Introduction

Stablecoins have come under the spotlight as we have just seen the death spiral of UST and how bad a fully algorithmic stablecoin design is. Centralized stablecoins such as USDC and USDT is backed by fiat but runs a risk of having government regulations. A decentralized economy still needs a decentralized stablecoin.

Frax is an open-source, permissionless, fractional-reserve algorithmic stablecoin protocol. It attempts to be the first stablecoin protocol to implement design principles of both to create a highly scalable, trustless, extremely stable, and ideologically pure on-chain money.

The end goal of the Frax protocol is to provide a highly scalable, decentralized, algorithmic money in place of fixed-supply digital assets like BTC.

FRAX & FXS

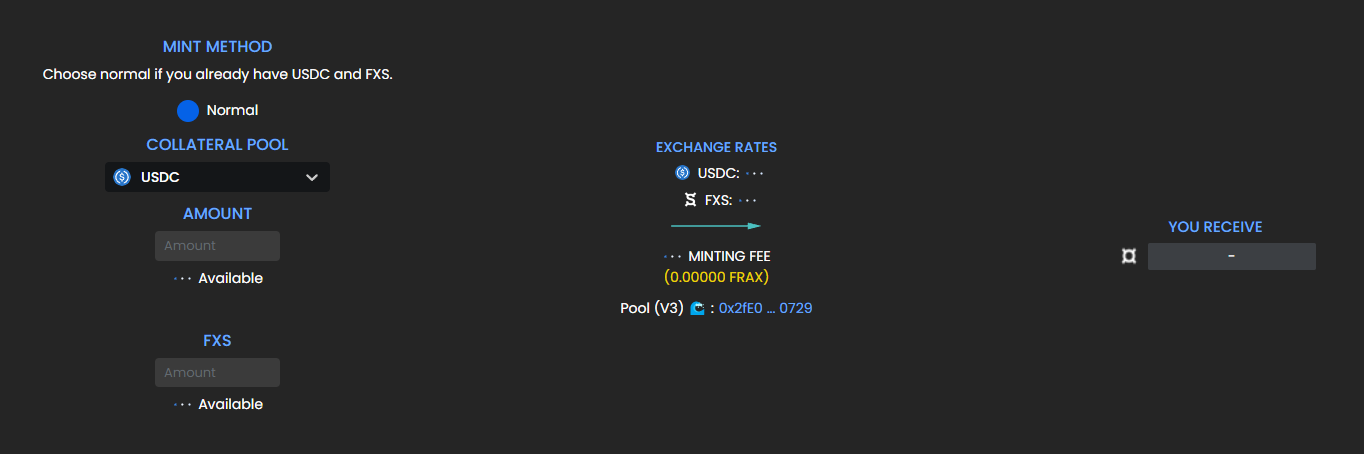

The Frax protocol is made up of 2 tokens, the FRAX stablecoin and FRAX Share (FXS) governance token. FRAX can be minted with a percentage of collateral in USDC and FXS.

The current collateral ratio as of this writing is at 89%, which means anyone can take $0.89 cents worth of USDC and $0.11 worth of FXS to mint $1 of FRAX and vice versa for redeeming FRAX.

The minting and redemption fees are between 0.2% and 0.45% in FRAX, hence the more minting and redemption is done, the more revenue the treasury makes. They have made over $40 million of frax since their start in Dec 2020.

As the peg becomes more trusted, the collateral ratio will drop, resulting in more FXS needed to mint FRAX, which will be bullish for $FXS. We can see from the graph below that the collateral has been ranging from 80%-90% in USDC since their launch.

The collateral ratio (CR) is updated using the Algorithmic Market Operations (AMO). Here's how it works:

1. Decollateralize - the portion of the strategy which lowers the CR

2. Market operations - the portion of the strategy that is run in equilibrium and doesn't change the CR

3. Recollateralize - the portion of the strategy which increases the CR

4. FXS1559 - a formalized accounting of the balance sheet of the AMO which defines exactly how much FXS can be burned with profits above the target CR.

The Decentralization Ratio is the ratio of decentralized collateral value over the total stablecoin supply backed. Off-chain collateral such as fiat currency, securities, and custodial assets like gold and oil are counted as 0% decentralized.

How does Frax make money?

Frax uses AMO to make money by leveraging on Frax assets in a systematic way by automatically moving collateral and FRAX to capital efficient locations.

AMOs are modular but share core functions that are restricted by one rule: they cannot break the FRAX peg.

- FXS1559 calculates all excess value in the Frax system above collateral ratio and 100% of this AMO revenue goes to veFXS holders.

- Collateral Investor AMO puts idle USDC collateral from the Frax treasury to work across DeFi platforms to earn yield.

- Curve AMO moves idle USDC collateral and new FRAX minted to the Curve FRAX3CRV pool. The FRAX3CRV pool will earn trading fees, CRV and other LP rewards.

- Uniswap v3 AMO puts FRAX and idle collateral to work by providing liquidity and earn trading fees.

- Frax Lending AMO allows FRAX to be minted into money markets such as Aave to allow anyone to borrow FRAX by paying interest. Frax earns from the interest paid by the borrowers.

Frax also allows investors to become liquidity providers by bonding FRAX/FXS or FXS/ETH on Uniswap, which generates fee revenue for the liquidity providers on trades.

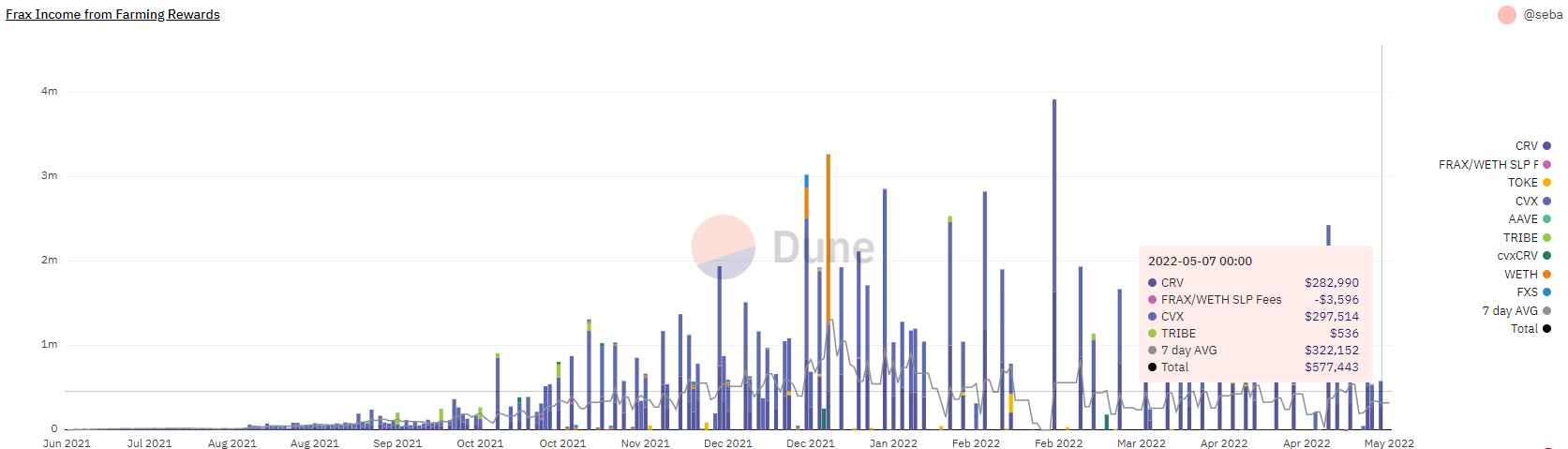

Frax earns $322k per week based on their previous 7 day average earnings from the various AMOs deployed on platforms such as Curve. They have generated a total of $40.92 million in profits with over $100 million worth of profits at its peak.

Frax Price Index

Frax Finance recently released a new stablecoin called Frax Price Index (FPI) which is pegged to the CPI and its governance token FPIS (Frax Price Index Share). Users who held their FXS on Convex, FRAX/FXS LP, veFXS or tFXS were eligible for the FPI airdrop on 20th February 2022.

The system will adjust every month the on-chain Consumer Price Index oracle so holders of FPI will increase their dollar-denominated value according to the reported CPI increase.

It does this by earning yield on the underlying FPI treasury, created from users minting and redeeming FPI for FRAX. Users can mint FPI with FRAX or redeem FPI for FRAX for a small fee set to 0.30% initially.

FPIS is the governance token of the FPI system, which is entitled to seigniorage from the protocol. Excess yields will be directed from the treasury to FPIS holders similar to the FXS structure.

During times where the FPI treasury does not create enough yield to maintain the backing for FPI due to inflation, new FPIS may be minted and sold to increase the treasury, decreasing the price of FPIS.

Since the protocol is launched within the Frax ecosystem, the FPIS token will also direct a part of its revenue to FXS holders.

Ecosystem TVL

Frax has currently $1.33 billion worth of assets locked according to Defi Llama. We can also see that there is a steady growth in terms of TVL since the launch of the protocol.

However, there is a drop in TVL from $2.3 billion due to the UST depeg which caused investors to lose confidence in decentralized stablecoins.

Current Valuations

FRAX Price: $9.21

Market Cap: $544,322,121

Fully Diluted Valuation: $911,458,779

Total Value Locked: $1,311,949,052

Circulating Supply: 60,254,204

Total Supply: 99,077,854

Market Cap / TVL Ratio: 0.42

Fully Diluted Valuation / TVL Ratio: 0.69

Tokenomics

As mentioned above, FXS is the governance token and is not pegged to anything. Market participants are incentivized to buy FXS tokens as they receive voting rights, transaction fees, and price appreciation.

There is a maximum supply of 100,000,000 FXS tokens, 65% for the community and 35% for the team and investors.

Community – 65% (65,000,000 FXS)

· 60% - Liquidity Programs / Farming

· 5% - Project Treasury / Grants / Partnerships / Bug Bounties

Team and Investors – 35% (35,000,000 FXS)

· 20% - Team / Founders / Early Project Members (12 months vesting with a 6 month cliff)

· 3% - Strategic Advisors / Outside Early Contributors (36 months vesting)

· 12% - Accredited Private Investors (2% unlocked at launch, 5% vested over first 6 months, 5% vested over 1 year with a 6 month cliff)

FXS is needed in order to mint FRAX. It has a unique tokenomics that allows for a positive feedback loop:

· More FRAX in circulation leads to more FXS burned.

· Higher FXS prices leads to a tighter FRAX peg and more liquidity

· A tighter FRAX peg and more liquidity leads to more trust in FRAX used

Depeg Risk

By calculating the top 50 holders of FRAX excluding DEX and bridges, it amounts to about $200 million FRAX and I will be using this amount to test the liquidity.

There is currently $788 million of FRAX and $580 million in the 3CRV pool. By swapping $200 million of FRAX to USDT, the exchange rate is 0.9995. However, the exchange rate for DAI and USDC is 0.8929 and 0.8556 respectively which is far from its peg.

Competition

DAI

DAI is the world’s first crypto-collateralized and decentralized stablecoin and is currently the leader for decentralized stablecoins with a market capitalization of about $6 billion. The collateralized assets backing DAI are other cryptocurrencies instead of fiat and are held within smart contracts rather than in institutions.

FEI

FEI is a fully decentralized protocol that uses a new stablecoin mechanism called protocol controlled value (PCV). It is more capital efficient and has a fair token distribution. The protocol uses a mechanism to maintain the liquid secondary markets. The market cap of FEI is $543 million currently which is much smaller than its competitors. However, there was a recent hack which drained $12 million from the protocol, causing users to exit the ecosystem.

USDD

Justin Sun, the founder of Tron, recently launched their algorithmic stablecoin, USDD. Their stablecoin mechanism follows the same model that Terra was previously using and the Tron DAO is seeking $10 billion in assets for a reserve to be used in case of a financial crisis. USDD has gained quite a lot of traction since its launch in May. The market cap of USDD is $542 million, slightly lower than that of FEI.

Team

Frax Finance was founded by Sam Kazemian and Stephen Moore. Sam Kazemian co-founded Everipedia in 2014, which looks to create a modernized Wikipedia on the blockchain. Stephen Moore previously worked with Donald Trump as a senior economic advisor before working on Frax Finance.

Some of the investors of Frax Finance includes some well-known VCs such as Dragonfly Capital, Parafi Capital, Crypto.com and Galaxy Digital, along with blue-chip DeFi platforms like Aave and Synthetix.

Upcoming Catalyst

The team is currently working on FraxLend which is a platform that supports real world asset loans, undercollateralized / credit based loans, and classic overcollateralized loans. The design is the exact same structure of a real bank with debt based reserves and credit creation, making the protocol much more sustainable.

To expand their privacy features, the Frax team has proposed an AMO Controller that would allow minting of FRAX directly into Tornado Cash as they believe that any increase in privacy is value generating. Their goal for this AMO is to anonymize the entirety of incoming FRAX supply when gas optimization solutions are fully implemented.

Frax also plans to expand their basket of assets that back its stablecoin by adding other cryptocurrencies, interest-generating tokens and traditional asset loans to the mix as their reserve collateral. Sam Kazemian recently mentioned that they are also looking to change their collateral to include blue-chips tokens like BTC and ETH.

As FRAX is on multiple blockchains, it would make sense to take a multichain approach in proportion to the demand across the chains for FRAX. This will facilitate more FRAX based transactions while creating a greater demand for their L1 tokens.

Technical Analysis

Looking at the charts for Frax Share, FXS/FRAX has the highest liquidity around $80m so we will be using that pair for our technical analysis.

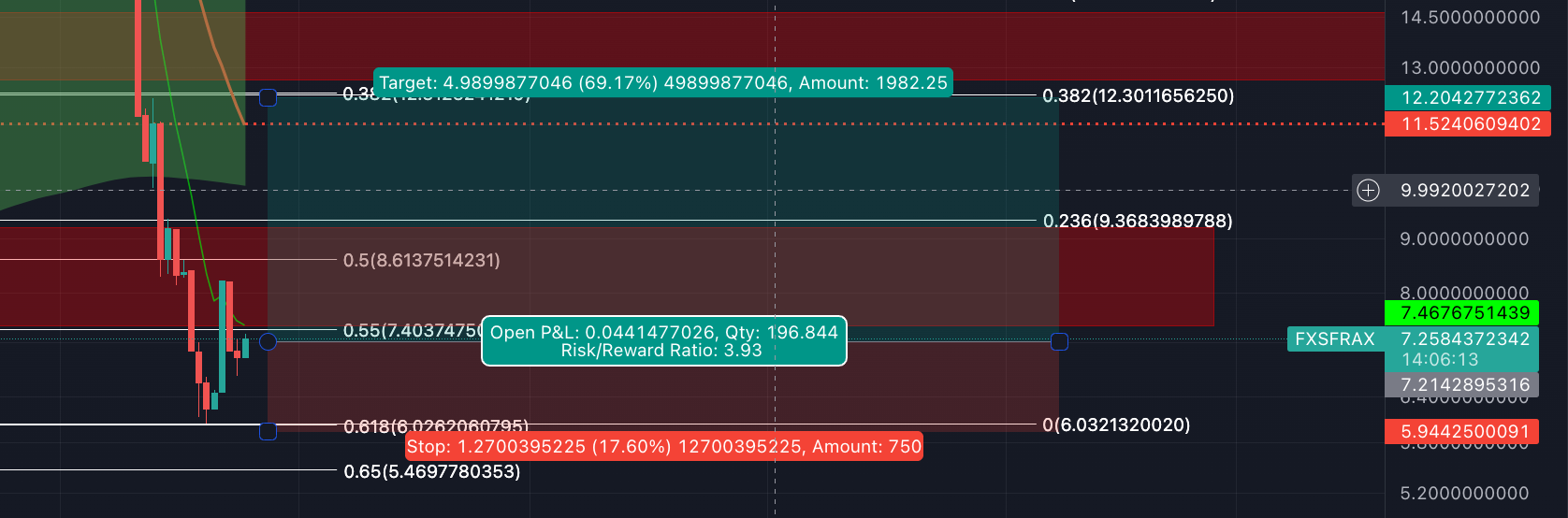

Using the Fibonacci Retracement tool from the bottom of the trend to the top, we see that the golden pocket (0.618 to 0.65) which is usually a key support lies around $5.5 to $6.0 and was touched during the most recent pull back.

The daily RSI has also dropped below 30, indicating that FXS is oversold on a technical level.

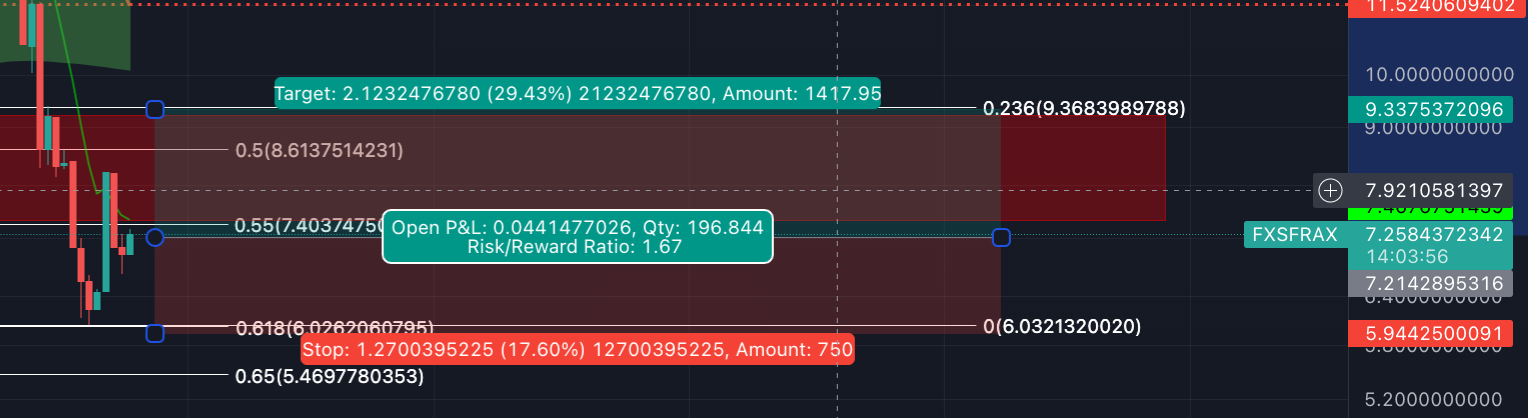

Assuming this is a temporary bottom, taking the Fibonacci Retracement from the top of the trend to the bottom shows that our first major resistance at the 0.382 is around $12.30, a 66% increase from current prices. This price has also historically been a strong support, hence it will now be a strong resistance. However, due to weak narratives surrounding algo stablecoins, it is possible that it only retraces to the 0.236 which is around $9.36, a 27% increase from current prices.

Looking at the R/R ratio, cutting loss below the golden pocket around $6, and taking profit at the first major resistance around $12, lets a R/R ratio of around 4 which is acceptable and will put its market cap around $740m without taking into account additional emissions.

However looking at a profit taking price at $9.36 only gives a 1.67 R/R ratio, which is not a decent R/R.

Conclusion

The current market capitalization of stablecoins is about 13% of the total cryptocurrency market. The stablecoin market is predicted to reach a few trillion of dollars once the cryptocurrency market matures in the future. This could be a strong catalyst for FRAX as the demand for stablecoins would cause more adoption for FRAX, which will result in the growth of the project and increase in the price of FXS as well.

Due to the decline of UST, it is will be tough for users to trust a fully algorithmic stablecoin for the time being. The FRAX hybrid model is extremely innovative and we believe that they can take the spot of being the leader of decentralized stablecoins as they continue to build on the project.