Inflation, according to Wikipedia, “is a sustained increase in the general price level of goods and services in an economy over a period of time”. Bitcoin, Ethereum and fiat — USD, JPY, SGD — are examples of inflationary cryptocurrencies and currencies. And over time, these currencies increase in supply for various reasons.

For Bitcoin and Ethereum, there are mechanics set in place to ensure a steady rate in inflation. Miners contribute to the ecosystem by “mining”transactions on the network and in return, get paid in the blockchain’s respective tokens. This increases the circulating token supply.

On the other hand, fiat inflates in supply as governments and federal reserves continuously introduce more dollars into the economy to stimulate economic growth. As governments print more dollars and increase the circulating supply, the value of the dollar decreases, reducing the amount of purchasable goods per dollar. (Case in point — Venezuela case study)

So, where do hyperdeflationary tokens come in?

Deflation, is the act of reduction of the general level of prices in an economy. In theory, the value of deflationary assets would increase over time due to its deflationary nature. Due to the assets decreasing over time, this creates scarcity, which is created when demand exceeds total supply. This causes the value of each asset to increase.

Compared to inflationary assets, in which you get less goods per asset spent over time, deflationary assets should yield more goods per asset spent.

As for deflationary tokens, the total supply of these tokens will decrease over time via measures such as burning of a small percentage of tokens (%) for each transaction.

Hyperdeflationary tokens, on the other hand, can exist in extreme cases when the total supply of tokens deflate at a rapid rate.

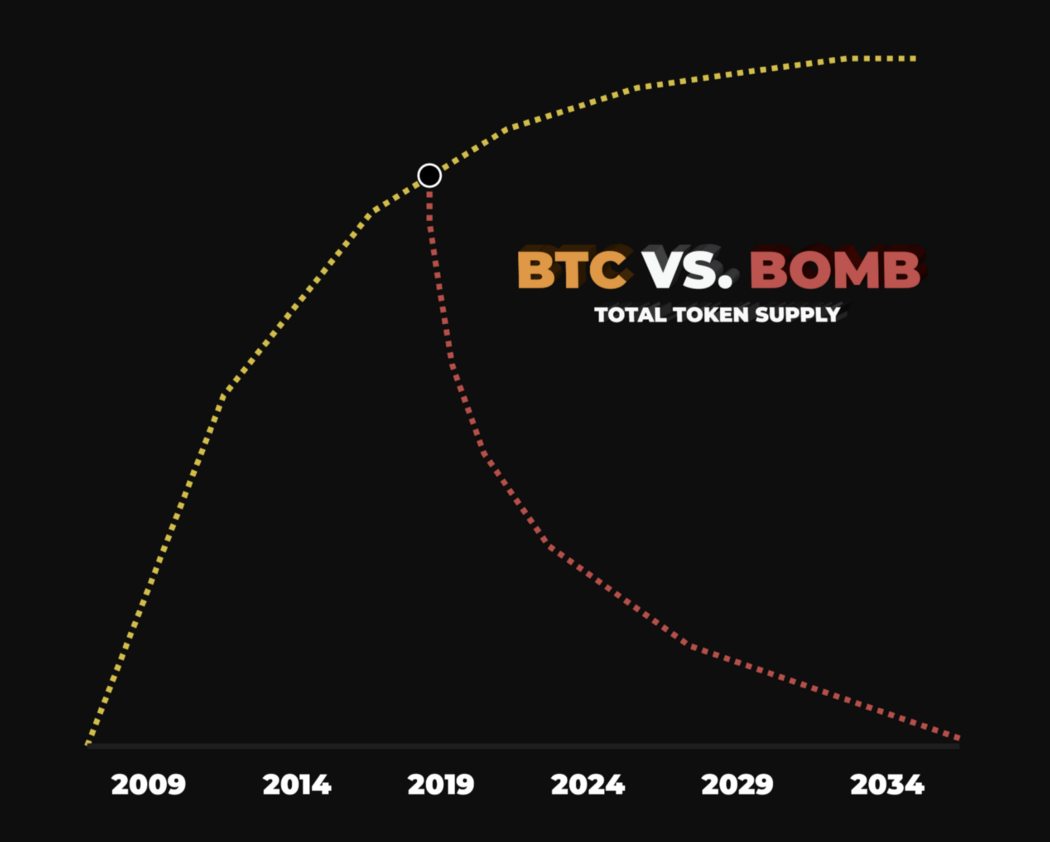

An example of a hyperdeflationary token is the BOMB Token.

BOMB is the world’s first self-destructing token based on the Ethereum platform. First started out as a social experiment and financial case study to measure the feasibility of a deflationary token, the intention is not to be used for day-to-day transactions, but rather as a decentralized hedge against traditional inflationary instruments.

How it works

With every transaction sent, 1% of the amount is destroyed and removed from the total circulating supply.

With only 1,000,000 BOMB minted, there will never be any more newly created BOMB.

With this being an emerging trend, it is fascinating to see what’s next in the crypto space.

Cryptocurrencies and digital tokens are subject to high market volatility and risk. As always, please apply your own due diligence before buying or selling cryptocurrencies and digital tokens.

BOMB tokens are not burnt when trades are executed on Switcheo but are only burnt on transfers.

Learn more about the difference here.

Check out the BOMB Token on Switcheo Exchange today.

Like what you read? Check out these articles that may interest you:

[Guide] Trading Hyperdeflationary Tokens on Switcheo

Discovery Series: How Switcheo Account actually works

Discovery Series: How Atomic Swap on Switcheo works

For more information on Switcheo: