With the successful launch of Nitron, Carbon's money market, it allowed anyone to deposit collateral and mint USC against their collateral.

USC is Carbon's stablecoin pegged to $1 and it uses an overcollateralized model so that one USC is always backed by more than $1 of collateral.

Currently USC is mainly sold to USD for more utility on Demex. This causes the price of USC to be lower than USD (while still being overcollateralized).

USC goes up when a user wants to buy cheap USC to repay their USC minting debt, or speculate that someone else will do this. However, this buying pressure usually happens when USC is under $1. If USC remains under $1, it is less beneficial for others to mint and sell USC for USD.

To improve USC's peg to $1 and price stability, here are 5 upcoming features to improve USC's intrinsic value and demand.

USC's Dynamic Interest Rate when minted:

Currently the interest rate to mint USC is fixed at 1.5%.

With this new update, interest rate model will if USC is not at $1, the interest rate on all minted $USC automatically adjusts up or down every 6 hours based on a TWAP of the market price of $USC.

In other words, this makes minted USC have a dynamic interest rate to protect the peg, and the interest rate applies to all minted USC, at all times, applying to both existing and newly minted USC.

If $USC is trading under $1, the interest rate is raised to strengthen the incentive for buying $USC on secondary markets.

If $USC is trading over a dollar, the interest rate is lowered to make minting $USC and selling it on secondary markets more attractive.

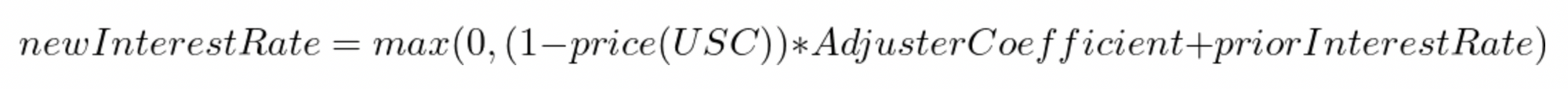

Each interest epoch will be 6 hours and the rate will adjust by 0.25 (the adjustor coefficient) of the difference between the price of $USC and $1.00. The adjustor coefficient and the epoch duration can be adjusted based on governance.

USC new interest rate formula for all minted USC:

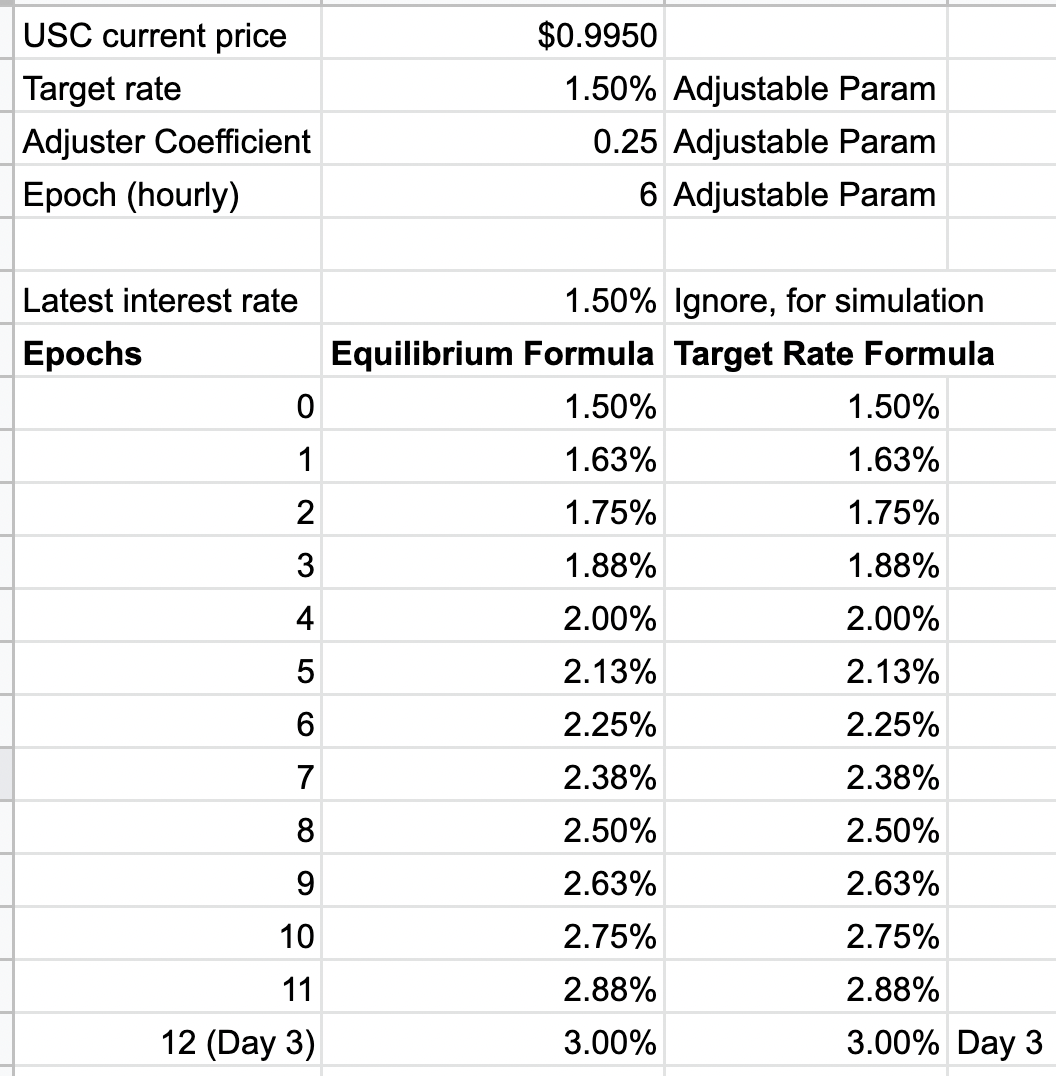

Example:

If the current interest rate (IR) is 1.5% and USC price dips to an average price of $0.995 over 6 hours, the IR increases gradually. Note: IR = APY.

If USC maintains at $0.995, by epoch 12 (day 3), the interest rate for minted USC will increase to 3%. If USC repegs to $1 then, the interest rate stays at 3%.

If USC minters finds that 3% IR is too high, they will buy back USC to return the loan, increasing the price of USC to above $1, which will reduce the interest rate back to a level where USC minters are comfortable minting USC again.

However if minters find the IR of 3% is reasonable, it will maintain there, and a higher IR means more profit to the protocol as well.

Is $USC like $UST now?

No.

USC is still overcollateralized by exogenous capital (outside of Carbon ecosystem), unlike $UST which relied on $LUNA (its own ecosystem). Only the interest rate of USC is updated dynamically.

$USC is still similar to $DAI and $USK, using an overcollateralized model to maintain the price at $1. This dynamic interest rate further helps keep the peg.

tldr;

USC remains overcollateralized, but its current fixed interest rate will be updated to a dynamic model that perpetually rebalances towards $1.

If $USC is trading above $1, the interest rate is lowered to weaken $USC price.

If $USC is trading below $1, the interest rate is raised to strengthen $USC price.

USC Farming Strategy Vaults:

If DeFi Farming sounds troublesome, you'll be happy to know that one-click farming vaults that only accepts USC will be coming soon.

It will start off with Delta Neutral LSD using USC collateral but can branch off to other higher APR but more degen strategies.

Example of Delta Neutral LSD Vault:

- One-Click-Deposit your USC into the vault

- Swaps USC into rATOM to earn >20% staking APR

- Deposits rATOM as collateral and borrow USD

- Short ATOM to be delta neutral using USD with leverage

- Earn the staking rewards of rATOM while removing price exposure to ATOM

This will make it easy to earn yield on your USC, which will increase its demand.

USC in incentivized spot LPs:

More spot LPs on Demex will be paired with USC and incentivized, for example:

- SWTH-USC

- USD-USC

- USDC (arbitrum) - USC

- cGLP-USC

This will incentivize users to buy up USC to provide LP to earn yield, increasing the buying pressure of USC.

USC in High Efficiency mode:

High Efficiency Mode (”eMode”) allows borrowers to extract the highest borrowing power out of their own collateral.

It helps to maximise capital efficiency when collateral and borrowed assets have correlations in price.

This means you can deposit USD to mint USC at near 100% LTV, making it easier to mint USC to maintain the peg of $1 when $USC is above $1.

This will be popular for stablecoin and LSDs borrowing, examples:

- Deposit USD to borrow USC or other stablecoins at near 100% LTV

- Deposit LSDs (like rATOM, stATOM, or stkATOM) and borrow the native token (like ATOM) at near 100% LTV, and stake it again to leverage loop!

USC as Cross margin collateral:

Once cross-margin is enabled, various assets in your wallet such as USC, ETH, ATOM, etc, can be used as margin for trading, and not just USD.

Hence it is important for USC to maintain its $1 peg strictly.

This can also include yield bearing assets in Nitron. Means that if you are holding cibUSC (USC deposited in Nitron), you earn USC's lending APR while trading!

But it will most likely not be used as collateral for borrowing, no double dipping!

Conclusion

Stablecoins remains one of the key pillar in DeFi and hence it is important to continue to improve the design of the Carbon stablecoin to have the most amount of features and utility which will naturally increase its demand.

The more USC minted, the more interest fee the protocol earns as well which goes to $SWTH stakers.

Summary

Currently USC offers the following features:

- Overcollateralized: Collateral backing is more than minted amount

- Self-repaying: You can use yield-bearing assets to mint it

- Permissionless: Anyone can hold it without fear of it being frozen

- Transferable: Can be sent to on any EVM or Cosmos app chain

Upcoming USC features:

- Automated peg stability: Perpetually rebalances USC towards $1

- Capital efficient: Use USD to mint USC at near 100% LTV (soon)

- Earn yield: Accepted in USC strategy vaults to earn high yields (soon)

- Cross margin: Can be used as margin when trading USD perps (soon)