Currency of the internet (COTI) is an all in one payment solution built on the Cardano blockchain. It was founded in 2016 by Shahaf Bar-Geffen, former CEO of the Web3 group. Its vision is to become a decentralized and scalable payments network to facilitate efficient global commerce.

Opportunity

The e-payment industry is expected to double in market cap by 2025. Existing players such as PayPal face problems of inefficiency and high transaction costs. Retail merchants are likely to adopt blockchain solutions for a higher profit margin. Being the issuer of Djed stablecoin, COTI is expected to see price upside once the Cardano ecosystem matures.

Product analysis

Base layer protocol: Trustchain

COTI’s payment solution has five major features, each serving a different demographic. In its base layer protocol, COTI employs a Directed Acyclic Graph(DAG) based distributed ledger, as opposed to a blockchain. Its major advantage is that greater network usage results in improved network scalability. This solves the issue of scalability, making day-to-day small transactions possible without paying exorbitant amounts of fees. It is capable of handling 100 thousand TPS, making it suitable for frequent retail transactions.

Consensus mechanism and trust scores

It employs a proof-of-trust (POT) consensus mechanism which combines proof-of-work(POW) and the Trustchain algorithm. Participants in a network are given trust scores. Higher trust scores will result in a better user experience.

Users with high trust scores enjoy lesser transaction confirmations. Thus, their transactions are processed faster. Merchants/institutions with higher trust scores require lesser reserves in their wallets. Nodes with higher trust scores have lower POW levels, thus processes more transactions and are rewarded with more fees.

This system punishes bad actors in the ecosystem. Participants gain trust scores by going through KYC processes, providing information about their business and issuing valid transactions. They lose trust scores when they declare bankruptcy/become bad actors. Traditional POW assumes that all parties are untrustworthy, resulting in a huge amount of computational power used to guarantee trust. Trust scores significantly reduce the “work” required for trusted parties, resulting in a highly scalable protocol. COTI uses POW for spam protection and network participant incentivization.

COTI Pay

COTI Pay is the all-in-one payments solution for network participants. Its main user interface is the COTI Pay app available on IOS and android.

At the same time, it is also available on PC web browsers such as Google Chrome and Firefox.

Consumers

It allows consumers to initiate peer-to-peer transactions, nearby wallet-to-wallet transactions, store digital and fiat currencies securely as well as exchange digital and fiat currencies. It has also integrated legacy finance instruments such Debit cards and PayPal.

Merchants

Merchants can easily connect to COTI Pay’s payment rails via API or by embedding an iFrame into their websites. The merchant onboarding process will be streamlined to the point that integration can be completed within a few hours. They will have access to a dashboard that provides detailed data and reporting functionality on their transactions. Within this dashboard, merchants can choose which COTI Pay-supported currencies they wish to accept, as well as their preferred settlement currencies. Moreover, the dashboard will provide merchants with wallet-like functionality that enables them to make payments to COTI Pay wallet holders and to other COTI Pay-powered merchants, as well as to use COTI-X's facility.

Developers

COTI provides a white label payment solution to developers who can build a payment protocol on top of COTI’s base layer.

Debit card and bank account

Using the crypto-friendly bank account, COTI users will be able to open a bank account on their name, with an IBAN, store fiat natively in their COTI Pay wallet and globally spend their balance at any merchant that accepts VISA cards, both online or in-store.

Arbitration

A unique feature of COTI is the arbitration process where Jurors rule disputes, collecting arbitration fees in the process. Incentives are given to jurors who vote honestly, in consensus with the majority. Jurors also undergo training.

COTI NFT

A raffle for all COTI holders. 1,000 COTI equates to one raffle ticket. Unique prizes such as NFTs and COTI tokens are won.

Stablecoins

During the Cardano Summit 2021, it was revealed that COTI will be the official issuer of Djed, an algorithmic hybrid stablecoin. Centralized asset-backed stablecoins such as Tether present problems such as difficulty verifying and auditing the underlying assets. Djed acts as an autonomous bank, keeping a reserve R of BaseCoins (BCs), and minting and burning StableCoins (SCs) and ReserveCoins (RCs). It maintains the peg of the SCs to a target price by buying and selling SCs, using its reserve. While doing so, it charges fees and accumulates them in its reserve. The beneficiaries of this revenue stream are ultimately the RC holders, who contribute with additional funds to the reserve and take the risk of price fluctuation. It is designed to be used for paying transaction fees on the Cardano network. One benefit of this is to make transaction costs more predictable, so avoiding volatile and exorbitant gas fees for users. Djed is currently a work in progress and is only deployed on the testnet.

Djed uses mathematical theorems to ensure price stability and pegging during crashes. It will be sold to minters at $1.01 and bought at $0.99. Thus resulting in $0.02 profit for Djed’s reserves. These reserves serve as a safetynet for market crashes. With more Djed getting minted, the reserves will get bigger. These reserves will be converted to COTI tokens and stored in the COTI treasury. The demand for COTI increases as more Djed gets minted.

It has two versions, minimal and extended Djed. The minimal version is designed to be as simple, intuitive, and straightforward as possible, without compromising stability. However, in reality, flaws such as bank runs might occur. Extended Djed is a more complex version that provides some additional stability benefits. The main differences are the use of a continuous pricing model and dynamic fees to further incentivize the maintenance of the reserve ratio at an optimal level.”

COTI X

COTI-X functions as an internally licensed exchange, a fiat on-ramp for the COTI ecosystem and is supported by several liquidity pools, including Uniswap.

Royalty networks

COTI allows merchants to issue royalty coins to repeated customers to increase user retention. These royalty coins are tradable.

ADA Pay

COTI was chosen by the Cardano foundation to provide the payment gateway ADA Pay. It is for organizations, merchants, and charities looking to directly accept and manage ADA payments and donations. Its payment flow is similar to COTI Pay.

Product analysis conclusion

The COTI network is set to become the premiere payment solution in the Cardano ecosystem. Its product has extensive features that can rival major players in the industry. Its most promising product is the Djed stablecoin which is set to become one of the main currencies for gas fees on the Cardano network. However, SEC Chair Gary Gensler has stressed several times that he believes many stablecoins are unregistered securities and should come under the purview of the SEC. This brings possible risks and uncertainties.

Fundamental analysis

The $COTI token

Market cap: $443,874,127

FDV: $1,021,960,112

Volume: $50,451,715

Circulating supply: 868,672,118

Total supply: 2,000,000,000

COTI trades in Binance, Huobi Global, HitBTC, Hotcoin Global, Coinbase pro, 1inchand Bitcoin.com Exchange.

The COTI token exists in ERC-20, BEP-20 and COTI mainnet standards. It is used as incentives for network participants. Cashbacks, referral rewards and incentives for running nodes. It can also be used to pay for transaction fees as well as a medium of exchange. It held its ICO on the 4th of July 2019, raising $3mn in total. The average price per token was $0.065.

Emission

COTI is emitted through its staking program where users receive COTI tokens via staking. Its annual supply emission is estimated to be 164,141,146 COTI.

Payment macro analysis

In the past year, the payment industry saw significant shifts in consumer behaviour. Consumers are going cashless, opting for online payments. In 2020, consumers spent $347 billion online with US retailers, up 30 percent from the same period in 2019. This is partly due to the global lockdown measures driven by the COVID-19 pandemic, causing a rise in Ecommerce demand. Looking at a bigger picture, traditional businesses are becoming increasingly digitised. These include healthcare, professional services and education. These combination of factors resulted in payments being top in terms of value created amongst banking sectors. The global digital payments market size is expected to increase from USD 79.3 billion in 2020 to USD 154.1 billion by 2025.

Cardano macro analysis

The Cardano ecosystem reached a key milestone on the 12th of september, bringing smart contracts capabilities to its mainnet. However, the ecosystem is still undeveloped at the time of writing. One key reason is the underlying programming language. It is based on haskell, a niche functional programming language that is not widely used. Thus, onboarding of new developers can be a slow process. Input Output Global, the engineering company responsible for developing Cardano, is developing a Plutus Application Backend(PAB) which would help developers create new projects. Growth in the ecosystem is expected to take off once PAB has been fully developed.

Another key milestone would be the launch of Cardano’s first DEX. Amongst many that are developing, the top contenders are Sundaeswap, Ergodex and OccamX. Sundaeswap is expected to launch in late October/ early November. At the moment, Cardano native assets are not tradable and many projects chose to launch their tokens in ERC-20 standard. With the launch of DEXes, it is expected to see significant influx of Capital.

Another milestone will be the launch of the first stablecoin. Stablecoins are a key component of DeFi, they are fundamental in the risk management process. They can be used to hedge against market crashes and uncertainties. Thus, the launch of stablecoins can attract investors who are risk averse. Overall, the Cardano ecosystem is not likely to see major price increase until these two milestones are near.

Competitors

COTI faces stiff competition both in traditional and blockchain e-payment systems. Traditional e-payment giants such as paypal (53.95% market share), Stripe (18.69% market share) and Amazon Pay (3.96% market share) dominate the e-payment landscape. These companies have extensive partnerships and brand equity. However, according to Mckinsey, payments will not be a “winner takes all” market. Different solutions will co-exist in the future landscape. There is sufficient market breadth for multiple networks, technologies and business models to succeed.

Source: https://www.marketsandmarkets.com/Market-Reports/digital-payment-market-209834053.html

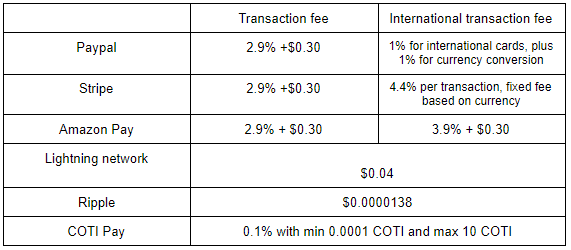

Fees

One key disadvantage of traditional e-payment systems is the high transaction fees associated. This is partly due to the profit maximising nature of companies. Leading to decisions made to capture consumer surplus. In a decentralised payment system, the lack of centralised decision can result in lower transaction fees. Another important factor is that decentralised systems tend to be more efficient. A consensus mechanism is used to establish trust amongst participants, reducing the manpower and work needed to establish credibility in centralised systems. The entire payment system can also be run automatically through smart contracts, reducing the need for manual inputs. Therefore, often resulting in lower fees.

It is unlikely that major institutions such as Paypal will be sitting ducks. They are likely to pivot in the next few years to remain competitive. Possibly integrating blockchain technology into their ecosystem. In the case of Paypal, it has integrated Cryptocurrencies such as Bitcoin and Ethereum, allowing consumers to purchase goods. However, due to the sheer size of such companies, it takes longer to maneuver and respond to industry trends. Thus, smaller market entrants are likely to carve out a piece of the market share.

Lightning network

The Bitcoin lightning network is a layer two solution to the slow and expensive bitcoin network. Its key features are instant settlement and low transaction fees. It has since grown in popularity shown by the number of nodes in recent years. It has resulted in the “pay with moon” browser plugin, allowing users to pay for online purchases using Bitcoin and Litecoins. Despite the popularity of the lightning network, it currently only supports a limited number of cryptocurrencies. It is not a direct competitor to COTI, which runs on the Cardano blockchain. It also lacks the analytics and arbitration function of COTI.

Ripple

Ripple is a real-time gross settlement system, currency exchange and remittance network created by Ripple Labs Inc., a US-based technology company. However, it has been enthralled in controversy from SEC regulatory lawsuits to frequent token dumps by Co-founder Jed McCaleb. Despite all that, it still maintains the sixth position in terms of market cap in the industry. It is a key contender in the payments market but not a direct competitor due to the niche nature of COTI.

Target audience

COTI targets crypto savvy consumers in the Cardano ecosystem seeking to use their Cardano native assets in retail purchases.

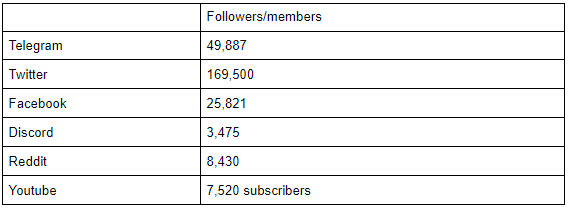

Community

The Coti community is strong with an impressive amount of followers across social media channels. Upon further investigation, its recent twitter posts get 200-700 retweets on average, a low number compared to its massive following of 169 thousand. Its telegram is rather active with messages almost every minute. A notable

The COTI Pay app is also rather popular on android devices, with over 10,000 downloads in the Play store. However, it has a rather average rating of 3.8, with some reviews citing usability issues in the US. It has a similar rating of 3.9 in the IOS app store. However, in a recent youtube update, the CEO justified that majority of COTI users still use the desktop client due to the relatively recent launch of the app.

Traffic

Google trends

COTI’s search traffic has been slowly increasing over the past year. However when compared to its competitors such as Ripple, COTI’s search traffic is rather low.

Similarwebs

Traffic to the COTI website see a gradual increase over the past few months with the majority of traffic from internet searches. Majority of the traffic also comes from the US and Brazil.

On reddit, we see a gradual increase in subscribers over the years. However, user activities are lacking with an average of 12 comments per day.

Team

The team behind COTI has extensive experience in the tech industry. The C-suite executives have founded various tech companies and had experiences in companies such as IBM, HSBC, Plus500 and Web3.

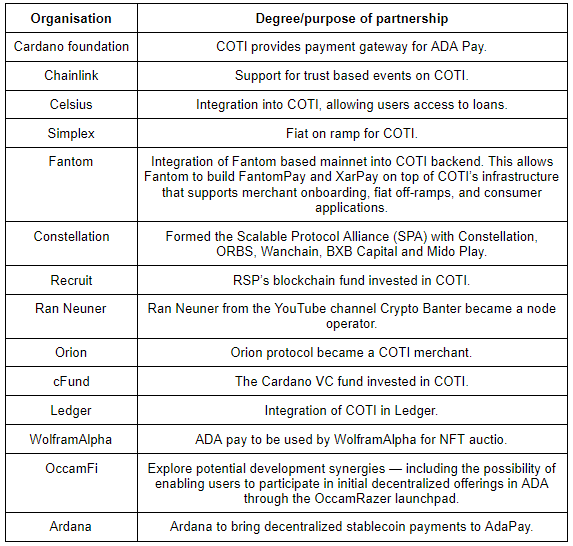

Partnerships

Organisation

Degree/purpose of partnership

Roadmap & Milestones

COTI has not released a definitive roadmap ahead. Its main development goal at the moment is the Djed stablecoin as well as the COTI treasury. The treasury will bind everything together. Promising features include a stablecoin factory, which allows entities to mint their very own stablecoins as well as treasury services, allowing borrowing/lending services.

Fundamental analysis conclusion

The COTI network is not the cheapest blockchain payment solution. However it has a variety of notable partnerships, which helps COTI to capture market share. It also offers features that are not yet developed in its competitors. Its team is competent with great track records.

A key risk that the Cryptocurrency industry faces is legislation and regulations. In April this year, President Joe Biden proposed a Capital gains tax increase. This prompted a massive selloff. Later in May, China banned financial and payment institutions from cryptocurrencies, resulting in a selloff that cut the industry market cap by half. Thus it is the opinion of this analyst that traders should avoid overleveraging in such a volatile market.

A key player in the blockchain payments industry, Ripple, was sued by the SEC for holding an unlicensed securities offering. Despite its victory, governmental regulations are certain in the long term.

Technical analysis

Using fib retracements, it looks like $COTI has bottomed out at 10 cents in July around the 0.382 fib level. It has since gone up to new all time highs.

In terms of fib extensions, 0.618 to 1.272 are likely profit taking areas. With a market cap of $500m, and the issuer of Cardano’s stablecoin, it is likely that there is still room to climb.

Macro analysis

Using the stock to flow, time and on chain signals created by PlanB, Bitcoin is expected to reach 100k by the end of year. We are likely to see a series of “red dots” resulting in a cycle top next year. After a strong rally, profits from Bitcoin are likely to spill over into altcoins, creating an altcoin rally for projects with good fundamentals. This will have a positive effect on COTIs price.

Conclusion

COTI is set to become the backbone payment solution in the Cardano ecosystem. In the short term, the Cardano ecosystem is not mature enough for an influx of capital. However, price upside is expected once the ecosystem matures.