Carbon has integrated with the Alliance module and we are looking to improve the way we do collaborations and form alliances in not just Cosmos but the wider crypto ecosystem.

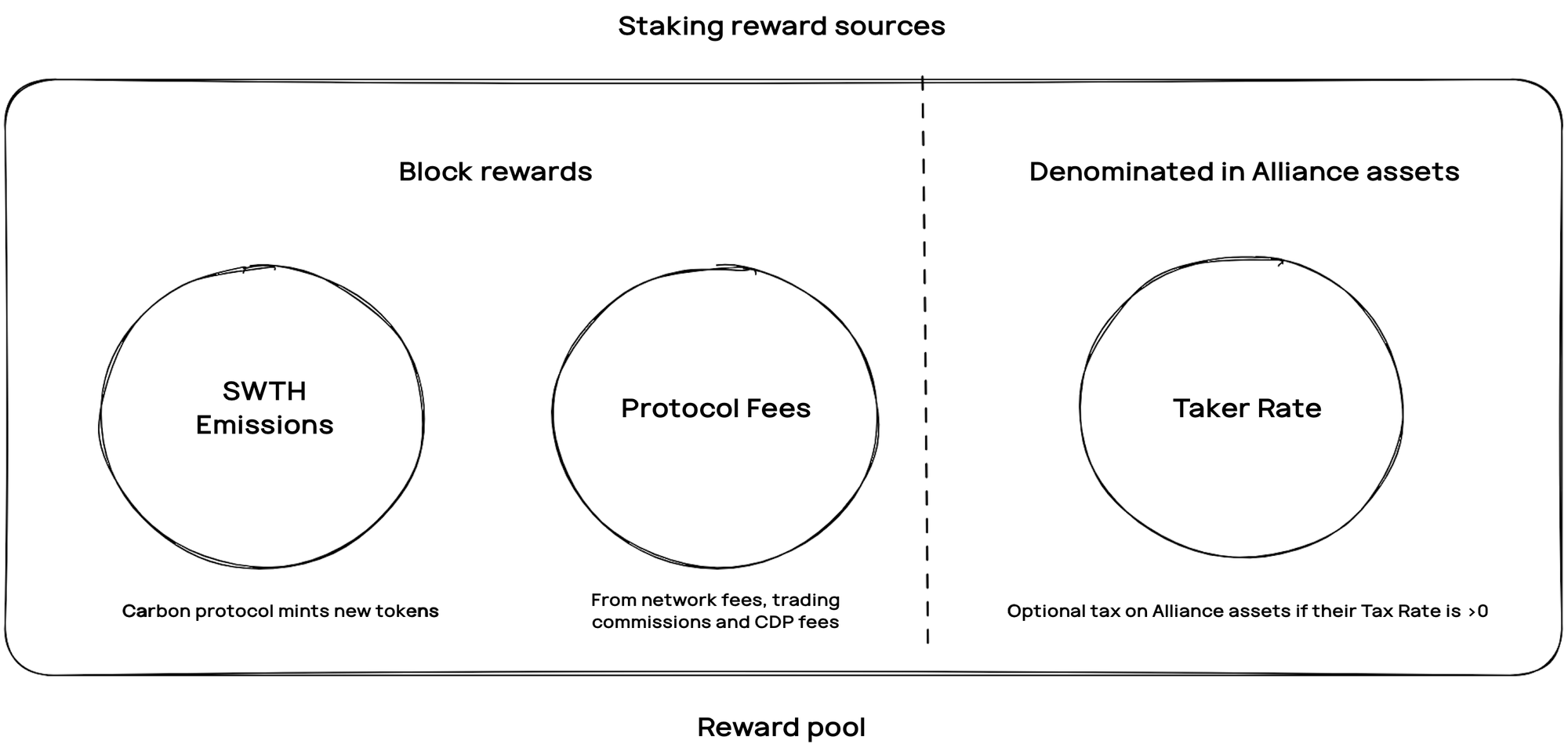

As Carbon is a real yield chain, by forming an alliance with Carbon, you earn our real yield rewards, turning your asset into a real yield asset.

We are excited to look for alliances and will soon announce our very first alliance asset, but first let's explain what is the Alliance module and how it works.

What is Alliance?

Alliance enables networks to form economic alliance by enabling their assets to be staked with the other party's network, in exchange for their staking yield.

An alliance can be formed one-way or two-ways.

For example, Carbon can first form a one-way alliance with any network, such as Terra, by listing it's governance token, LUNA, as an alliance asset.

Now all LUNA holders can stake their LUNA with Carbon and earn our staking reward, which includes SWTH and trading fees, aka real yield.

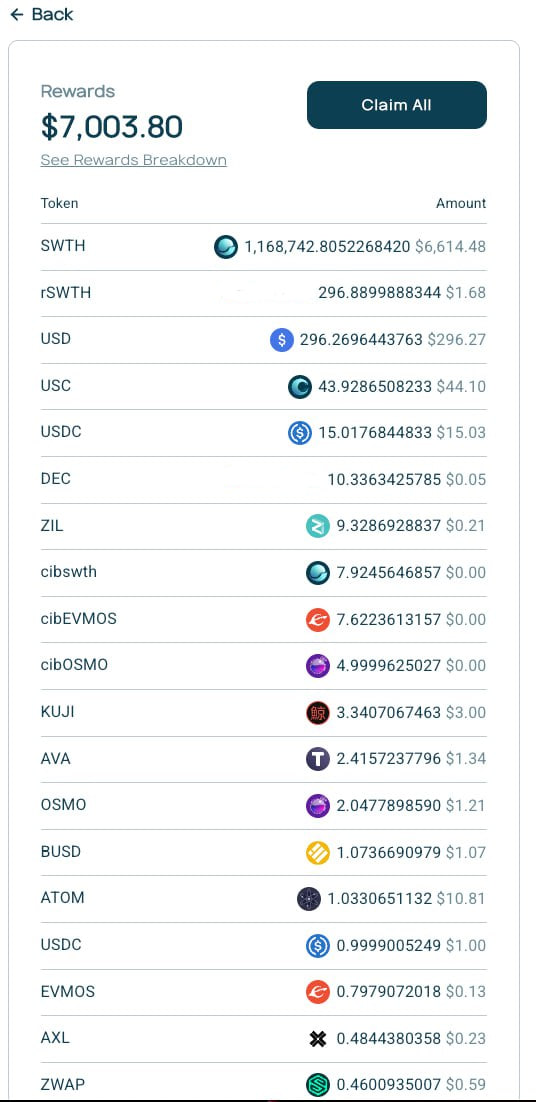

Staking SWTH allows you to earn the trading fees on Carbon, this means if you are staking your LUNA with Carbon, you earn a diversified yield similar to:

As Carbon's largest volume comes from trading perpetual contracts which are denominated in USD, you will be getting lots of USD as our volume grows, similar to dividends! The goal is to stake your asset on Carbon and collect these real yield dividends till the end of time.

Soon there will be a conversion feature to allow all these rewards to be converted into USD easily.

To make things even more exciting for stakers, we're about to launch the first perp AMM liquidity pool which will provide more liquidity, which means more volume, which means more staking rewards in USD! 🤑

There's usually a 7 days delay period after the proposal is passed before an Alliance asset starts receiving yield. This is to ensure that sufficient time to attract stakers before the incentives goes live. At Carbon, we have reduced the delay to 3 days so Alliance asset stakers can start earning yield faster.

However, staking LUNA with Carbon means losing out on LUNA staking rewards from the Terra chain, which is currently around 15%. This is where LSDs comes into the picture.

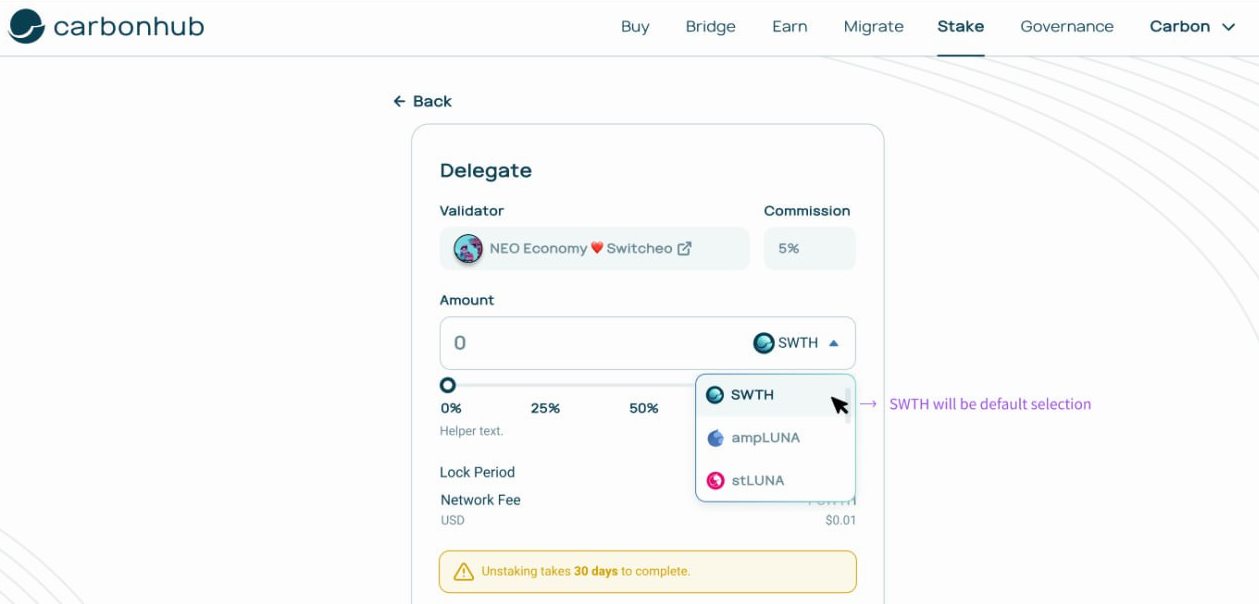

Instead of listing LUNA as an alliance asset, a LUNA LSD is listed instead. Examples include as stLUNA, ampLUNA, bLUNA, etc, allowing these assets to be staked with Carbon instead, so they continue to earn auto compounded LUNA staking rewards on top of SWTH staking rewards.

Double dip your staking rewards!

Carbon will aim to maintain a staking APR for LUNA LSDs of not less than 20% in the beginning, so combined with LUNA staking rewards, that would be around 35% staking APR!

If you're an early staker, the APR will be astronomical, in the 3-4 figures range, so make sure you follow our Twitter to know when we go live with LUNA LSDs!

However, allowing LUNA LSDs to be staked with Carbon means that Carbon staking rewards are shared with both SWTH and LUNA stakers, which dilutes the rewards to SWTH stakers.

What's in it for SWTH stakers and how does this actually work?

Let's explore further.

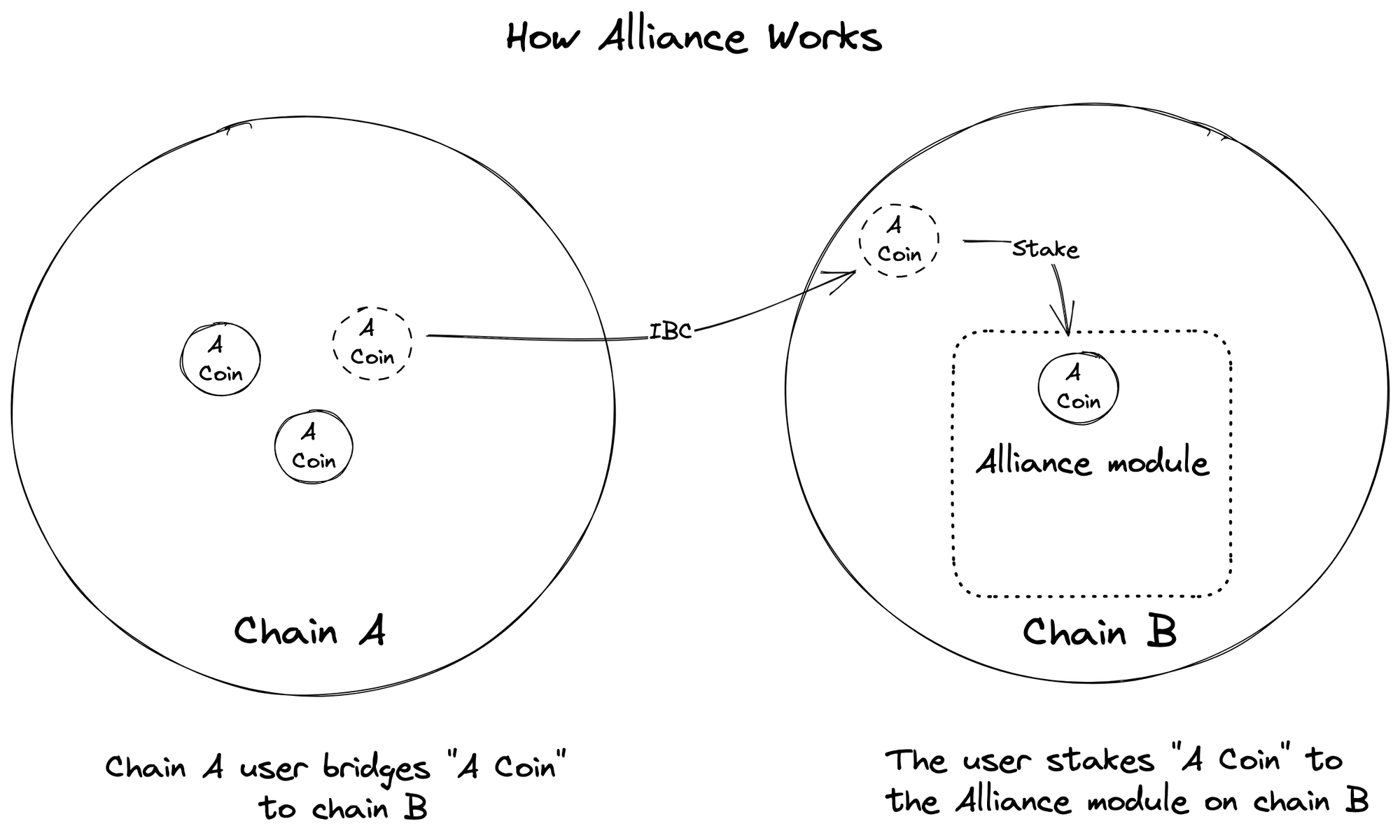

How does Alliance work?

Carbon will have to first perform a governance vote to decide the assets that can be staked on Carbon.

These are known as Alliance assets. They have to use a Cosmos ICS standard and can be bridged via IBC to other chains to be staked to earn staking rewards.

Example staking UI:

Each Alliance asset is assigned a Take Rate and Reward Weight.

Take Rate: This is like a commission to the Carbon network. It is the percentage of staked Alliance assets the chain redistributes to native chain stakers. A higher Take Rate means more Alliance asset is distributed to SWTH stakers, and based on the example above, it means SWTH stakers also earn LUNA LSDs.

Reward Weight: This is the percentage of native staking rewards the Carbon network distributes to Alliance asset stakers. A higher Reward Weight means more Carbon staking rewards are given to Alliance asset stakers, i.e. LUNA LSDs.

For more info please visit our docs: https://guide.carbon.network/module-architecture/carbon-core/alliance-module

What are the benefits of Alliance?

Welcoming New Users, Liquidity, and Developers

If you think about it, forming an Alliance is similar to liquidity incentives.

By offering a higher reward weight and a lower take rate for an LSD with a large community, it will create a high staking APR for that token, thus attracting their users to our ecosystem.

Once they're on Demex, they can check out its various features, from trading spot and perp markets, to lending and borrowing, providing liquidity to spot and perp AMM, and more.

This helps Carbon get more users and build a larger community.

When our community expands, it'll also attract developers to take a look and discover the amazing native DeFi modules that Carbon has to offer and build useful dApps which will in turn attract more users.

So far we've talked about one-way alliance, but alliance is meant to be two-ways.

What if the other network also adds our liquid staked SWTH token as an Alliance asset? Let's explore in the next section.

Diversifying Staking Rewards

If other networks, such as Terra, forms an alliance with us by listing our a SWTH LSD as an alliance asset with a Reward Weight above 0%, SWTH stakers have the opportunity to diversify and amplify their staking rewards.

Additionally, by setting a Take Rate above 0%, SWTH stakers can now also earn other Alliance assets in their staking rewards, further diversifying their staking rewards.

Attracting More Traders

In the near future, a Fee Discount Tier program will be launched, allowing SWTH stakers to enjoy great trading discounts.

Alliance asset stakers will also be counted as SWTH stakers and can also receive these trading discounts.

This helps to attract traders from our alliance community who stake their alliance asset with us, to trade on Carbon's frontend UI, Demex.

Conclusion

Alliance reminds me of EigenLayer, which is a protocol built on Ethereum that allows ETH LSDs to be staked with other networks or protocols to secure it while earning more yield. EigenLayer raised $50m in funding, which means restaking may be serious business. Alliance similarly allows for assets to be staked with a network for more yield.

What makes Alliance unique is that it opens up the possibility for two-way beneficial synergies on the network layer to help mutually attract users and liquidity, and potentially having two different communities, or even competing communities, to come together and support each other.

Although Alliance is an open-source Cosmos SDK module that only Cosmos chains can integrate with, its use cases can extend beyond Cosmos. For instance, it is possible to allow ETH LSDs to be staked on Carbon, and might make financial sense if it receives a large publicity boost from the ETH community.

Another creative example would be using an LP token of LSDs such as rSWTH-SWTH LP to be the alliance asset, deepening liquidity for essential token pairs while forming an alliance.

Carbon is always looking to form win-win alliance across crypto, if you would like to work with us, reach out to us at https://t.me/carbon_ecosystem.