Context

The inter-blockchain communication protocol (IBC) has recently gone live which will bring about positive changes to Cosmos applications.

IBC allows for cosmos dapps to transfer tokens and data to each other, meaning that blockchains with different applications and validator sets are interoperable, essentially able to talk to one another.

This greatly expands the possibilities for blockchain applications through:

- Integration with existing systems,

- Initiating transactions on other networks

- Conducting transactions with other chains

- Transacting between deployments on the same chain by integrating apps

- Making it easy to switch one underlying platform for another

Blockchain interoperability is key to adoption and it accrues value for the ecosystem, and it is beneficial to the ecosystem to see these initiatives increasing day by day.

Let’s explore the Osmosis DEX, an AMM swap built using the Cosmos SDK as well.

Overview

The Osmosis DEX is built on top of the Osmosis chain (a chain built using the Cosmos SDK). It supports the swapping and pooling of any IBC-enabled Cosmos SDK asset. Osmosis brands itself as an AMM laboratory, offering high customizability for its AMM pools.

Opportunity

From its mainnet launch in June 2021, the Osmosis chain has had IBC (Inter-blockchain Communication) built in. This makes Osmosis the first IBC-enabled AMM DEX to go live in the Cosmos ecosystem. The Osmosis DEX allows for swaps of any IBC-enabled asset, as well as the pooling together of any pair of such assets, allowing liquidity providers to earn trading fees and LP rewards.

At the time of writing, Gravity DEX (the DEX being built by the Cosmos team on the $ATOM native chain) is still on testnet. This means that currently, the Osmosis chain is the only chain that allows for the swapping and pooling of Cosmos SDK-based assets. Potentially, this gives Osmosis the first-mover advantage.

Unlike other AMM DEXs like Uniswap or Sushiswap, Osmosis offers deep customizability for its liquidity pools. Nothing about the underlying structure of AMMs on Osmosis is hard-coded. This means that swap fees, pool weightages, curve algorithms, and TWAP calculation are all fully customizable for each pool. Pool creators have the freedom to input novel mathematical expressions, and experiment with new AMM methods.

This unique customizability separates Osmosis from other AMM swaps.

The increased freedom afforded to pool creators, as well as its first-mover advantage within the Cosmos ecosystem could multiply the staying power and long-term growth of the Osmosis DEX and its $OSMO token.

For Proof of Work blockchains like Bitcoin and Ethereum that do not meet the requirements of IBC, bridges to the Cosmos Hub are already being built. With the gravity bridge, free flow of ERC20 tokens between Ethereum (and other EVM-enabled chains) to the Cosmos Hub is now possible. This allows DeFi dApps to scale — and expand the ATOM’s scope well beyond the Cosmos. The Bridge will also allow IBC tokens from Cosmos to be sent to Ethereum. This could have huge implications for the growth of DeFi, a burgeoning sector with more than $62 billion of value locked in its multiple predominantly Ethereum-based protocols.

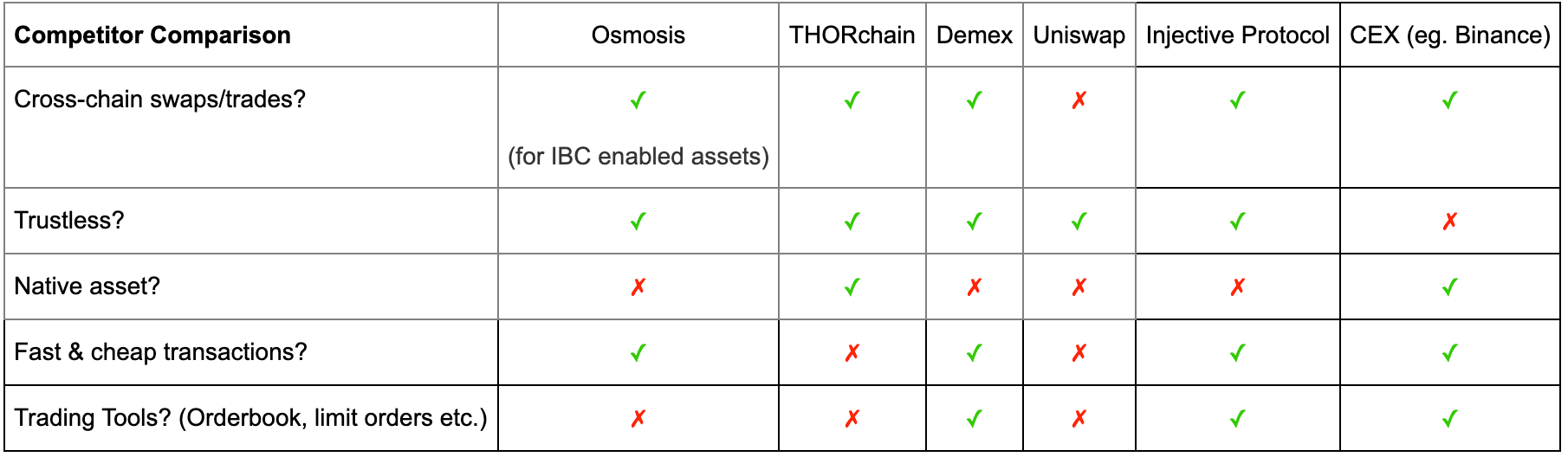

Competitor Analysis

Macro Trend

With the launch of Stargate and IBC, the grand vision of the Cosmos project is finally being realized - a fully interoperable ecosystem of Cosmos SDK-based chains. Currently there are over $75 billion worth of assets secured in the Cosmos ecosystem. Some of the largest and most popular chains are built using the Cosmos SDK. These include Binance Smart Chain, OKExChain, Terra, Crypto.com Chain, THORchain, and of course, our very own Switcheo Tradehub Chain.

Once interoperability between all these chains is fully functional, the possibilities are truly endless - and Osmosis is in a good position to facilitate this interoperability. As the first DEX to make use of IBC, Osmosis is currently the only place Cosmos users can perform permissionless swaps between their Cosmos assets, and earn high liquidity rewards for pooling those assets.

Tokenomics

The total supply of $OSMO is 1 billion, starting with an initial supply of 100 million. Half of the initial supply went to $ATOM holders who fulfilled certain requirements, and the other half went into the strategic reserve. New tokens will be released following a ‘thirdening’ schedule (token issuance will be cut by ⅓ every year), with 300 million tokens being released in the first year. The thirdening schedule will allow OSMO to reach an asymptomatic total supply of 1 billion.

Newly released tokens will be distributed to a combination of staking rewards, liquidity mining incentives, developer vesting, and community pool according to the following distribution:

- Staking Rewards: 25%

- Developer Vesting: 25%

- Liquidity Mining Incentives: 45%

- Community Pool: 5%

The initial rate of inflation is very high. Investors should be cautious of this fact. The high rate of inflation is being used to incentivize users to provide liquidity and earn liquidity mining rewards, as well as hodl and stake their OSMO tokens to earn staking rewards.

The high liquidity rewards are meant to attract large numbers of users to the Osmosis platform. Currently, users can earn ~250% APR from the ATOM/OSMO pool, ~312% APR from the CRO/OSMO pool, or ~93% APR from the ATOM/CRO pool (for LPers who do not wish to maintain large exposure to OSMO). Users can earn similarly high rewards for pooling other Cosmos tokens such as IRIS, ION, XPRT, REGEN, and AKT.

If the high rate of token emissions succeeds in drawing large amounts of users and liquidity to the Osmosis platform, it could quickly become the go to DEX for the Cosmos ecosystem. As the OSMO token is the governance token for the DEX as well as the Osmosis chain, this could lead to greater demand.

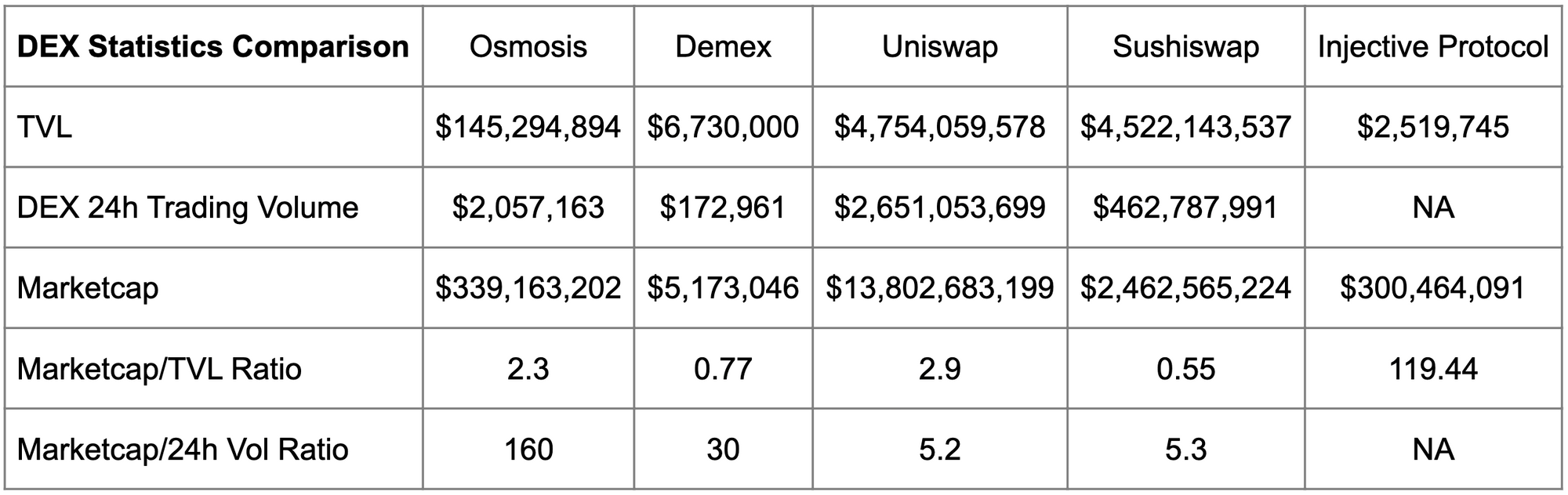

Product

The Osmosis DEX is fully up and running, with ~14 tokens being actively traded and pooled together. The incentivised liquidity pools boast high rewards between 93% - 398% APR.

At the time of writing the 24h volume of the Osmosis DEX sits at over $800k, and its total value locked (TVL) is over $97 million. Assuming that the demand for DeFi remains strong, and that DeFi users see the Cosmos ecosystem as a profitable place to earn high yields, we could see large amounts of liquidity and capital flowing into the Osmosis DEX in the near future.

Somewhat analogous to how Pancakeswap quickly became the largest DEX on the Binance Smart Chain, Osmosis could take the throne as the leading DEX in the Cosmos ecosystem.

Next, the integration of stablecoins into the Osmosis system. Stablecoins offer the best of both worlds — a stable asset within the crypto space with an advantageous transactional speed. Other chains are coming that have stable coins, but need to roll out the IBC upgrade first. Making USDT, and all the other Ethereum stables available on Osmosis would be a big deal for Osmosis as many others in the Cosmos ecosystem would want to DeFi with stables.

Risks

The OSMO token is currently undergoing a period of high inflation. Over the next year, 300 million additional tokens will enter the market, adding to the current total of 100 million. This will be followed by 200 million entering the market in the following year, and ~133 million the year after that. If demand is unable to keep up with this fast-inflating supply, the price of the OSMO token will be repressed.

There is also the risk that the Osmosis chain will be fully eclipsed by the main Cosmos chain and the Gravity DEX that is being built there. Although the Osmosis team is making efforts to brand itself as complementary to the main Cosmos chain, there always remains the risk that users will unilaterally choose to use the main Cosmos chain for any token swaps and exchanges, over the Osmosis chain.

Team

The Osmosis project was founded by Sunny Agarwal, a prominent researcher and developer for Tendermint/Cosmos. Chainapsis, the team behind Osmosis, is the same one that built the Keplr Wallet. Chainapsis is a prominent Cosmos SDK development hub, and their success with the Keplr wallet is testament to their capabilities.

Marketing

The Osmosis project is still in its early stages, having only launched in June 2021. Currently, their twitter account @osmosiszone sits at 13.7k followers. However, the team has close ties with the rest of the Cosmos ecosystem, and the project has been featured extensively by prominent Cosmos influencer @catdotfish.

Roadmap

The Osmosis team is building fast. Their code is open source, and can be viewed here: https://github.com/osmosis-labs/osmosis

After integrating native Cosmos assets, Osmosis has plans to integrate with non-IBC enabled chains including Ethereum (via the Althea gravity bridge), as well as other Bitcoin-like chains. If successful, this could transform Osmosis into a one-stop-shop for swapping and pooling of all assets from all chains.

Conclusion

By allowing for high customizability of its liquidity pools, the Osmosis DEX offers a unique solution to the standard AMM model. This, combined with the fact that the DEX market within the Cosmos ecosystem remains largely untapped, could lead to accelerated growth for the Osmosis platform. However, investors should remain keenly aware of the risks associated with the high rate of inflation of the $OSMO token.

Disclaimer: The writer of this article holds a position in $OSMO.