

$RUNE is the native token of the network to run the protocol and is used for liquidity, security, and governance, with a current mcap of $1.7 billion and a TVL of $693.2 million.

Introduction

THORChain allows you to swap natively from $ETH on Ethereum network to $BTC on Bitcoin network without relying on proxies such as wrapped bitcoin that relies on a centralized custodian.

Node Operators, which are essentially validators, help to operate the liquidity pools that pair assets of different chains, i.e. BTC, with $RUNE. The Node Operators also govern a multi-sig wallet that handles the transfers of native assets in and out of the different liquidity pools and are required to bond twice the value of the liquidity pool as a security design.

THORSwap currently acts as their main interface for swaps and providing liquidity. Every asset pair is paired with $RUNE, this means if users deposit their assets into the pool, half of it will be swapped to buy $RUNE. This creates deep liquidity for THORChain pairs as $RUNE is always the base pair.

As more liquidity enters, this will boost the price of $RUNE as half is sold into $RUNE, while also adding more liquidity to the pools. Users can also earn yield with their native assets by providing liquidity with it on THORSwap.

Incentive Pendulum

What makes $RUNE attractive for investors is the ability to determine $RUNE's fundamental value beyond speculation. This is because $RUNE has a deterministic price. As we mentioned earlier, when liquidity is added into $RUNE pairs, half is sold into $RUNE.

These liquidity pool asset sit in two vaults, the Asgard vault and Yggdrasil vault. The Asgard vault is the primary vault that holds the majority of the assets including the Node Operator's bonded $RUNE and is responsible mainly for adding and removing liquidity. The Yggdrasil vault, which is run by each node, helps to perform the swaps.

Due to the security design of the THORChain network, Node Operators are required to bond twice the value of assets of the vault in $RUNE to run a THORNode. This is . This is because their $RUNE is kept inside the Asgard vault as insurance which the Node Operators do not have access to. If the Node Operator acts in bad faith against the network by stealing the funds in the vault, their $RUNE will be taken away from them, and because they will lose 1.5x the value of what they stole in $RUNE, it is not economically sensible for them to do so.

Hence the deterministic value, which is similar to the fair value, is 3x the value of non-$RUNE assets in the pools. In other words, for every $1 of outside liquidity added in, $RUNE market cap is increased by $3.

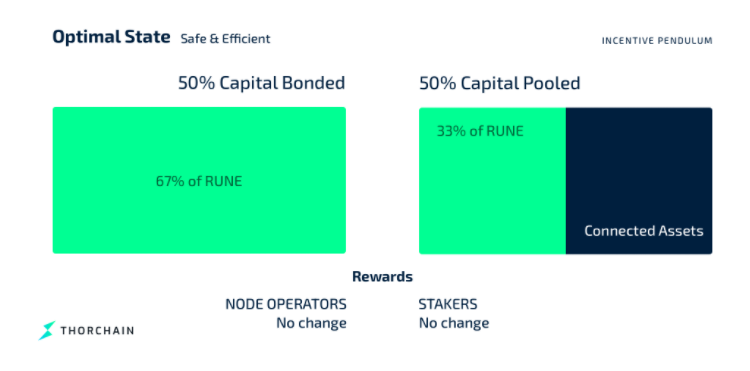

As long as it maintains this ratio of 1:3, this is the optimal state and will ensure that the assets provided by liquidity providers in the vaults are safe, and capital is efficiently utilized.

The simple calculation for $RUNE's deterministic price is = (3 * Sum of Assets Locked) / RUNE Circulating Supply.

Impermanent Loss Protection

As a liquidity provider, depositing your assets into THORChain means providing half into $RUNE and being subjected to impermanent loss. To mitigate this loss, THORChain has implemented impermanent loss protection (ILP).

When you withdraw your assets, if your impermanent loss is greater than the income you have earned as a liquidity provider, THORChain will pay you the difference. There is a linear 100 day increase (1% per day) in the amount of coverage receive, after 100 days you will have no impermanent loss.

This is because THORChain believes that the income produced by liquidity pools will be greater than the impermanent loss that users will incur, hence THORChain will not need to pay it. Take note that this only applies to active pools and if you make additional deposits, you reset the timer.

Synthetics

THORChain synthetics holds the underlying assets and creates synthetics in an exchange. They are 100% backed by 50% $RUNE and 50% underlying assets, which can be used to provide liquidity into synthetic vaults for compounding yield.

As synths are backed by liquidity pools that contain $RUNE and the underlying asset, the collateralization ratio is only 100%. The users are not borrowing anything, which means they can't get liquidated. They can be also used for interaction with any Cosmos chains that have implemented the IBC.

Yield Incentives

Liquidity providers deposit their assets in liquidity pools and earn yield in return. This yield comes from swap fees as well as $RUNE emissions. They earn tokens in $RUNE and the native asset from the pool. Yield is paid out to liquidity providers when they remove assets from the pool and rewards are calculated according to swap transactions.

THORChain Chaosnet has a limit on pooled liquidity. This is a limit across all pools combined and no more liquidity can be added once the cap has been reached, until they are further raised. This mechanism is currently in place to protect the network and its users.

Projections

With the announcement of $LUNA $UST integration coming, this allows native $UST to be swapped with native $BTC, forming a pretty neat decentralized narrative and removing the soft cap for liquidity pools. If THORChain manages to capture just 0.1% of Bitcoin’s TVL and 1% of $UST’s TVL, that would increase their TVL by 5 times to $2.52 billion.

$THOR.USD is also being created where $RUNE is burnt to mint it, similar to the LUNA-UST model. This might cause the demand of $RUNE to grow should there be a demand for decentralized stablecoins on THORChain. ThorFi is a lending protocol that is also coming to THORChain, with more integrations with dex aggregators and wallets for better accessibility. This will allow users to borrow $THOR.USD by depositing their assets, generating more liquidity and TVL for the network.

Threats

THORChain has a bad reputation of being exploited 3 times as they are dealing with a complicated protocol. This can cause fear for users participating in THORChain as the previous exploit resulted in a loss of over $8 million in $ETH.

THORChain also has a complex interface that is not ideal for retail user interaction and its non-EVM UIUX might turn Ethereum native users away.

Tokenomics

There is a maximum supply of 500 million $RUNE, 100% of which was created at genesis and distributed.

Emission schedule:

The remaining 45% of $RUNE will be distributed to node operators and LP providers over the span of 10 years.

Team

THORChain is a decentralized project with no CEO or founders. The protocol runs on several individuals and teams that are influenced by the direction of the community. However there are prominent figureheads such as Chad Barraford who actively generate publicity.

THORChain is backed by credible investors such as from Delphi Digital, Multicoin Capital, and X21 Capital. The protocol has responded well to recent exploits and continues to develop according to their github.

Roadmap

THORChain updates their community on a bi-weekly and monthly basis through their Medium page. Currently these are their milestone updates that are required before the mainnet launch.

- Terra launch and soft cap kill in Chaosnet

- THOR Name Service (TNS) activation in Stagenet, required for Haven and Monero integrations.

- Multiple bond providers, target release 0.81.0

- Hardfork and Cosmos SDK update in Stagenet after Terra launch

- Development of https://dev.thorchain.org/ to support easy integration

- Activation of Synths in Chaosnet, initially capped

- TNS activation in Chaosnet

- 100 active nodes target

- Hardfork and Cosmos SDK update in Chaosnet

Conclusion

In the future, we should see more applications and wallets integrating with THORChain along with new chains and assets being onboarded to the network.

There are a few near term drivers that might cause the price of $RUNE and the TVL of THORChain to increase tremendously. Some of which include the recent release of synths, the announcement of IBC and Terra integration, and the upcoming launch of their mainnet.

Eventually, the network will be fully secured and the Chaosnet will be replaced by their Mainnet. THORchain looks like an interesting protocol and a missing piece in the DeFi ecosystem that would allow people to swap between native assets without using centralized exchanges.