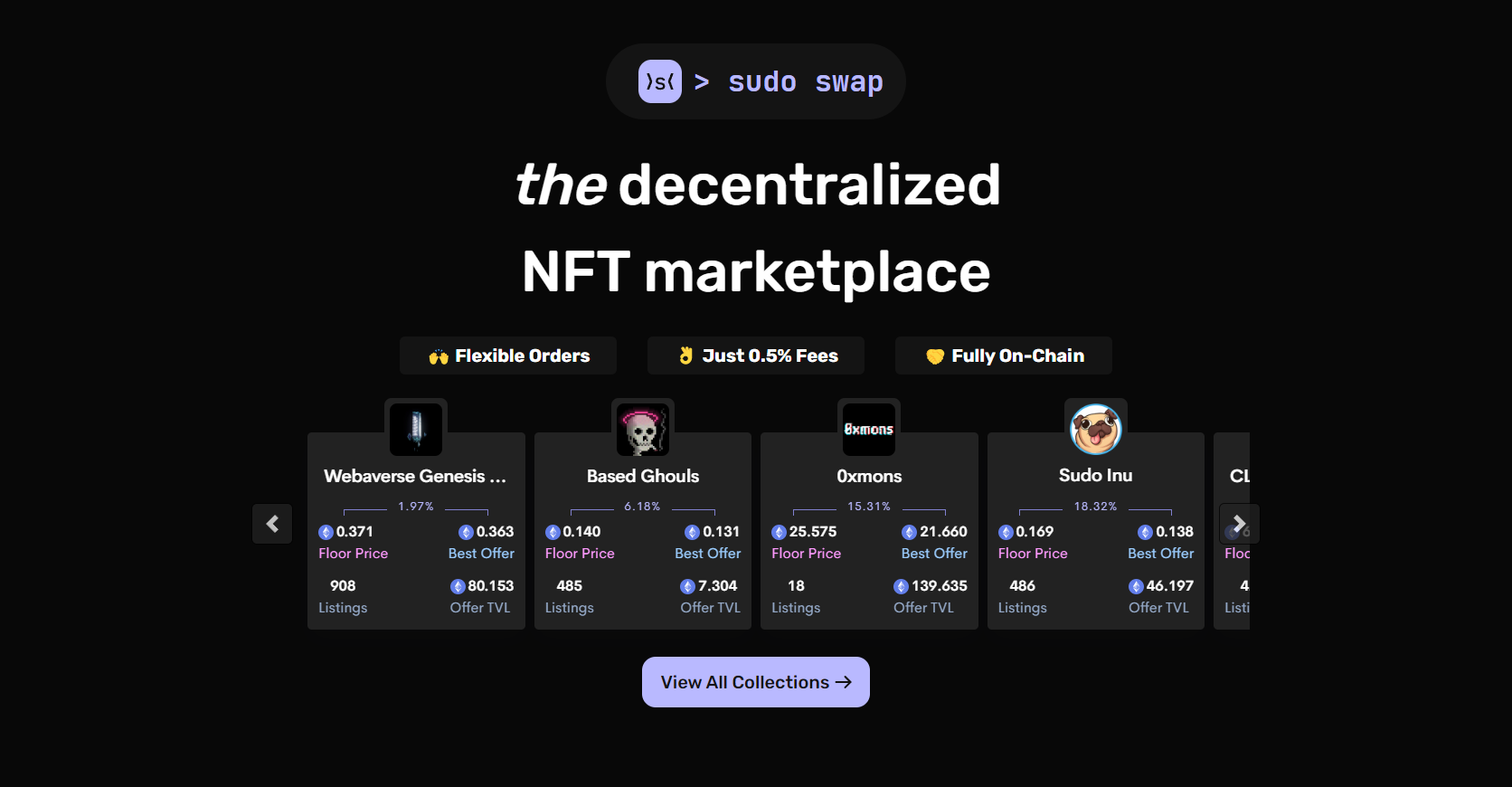

With over 15,000 users generating $25 million in volume, Sudoswap could disrupt the NFT trading industry with its automated market making (AMM) algorithms and liquidity pools. It utilizes a similar model to the top decentralized exchange (DEX) - Uniswap v3.

Introduction to Sudoswap

Originally launched as an over-the-counter (OTC) swap for NFTs in April 2021, Sudoswap was designed by a pseudonymous developer who was more well-known as the creator of 0xmons - an experimental pixel monster collection. It allows anyone to trade ERC-20, ERC-721, and ERC-1155 assets without incurring additional fees.

NFT traders and collectors have long been plagued by poor liquidity and large slippage from NFT marketplaces. A Kaiju Kingz NFT might sell for $10,000 on one occasion but could drastically decrease in value and not garner similar offers for weeks or months. This leaves investors confused over how much it’s actually worth.

In July 2022, Sudoswap launched its own brand of AMM called SudoAMM. The platform allows NFT traders to buy and sell instantly without having to wait for an offer. Unlike OpenSea, Sudoswap allows sellers to contribute their NFTs and ERC-20 tokens (currently only ETH) as liquidity to facilitate smoother automated trades. This ensures that orders are settled on-chain within the specified pool rather than one-to-one.

Did you know that Sudoswap only takes a 0.5% fee which is 5 times cheaper than what OpenSea charges at 2.5%?

Benefits of Sudoswap

At first glance, Sudoswap offers completely decentralized pools that are funded by its users. The creator of the trading pool is allowed to set perimeters such as swap fees and the type of bonding curves.

The platform provides 3 options for traders:

1. Buy-only pools

Buy pools contain ETH and are used to buy NFTs with ETH. This allows anyone to dollar cost average (DCA) into an NFT collection as the floor price decreases.

2. Sell-only pools

Sell pools contain NFTs and are used to sell NFTs into ETH. Likewise, this allows for DCA-ing out of an NFT collection as the floor price increases.

3. Dual pools

Dual pools or two-way pools contain both NFTs and ETH that receive fees from trades. Fees generated from assets traded within the pools are redirected to those providing the NFT and ETH liquidity.

Additionally, Sudoswap bypasses any royalties on NFT collections set by creators which is a heavily debated topic amongst the community.

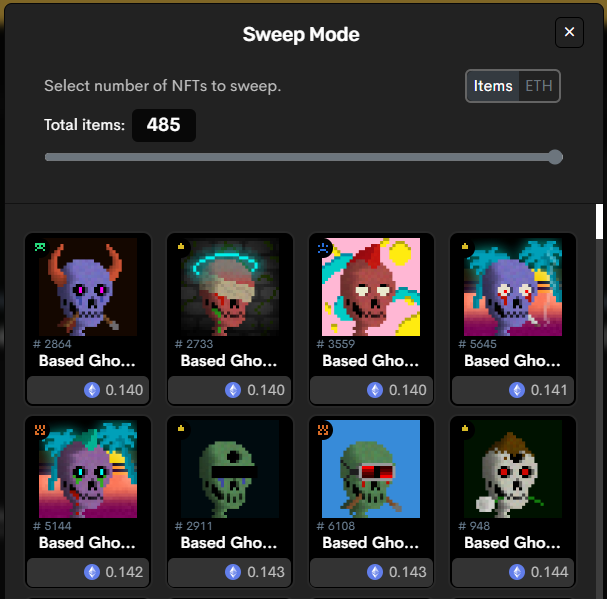

Sweep Mode

As buying NFTs individually would cause the floor price of a pool to increase, it is often better to use various pools to purchase multiple NFTs. Sudoswap has created a built-in feature called “Sweep Mode” that helps users to find the best combination of purchases.

For example, if you were to buy 5 NFTs, the cheapest option would be selected for the first purchase. However, this would increase the floor price of other NFTs in the same pool. Sweep Mode collects the floor price of different pools and presents this information to users. This allows us to pick up a couple of NFTs at a similar price instead of buying upwards.

The same principles when selling multiple NFTs. To sell several NFTs from a collection, you would likely get a better price by selling single NFTs to individual pools rather than selling all of them to the same one.

Do note that users can select the exact NFT they receive when buying NFTs from Sudoswap pools. This works well for collections with variable rarities as it gives buyers a chance to buy NFTs with rare traits close to the floor price. Conversely, NFT sellers with rarer assets would probably find better prices for their grails on other centralized marketplaces.

Concentrated Liquidity

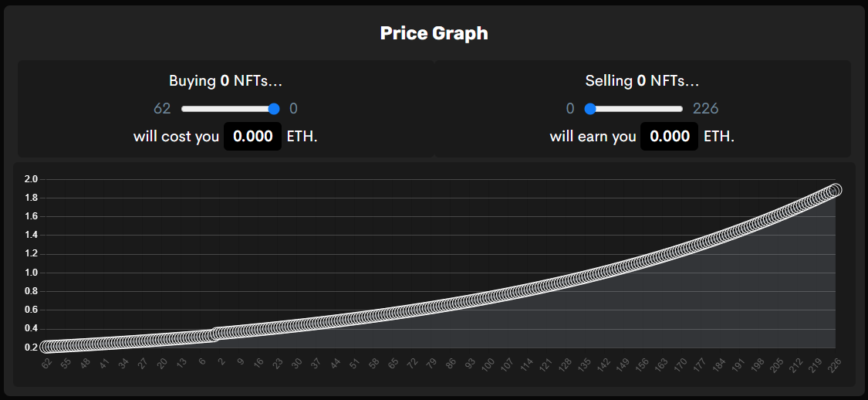

Traditional AMM models support prices from 0 to infinity which has been proven to be less capital efficient with Uniswap v3. SudoAMM uses a concentrated liquidity AMM for trading whole NFTs.

This gives anyone the freedom to customize a specific price range just like on Uniswap v3. Let's take a look at how that works below.

How does Sudoswap work

As mentioned above, SudoAMM has brought the x * y = k formula from traditional DEXes to solve the liquidity problem in the NFT space.

If you have interacted with Uniswap v3 previously, Sudoswap works very similarly where liquidity providers are free to select a customized price range while putting up their NFTs and ERC-20 tokens. This is definitely the most innovative area of Sudoswap, where it manages the value of the NFTs traded through its pools.

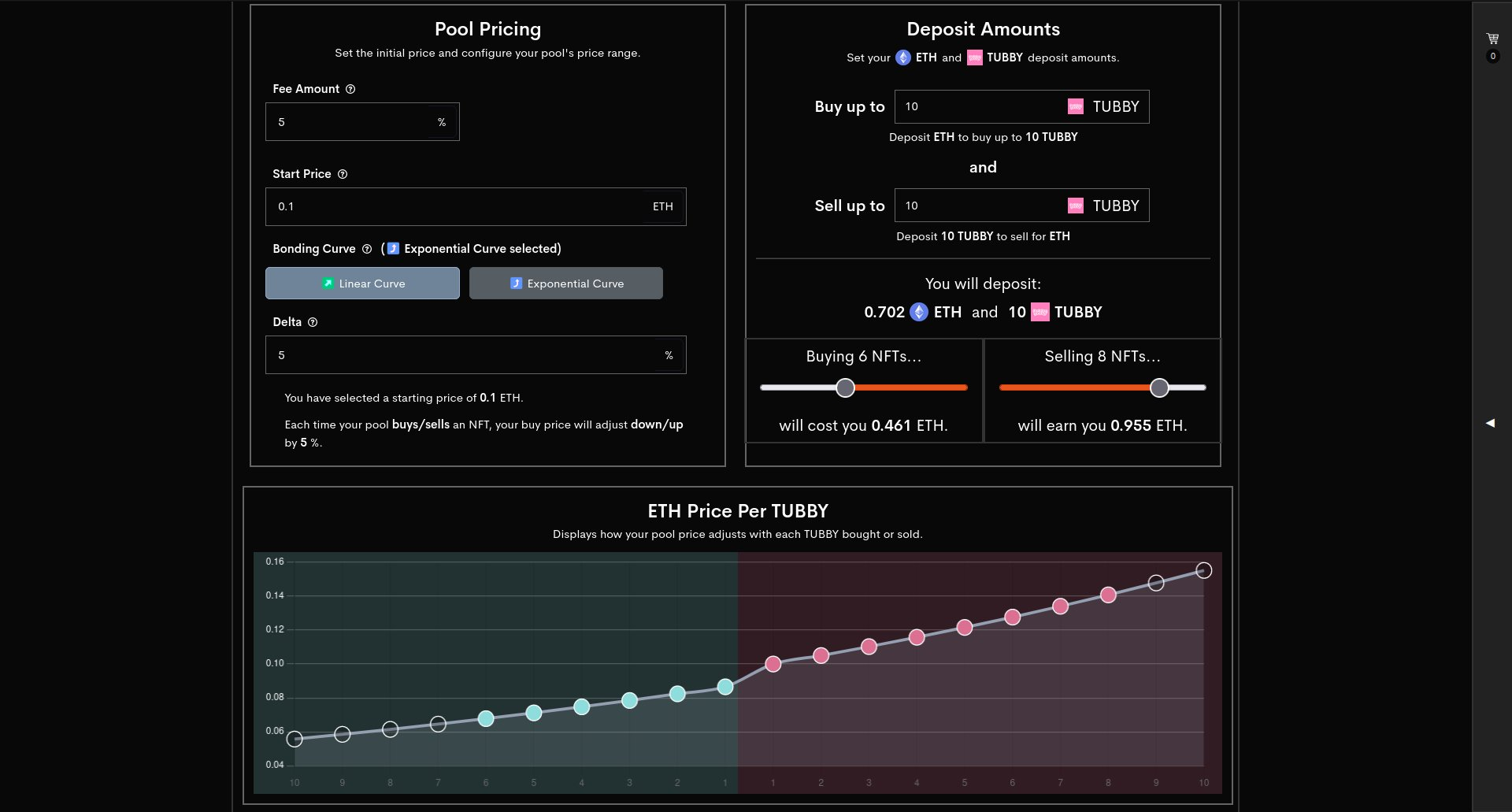

The platform uses bonding curves to automatically increase and decrease the bid and ask on each collection depending on how many NFTs are bought or sold. Users can choose between two curves: Linear Curve and Exponential Curve, along with the delta which adjusts the floor price of the pool each time an NFT is bought or sold.

For example, when a user sells a Tubby Cat NFT into a pool, it increases the supply which causes the buy price to decrease according to the delta value. The more NFTs sold, the lower the price per NFT becomes until the market decides on its fair value.

On the other hand, buying an NFT from a pool incrementally increases the cost of subsequent purchases, keeping the asset prices in line with demand.

Users are incentivized to trade in pools with lower fees. This creates a “race to the bottom” scenario for pool creators to offer the lowest fees, benefiting end users as a result.

Linear vs Exponential

As mentioned previously, liquidity providers on Sudoswap are given a choice between two bonding curves.

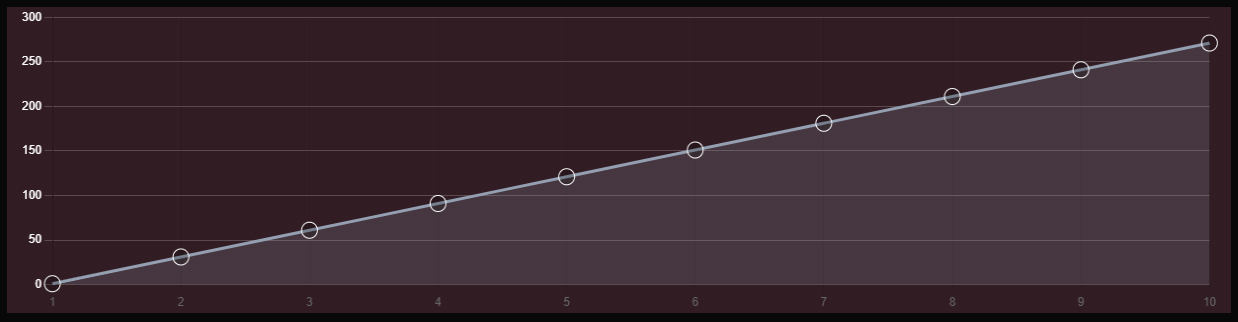

Linear curve

With a linear bonding curve, the price of an NFT fluctuates by a flat amount (delta) every time an NFT is bought or sold from the pool.

For example, a pool with a floor price of 1 ETH and a delta of 0.1 ETH would cause the floor price to increase or decrease by 0.1 after every purchase or sale.

This means the floor would increase to 1.1 ETH after the first NFT is purchased, 1.2 ETH subsequently and vice versa during a sale.

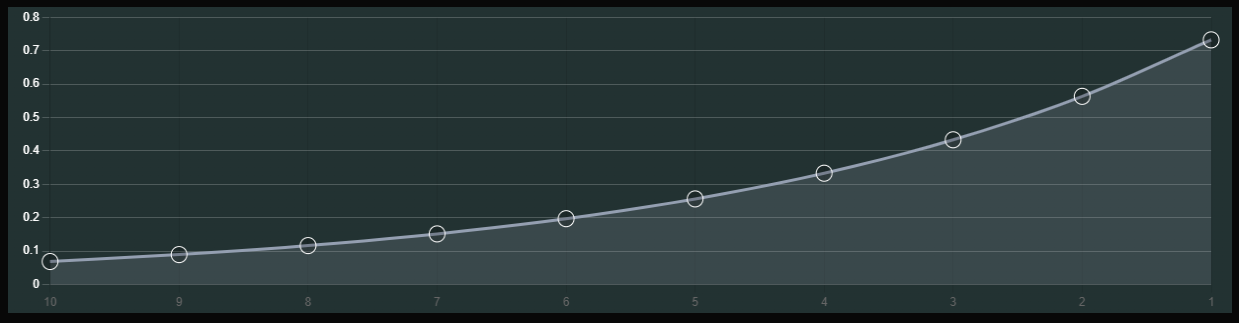

Exponential curve

With an exponential bonding curve, the price of an NFT fluctuates by a certain percentage (delta) every time an NFT is bought or sold from the pool.

For example, a pool with a floor price of 10 ETH and a delta of 50% would cause the floor price to increase to 10 + 50% = 15 ETH after the first purchase and 15 + 50% = 22.5 ETH after the second purchase.

To calculate the equivalent decrease, convert the percentage to a decimal index (e.g. for 50%, the index would be 1.5) and divide the price by this number.

Valuation

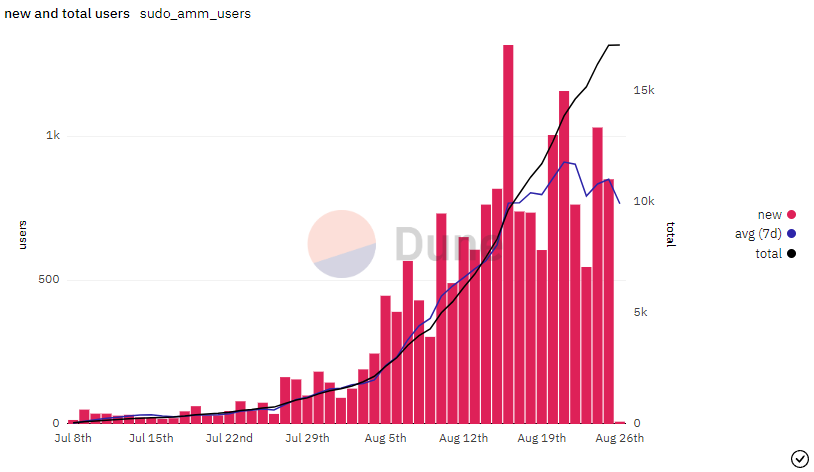

Over the past few weeks, the number of daily users interacting with Sudoswap has surged by over 10,000%. According to this chart, the platform started with an average of 17 users in July. Currently, Sudoswap has registered around 1,700 daily users with a total trading volume of $26.4 million among 112,157 NFTs traded.

We have also seen steady growth with the platform onboarding between 500 to 1,000 new users daily since the start of August, and even surpassing 1,200 users on a good day.

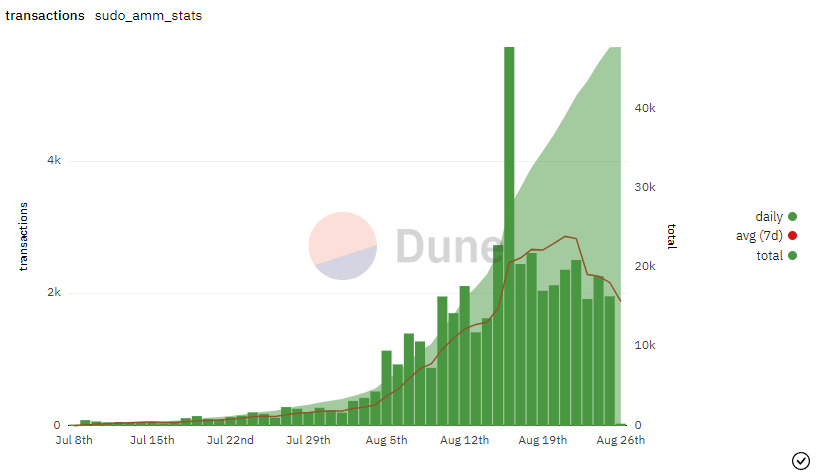

Their user growth has translated similarly to the increase in transactions on the platform. This in turn drives up fees collected by Sudoswap while generating more yield for liquidity providers on the platform.

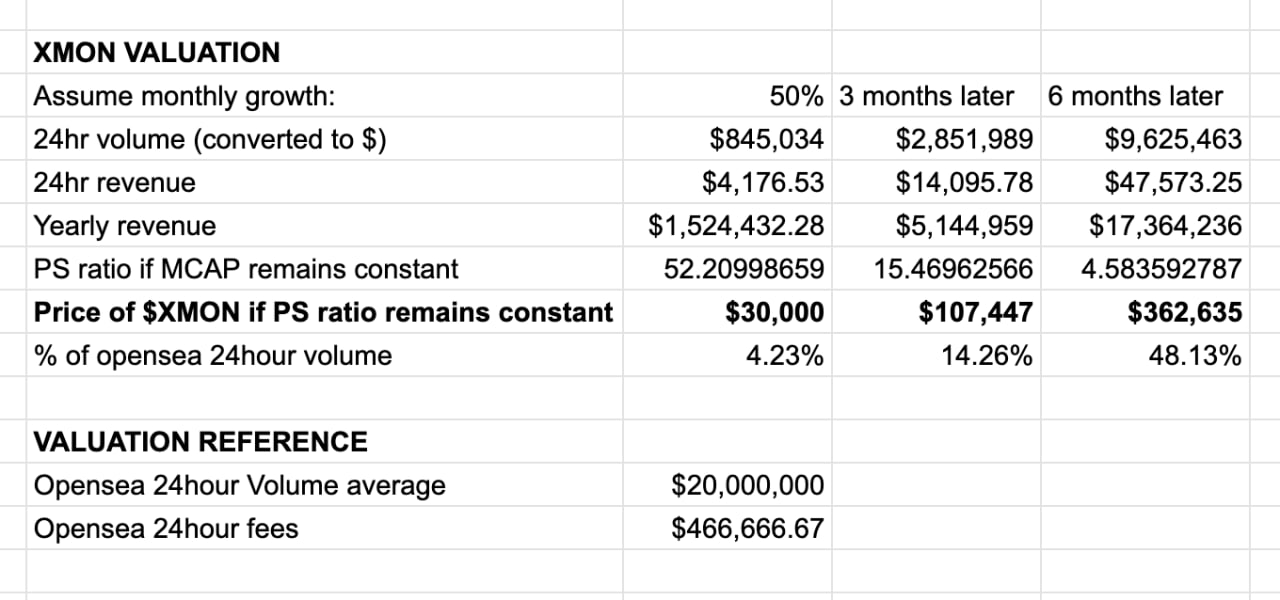

As Sudoswap has yet to launch its token, let's assume that the current fees are directed to the XMON treasury. We will also assume a monthly growth of 50% and reference them with the largest NFT marketplace - OpenSea.

From the table above, we can see that XMON would have a fair value of $107,447 in 3 months IF the PS ratio of remains constant. This would project a $2.8 million daily volume on Sudoswap or 14.26% of OpenSea's current volume.

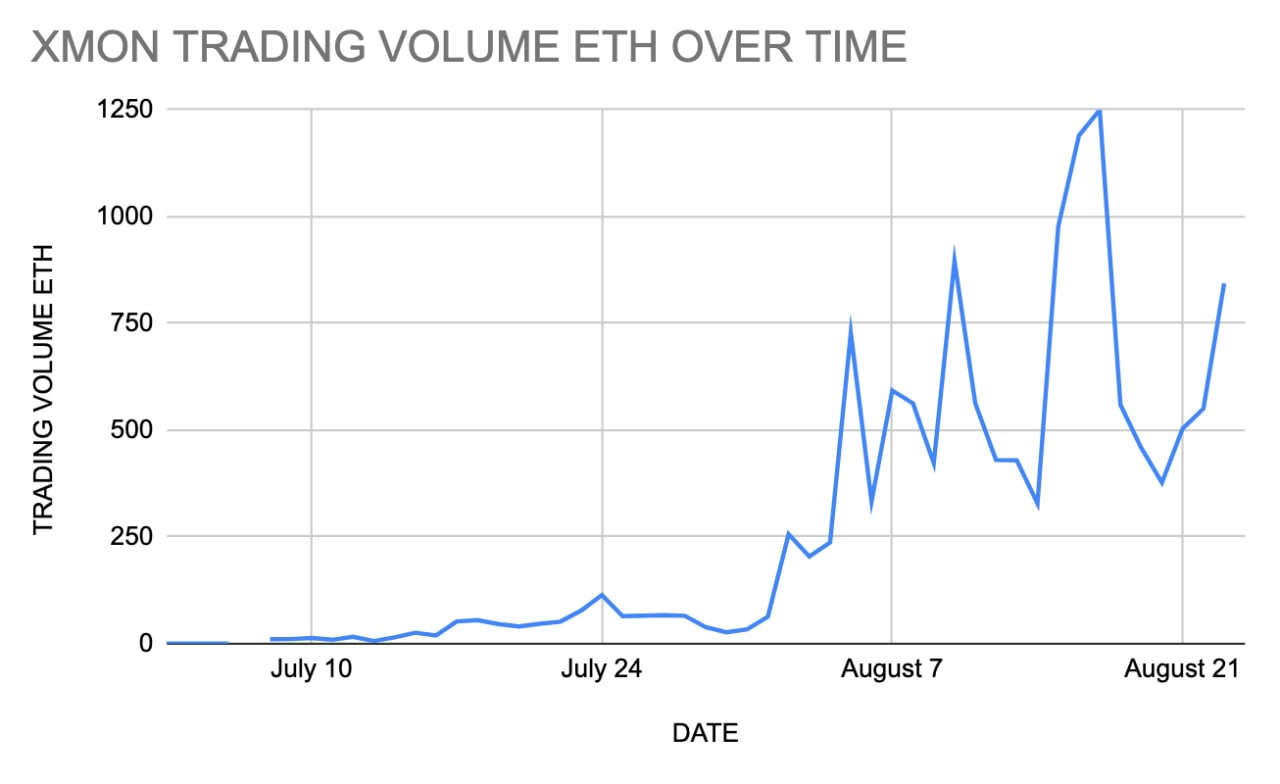

The XMON token has also been trading well against ETH since its launch in July. Although dips can be seen after every runup, the token has been in an uptrend since the announcement of plans around SUDO.

SUDO Token

SUDO will be the governance token of Sudoswap and is designed to be non-transferable (subject to change by governance).

While there are no details of the airdrop or token distribution yet, there is speculation that XMON holders might get a share of SUDO tokens with 0xmons NFT holders confirmed to receive a portion of SUDO via a tweet from the founder.

Stayed tuned for more updates on the SUDO token here.

Conclusion

With Sudoswap, NFT collectors can sell their digital assets instantly without having to wait for a buyer. This improves the liquidity and efficiency of the overall NFT market, bringing both NFT and DeFi communities together which in turn encourages more users to come on board.

While Sudoswap is still relatively new, it could revolutionize the way users trade NFTs and force creators to seek alternative monetization routes. Following the footsteps of every successful protocol in the space, the success of Sudoswap has spawned various derivatives to capitalize on the hype such as Sudo Loot and Sudo Inu.

If you have any NFTs lying around, do give Sudoswap a try as you get to earn fees on your NFTs. Do keep in mind that you would most likely not receive the same NFT(s) from your initial deposit should you decide to provide liquidity on Sudoswap.

Nonetheless, Sudoswap has plans to launch its native SUDO token and users *might* receive an airdrop as a form of appreciation for supporting and trying out their platform.