In this strategy, learn how you can earn 20% APR yield with USC, Carbon's decentralized stablecoin, on Demex.

USC is an overcollateralized decentralized stablecoin, where it can be minted on demand by putting up more collateral than the minted value, through the use of autonomous smart contract on Carbon.

Read more here: guide.carbon.network/usc/what-is-usdusc

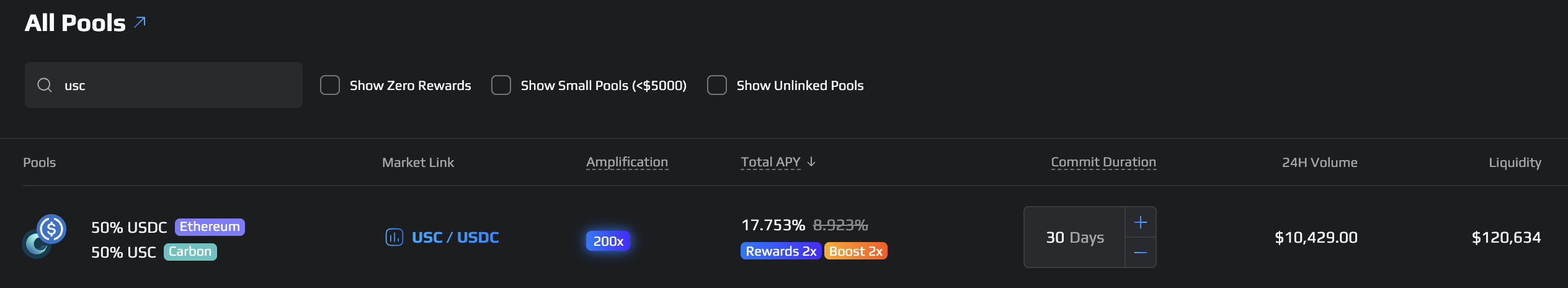

#1: USC-USD Spot LP Farming

A fairly straight forward strategy. As of this writing, simply provide USC-USD LP and bond it for 30 days to earn maximum APR of above 20%.

Step by step:

- Obtain USC by buying it on Demex (recommended if USC <$1) or minting it

- Obtain USD on Demex (recommend depositing axlUSDC from Osmosis)

- Alternate: Sell USC into USD on Demex (watch for slippage)

- Go to Demex's pools and search for USC-USD pair and click "Add Liquidity"

- Add liquidity and commit duration for 30 days for max rewards (you can only withdraw liquidity when the commit duration is over)

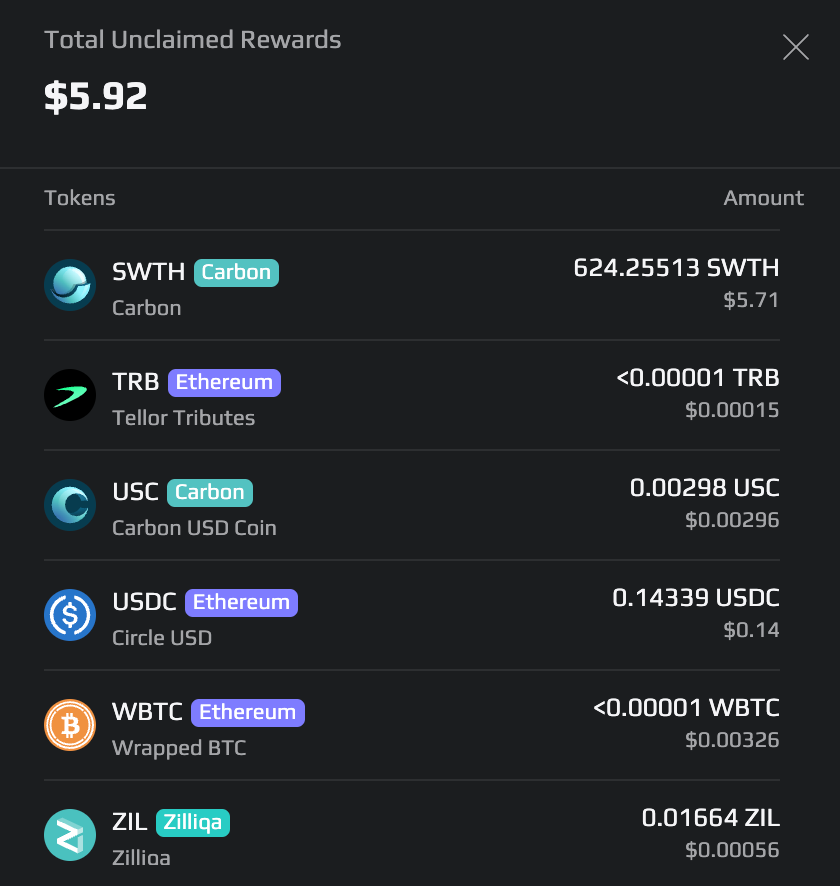

Note: You can commit for 0 days as well to earn rewards without being bonded. Rewards will primarily earn SWTH fees but also other Carbon network reward tokens as part of Carbon's real-yield tokenomics.

#2: USC-USD LP Supply on Nitron

A no-commit low-risk using USC-USD LP tokens.

There will be incentives provided for USC-USD LP on Nitron, allowing you to use USC-USD LP as collateral while earning over >20% APR in SWTH.

Step by step:

- Obtain USC by buying it on Demex (recommended if USC <$1) or minting it

- Obtain USD on Demex (recommend depositing axlUSDC from Osmosis)

- Alternate: Sell USC into USD on Demex (watch for slippage)

- Go to Demex's pools and search for USC-USD pair and click "Add Liquidity"

- After obtaining USC-USD LP, instead of bonding (committing) it, you can deposit the LP token into Nitron instead to be used as collateral

Having USC-USD LP collateral allows you to:

- Mint more USC to sell half into USD (recommended if USC >$1)

- Or borrow USD to buy half into USC (recommended if USC <$1)

- Or just mint half USC and borrow half USD (recommended if USC = $1)

Allowing you to use the USC and USD to LP again and deposit as collateral and repeat to earn more SWTH incentive rewards while just using stablecoins.

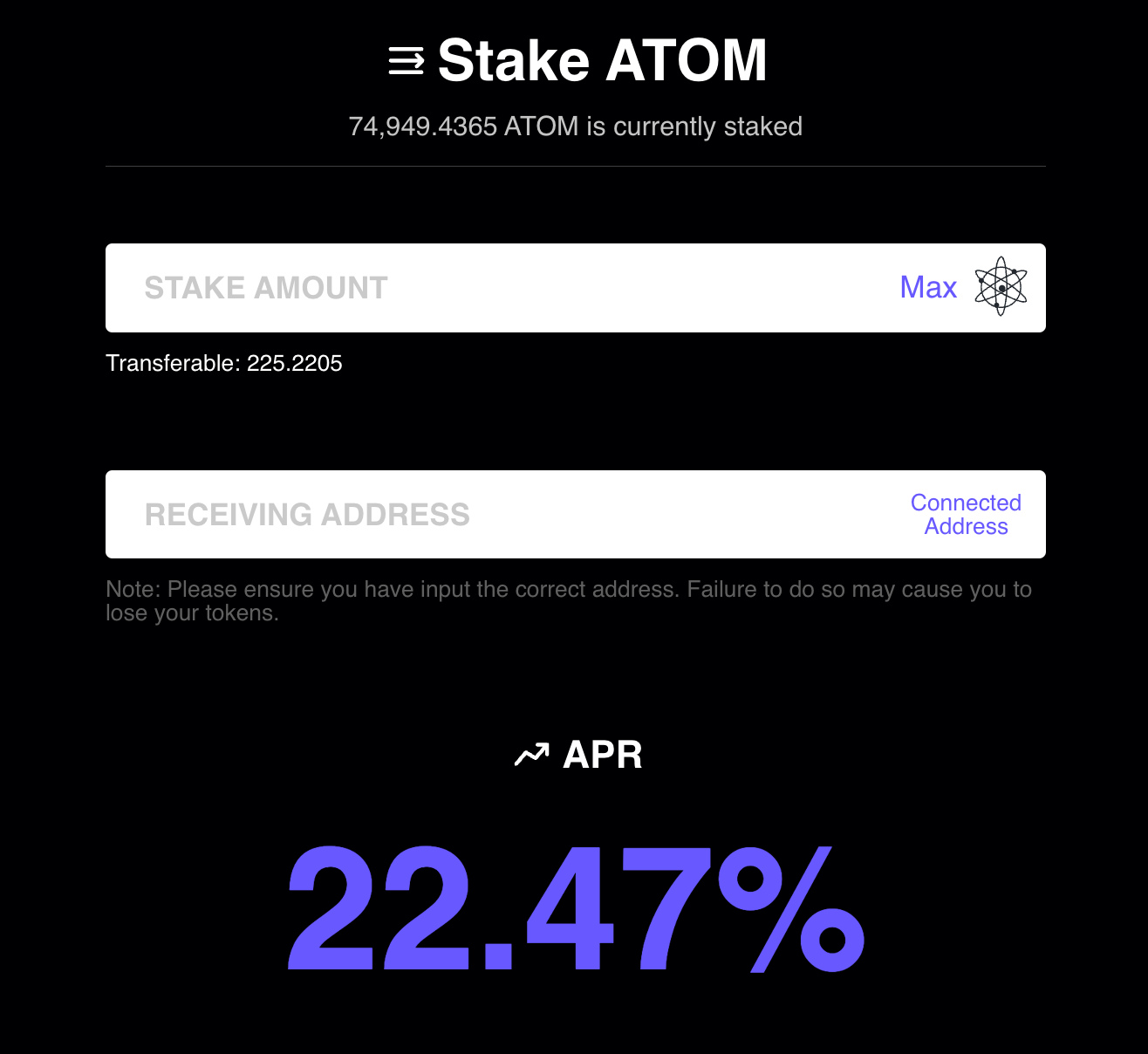

#3: Delta Neutral LSD Farming

This strategy involves depositing USC to get an LSD's staking yield of >20% APR in a delta neutral (DN) and non-liquidatable fashion.

For this example, we'll use rATOM as it has a high APR of 22%.

Step by step:

- Obtain USC by buying it on Demex (recommended if USC <$1) or minting it

- Deposit USC into Nitron, at 83% LTV, it has a very high capital efficiency

- Borrow ATOM and stake it with StaFiHub to earn >20% APR as rATOM

- Alternate: Sell ATOM into rATOM on Demex or rDEX (watch for slippage)

- Deposit rATOM into Nitron to increase your health factor

- Your profit is in the ATOM you earn from rATOM/ATOM's price increase

Currently the actual APR you'll be earning is around 10-20% depending on the borrow APR of ATOM, however if you use rATOM, there's additional $FIS incentives thanks to the collaboration between Carbon and StaFi.

The incentives will push this strategy to around 100% APR during this incentive period (will end about mid of March).

Because you're using USC to short ATOM and long rATOM, you don't have liquidation risks and are delta-neutral, unless rATOM depegs against ATOM which is usually only temporary

This strategy can be peformed can be performed with other high APR LSDs such as EVMOS, OSMO, LUNA, etc, as long as the borrow APR is lower than the staking APY so that your strategy yields a profit.

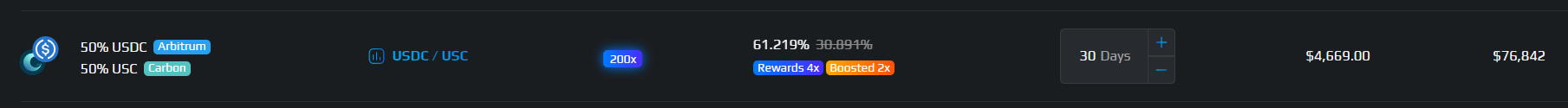

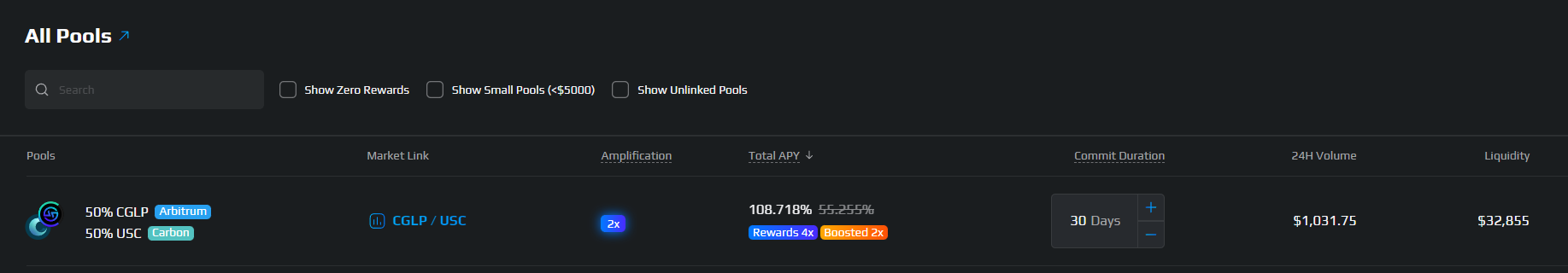

#4: cGLP-USC Spot LP

Carbon's own Arbitrum GLP zero-fee autocompounding vault - cGLP, has entered the Cosmos and it's time to create liquidity so more cosmos users can come over to Demex to gain exposure to GLP with fees.

As of this writing, simply provide cGLP-USC LP and bond it for 30 days to earn maximum APR of above 20%.

Step by step:

- Obtain USC by buying it on Demex (recommended if USC <$1) or minting it

- Obtain cGLP on Arbitrum here (not sure what is cGLP? read this guide)

- Alternate: Sell USC into cGLP on Demex (watch for slippage)

- Go to Demex's pools and search for cGLP-USC pair and click "Add Liquidity"

- Add liquidity and commit duration for 30 days for max rewards (you can only withdraw liquidity when the commit duration is over)

Note: You can commit for 0 days as well to earn rewards without being bonded. Rewards will primarily earn SWTH fees but also other Carbon network reward tokens as part of Carbon's real-yield tokenomics.

Conclusion

Carbon will continue to build itself to be an all-in-one DeFi hub where traders and investors can partake in various strategies to earn yield in this crypto market. We hope you enjoyed this strategy and stay tuned for more feature update and guides!

Not financial advice

The information and publications are not intended to be and do not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort offered or endorsed by Switcheo. Switcheo does not take into account your personal investment objectives, specific investment goals, specific needs or financial situation and makes no representation and assumes no liability to the accuracy or completeness of the information provided here. Switcheo also does not warrant that such information and publications are accurate, up to date or applicable to the circumstances of any particular case.