Liquidity Unlocked

On Carbon, stakers receive a portion of block rewards in return for helping to secure the blockchain. Currently, 65% of block rewards go towards stakers.

One drawback of staking, however, is that $SWTH are locked up for a period of time, which can limit liquidity and prevent stakers from using their funds for other purposes.

$SWTH is the native and governance token of Carbon; Learn more here.

In light of this, we turn to Liquid Staking - A liquid staked version of $SWTH that would allow users to use their staked assets for other DeFi activities whilst earning staking rewards. With a staggering 70% of all $SWTH currently staked, this unlocks a significant amount of liquidity for the Carbon ecosystem.

This is where rSWTH comes in.

What is rSWTH?

Powered by StaFi Hub, rSWTH is a derivative asset that represents a staker’s staked $SWTH assets. rSWTH unlocks the value of the staker’s SWTH assets without having to unstake them, allowing stakers to retain the benefits of staking (i.e. continue earning staking APY) while maintaining the liquidity of their staked $SWTH assets.

rSWTH is a token that is pegged to the value of SWTH. Stakers can trade their staked $SWTH for rSWTH, which can be utilized for various DeFi activities, such as trading, borrowing or providing liquidity on decentralized exchanges.

How to obtain rSWTH

Navigate to https://app.stafihub.io/rToken/rSWTH/stake.

Connect your wallet.

Enter the amount of $SWTH you wish to stake in the initial field and the destination address in the second field. Note: Please ensure you input the correct address. Failure to do so may cause you to lose your tokens.

Ensure that the rSWTH value received is accurate and then click on the button "You will receive X rSWTH" to proceed.

This will prompt a pop-up window to appear. Click 'Understood'.

Then, verify the transaction and pay the relevant transaction fees by clicking on the 'Approve' button.

$SWTH successfully staked. You have successfully minted rSWTH!

Benefits

There are many use-cases for rSWTH.

1. Increased Liquidity of $SWTH

rSWTH can help to increase the liquidity of the SWTH market. By providing a liquid market for staked $SWTH, rSWTH can attract more liquidity to the ecosystem, which can help to increase the overall value of the ATOM token. Additionally, the increased liquidity can help to reduce volatility and improve price stability.

2. Maximize Yield

rSWTH allows stakers to unlock the liquidity of and maximize the returns on their staked $SWTH assets. When $SWTH is staked on StaFi Hub, users are given rSWTH, which allows stakers to (i) continue to secure the Carbon blockchain and (ii) earn staking APY, while also engaging in various DeFi activities.

Here’s one strategy for your reference:

Step 1: Enjoy staking APR by staking $SWTH on StaFiHub, and mint rSWTH

Step 2: Provide liquidity to the rSWTH-SWTH liquidity pool on Demex

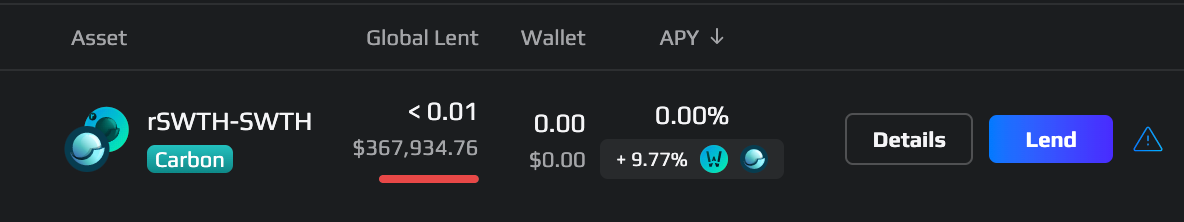

Step 3: Lend rSWTH-SWTH LP token on Nitron to earn FIS and SWTH incentives

Starting in May, the rSWTH-SWTH LP lending pool will be incentivized with $1600 FIS and SWTH each month, across a period of 6 months.

Step 4: Enable rSWTH-SWTH LP token as collateral to either borrow other yield-generating assets or mint $USC on Nitron. As an example, you may wish to borrow the Carbon grouped USD token to buy more $SWTH and trade on the SWTH-USD market on Demex.

Step 5: Repeat Step 1 to 4 to form a leverage loop and enjoy maximum yield!

3. Greater Flexibility in Asset Management

By allowing stakers to trade their staked SWTH for rSWTH, they can use their funds for other purposes without having to wait for the staking period to end. This can be particularly useful for users who need access to their funds for unexpected expenses or investment opportunities.

4. Improve Overall Health of the Network

rSWTH can benefit the Carbon ecosystem by increasing the number of stakers participating in the ecosystem. By providing a more flexible staking option, rSWTH can attract more users who may have been hesitant to stake their SWTH due to the lock-up period. This can help to increase the security and decentralization of the network, making it more attractive to developers and investors.

5. Higher Revenue for Validators

With the possibility of liquid staking, validators can attract more stakers, increasing their revenue and profits. This can in turn incentivize more validators to participate in the network, leading to a more secure and decentralized ecosystem.