Switcheo's 2023 roadmap is focused on liquidity, and we are proud to release Multi-pool Routing for AMM Orderbooks, another first in DeFi.

This feature deepens liquidity and reduces slippage for spot markets, improving the spot trading experience, while improving SWTH's price.

Quick recap: Carbon is an AMM-backed Orderbook

Carbon uses an Automated Market Maker (AMM)-backed orderbooks, which relies heavily on liquidity as it directly impacts the ability of traders to buy or sell assets in the market at a good price.

In an AMM model, liquidity is provided by liquidity providers who deposit their assets into liquidity pools, which are then used to facilitate trades between different assets.

Low liquidity in a market means that large trades can result in higher price slippage, reducing the profitability of trades. If traders are not attracted to trade on Carbon's market, it reduces volume and fees generated.

Multi-pool routing helps to consolidate liquidity to reduce slippage.

What is Multi-Pool Routing?

Multi-Pool Routing is a mechanism used by decentralized exchanges (DEXs) that operate using the Automated Market Maker (AMM) model, such as Uniswap, in order to use all relevant pools to give the best pricing to traders.

Put simply, in a multi-pool DEX, there are multiple liquidity pools that each contain different pairs of assets with a common asset that you want to buy/sell, and multi-pool routing helps give you the best price. Without it you will have to split up your trade across multiple pools manually.

For example, Carbon has ETH/USD, ETH/SWTH and SWTH/USD LP. If I want to sell ETH into USD, I need to go through 2 markets to get the best USD return:

- Sell ETH into USD

- Sell ETH into SWTH then sell SWTH into USD

If I sold all my ETH into just one of the markets, I will incur a greater slippage compared to spreading my trade by going through both pools, but doing so is manual and not time-efficient.

Multi-pool routing helps do this for you automatically, so if you are selling ETH to USD on the ETH/USD market, it already includes ETH/SWTH and SWTH/USD liquidity as well, giving you the best ETH/USD rates.

Why is Multi-Pool Routing important?

Deeper liquidity for spot markets

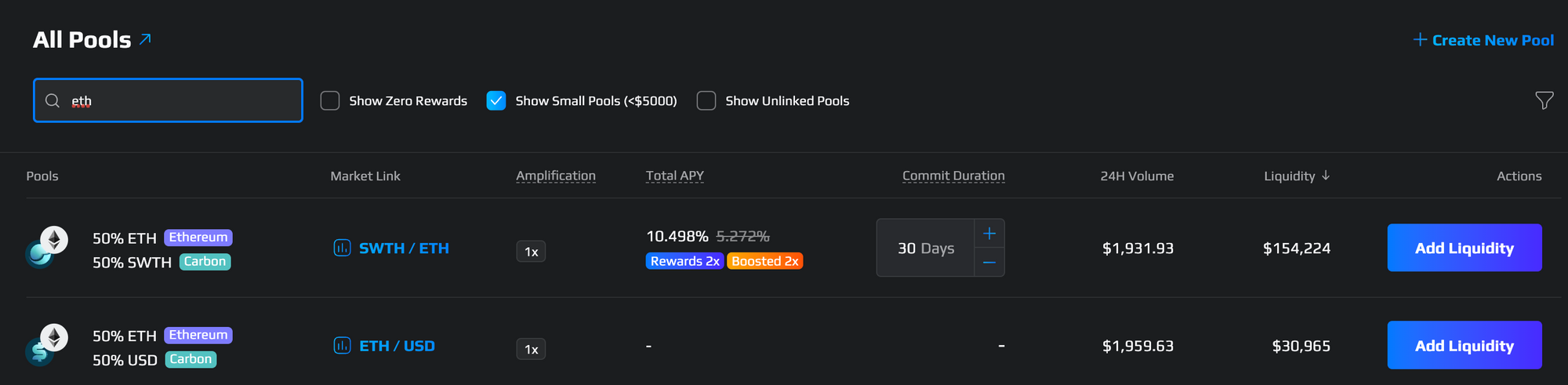

On Demex, which is Carbon's frontend UI, looking at ETH/USD LP, it only has $30k of AMM liquidity, not including any manual limit orders set by traders or bots. The bulk of the AMM liquidity lies in ETH/SWTH LP at $154k.

With Multi-pool routing, the ETH/USD market will combine both liquidity to get an AMM liquidity of $184k, on top of any limit order liquidity, which should result in far more liquidity.

More volume on USD markets

Multi-pool routing helps to create more USD markets, which is easier to calculate prices than non-USD markets. USD markets will also have higher liquidity and volume, overall offering a better spot trading experience.

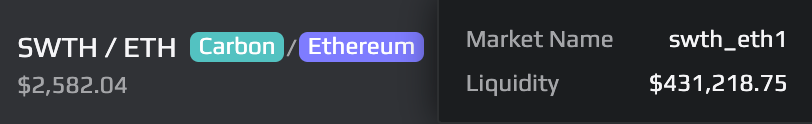

This is because most traders trade USD markets. This is evident when looking at ETH/USD market with $26k of liquidity and a volume of $6.3k and SWTH/ETH market with a higher liquidity of $431k but a lower volume of $2.5k.

This also means markets like KUJI/SWTH can be converted into KUJI/USD markets, which makes manual arbitraging much easier for traders.

More USC markets

USC is Carbon's overcollateralized stablecoin.

Similar to the above, if the liquidity for SWTH-USC and SWTH-USD is thick enough with nearly 0 spreads, USC markets could be created in-place of USD markets, especially for more exotic pairs.

This can help increase the utility and adoption of USC gradually, and the more USC is minted, the more interest rate is earned by SWTH holders, increasing the intrinsic value of SWTH, the governance token of Carbon.

Dissuade Mercenary Farm and Dump of SWTH

Multi-pool routing also allows us to focus liquidity rewards and incentives to SWTH liquidity pools instead of non-SWTH liquidity pools.

In other words, Carbon can afford to stop providing incentives to non-SWTH liquidity such as cGLP/USC or wstETH/ETH which do not require SWTH but earns SWTH rewards.

Liquidity providers have to buy SWTH to provide liquidity to SWTH LPs. This means they will likely research into SWTH before buying. If they like what they see, they will be more confident in holding SWTH than the average non-affiliated farm and dumper, and will be less likely to sell SWTH.

This can help prevent mercenary capital from farming SWTH rewards, which will likely sell SWTH as they don't hold SWTH and have no allegiance.

This also helps promote a more loyal following of SWTH holders that are aligned with SWTH's vision and price, and are more willing to promote SWTH

However for LSD markets, it may be harder to attract liquidity as it will require LSD/SWTH and non-LSD/SWTH such as i.e. stATOM-SWTH and ATOM-SWTH LP in order to have the liquidity populate on an stATOM-ATOM market.

That said, it is more capital efficient for LSD markets to have liquidity from limit orders than AMMs due to the fixed and ever-growing LSD redemption rate.

Easier integration with DEX aggregators

As multi-pool routing essentially aggregates multiple liquidity pools, it is easier for DEX aggregators such as TFM to integrate with Carbon's DEX as well, as part of the heavy lifting in doing aggregations is already done for them.

Conclusion

With support for multiple pool routing, multiple liquidity pools with the same token pair (of different parameters) can participate on the orderbook at the same time, using the fair-matching system of the orderbook.

Stay tuned for more mechanisms coming to Carbon that will improve liquidity!