New narratives and trends merge often in crypto, making it challenging for investors and traders to get into these trends without hassle.

One such mega trend is liquid staking governance tokens such as Lido, Rocket pool, Frax Share, and many more. To get exposed to all of them on-chain would require significant effort, time, and transaction fees.

What if you could long the best LSD protocols in just one click, from any chain, anytime?

That is why Carbon is launching crypto's first Liquid Staking Index (LSI).

What is an Index?

An index is just a way to track the performance of a group of assets in a standardized way and is intended to replicate a certain area of the market.

The index allows a market to be built on it, and we are launching that as well.

Fun fact: Carbon built its own native decentralized oracle service when we launched, and thus can create any kind of index that track crypto assets.

What is Carbon's Liquid Staking Index?

Our Liquid Staking Index and market we created replicates the performance of liquid staking governance tokens.

This makes it easy for anyone to capitalize on the latest trends in a diversified and safer way, and can help outperform BTC and ETH for more savvy investors and traders.

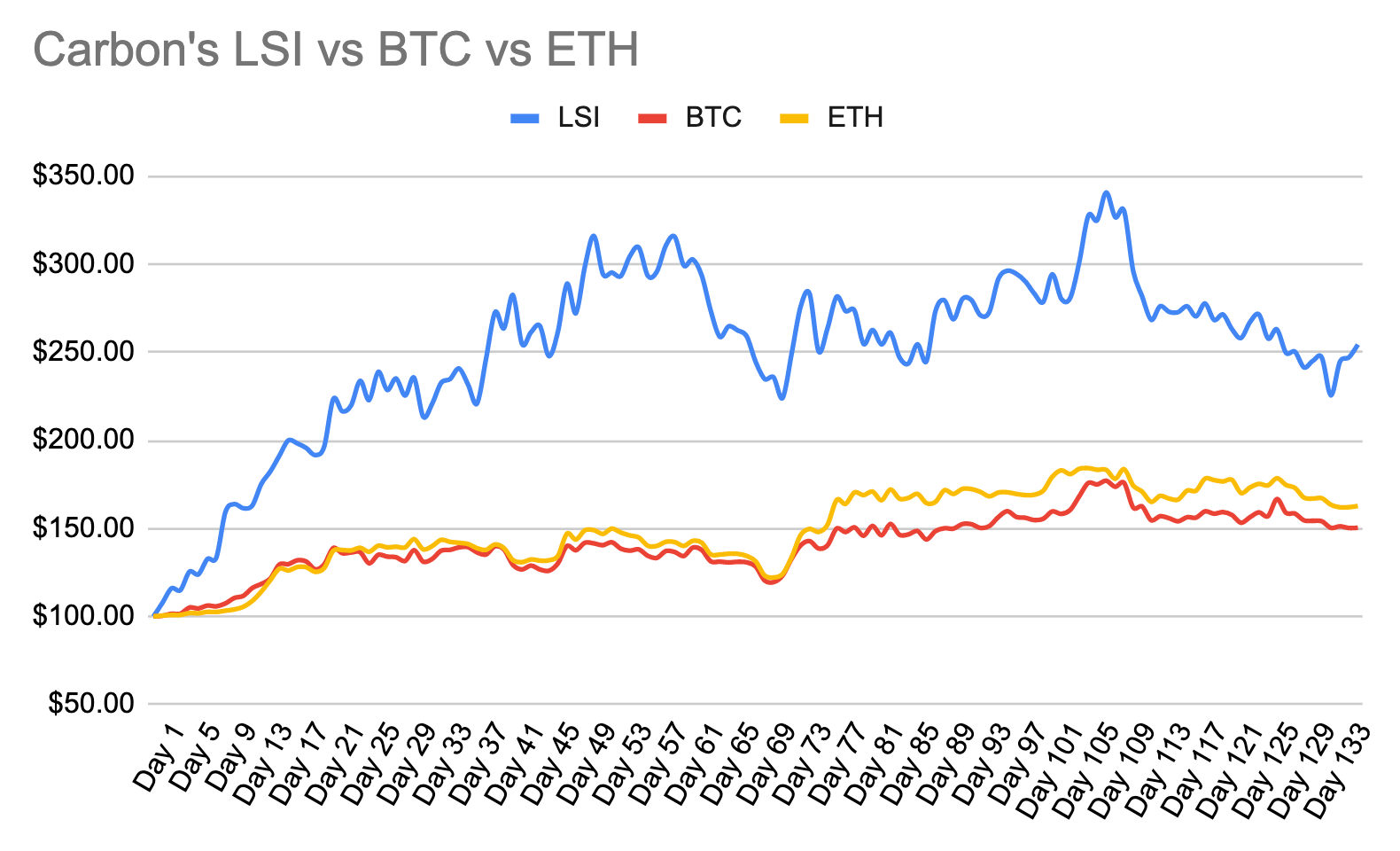

Case study: Outperforming BTC and ETH

At the start of this year, if you deposited $1000 to the LSI, BTC and ETH each, you would end up with over $2500 in the LSI today, but only about $1500 for BTC or ETH.

The main purpose of this index is to provide an easy way for traders to have a diversified portfolio of liquid staking governance tokens, while avoiding the risk of picking individual tokens.

What makes Carbon's LSI market unique is that it is a Perp market rather than a Spot market. This makes it easier for market makers to move the market price to the index price by using Carbon's price oracles and funding rates.

Additionally, it means you can also use leverage if you desire more capital efficiency, and Demex offers up to 50x leverage.

Liquid Staking Index Methodology

The four main components for our index methodologies are:

- Construction: How the assets are selected

- Weighting: How the variables are weighted relative to one another

- Calculation: How the index values and returns are generated

- Review: How the index is maintained on an ongoing basis

Let's start by exploring the liquid staking protocols that we have added to our index.

Construction:

Carbon's LSI is constructed by shortlisting liquid staking protocols that are established, have a unique selling point, and strong growth potential.

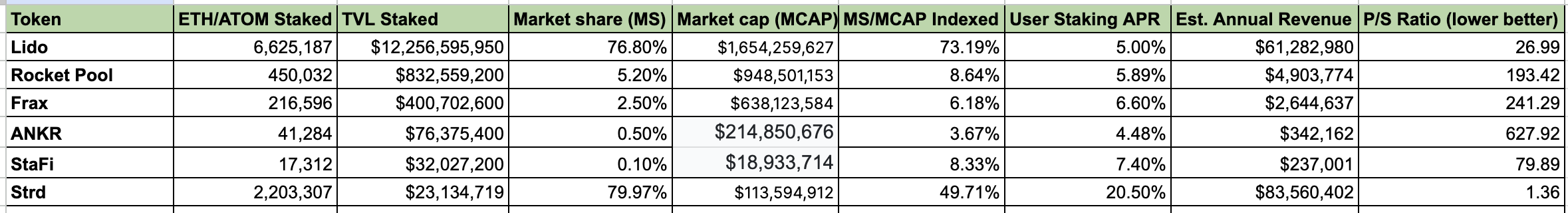

Here are the shortlisted protocols:

- Lido

- Rocket Pool

- Frax

- ANKR

- StaFi

- Stride

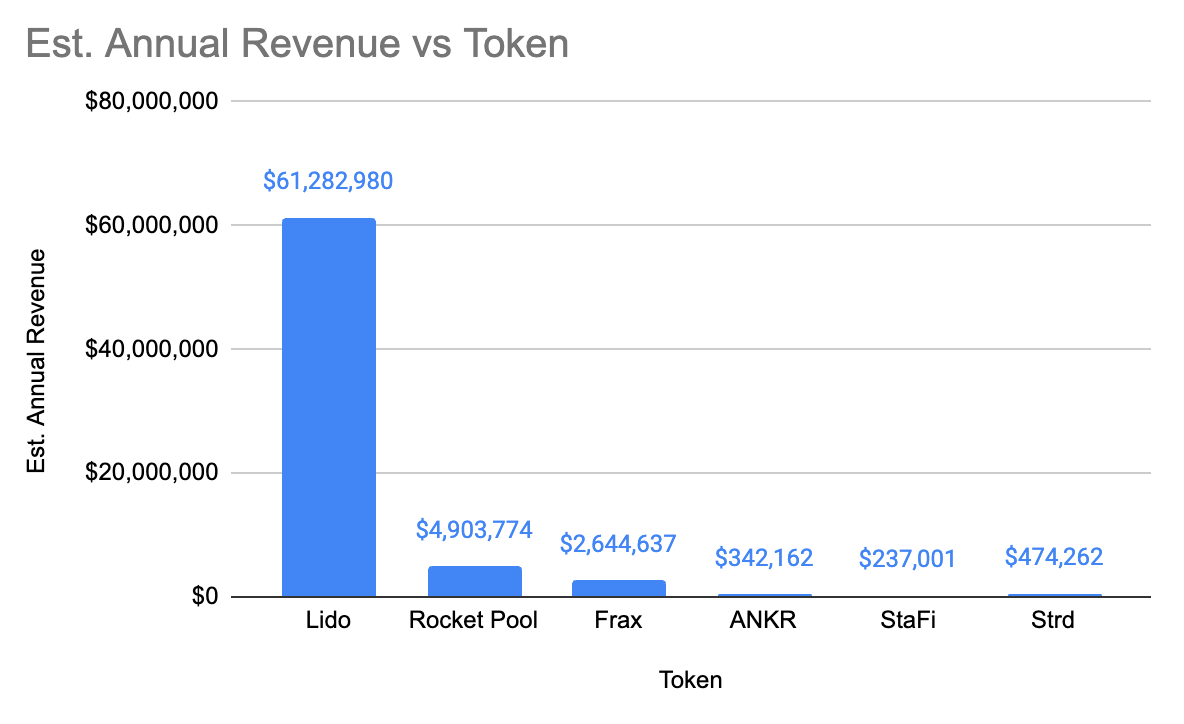

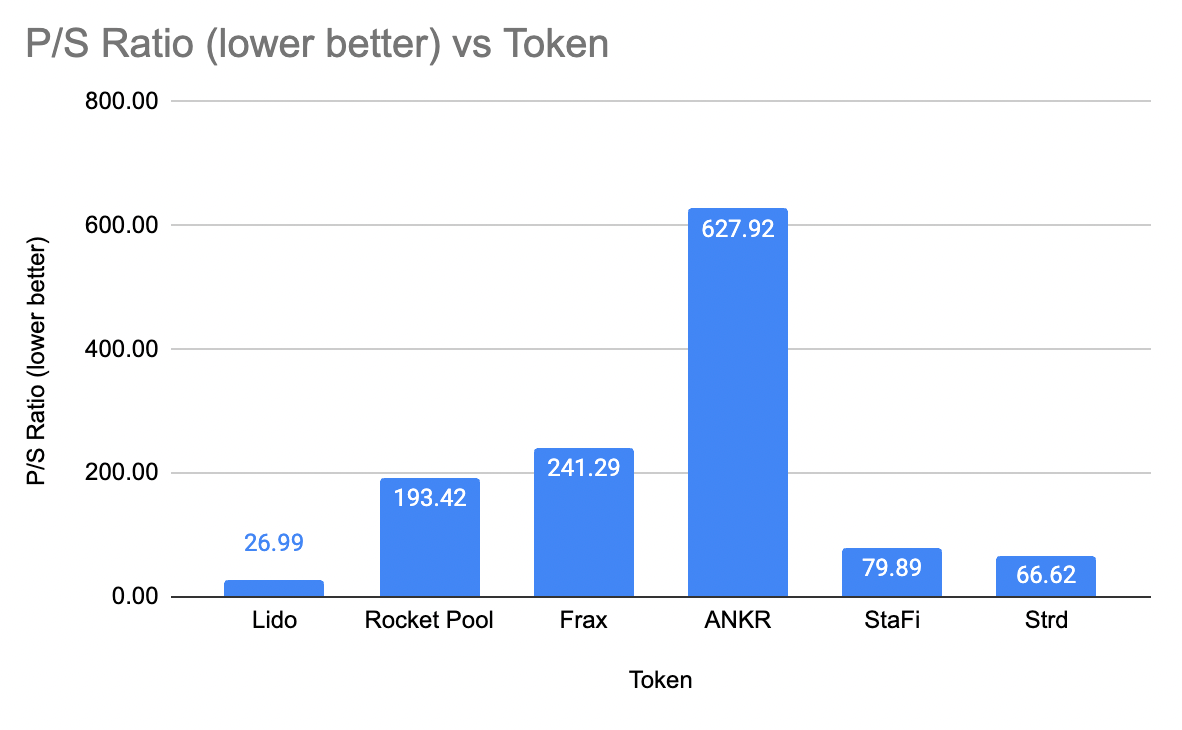

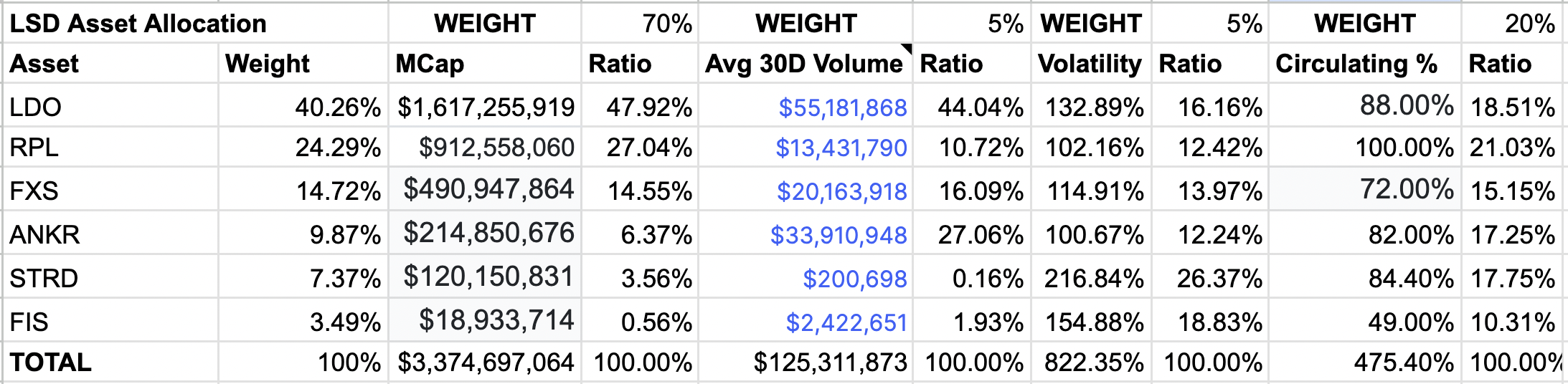

Here's a comparison table of LSD protocols with their key metrics.

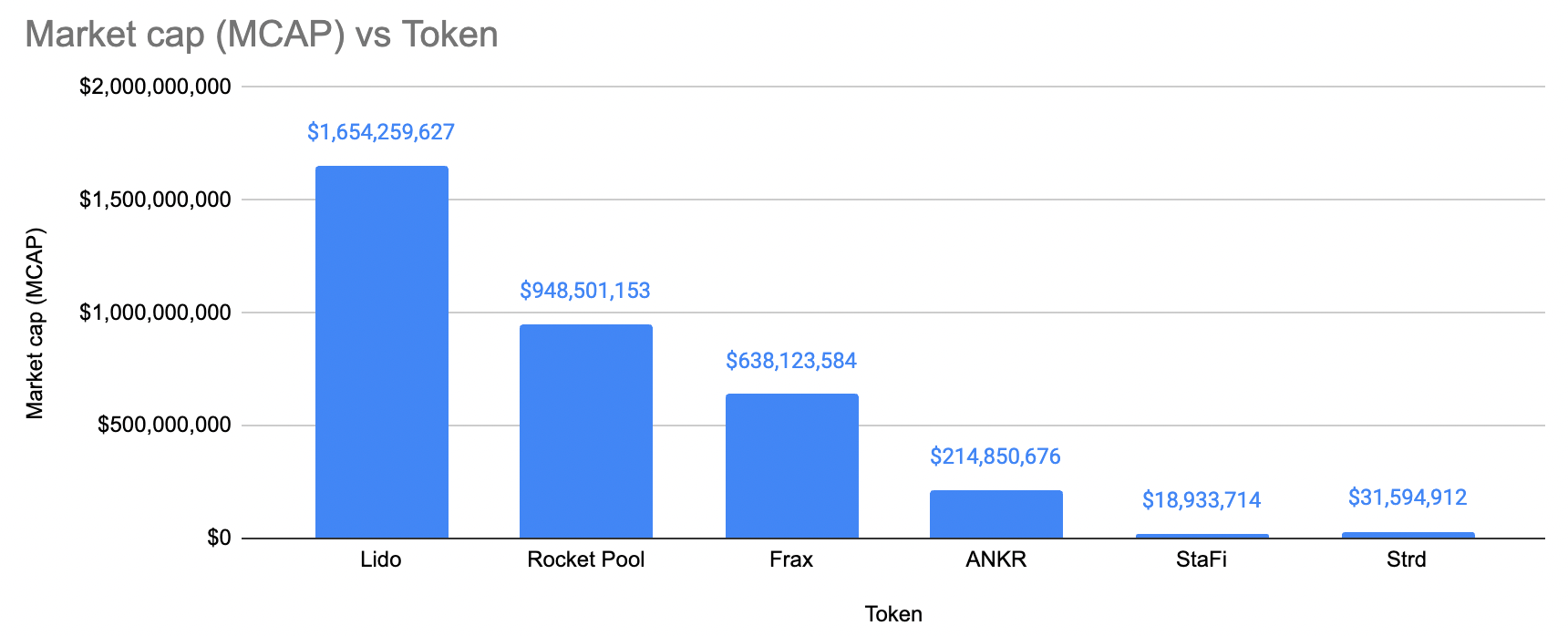

Lido:

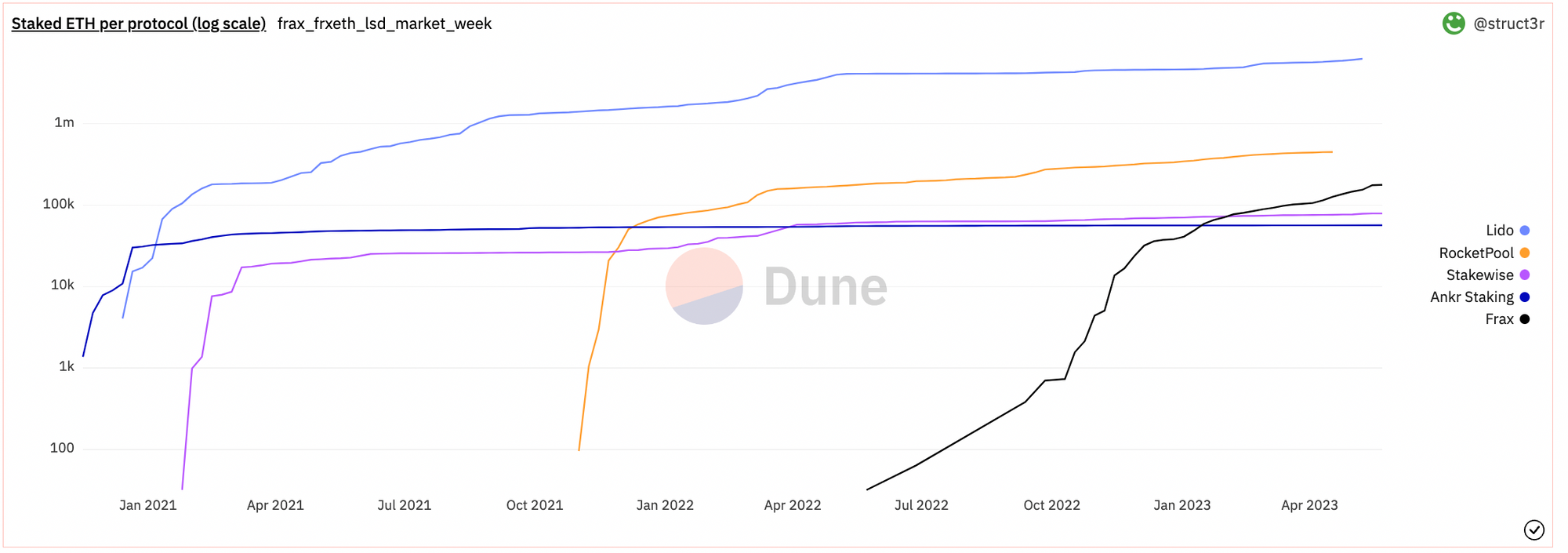

The most popular liquid staking protocol for Ethereum that allows users to earn staking rewards while maintaining liquidity. It has over $10 billion in ETH staked with them and has the majority market share of liquid staked ETH at about 70%.

They have two ETH tokens, stETH which uses a rebase model, and wstETH which is wrapped stETH that uses a value accrual model.

wstETH from Arbitrum is also listed as a collateral on Nitron.

Lido was added as it the largest market cap and revenue.

Rocket Pool:

One of the most decentralized Ethereum staking platform that enables users to earn staking rewards by depositing their ETH into a pool to get rETH a value accruing ETH, as well as allowing validators to set up ETH nodes with just 16 ETH instead of 32.

RPL was added it has over 1000 node validators which is far more decentralized and censorship resistant compared to Lido who only has around 30 currently.

Frax Share:

Started with a stablecoin, Frax Protocol have also launched their own ETH liquid staking platform and is the fastest growing ETH liquid staking provider. This is also because they have the highest yield for ETH stakers due to controlling a large percentage of CRV rewards to their frxETH liquidity pools on Curve.

They have two tokens, frxETH which is 1:1 to ETH, and sfrxETH which is staked frxETH that uses a value accruing model similar to wstETH.

FXS was added as they have the fastest growing amounts of ETH staked.

Ankr:

One of the earliest liquid staking protocol that started in 2019, providing easy access to staking services for various cryptocurrencies, including Ethereum. Their ETH LSD is called ankrETH and uses a value accrual model.

Ankr globally distributed node infrastructure allows us to build the best possible multi-chain tools as a foundational layer for Web3, DeFi, and the crypto economy.

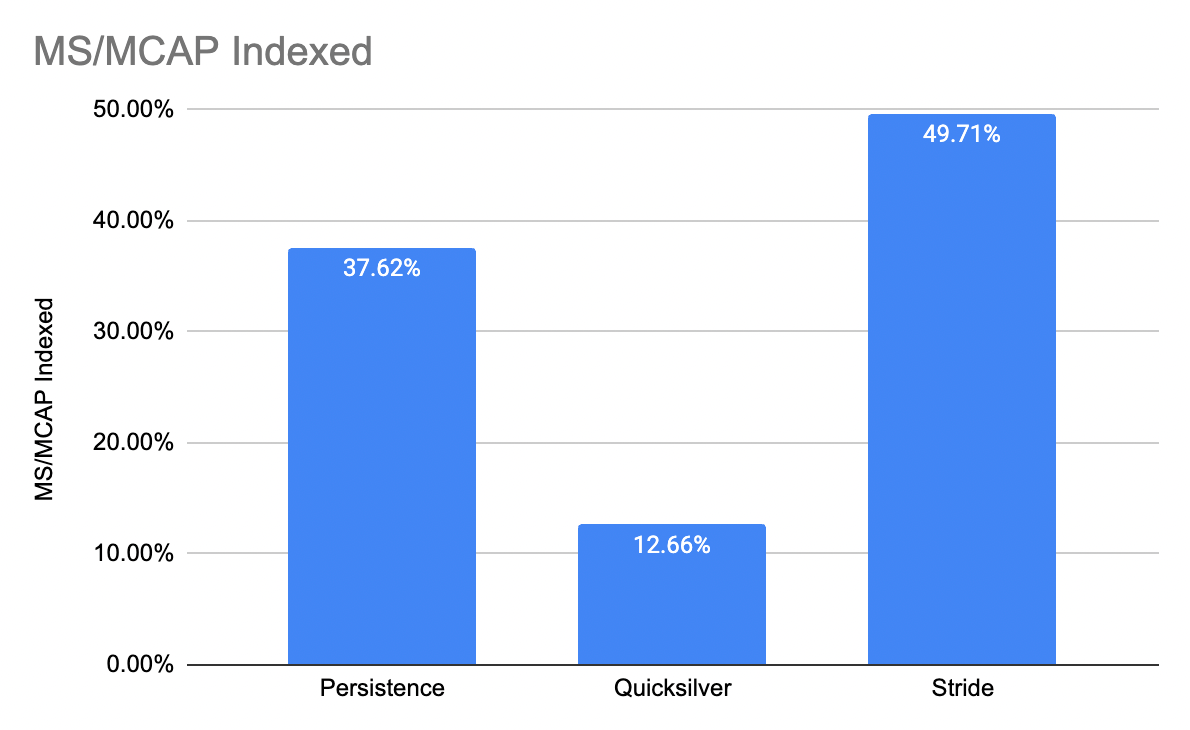

Stride Zone:

Unlike the other ETH liquid staking providers on this list, Stride focuses on the Cosmos ecosystem. They are a liquid staking app chain built on Cosmos SDK for other cosmos tokens such as stATOM, stOSMO and more.

Stride focuses on security and liquidity for their liquid staking solution. Cosmos app chains uses Proof-of-Stake tokens that usually have high staking rewards and can benefit greatly from having an LSD version.

Stride was selected as it is the leading liquid staking provider on Cosmos, with a market share of ~80% for ATOM that has been liquid staked.

We also wrote an article explaining about how undervalued they were when it was just $0.20, and it went all way above $2.00 afterwards.

StaFi:

One of the earliest multichain liquid staking protocols for EVM and non-EVM chains like Ethereum, BSC, Polkadot, and more.

It also has one of the lowest commissions at 5%, and lowest requirements for running an ETH validator node with just 4 ETH compared to Rocket Pool which requires 16 ETH. Their LSD tokens have an 'r' prefix such as rATOM.

These selection of liquid staking protocols can be changed during the review process or via a governance vote.

StaFi was added as it has low market cap while still maintaining a low P/S ratio right after Lido (excluding STRD as it's a different sector).

Weightage:

Carbon's LSI is a weighted index. Right now it factors in four different variables with different weights.

The shortlisted markets, corresponding weights, and selected variables, can all be adjusted by Carbon governance initiated by SWTH holders, and in the future more variables such as YTD performance, profitability, etc, can be weighed.

Let's go through what these factors are and why we factored these in.

Market Cap: The total market capitalization and valuation of the protocol. This has the highest weight as it is a proxy for the success and credibility of the token. Higher is better.

30 Day volume: The total volume traded in the past 30 days. This tells us the trading demand for the token. Higher is better. This can be easily manipulated hence the weightage is reduced.

Volatility: The annualized volatility of a token. It is calculated by taking the square root of 365 days (crypto is 24/7/365) multiplying by the standard deviation of the daily log return of the token. This tells us how much the token is expected to move, in either direction, in a given year. The higher the better for traders as more volatility means more trading opportunity. As you can see, LSD gov tokens are a highly volatile sector which is great for trading.

Circulating supply: The circulating supply is calculated by taking the circulating supply divided by the total supply. This is tell us how much emission is left. The higher the better as it means there is less emission which means less inflation and thus selling pressure.

Calculation:

The LSI is normalized to $100 which will be its starting price.

It uses a price-normalized and weighted index methodology. Here's how it works.

At every block:

- The price of each constituent asset is calculated from the price feed

- The price is multiplied it by the normalization factor to account for the weight of the constituents to get the normalized price of each constituent

- The normalized price of each constituent is now summed together to recalculate the normalized index

Carbon's block time is approximately 2 seconds.

Review:

LSI will be reviewed by the Carbon team every 2 months for rebalancing, adjusting the variable weights, adding new variables, and adding or remove constituents.

When new constituents are added or removed, the index price remains the same.

Why Liquid Staking?

Liquid staking gives users more capital efficiency and is a key pillar in DeFi that is growing rapidly.

Lido recently deployed their v2 which allows for stETH to be redeemed into native ETH, and MetaMask also announced native in-app staking and unstaking of ETH. These improvements in liquid staking user experience will allow for mainstream adoption, which will continue to grow the liquid staking scene in crypto.

Many protocols are now building on top of liquid staking, and with such growing popularity and userbase, it makes sense for us to create a liquid staking index and market to allow traders to easily get exposed to this mega trend.

Conclusion

As the liquid staking narrative heats up, investors and traders are looking for an easy way to ride this trend.

With the introduction of the first Liquid Staking Index by Carbon, it is now easier for the general public and traders alike to access a diversified exposure to this growing trend of liquid staking governance tokens.

The index uses Carbon's oracle services to track token performance in a weighted approach and launched a market that mimics the index movement. Carbon's liquid staking market also allows users to leverage up to 50x.

On 23rd May 2023, you can start trading our Liquid Staking Index at Carbon's reference trading UI, dem.exchange.