Following the rise of Ethereum, we have seen the recent growth in decentralized finance (DeFi), and now the explosion in non-fungible tokens (NFTs). However, Ethereum is only able to process less than 20 transactions per second (TPS), causing a massive surge in the gas prices due to network congestion. There is a need for higher throughput and cheaper fees before these networks can be effectively adopted on a wider scale.

Enter Layer 2 (L2) solutions. L2 refers to a secondary framework built atop of an existing blockchain ecosystem. The primary goal of these protocols is to solve the inefficiencies that are being faced by the major networks.

One of the advantages of these solutions is the preservation of their original structure. This is possible as the second layer is added as an extra layer. As such, L2 solutions have the potential to achieve high throughput without sacrificing network security.

Thus, the majority of work executed on the main blockchain can be moved to the second layer. So while the L1 continues to provide security, L2 is able to offer high throughput by being able to perform thousands of transactions per second.

In this article, we will be comparing the promising emergence of L2 networks that have an existing token, namely Aurora Protocol ($AURORA), Boba Protocol ($BOBA), and Metis Protocol ($METIS). While these protocols have yet to top the charts, they have some powerful hands nurturing them.

Layer 2s

Aurora Protocol

Aurora is a high performance Ethereum Virtual Machine (EVM) created by the team at the NEAR. It provides a turn-key solution that allows developers to operate their apps on a high-throughput, scalable and future-safe platform, with low transaction costs for their users. With 10 protocols running on Aurora, they are ranked #20 in terms of TVL, at $640 million.

Introduction

The high cost and slow transactions of ethereum has turned away many users and prevented developers from further scaling their protocols. To address these challenges, Aurora enables developers to extend their reach to additional users from different markets.

Aurora runs on the NEAR Protocol and takes advantage of its many unique features, including sharding and developer gas fee remuneration. The Aurora environment consists of the Aurora Engine, which allows for seamless deployment of smart contracts, Rainbow Bridge, which facilitates the permissionless transfer of tokens and data between Ethereum and NEAR, and AuroraDAO, the autonomous governance of the Aurora protocol.

According to Messari, NEAR is the 3rd most popular asset across venture capital and hedge funds as well.

Key Features

Aurora will be able to benefit from all current and future advantages as it is implemented as a smart contract on the NEAR blockchain.

- Trustless Bridging: Aurora allows for permissionless token bridging, using the Rainbow Bridge technology for transfers between Ethereum and NEAR, and NEAR native assets to be transferred to Aurora. Thereby becoming a point of connection for Ethereum and NEAR.

- AuroraDAO: Launched as an autonomous ecosystem governance. The AuroraDAO consists of a “council” of seats. The holders will vote on high-level decisions and will direct subordinate organizations to implement those decisions.

- Low transaction costs: Aurora fees are up to 1000 times lower than Ethereum, and 50 times faster than Ethereum 1.0.

- Full Ethereum compatibility: Aurora also offers a greener alternative for Ethereum users: full, uncompromising compatibility on top of their decentralized and climate-neutral Proof-of-Stake (PoS) L1 network. No need to re-write your applications.

- ETH base currency: Transaction fees are paid in ETH, providing a great UX for Ethereum users.

- High throughput and scalability: Aurora runs on the NEAR Protocol, one of the highest performance 3rd generation L1 protocols.

- Advanced EVM: From its core SputnikVM, to full tool-chain support and gasless transactions. Aurora is the most advanced EVM on the market.

Tokenomics

The circulating supply of AURORA is around 10 million. The total supply is 1 billion AURORA. AURORA was made available to the public during their Token Generation Event (TGE) on 18 November 2021.

- Community Treasury: 20% (200 million) unlocked

- Long Term Incentives: 16% (160 million) locked

- Private Round Investors: 9% (90 million) locked

- NEAR ecosystem: 3% (30 million) unlocked

- Early Contributors: 2% (20 million) locked

- Project Advisors: 1% (10 million) unlocked

- Bootstrapping: 1% (10 million) unlocked

- Future Projects: 48% (480 million) unlocked

Emission Schedule

The emission schedule for all locked tokens begins following the TGE on 18 November 2021.

- 2 year unlocking schedule

- Linear vesting with unlock events every 3 months

- 6 month cliff, starting 18/11/21 (25% unlocked after 6 months, then additional 12.5% after 9, 12, 15, 18, 21 and 24 months)

Source: https://aurora.dev/tokenomics

Use Cases

AURORA is the governance token of AuroraDAO. The portion allocated to the Community Treasury will be to fund existing and proposed projects, in which token holders will vote on.

The AuroraDAO will consider other use cases, including but not limited to:

- AURORA token staking

- Taking part in deciding of the Community Treasury allocation

- Rainbow Bridge fast transfer and finalization fees

- Aurora contract additional execution fees

- Aurora validator private transaction pool service

- Farming of locked funds in the Rainbow Bridge connectors

Team & Investors

Alex Shevchenko is the CEO of Aurora Labs. He was previously the CTO at SonoCoin, a first-of-a-kind decentralized audible token network based in Geneva.

Aurora has completed its first funding round with $12 million raised. Over 100 investors took part in the round with the lead of Pantera Capital, Electric Capital, Dragonfly Capital. Some of its other partnerships include 1inch, DODO, Chainlink, etc.

Outlook

Since its launch in May 2021, Aurora has achieved many of its milestones, some of which including:

- Deployment of Ethereum dApps on Aurora

- Transfer of ETH, ERC-20, and NEAR tokens between Ethereum and NEAR

- Completion of fund-raising campaign

- Filling of all AuroraDAO initial seats

- Ensuring fast token transfers and ERC-20 gas fee implementations

- Simplification of UX for non-blockchain users

As we step into 2022, Aurora looks to horizontal scaling and potentially increase the platform’s overall throughput capacity. The team is also planning to deliver a sharded version of Aurora early next year.

Conclusion

As the DeFi market continues to grow at an unimaginable rate, Aurora and NEAR will continue to expand into the DeFi market. With large funding campaigns being secured, this will definitely bring in more developers and even users who are seeking alternatives to protocols on the Ethereum ecosystem.

Boba Protocol

An Ethereum Layer 2 (L2) scaling & augmenting solution. Boba Network joins existing scaling solutions such as Arbitrum, Polygon, and zkSync to address these scalability issues. There are currently 6 protocols running on Boba, ranking it #32 in terms of TVL, at $113.59 million.

Introduction

Boba uses Optimistic Rollup technology, where a smart contract is passed on from the main chain to a L2 network using transaction data. The sequencer then wraps multiple transactions into a batch, delivering it back to the main chain through a single transaction. It has various features such as swap-based on-ramp, fast exit, cross-chain bridging and other features. This augmenting solution reduces gas fees, improves transaction throughput, and extends the capabilities of smart contracts.

Their goal is to make DeFi and NFT dApps on Ethereum affordable which are currently too costly for mass adoption. Boba can improve transaction speed and costs while maintaining security levels from Ethereum by transferring processes to their L2 network. This is extremely imperial to gaming in GameFi, with micro transactions taking place between participants every second.

Currently it costs around $3-$10 for a transaction.

Key Features

- Inexpensive Gas: Tackling the problem of high gas fees is of top priority as they can surge during peak trading hours. Boba solves this by reducing fees to as low as 10 Gwei (gas prices on L2 changes every 30 seconds).

- Fast Exit: Users are able transfer their money in and out of the network in a matter of minutes given sufficient liquidity. This process usually takes from 45 minutes to 3 hours on other L2 solutions.

- NFT Bridging: Users can easily mint, transfer, and sell their assets between L1 and L2, or between different L2s. This has made the development of NFTs, particularly GameFi, easier and more convenient.

- Hybrid Computation: Boba Network enables Ethereum developers to run codes on web-scale infrastructure such as AWS Lambda, allowing them to implement sophisticated algorithms that were previously impossible to perform on-chain.

- Secured by Ethereum: As an Optimistic Rollup L2, Boba Network will be well protected as long as Ethereum maintains its high security.

Tokenomics

The circulating supply of BOBA is currently around 150,000,000, with a total supply of 500,000,000 BOBA. BOBA was launched together with its mainnet on 21 September 2021.

Source: https://boba.network/token/

- OMG Token Holders: 28% (140,000,000)

- Treasury: 42% (210,000,000)

- Current & Future Team Members: 20% (100,000,000)

- Strategic Investors: 10% (50,000,000)

Airdrop: Users that held OMG tokens on L1 or L2 on 12 November 2021 (snapshot date) can claim BOBA on a 1:1 basis by bridging their OMG to Boba Network through the gateway or a partner bridge with the same wallet address that held the OMG on L1.

L1 Ethereum Snapshot Block: 13597967.

L2 Boba Network Snapshot Block: 15354.

Tutorial: https://boba.network/wp-content/uploads/2021/10/video_2021-10-25_10-26-22.mp4

Emission Schedule

The circulating supply will gradually increase over the next four years to reach the maximum supply of 500M. Some of the fees earned by Boba Network will be allocated to purchase BOBA tokens on behalf of the Boba treasury over time. The treasury will be deployed to fund liquidity mining incentives and build the Boba ecosystem.

Use Cases

1. Governance

BOBA will be used to participate in the governance of Boba DAO. Each BOBA holder will get one vote for every token that they stake on Boba Network. Token holders will be eligible to submit proposals, vote, and delegate votes for proposals on the DAO in accordance with the governance guidelines.

Find out more on how to vote: https://forum.boba.network

2. Staking

BOBA staked on the network will receive a portion of the transaction fees earned through an on-chain distribution governed by the community. BOBA stakers will receive equivalent xBOBA tokens that will retain the same voting rights as BOBA.

Incentive Program

Boba has announced the launch of an incentives program utilizing Wagmi choices. With Wagmi options, which will depend on network parameters such as total value locked (TVL), or specific project developments, the team hopes to keep the momentum going inside of its network.

On this, the Boba team explained:

“Traditional liquidity mining programs are zero-sum: users come to collect high rewards and are incentivized to keep those rewards. WAGMI farming turns this model on its head by being positive sum: users are incentivized to evangelize and encourage behaviors that grow Boba.

These options will have different versions and are to be adopted by several projects that apply to include them in the coming weeks.

Several chains have tried to incentivize builders and developers to construct apps on top of their chains. Avalanche, Harmony, Cardano, and BSC are just some of the players in the market that have applied this technique to increase activity and bring users to their chains, with different results. Boba Network seeks to turn this into a “positive-sum, sustainable mechanism.”

Boba’s mainnet was launched in September last year, and it managed to rise as one of the leading L2 networks, reaching the second spot in TVL among these on November 28, only behind Arbitrum. However, since then, the network has lost some steam, falling to fourth place while being surpassed by Loopring and Dydx, according to the info at L2beat, an L2 statistics monitor.

The team behind this initiative states this will be the first time that options farming is implemented in any network and that they hope this initiative could also set a trend for other projects to take advantage of options to better distribute incentives.”

Outlook

Details on future plans have not been revealed.

Team & Investors

Alan Chiu founded Boba Network in 2018. He is also the founder and CEO of Enya.ai, which pioneered decentralized privacy and is the largest provider of secure multiparty computation services, serving more than 10 million users across 91 countries. Enya is a core contributor to Boba Network.

OMG Foundation is a non-profit organization dedicated to expanding the Ethereum ecosystem to encompass as many developers and users as possible in order to bring the ideals of the Web3 movement into reality. Boba Network was developed by OMG Foundation and launched onto the mainnet as a L2 Optimistic Rollup.

Some of Boba’s early investors include XSeed Capital, Ulu Ventures, 2.12 Angels, etc. Boba Network has also partnered with Anyswap, GBV Capital, and API3, just to name a few.

To learn more about Boba, visit boba.network.

Conclusion

BOBA will be used for governance of the Boba DAO in the future. Users who hold BOBA will get one vote for every token they stake on the Boba Network. BOBA has received a lot of attention recently, but true momentum will likely kick in once it’s made available on more exchanges.

Ultimately, the Boba Network is an upgraded version of Ethereum that will allow mass adoption of DeFi and NFTs (GameFi) with its cheap and fast network alongside its NFT bridging capabilities, if it can attract new users and adoption .

Immutable X ($IMX):

Introduction

Immutable X is a L2 Ethereum solution for NFTs using Starkware’s ZK rollup. It is one of the best-known ZK-Rollup-powered protocols that is live on the mainnet. Since its launch in April 2021, IMX has seen the NFT activity on this lightning-fast L2 network has experienced pleasant growth in the past few months. However, there is still a lot of room for improvements for $IMX, as their $120 million trading volume is still lower than that of OpenSea, which averages between $150 and $250 million daily.

Key Features

- Gas-free: Users do not have to pay gas fees for minting or exchanging assets.

- Instant trades: Supports over 9,000 transactions per second (600x of Ethereum).

- Self-custody for NFTs: There is no custodial risk as all users get to keep their private keys.

- Secured by Ethereum: As a ZK-Rollup L2, Immutable X is well protected by the security of Ethereum.

- Carbon neutral: All NFTs traded on Immutable X are 100% carbon neutral.

Tokenomics

The circulating supply of IMX is currently around 188,160,768, with a total supply of 2,000,000,000 IMX.

Source: https://twitter.com/cryptoMaxi420/status/1457127205511655425?s=20

The IMX token allocation is as follows:

- Ecosystem Development: 51.74%

- Project Development: 25%

- Private Sale: 14.26%

- Public Sale 5%

- Foundation Reserve: 4%

Emission Schedule

Use Cases

There are 3 main use cases for IMX tokens:

- Governance: IMX holders will be able to vote and decide on the future of Immutable X.

- Transaction fees: Transactions on Immutable X are paid in IMX. If users do not have IMX, they can pay in another currency, which will be swapped for IMX on the open market.

- Staking: Stake IMX to earn a proportion of fees from Immutable X.

Outlook

Source: https://www.immutable.com/blog/immutable-x-alpha-trading-launch

Team & Investors

James Ferguson is the founder and CEO of Immutable alongside his brother, Robbie Ferguson who is the co-founder and president. James previously led a software development team at a large ecommerce provider.

Immutable raised $15 million in a Series A round in September 2019 to accelerate development of its flagship trading card game, Gods Unchained. The round was led by technology investment companies Naspers Ventures and the Galaxy Digital EOS VC Fund, a blockchain-focused merchant bank, together with Apex Capital Partners.

Conclusion

While Immutable X could benefit tremendously from the massive ZK-Rollup hype with potential adoption in the near future, we should also take into account their tokenomics, as highlighted in the following twitter thread:

https://twitter.com/cryptoMaxi420/status/1457127205511655425?s=20

Hence, $IMX might not be the best bet to put our money in unless we are looking for a shorter term play.

Metis Protocol

Metis is a Layer 2 (L2) scaling protocol that uses optimistic rollup technology. Its rollup solution allows developers to run applications, process transactions, and store data on a layer above blockchains like Ethereum. With only 3 protocols running on Metis, they are currently ranked #35 in terms of TVL, at $108 million.

Introduction

Metis Protocol is a governance and management framework for distributed collaborations. Anyone can build a Decentralized Autonomous Company (DAC) with Metis to establish and govern the partnership and achieve their business goals. Metis also provides a framework to support and manage the implementation of the collaborations transparently and efficiently.

Metis offers a scalable and cost-efficient environment for building and interacting with Web3 applications. It features an EVM-compatible virtual machine called the Metis Virtual Machine (MVM) that allows developers to create contracts in a similar environment to Ethereum. Similar to Boba Network, it inherits its security from its L1 counterparts.

Source: https://metisdao.medium.com/the-vibrant-and-growing-metis-ecosystem-d517b36accb8

Metis aims to make creating dApps and DACs effortless for the everyday blockchain user.

Source: https://miro.medium.com/max/2400/1*mioGcHP3s46So4UJkuXB3Q.png

Key Features

The team has optimized Metis to include new features, differentiating it from Optimism.

- Multiple VMs and sequencers

- Framework containing developer templates, API, and modules to assist with dApp development

- DACs that can set up independent VMs, manage organization roles, decide data storages of information, and determine templates and fee rates

- Separation of Computing and Storage

- Private Native Storage Layer Based on IPFS (not possible on Ethereum or Polygon)

- Fast transactions (2,000 TPS) with low gas fees

- No coding smart contracts (one-click deployment from our pre-developed templates)

- 100% EVM compatible (port to Metis from Ethereum conveniently at no cost)

Tokenomics

The circulating supply of METIS is currently around 2,000,000, with a total supply of 10,000,000 METIS. METIS was launched on Ignition, the Initial DEX Offering (IDO) was held on 13 May 2021.

The initial distribution of METIS is as follows:

- Founding Team: 7% (locked for 6 months, 12.5% quarterly vesting over Year 1 & 2)

- MetisLab Foundation: 4% (10% unlocked at TGE, 11.25% quarterly vesting over Year 1 & 2)

- Advisors: 1.5% (5% unlocked at TGE, 11.875% quarterly vesting over Year 1 & 2)

- Angel Investors: 1% (5% unlocked at TGE, 11.875% quarterly vesting over Year 1 & 2)

- Seed Investors: 6% (10% unlocked at TGE, 22.5% quarterly vesting over Year 1)

- Private Investors: 7% (10% unlocked at TGE, 22.5% quarterly vesting over Year 1)

- Strategic Investors: 1.5% (10% unlocked at TGE, monthly vesting over Year 1)

- Community Investors: 3% (10% unlocked at TGE, monthly vesting over Year 1)

- Gate.io IEO: 0.1% (No vesting)

- Paid Network IDO: 0.2% (No vesting)

- Airdrop: 6%

- Liquidity Reserve: 6%

- Community Development: 9% (6% over Year 1 at TGE & 3% over Year 2)

Emission Schedule

Ongoing Emissions:

The remaining 47.7% of the supply will be minted over ten years following Metis' mainnet launch, to support the protocol's transaction mining program. About 31% of this total (1,486,400) will be released in the first year following Metis' mainnet launch. The remaining 69% will be emitted over the course of the following nine years.

Source: https://messari.io/asset/metis/profile/supply-schedule

Source: https://twitter.com/crypto_saint/status/1475265174990991361

Use Cases

METIS operates as the native currency for staking and payments. Users have to pay for goods and services offered through DACs built on the Metis protocol.

METIS has three key roles within the Metis protocol:

- Require deposit to activate the Metis Virtual Machine (MVM) to create a decentralized autonomous company (DAC)

- Staked collateral when users intend to collaborate with others

- Any transactions leveraging Metis protocol on L2 will use METIS as gas

Outlook

Source: https://metisdao.medium.com/decentralization-roadmap-of-metis-layer-2-infrastructure-3716a17648c7

Metis has potential to stand out from its upcoming projects.

- MetisSwap (L2 DEX in beta testing)

- Polis (Allows users to log into any DApps built on its platform)

- Tribe (Community-minted NFT Project).

Roadmap

- Q1 2022: Verifiers will conduct real-time verifications, shortening the transaction finalty. With the current withdrawals from L2 to L1 taking days, this will drastically improve the transactions to a few hours, and eventually it would take just a few minutes.

- Q2 2022: The Metis Sequencer Pool will be open to the community. All verifiers will automatically be added into the pool. A challenge and voting mechanism will ensure that sequencer positions rotate efficiently.

- Q3 2022: The cloud deployment code will be released for both main and peer nodes, enabling everyone to run a Metis node with high security and efficiency.

When Metis reaches the final stage, the L2 infrastructure will have achieved 100% decentralization. No other Rollup, commit chain, side chain, or any kind of Ethereum scaling solution can make this claim.

Team & Investors

Elena Sinelnikova is the CEO of Metis. She founded Metis along with Kevin Liu (CPO) and Yuan Su is (CTO).

Their board of advisors include Lucia Gallardo (Founder & CEO at Emerge), Medha Parlikar (CTO at CasperLabs), and Ralph P. Gerteis (Co-Founder & CEO at Scaleswap).

Vitalik Buterin’s mother, Natalia Ameline, is also a technology researcher for Metis.

Conclusion

Metis is continuously in a building stage. In the near future, Metis intends to convert the management from their core team to the community as a whole. Rather than Metis existing as a centralized company, it will instead be governed and managed by the Metis DAC framework. In summary, Metis will be able to support application and business migrations from Web 2.0 to Web 3.0 with their infrastructure.

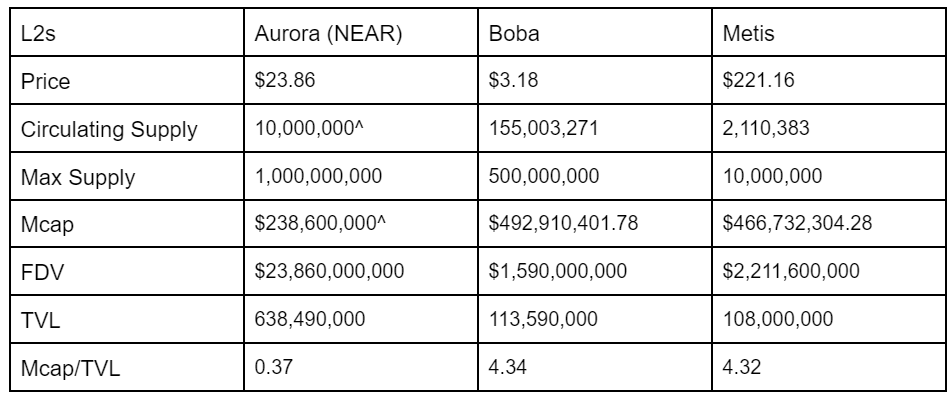

Comparing Key Stats

*Figures correct as of 5 January 2022 on CoinGecko, CoinMarketCap and Defi Llama.

^Self-reported according to the project and not verified on the various platforms,

Conclusion

With more applications coming onto the blockchain, the amount of user adoption and transactions will scale exponentially due to the effect of Metcalfe's Law where the network value is proportional to the square of the number of connected users of the network.

From DeFi to DAOs, they will eventually use up even more activity, throughput and cost of transactions on Ethereum, making it unusable and congested thus hindering the expansion of the blockchain to a larger population.

Aurora has the highest TVL and lowest MCAP/TVL compared to boba and metis, but Aurora’s TVL is still significantly lower than arbitrum and optimism, however they currently do not have their own tokens.

L2s are currently the best solution for the expansion of Ethereum, offering high throughput and cheaper fees while leveraging on the security of L1s. In the future, we will see many projects migrating or being created on L2s with improved user experiences.

As one of the hottest trends in 2021, L2s will continue to build a large and loyal user base, which will become one of the most important development of Ethereum.