Introduction

BitDAO is one of the largest decentralized autonomous organizations (DAO) globally, with a massive treasury of more than $1.1 billion in liquid assets, of which $691 million is in ETH, USDC, USDT, FTT, xSUSHI and the rest in their protocol-owned token, BIT.

Launched by Bybit in June 2021, they aim to provide funding for innovative and value-adding crypto projects through community-driven investment proposals and aim to create a leveled economic playing field for the average individual through the acceleration of decentralized tokenized economy.

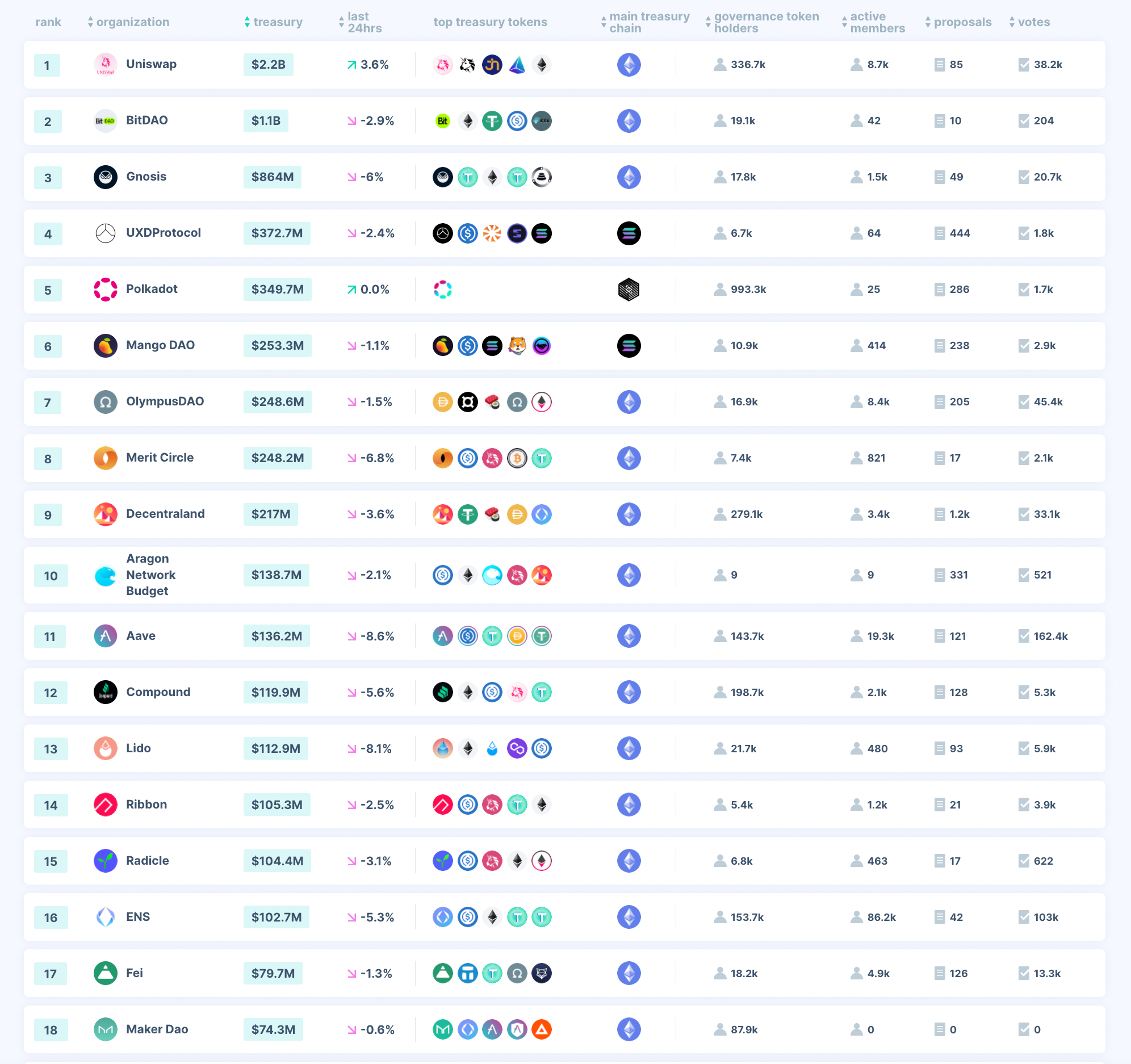

List of DAOs and their treasuries as of 23 June 2022:

Source: https://deepdao.io/organizations

BitDAO

BitDAO plans to develop a network of investments across multiple ecosystems. They support a broad range of projects including DeFi, DAOs, NFTs and gaming, through R&D, liquidity bootstrapping and funding.

As these investments mature, they are expected to contribute value back to BitDAO, creating a positive feedback loop. This is done via token swaps and co-development efforts with partner projects, which will allow their treasury to accumulate a collection of top crypto project tokens.

Their core strategy is to support the growth of web3 through a process they call “fractal expansion”, using their treasury assets to bootstrap and spin-off specialized sub-organizations known as Autonomous Entities (AE) that operate within different sectors.

They even encourage AEs to spin off their own sub-AEs, further expanding the fractal network of projects with BitDAO at the center. As previously mentioned, once the AE matures, they will begin to send funds to their parent AE, and eventually to the BitDAO treasury. BitDAO could then use these funds to seed more projects, driving consistent value to BIT token holders.

With each investment creating, expanding, and running their own fractal network, they could create significant revenue streams for themselves, which all drives value back to BitDAO and BIT holders.

Comparison

While BitDAO investments cover all aspects of crypto, let’s compare them with a GameFi focused DAO. Enter Yield Guild Games (YGG).

YGG is a DAO that invests in non fungible tokens (NFTs) used in virtual worlds and play-to-earn games. They aim to create the biggest virtual world economy, optimizing its community-owned assets for maximum utility and profit sharing with its token holders.

They currently own a large number of NFTs that are used by guild members to play games and generate yield. The primary revenue of the DAO will come from leveraging YGG-owned NFT assets, both directly or indirectly, via a rental program where guild members utilize the assets in exchange for a portion of the in-game rewards going directly to YGG.

SubDAOs were introduced to host specific game assets and activities. All assets are acquired, fully owned and only controlled by the YGG treasury through a multisig hardware wallet. YGG has since pursued global expansion through the implementation of regional SubDAOs as community members split into a series of smaller guilds focused on either geographic region or a specific game.

Yield Guild Games has a unique treasury that oversees the management of all Yield Guild Games assets to maximize the value returned to the YGG DAO over time. Similar to BitDAO’s structure, SubDAOs and investments that are successful will redirect value back to the YGG treasury and their token holders over time.

Their treasury as of their last update in October 2021, boasts over $800 million worth of assets including YGG, ETH, USDC, USDT, AXS, SLP and SAND since their launch in 2020.

BitDAO Treasury

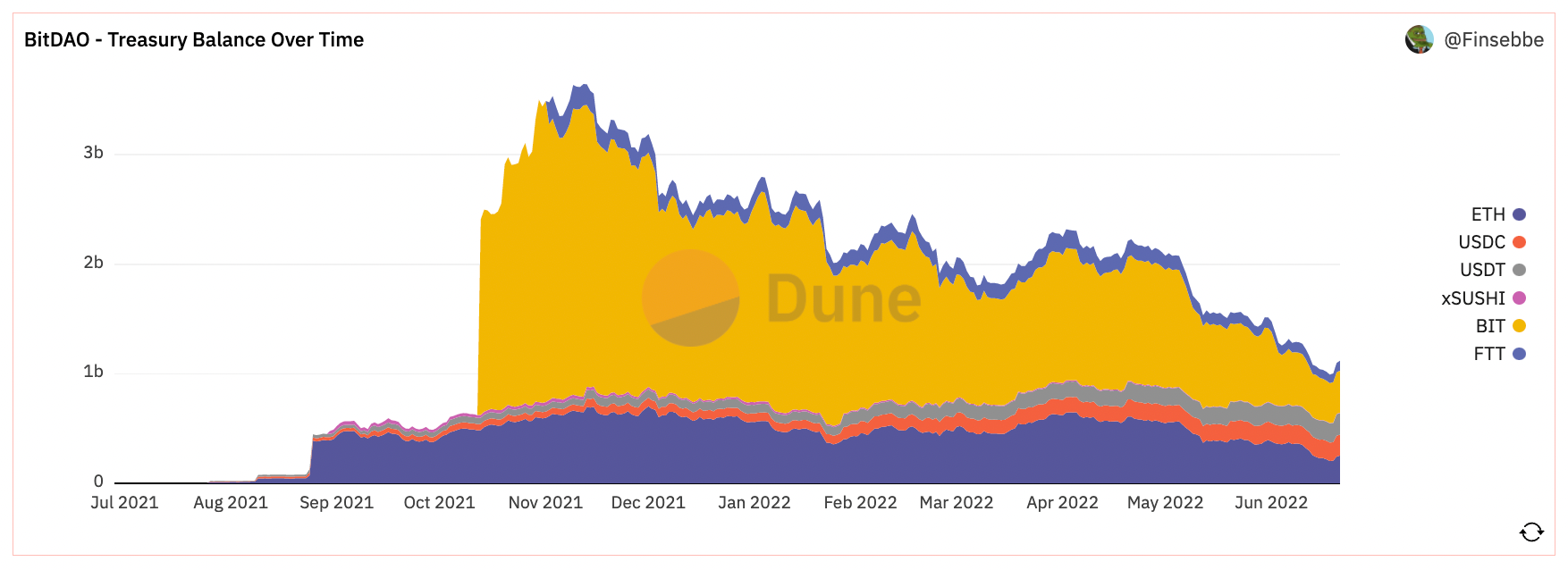

A major factor in BitDAO’s early success is their massive treasury, consisting of a basket of assets. They control a treasury of over $1.3 billion in liquid assets as of 9 May 2022, accumulated from a combination of large seed raises and a constant supply of futures revenue from ByBit.

Their treasury includes a well diversified treasury of ETH, BIT, FTT, USDT USDC, and a small portion xSUSHI.

The treasury has more than enough funds to seed future projects across the ecosystem. However, their vision of creating an investment network will require years of development before any value is driven back to BitDAO and BIT holders. As most of their investments are relatively new and are in their early stages of development, none of them have turned a profit for BitDAO.

BitDAO’s treasury has been steadily growing at a daily rate of $2.4 million. This is due to the ByBit pledge, which offers to contribute a portion of its futures revenue to BitDAO. They have promised to deposit 2.5 bps of daily futures trading volume, which adds up to 35% of ByBits futures revenue, into the BitDAO treasury.

This is split into a 50:25:25 ratio and paid monthly in ETH, USDC, and USDT, generating a strong passive revenue stream for BitDAO. Since the pledge began on 15 July 2021, ByBit has contributed around $760 million to the BitDAO treasury. However, since contributions from ByBit are based on trading volumes, this could decrease substantially in a bear market.

BitDAO Treasury value has been going down recently due to $BIT and $ETH price dropping over the past few months, however their daily contributions remain strong at around $2 - $4 million per day which is a healthy sign.

Source: https://dune.com/Finsebbe/BitDAO-Key-Metrics

Partnerships

BitDAO has previously allocated $739 million to fund various protocols, including investments in a blockchain gaming accelerator, an AE committed to the growth of zkSync, and 100 million BIT treasury swap for 3.36 million FTT worth $180 million on 26 October 2021.

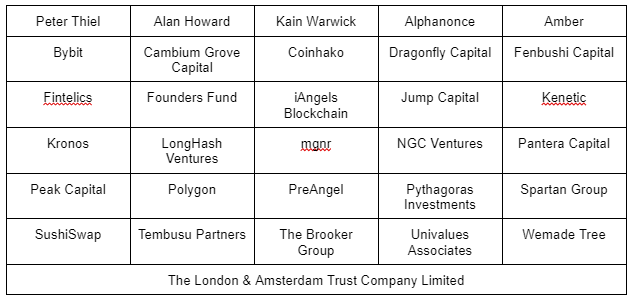

Backed by some of the largest names in DeFi, their early partners include a long line of credible investors ranging from large venture capitalist firms such as Dragonfly Capital, Pantera Capital, Spartan Group to large exchanges like Coinhako and SushiSwap, and notable entrepreneurs including billionaire Peter Thiel, Alan Howard and Synthetics founder Kain Warwick.

Tokenomics

BIT is the governance token of BitDAO and holders can vote on proposals such as:

- Token swaps with existing and emerging projects

- Treasury allocation into various projects or AEs

- Adjustment to BitDAO governance and treasury management functions

There will be a total supply of 10 billion BIT tokens.

Private Sale - 500 million / 5%

- 3 months cliff

- Vested linearly over 12 months

- First unlock on 15 October 2021, vesting ends on 14 October 2022

- 1.37 million token unlocked daily, around $753k selling pressure at current price

Launch Partner Rewards - 240 million / 2.4%

- 100% unlocked at launch

SushiSwap Partnership - 260 million / 2.6%

- BIT rewards emitted into circulation

BitDAO Treasury - 2.9 billion / 29%

- 10% unlocked at launch

- 3 month cliff

- 20% vested linearly over 12 months

Alameda FTT Swap - 100 million / 1%

- 36 month cliff

- Treasury swap for FTT ($180 million notional)

Bybit Flexible - 1.5 billion / 15%

- 100% unlocked at launch

Bybit Locked - 4.5 billion / 45%

- 12 months cliff

- Vested linearly over 24 months

- First unlock 15 July 2022, vesting ends 15 June 2024

The BitDAO treasury owns 30% of BIT. These tokens can be used for swaps, grants, rewards, etc. Any usage of funds will only be executed after a proposal has been passed. BitDAO states that treasury tokens are effectively owned by token holders in proportion to their token holdings, that means a 1% token holder has a maximum but limited 0.3% ownership of the overall 30% in the treasury.

ByBit has been allocated 60% of the BIT token supply in exchange for monthly contributions into the treasury. Out of which, 15% of the allocation is fully liquid with neither a cliff nor vesting schedule. The other 45% remains locked with a 12 month cliff that will begin to unlock in July 2022. The locked supply will be vested at a rate of 1.88% per month until June 2024.

ByBit has recently launched their BIT buyback program (BIP-9), which is targeted to purchase $700k worth of BIT per day or $21 million per month using funds from the ByBit pledge . BitDAO will also be deploying an additional $60 million into the BIT-ETH pair on Uniswap v3 as per BIP-10, creating more protocol-owned liquidity for BitDAO while removing the 100k BIT emissions per day.

While BitDAO owns 30% of the total supply, this buyback program would drive more BIT into their treasury, increasing its protocol-owned liquidity. The monthly buybacks and removal of incentive emissions could serve as a strong catalyst for the BIT token, reducing supply in the open market in hopes to drive demand for their token.

Risk

While not a first mover in the space, BitDAO is a promising project with a massive treasury and a strong backing. However, there are some risks to consider before you decide to become a BIT holder. An important risk is that while token holders get to decide on which fund AEs to fund, they may never get a return on investment if these protocols do not succeed. As with any investment funds, the entity is only valuable if it makes good investments with profitable results. A bad track record will only drive interested investors away and BIT holders may decide to dump their tokens due to lackluster performance.

As previously mentioned, since any early stage investments will probably not see a profitable return for the next few years, BIT holders have to be extremely patient and hope that these projects will succeed in the coming years. If you’re looking for an easy 100x, BIT might not be the right fit for you.

Given that a portion of ByBit’s locked allocation will begin vesting soon, BIT holders might want to watch out for some downward price pressure should ByBit decide to sell some of their BIT tokens. The addresses for the locked BIT tokens are shown and can be monitored for any movement.

BitDAO currently relies on multisig and snapshots for their governance. This reduces their censorship resistance and overall security. BitDAO has addressed this with plans to build a custom governance module with on-chain voting in the future.

Price Action

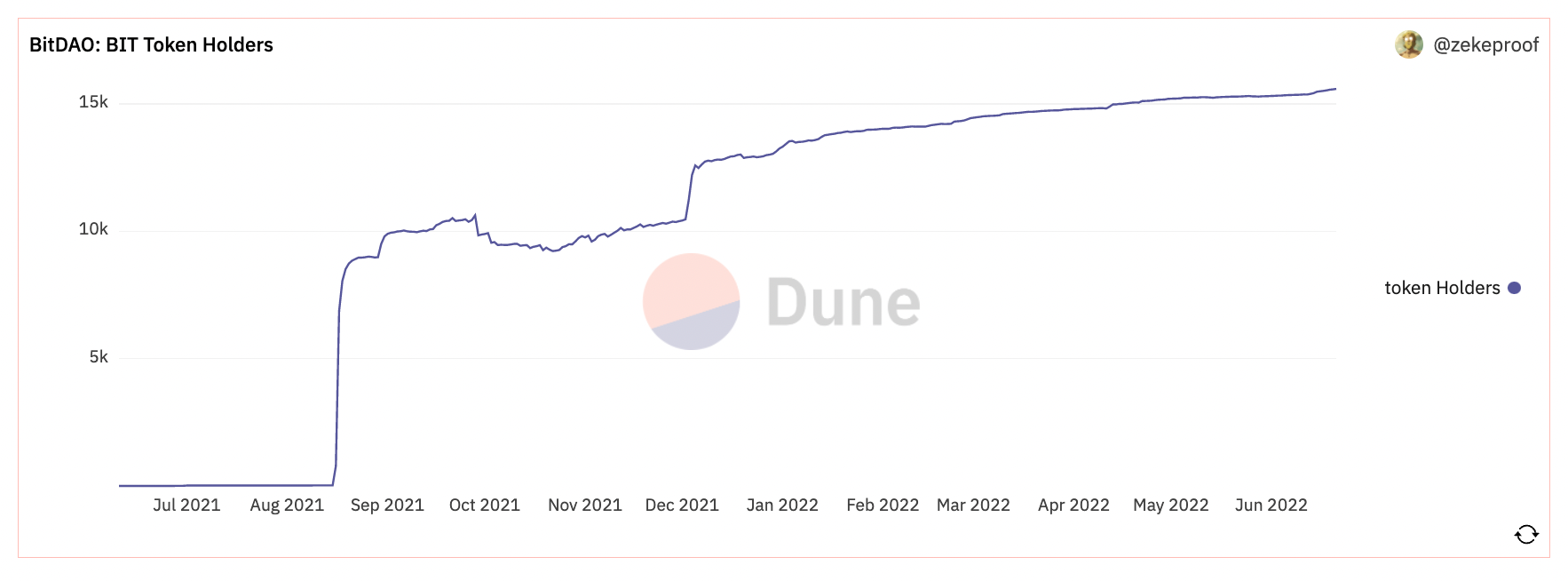

BIT token has seen a downtrend in price action since its all-time highs of $3.10 on 12 November 2021, with prices reaching all-time lows of $0.40 on 19 June 2022. Since their previous $230 million raise in 2021, some investors are almost back at breakeven with an entry price of $0.46.

Despite this downturn in price, the amount of holders has been gradually increasing, showing the strength of the BitDAO community and their beliefs.

Source: https://dune.com/zekeproof/BitDAO

Conclusion

BitDAO is a decentralized investment collective with an average passive revenue stream of $2.4 million per day. Currently there are other DAOs that provide community funding to campaigns that launch on their platforms but none comparable to the size of BitDAO's treasury.

With their recent BIT-9 and BIT-10 proposals approved, this may be in favor of BIT holders due to token buybacks and incentive eliminations which could see an upward movement for the price of BIT.

For now, we will wait while we closely monitor the BitDAO treasury, their investments and the price of BIT. Once the first AE starts to provide value to BitDAO and its token holders, there could definitely be some buying pressure and it may present a buying opportunity for BIT once that happens.

It would be interesting to watch their vision unfold in the coming years and what becomes of BitDAO. If this model succeeds, it could become a unique way to bet on the growth of crypto.